Investors often resort to precious metals like gold and silver to protect themselves from adverse economic conditions. What are the repercussions of an unsuccessful attempt at hedging if the stock market falls? To make educated investment decisions in the event of a severe recession or depression, it is vital to understand how a market collapse and the subsequent decline in the dollar value would influence silver and gold.

Is Gold a Good Investment If the Market Crashes?

Based on past performance, gold is a good investment during a market crash or recession. Usually, when the stock market is down, investors avoid investing in a bear market. Hence, precious materials like gold and silver usually increase in prices during a recession. To protect the asset value, some investors invest in Gold IRA.

(Read our article Augusta Precious Metals Review and Why invest in a Gold IRA to learn more about this topic.)

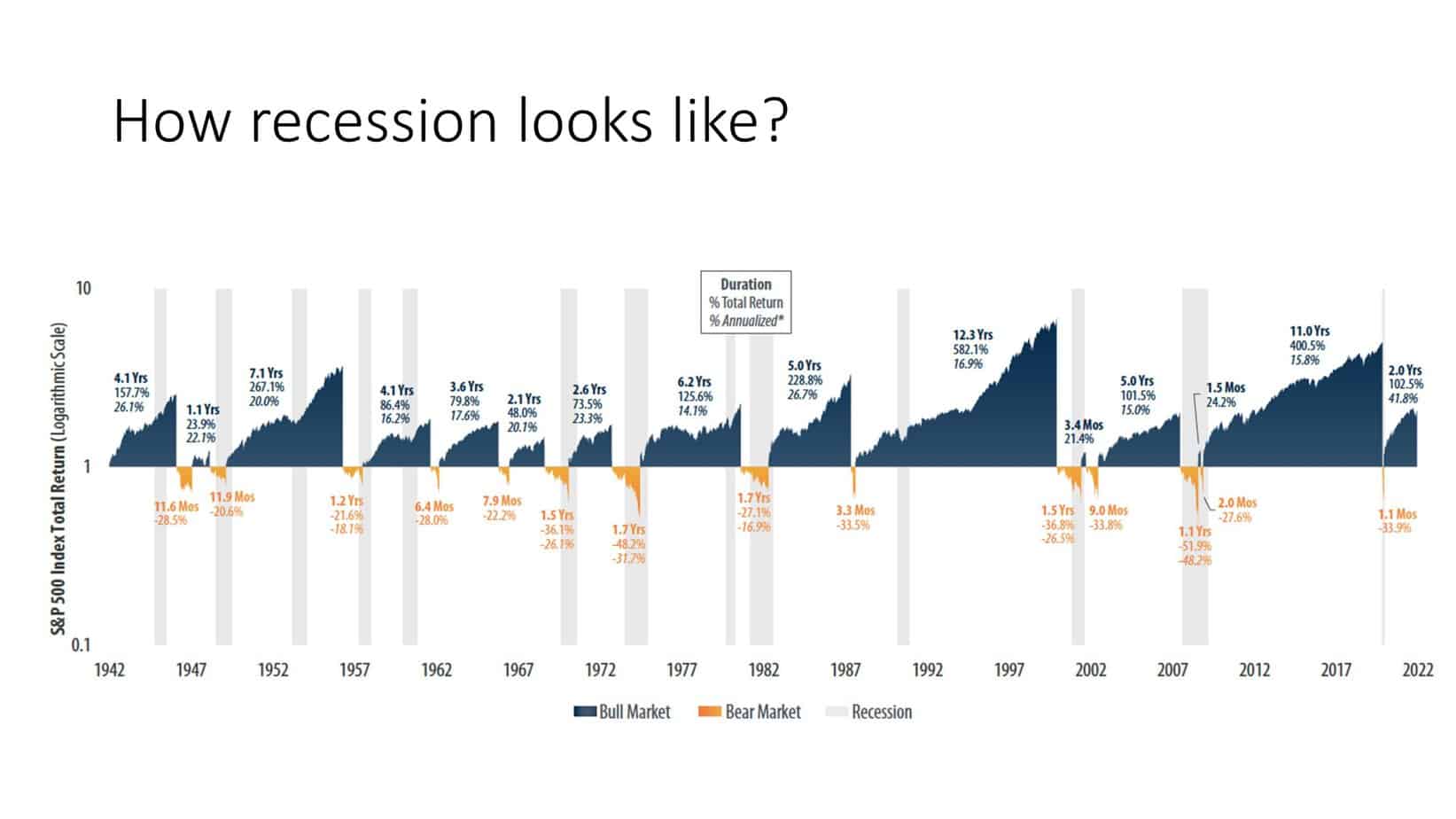

Let us see past performance during the recession:

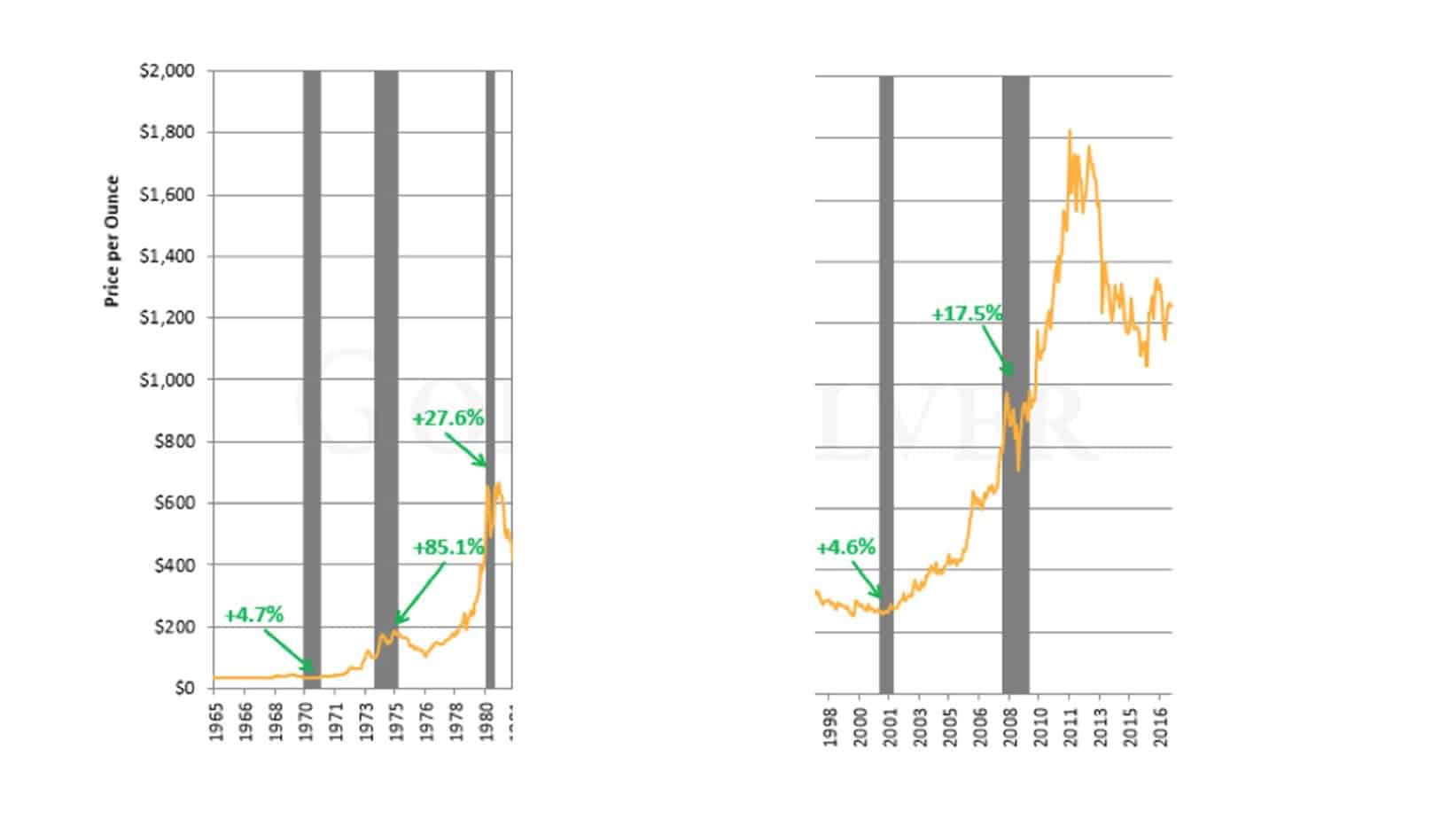

As shown in the image below, gold prices usually increase during a recession. For example, let us see the last crisis in 2008:

But how can we explain this?

For example, everything starts with inflation:

After inflation, governments increase the interest rate, and the dollar rises:

Given the information at hand, we can draw a few reasonable conclusions.

- During the stock market collapses, gold prices usually climbed.

Does gold rise as stocks fall? Recent answers have been “Yes!” This was true regardless of how long the crash lasted. Gold even increased during the worst crisis, a two-year, 56% drop in the initial 2000s. In stock market crashes, gold has generally risen, not fallen.

- Don’t panic if gold prices decline in the first months of the recession.

Gold fell amid the 2008 financial crisis’s first shock. This recent, notable event may be why many stockholders fear gold will plummet with stocks. Whereas the S&P fell, gold rose 5.5%. Gold increased 25% during the 18-month stock flea market selloff. However, if gold first decreases following a stock market crash, it’s not out. History suggests it’s an excellent purchasing opportunity.

Gold or XAUUSD is related to dollar price. XAUUSD (gold) has a weaker price if the US dollar is stronger.

- Gold’s only significant reimbursement (46% in the initial 1980s) came after its most important bull market.

From 1970 to 1980, gold climbed by 2,300%. So it’s hardly unexpected that it sank with the stock market. In modern times, things have changed. From 2011 to 2016, gold fell 45 percent, the worst downturn in its history. This isn’t altogether surprising given its fast gains throughout the 2008 catastrophe and 2011 meltdown.

- Silver performed slightly poorly than gold in market collapses.

Only one S&P selloff saw it rise, while another was flat. This is to be expected owing to silver’s substantial industrial usage (56% of the entire resource) and the fact that stock marketplace payoff is frequently linked with a weak economy. In all but one collapse, silver dropped under the S&P. Silver’s intense volatility generally causes it to decline further. Silver’s most significant jump (15 percent in the 1970s) occurred during its largest bull market. It finished flat in initial 2009, which was its 2nd-largest bull marketplace. Silver has historically done fine in a stock market meltdown if it’s in a bull market. It may struggle otherwise.

History suggests gold would certainly climb following a stock market crisis. Silver’s bullishness may determine its price.

What causes gold’s behavior?

Gold’s yin to stocks’ yang

Because gold and stock market collapses are inversely connected, gold is robust. When one rises, the other falls.

It’s obvious. Gold paybacks as of fiscal misery and crises, whereas stocks do not. When the stock share arcade collapses, investors seek the safety of gold. If equities are booming, mainstream investors don’t need gold.

The negative link between gold and equities is supported by history. This chart compares gold to other assets. The zero line suggests gold often performs poorly. If the line is beneath zero, gold transfers against rather than with that investment; if it’s overhead zero, it transfers with it.

Gold has typically risen more than fallen when the stock marketplace (U.S. Impartialities) falls. Gold generally has outperformed bank and money market funds. Real estate prices only follow gold partially.

Investors should conclude:

Gold frequently rises while other assets decrease.

Gold won’t appreciate with every stock market decline. Gold is a safe refuge in the largest collapses, according to history. If you anticipate the economy will be strong, hold less gold. If you predict the economy will weaken, buy more gold. If you expect economic turmoil, you might desire to acquire a lot.

Another option…

What if stocks don’t crash?

Stocks might be hard to anticipate. Then what? Or what if the fair is flat? That may seem unlikely given our fiscal, business, and economic risks. The 1970s saw three declines, an oil stoppage, 20% interest rates, and the Soviet invasion of Afghanistan. Here’s the S&P and gold’s performance.

The S&P had a stagnant 1970s. 14.3% afterward ten years (exclusive of disbursements). Gold produced a considerable profit. It had increased 2,328 percent from $35/ounce in 1970 to $850 in January 1980.

Gold’s largest bull market in recent period happened while stocks were flat. Gold rose because of financial and increment issues, not the stock market. We must permit for the option that this ensues over and that people buy gold for whys and wherefores distinct to the S&P.

Stock Market Crash Recovery Time

Stock traders commonly use a 100-year plan of the share marketplace to indicate that it usually rebounds and rises after large collapses. They don’t illustrate how long recovery takes following price rises.

Some share marketplace disasters take so long to recover that the equal quantity of money won’t purchase as much. Inflation weakened their buying power despite regaining what they’d mislaid in the crisis.

After the most significant stock market place collapses, it takes years to rebuild buying power.

Gold has always been the most potent safeguard against a stock market collapse and inflation.

Investing’s Best Plan of Action

When the markets experience unusually high volatility, anything may happen. With all the current hazards, is it wise to remain without a significant quantity of actual gold and silver?

The optimal option may be to have some cash on hand in case precious metals prices drop again but to also have some gold on hand, whether the subsequent calamity refers to gold soaring.

Do You Think Gold is a Good Investment?

Gold is considered a good investment because gold’s price does not typically change in tandem with market prices and is meant to provide security in times of market collapse. Gold prices did not always rise, even when the markets were booming. As a result, it might be considered a risky investment. Investors generally invest in gold when the market is fearful and stock prices are expected to fall.

Adding insult to injury, gold is not a source of revenue. Gold’s return is contingent on price obligation as opposed to other investments. In addition, there are certain expenses associated with a gold investment. There are storage and assurance charges since it is a tangible asset. Though generally seen as a “secure” investment, gold’s price fluctuates widely and may even fall. Gold is best used in a diverse portfolio, especially working as a border alongside a declining stock market. Check the long-term performance of gold.

Important points to make

- Over the years, gold has always been seen as a reliable store of wealth and inflation guardrail.

- On the other hand, shares and bonds have exceeded gold’s price gain on average over the long term.

- Gold, on the other hand, has the potential to outperform silver over shorter time frames.

- In times of high price rises and geopolitical unrest, gold prices tend to climb.

- During the covid-19 epidemic and the Russia-Ukraine war, gold rose to an all-time high of approximately $2,075 per ounce in 2020.

As an asset, gold’s long-term performance may vary greatly depending on the period being studied. Some 30-year times saw equities outperform gold, while other 15-year stages saw gold beat shares and bonds.

The gold price rose by over 360 percent between 1990 and 2020.

The dow jones industrial average (DJIA) increased by 991% within the same period. Gold’s price rose by 330 percent in the 15 years from 2005-2020, or almost as similar as in the 30 years before. The DJIA gained just 153 percent in the same time frame. If we merely look at the years 2021 and 2022, gold has done better than equities because of the global rise in inflation and geopolitical concerns.

In the long run, equities seem to beat gold by a factor of three to one, but in the near term, gold may be the clear winner. Stock returns have outperformed gold since the 1920s and continue to do so now.

The average yearly return rate on share-score corporate bonds from the 1920s over and done with 2020 is roughly 5%.

As a result, corporate bonds have given back about 330 percent over the last 30 years, a return just below that of gold. Bonds have provided a poorer return over 15 years than equities or gold.

A view from the past

From January 1934 until august 1971, when President Richard Nixon locked the US gold securing space, the price of gold was practically fixed at $35 per ounce, providing historical context for current gold prices.

People who accumulated large amounts of gold before the gold backup act could not invest in it because they had to turn it in for dollars. This made it problematic, if not unbearable, for them to make a profit from their gold holdings.

As of q1 2022, gold is expected to have a price gain of roughly 5,700 percent based on the current rate of $35 per ounce and the expected rate of $2,000 per ounce in q1. The data’s value has increased by 4,500 percent since 1971, according to data from the first quarter of 2022.

When Investing in Gold, What Should I Expect as a Return?

The gold return rate varies with the length of time being considered. Gold had an average yearly return of 10.6 percent from January 1971 (the minute dollar was no longer tied to gold) and December 2019. It returned 11.3 percent for the world’s stock markets over a similar period. Among various assets, gold’s average annual return in 2020 was 24.6%, making it the 2nd-maximum return, after silver, which had the best return.

Why Has There Been a Decline in Gold Investment? Why Invest in the Stock Marketplace if You Can Make Money?

When the stock market is rising, gold’s performance tends to suffer. Among other things, gold is neither a source of revenue nor a barometer of industry or business progress. Since its rarity and socio-historical antecedent are considered valuable, it is valued as such. Investing in equities is more appealing when the budget is expanding and firms perform fine.

Is It a Better Investment to Buy Bitcoin Than to Buy Gold?

Bitcoin (BTC), an online cryptocurrency, has exceeded all other benefit programs, including gold, with time. Many think Bitcoin and other cryptocurrencies are similar to digital gold because their supply is limited and constantly decreasing. We’ll have to watch and see whether it manages to keep up with the competition.

The Closing of the Chapter

When purchasing any asset, it is essential to consider the investment’s long-term aims and research how the market will behave in the coming years. The price of gold fluctuates in response to a diverse range of economic situations throughout the world, much like the price of stocks and bonds, which are also susceptible to market volatility. Participating in gold markets during periods of market declines, which coincide with an increase in the price of gold, may help to widen a selection, which is essential for all investment portfolios.

GET GOLD IRA GUIDE