Table of Contents

The price of gold is one of the most closely watched indicators in the global economy. Gold is a valuable commodity used throughout history for its beauty, durability, and scarcity.

On this website, we analyzed gold volatility during last year, 2023.

The price of gold can fluctuate significantly in response to changes in global economic conditions and geopolitical events. Because it is viewed as a safe-haven asset, many investors buy gold when there are signs of instability in the financial markets or geopolitical uncertainty.

At the same time, factors such as inflation or changes in interest rates can also impact the price of gold, making it an essential indicator for economists and analysts worldwide. So whether you’re looking to invest in gold or want to stay up-to-date on this key economic indicator, it’s crucial to understand how and why gold prices move over time.

See the video that I published on YouTube:

What is a pip in gold?

Usually, one pip increment in gold is 0.01 increment. So if the gold price is 1800,00, then one pip increment is 1800,01.

One pip in gold is $0.01 or 1 cent for 1 micro lot position size.One1 pip in XAUSUD for 1 lot is $1. Learn more in our article oncalculatinge pips in gold.

How many pips does gold move in a day?

Gold moved around 2000 to 3000 pips on average in the last decade. In the year 2023, gold ranged from approximately 2406 pips. The average moving range for gold in 2023 was 2406 pips, from 587 to 10244.

Gold Daily Volatility in 2023:

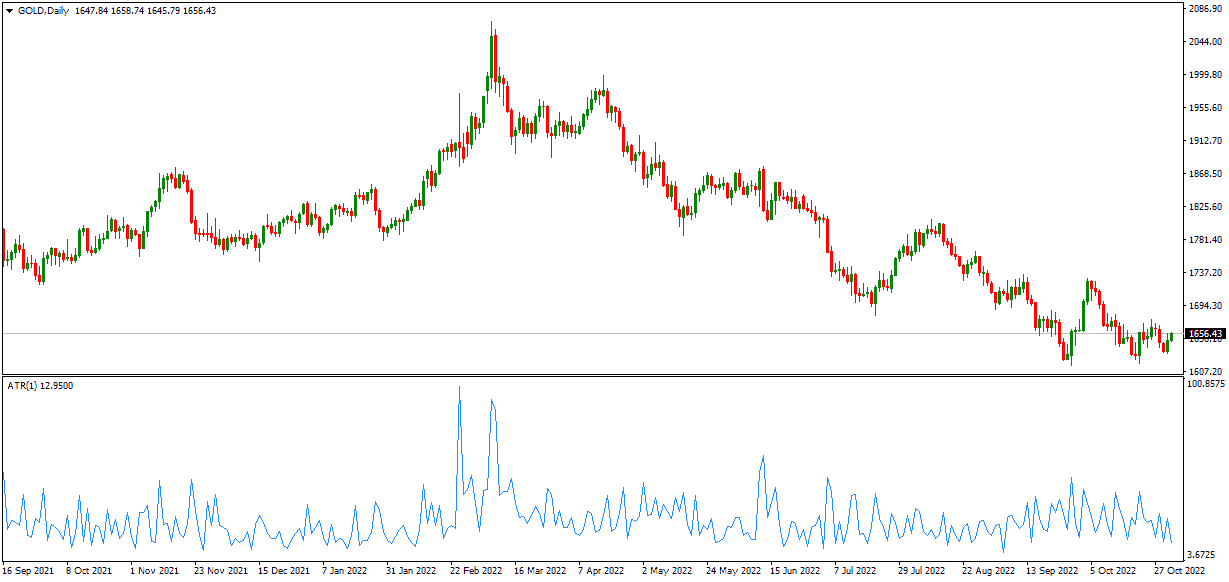

Gold daily volatility in 2022:

Gold can easily swing from 50-400 pips within minutes because significant reversals are common for XAUUSD. As a result, gold is a volatile trading instrument, and traders must be careful when calculating risk and position size during gold trading.

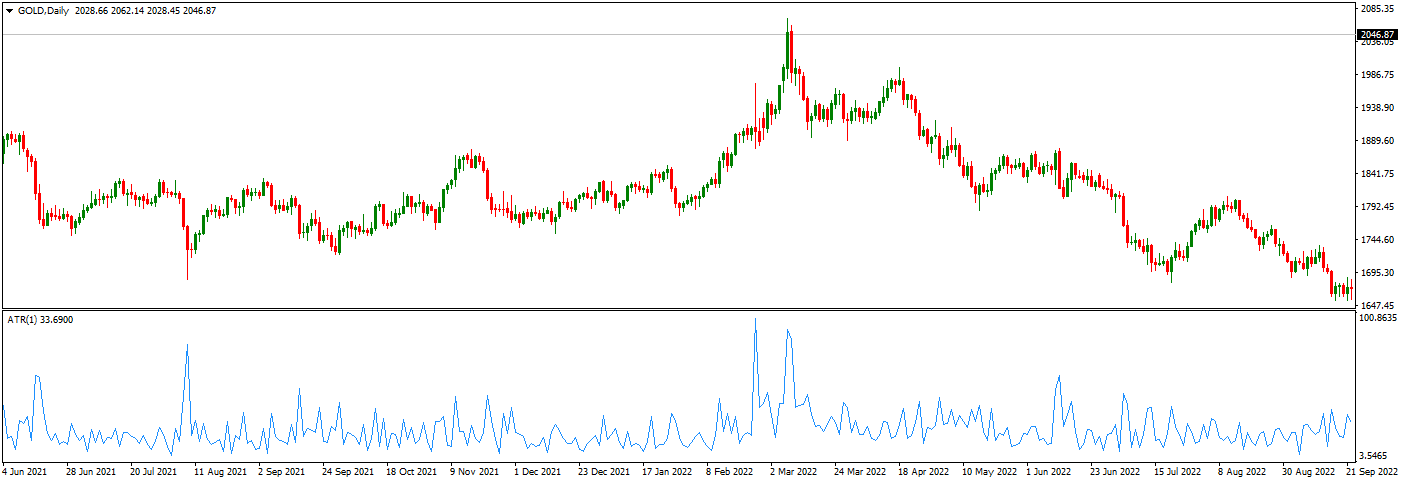

You can use the Metatrader indicator ATR, the Average True Range, to determine how many pips make gold move in a day. This indicator calculates the average number of pips based on the period. For example, if you want to calculate the average number of pips for gold in the last year, go to the indicator and set 365 days as the period for observation. Usually, traders use 14 days or 30 days as a measurement.

More about calculating gold pips in forex can be read on our page.

Gold volatility research

Based on our research, gold prices in 2022 were not highly volatile commodities. The highest volatility occurred during the beginning of the Russian-Ukraine wag, while volatility dropped significantly in the last quarter.

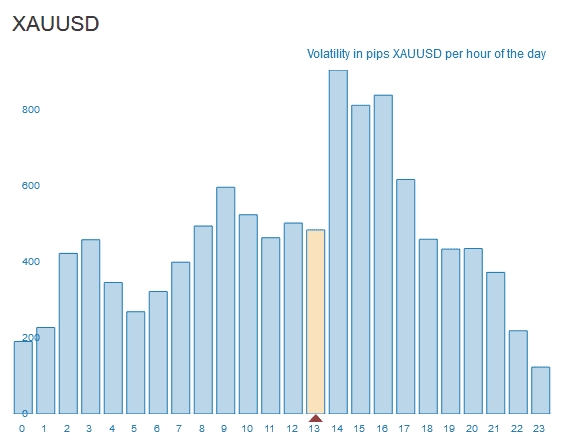

As shown below, the highest volatility for XAUUSD (gold) is 14 hours before the US market opens. By average, the highest hourly volatility in 2022 was 906 pips.

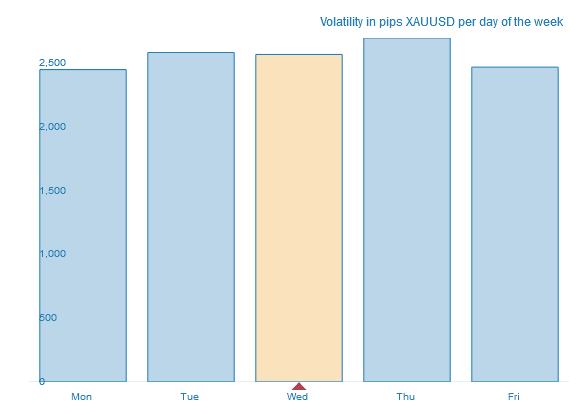

Gold’s daily volatility was usually 2450 pips, with a daily range from 2500 pips on Monday to 2701 pips on Thursday. As we can see, gold has a minimal price range on Monday and Friday during the most significant Thursday on average.

Gold volatility

Gold is one of the most highly traded commodities in the world, and its price is often highly volatile. For example, in 2022, gold experienced wide fluctuations in value, ranging from lows of around 792 pips to highs of 9660 per ounce.

One reason for this volatility is that gold is seen as a safe investment in times of economic uncertainty. As investors seek to protect their wealth during financial instability, they often turn to gold as an asset that is less likely to lose value than other investments like stocks or bonds.

However, while this can make gold very attractive during market turmoil, it can also lead to sudden spikes or dips in its price when investors are more confident about the economy. This makes gold a risky investment choice at times when overall economic conditions seem stable and positive.

Despite these fluctuations, many analysts believe that gold will remain an important asset class for many years. With global economic growth expected to slow down over the coming decade and inflationary pressures remaining high, many experts see continued demand for precious metals like gold as a way for investors to protect themselves against potential losses caused by inflation or other sources of financial instability.

As such, despite its volatility, gold will likely remain an essential asset for individual and institutional investors for many years. Therefore, whether you are looking to invest in gold or understand better how this precious metal impacts the markets around us, it is essential to understand this asset’s unique characteristics and how they can affect broader financial trends over time.