IC Markets is a popular broker for traders dealing with foreign currency (forex), precious metals, and contracts for differences(CFD) using scalping and other strategies. The lower commissions and spreads charged by IC markets make it more popular than other brokers.

IC Markets is one of Australia’s biggest CFD brokers and was founded in Sydney in 2007 by finance professionals. Though it handles CFD markets in North America, Europe, and Asia, the customer base is even more significant, including Hispanic Latin American countries like Argentina, Colombia, Spain, and Mexico.

Please read IC Markets Review

IC Markets is a popular forex and CFD broker regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). To comply with these regulations, IC Markets has a verification process for its clients. Here’s a brief overview of the verification process at IC Markets:

- Account registration: To start the verification process, clients must first register for an account on the IC Markets website. This involves providing personal and contact information, such as name, address, phone number, and email address.

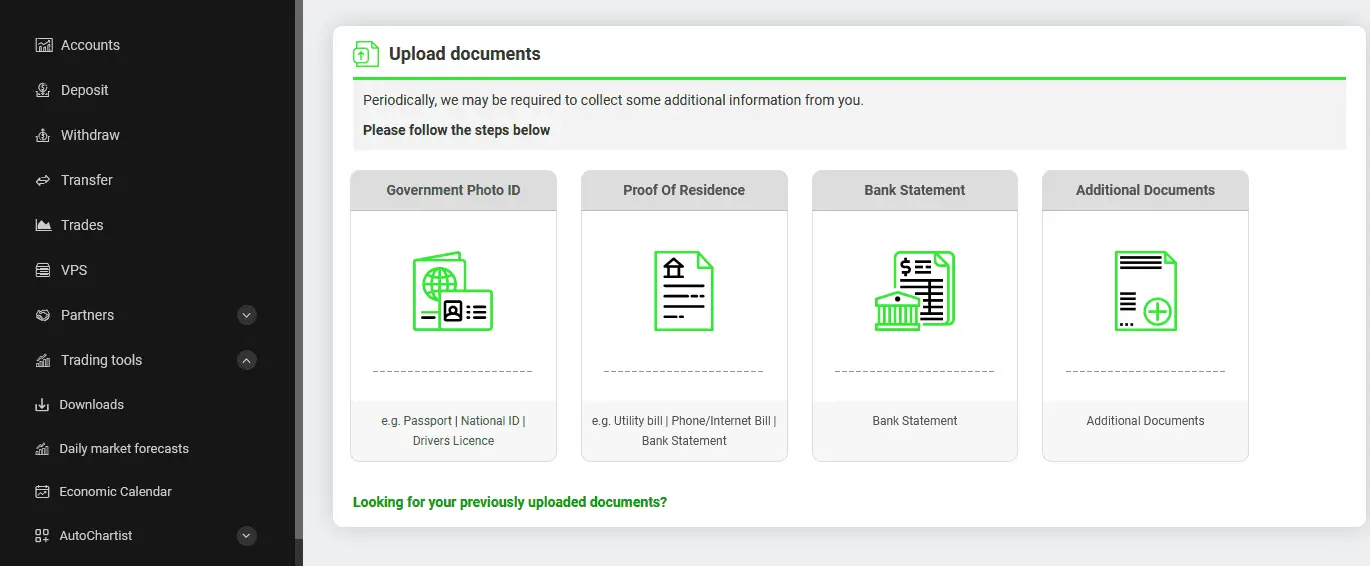

- Document submission: After registering for an account, clients must submit certain documents to verify their identity and address. These documents may include a government-issued photo ID (such as a passport or driver’s license), proof of address (such as a utility bill or bank statement), and sometimes, proof of source of funds.

- Verification review: Once the documents are submitted, IC Markets’ compliance team will review and verify the information provided. The verification process can take up to 1-2 business days.

- Account activation: Once the verification process is complete, clients can activate their trading account and start trading on the IC Markets platform.

It’s important to note that the verification process is necessary to ensure the security and legitimacy of the trading accounts on the IC Markets platform. By verifying the identity and address of its clients, IC Markets can comply with regulatory requirements and prevent fraudulent activities such as money laundering and identity theft.

To open an account with ICMarkets, the user will first complete the form with personal information like name, email, mobile number, and country. First, the trader should choose an individual account, then write the birth date, address with zip code, and province.

The user can specify who referred him to the website. The trader must choose between the trading platforms Crader, Metatrader 4, and Metatrader 5, with Metatrader 4 usually preferred. The trade can choose between the true ECN or standard account.

The default currency is the USD dollar, and the user can opt for special offers. The trader has to indicate his experience in trading forex, beginner or better, answer the security question and then accept the terms and conditions.

After the registration, the username and password will be sent on email.

IC markets Account Verification Procedure is based on verifying every trader’s identity before using the trading account. Hence a photo of the identity card, passport, or driver’s license must be uploaded. In addition, proof of residence should also be uploaded to confirm the address.

The files should be selected and uploaded. The IC markets staff will approve the uploaded documents and verify the account, usually within 24 hours. The proof of residence should be less than three months old for approval. If all the documents submitted are approved, the account status shows approved, and the user can start trading.

IC Markets Features

- Multiple trading platforms: IC Markets offers various trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and WebTrader, giving traders the flexibility to choose a platform that suits their needs.

- Low spreads and commissions: IC Markets offers tight spaces starting from 0.0 pips and low commissions, making it a cost-effective option for traders.

- Wide range of trading instruments: IC Markets provides traders access to over 300 financial tools, including forex, stocks, indices, commodities, bonds, and cryptocurrencies.

- High leverage options: IC Markets offers high leverage options up to 500:1, allowing traders to increase their potential profits. However, it’s important to note that high leverage carries a higher risk.

- Fast execution speeds: IC Markets uses cutting-edge technology to ensure quick execution speeds, with average execution times of under 40 milliseconds.

- Advanced trading tools: IC Markets provides traders access to various advanced trading tools such as Autochartist, Trading Central, and VPS hosting.

- Educational resources: IC Markets offers a range of educational resources for traders, including video tutorials, trading guides, webinars, and market analysis.

- Excellent customer support: IC Markets has a dedicated customer support team available 24/7 via live chat, phone, and email, to assist traders with any issues or questions.

- Regulated broker: IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), providing traders with added security and peace of mind.

Overall, IC Markets provides traders with a range of features an

The Australian Securities & Investment Commission(ASIC) has authorized and regulated ICMarkets to protect investors and customers, specifying the financial regulations. The ICMarkets offices are located at Limassol and Sydney. The transactions are directly carried out using the LP & ECN system. There is no dealing desk, so ICMarkets has a reliable interbank currency market. The trading instruments are forex, precious metals, and CFD. Trading platforms are Metatrader 4, Metatrader 5, and ctrader. The spreads are low and vary from 0.0 pips for some accounts. The maximum leverage is 1:500. The minimum lot size is 0.01 lots. The minimum deposit is $200. The deposit and withdrawal methods are VISA, Mastercard credit cards, Neteller, PayPal, Skrill, Bank wire transfer, and Bitcoin.

Deposits and other aspects.

Traders can make deposits using their menu options for deposit funds, with the minimum amount being $200. In addition, the accounts menu has an opportunity for opening a demo account. Beginners in forex trading who wish to start practicing trading without taking the risk of investing their money can open a demo account. First; The trader must specify the trading platform, currency, account type, leverage, and initial deposit amount. After providing all the information, the trader will receive an email with the demo account’s login details.

IC Markets Trading platforms

Metatrader 4: This is the most popular trading platform for forex, using the latest design and technology. It is easy to use and efficient with fast trade execution. The developers of Metaquotes are constantly innovating to add new features. It has multiple tools for market analysis, especially several dozens of inbuilt technical indicators. In addition, the expert advisor’s modules evaluate, design, and implement automated systems for trading possible.

cTrader: This electronic trading platform of ICmarkets is suitable for precious metals and forex. Customers get a lot of liquidity with this platform, which features thirteen stock indices, up to 64 currency pairs, with streaming prices from banks worldwide. It has a spread from 0.0 pips for most major forex pairs. There are also no trading restrictions so traders can link and trade with liquid traders worldwide.

Metatrader 5: This popularity of the trading platform increases since it is an improved version of Metatrader 4 from Metaquotes, with access to more markets for trading and additional features to make trading and investing more accessible.