The NFP (Non-Farm Payroll) report is an important economic indicator released by the United States Department of Labor on the first Friday of every month. The report provides a snapshot of the job market in America and is widely watched by investors, economists, and policymakers to assess the economy’s health.

You can check our NFP calendar page to see NFP dates.

Generally, a strong NFP report implies that the job market is healthy and more Americans are finding employment, which is good news for businesses and consumers. Conversely, a weak NFP report suggests that there has been a contraction in jobs, signifying that economic activity may be slowing down. As such, an unexpected change in the numbers can significantly affect stock markets and currency exchange rates.

What is NFP?

The non-farm Payroll report represents the number of jobs added or lost in the US economy over the last month. NFP means Non-Farm Payrolls and represents a number that measures the number of workers in the United States for the previous month without farmworkers and a handful of workers. So, the word “Non-farm” means that farmworkers are not included in the payroll jobs counting.

The NFP report looks at net changes in non-farm payrolls – i.e., those employed outside traditional farming or agricultural occupations. It includes wages from services such as retail trade, education, healthcare, and hospitality; and excludes military personnel and government employees. The number provided in the report represents an estimate for all employees not working on farms, including both full-time and part-time workers but also those working as independent contractors or self-employed individuals with no central employer.

In addition to providing information on changes in non-farm payrolls, each NFP report also contains estimates of average hourly earnings (AHE), which indicate how much wages have grown over time – this helps to provide insight into consumer spending power which drives two-thirds of US GDP growth.

The monthly release of the NFP figures can cause significant volatility across equity markets; when the number deviates significantly from expectations, it often leads to substantial trading movements as traders adjust their positions based on the new information provided within this critical economic indicator. Accordingly, investors – particularly those with long-term investments – should be aware of what data is being published each month when constructing their portfolios so they can react appropriately to any unexpected movements caused by it.’

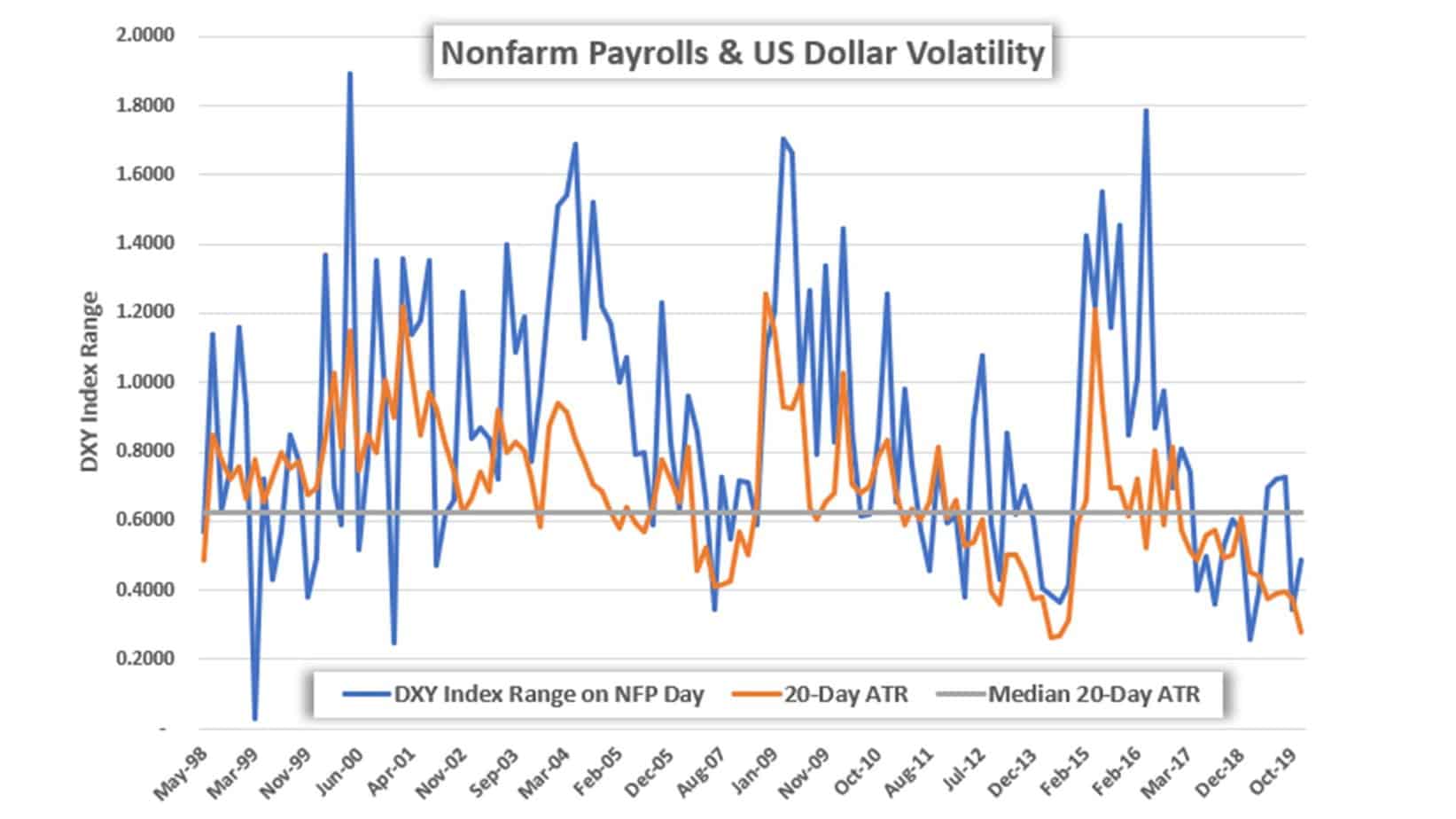

How Many Pips Does NFP Usually Move the Asset?

Usually, major US forex pairs move around 80% daily average true range in the first hour of the NFP report. For example, in the year 2022. EURUSD moves 66 pips while GBPUSD 78 pips during the NFP release.

Non-Farm Payroll (NFP) volatility is a significant factor in the foreign exchange (forex) market. The release of the NFP report causes substantial movements in the central US currency pairs, such as EURUSD and GBPUSD, as well as other global currency pairs. Understanding how NFP affects forex markets can help traders make more informed decisions and potentially increase their profitability on their trades.

When the monthly NFP report is released, it can cause significant volatility in the forex market, with traders and investors looking to capitalize on any potential movements that may arise from the news. Traditionally, major US currency pairs move around 80% of their daily average true range during the first hour after an NFP report has been released. For example, in 2022, EURUSD moved 66 pips while GBPUSD 78 pips during a single NFP release.

This extreme volatility can be significant for traders willing to take on greater risk for more considerable gains; however, there are also risks associated with taking advantage of these extreme price moves following an NFP release. One of these risks is order slippage which occurs when your trade doesn’t get filled at the price you expect it to be served at because of high volume and liquidity issues caused by increased volatility surrounding an NFP release. To limit this risk, traders need to use limit orders when trading near an NFP release to avoid any unexpected losses due to order slippage.

Another risk associated with trading near an NFP release is that prices tend to move quickly and unpredictably during this period, so traders must act quickly if they want to capitalize on any potential profits available following an NFP release. This means traders must have a clear strategy before entering into any position immediately following an NFP release; otherwise, they could see their positions become quickly unprofitable due to rapid price changes during this volatile period.

It’s vital for all traders, regardless of experience level or trading style, to understand how volatility surrounding Non-Farm Payroll releases can affect their trading results and ensure they have measures in place to mitigate any potential risks. By understanding Non-Farm Payroll volatility and having a plan in place beforehand, many traders have found success trying to capitalize on these large movements following an NFP report release each month.

NFP volatility is very high for US-related pairs such as EURUSD, GBPUSD, USDJPY, etc. Please watch our video related to NFP volatility:

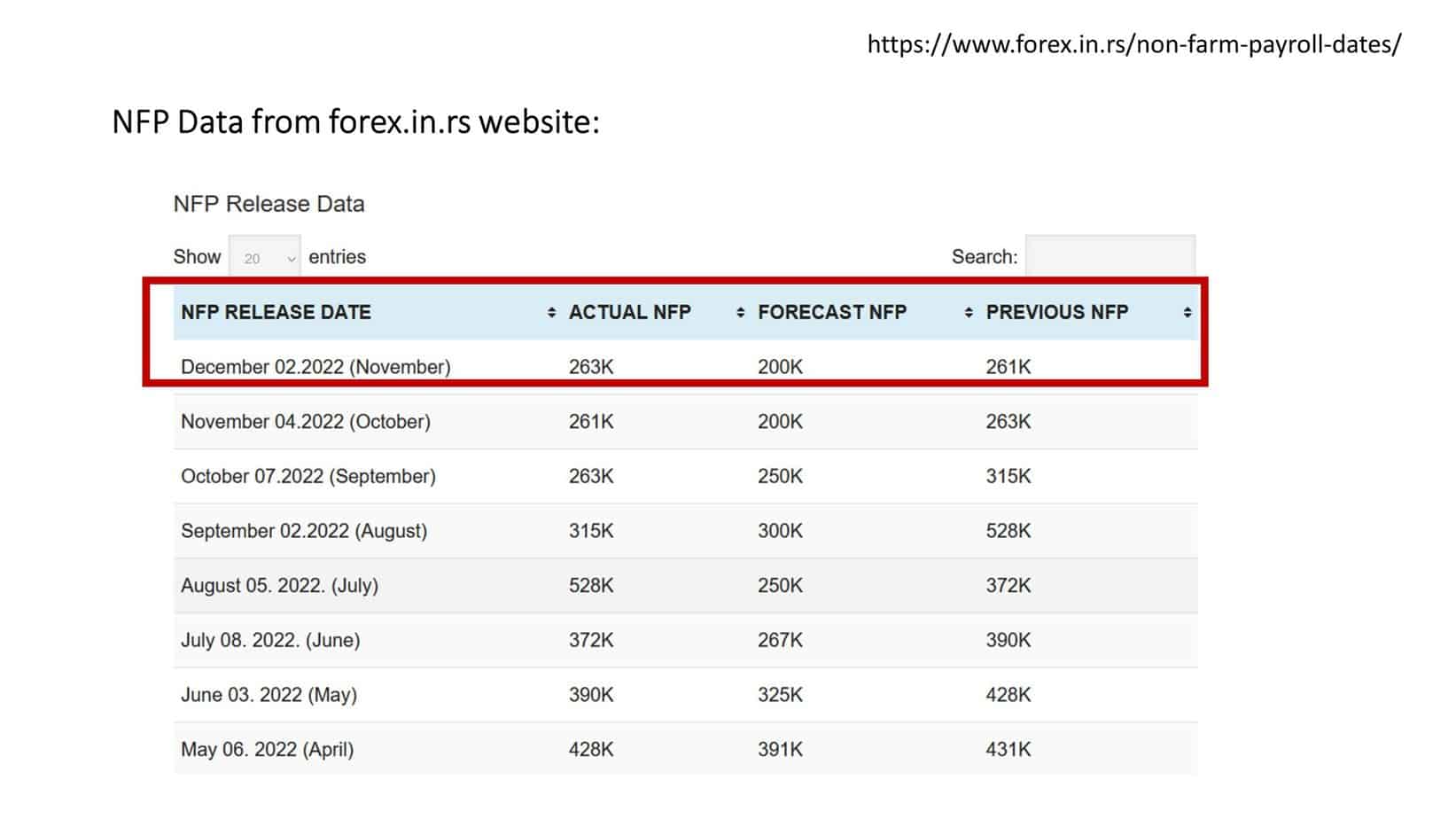

To analyze NFP dates, you need to check the Non-farm Payroll calendar, which you can do from our website:

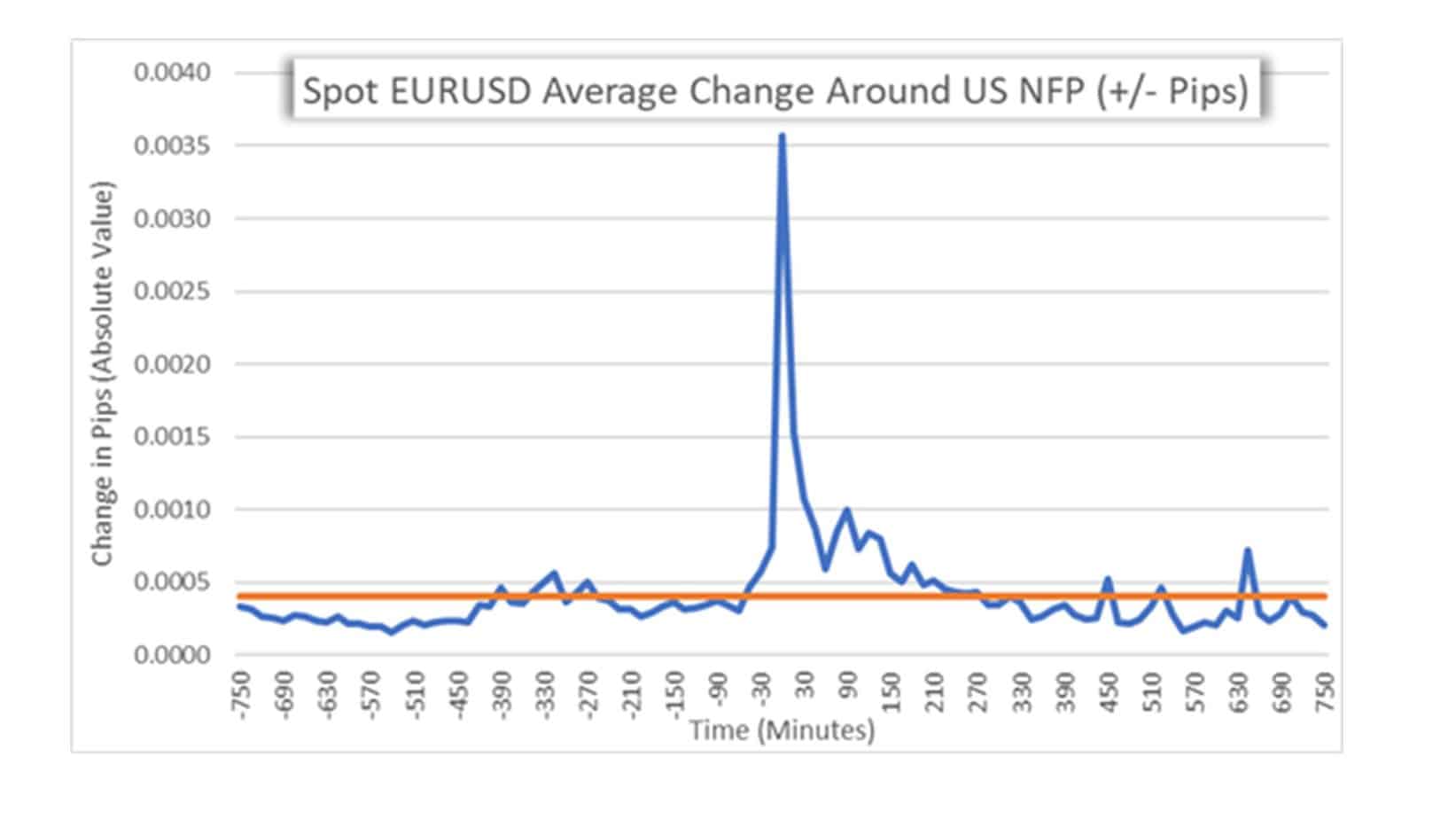

Now let us see NFP volatility charts:

As we can see on the chart above, the first volatility will occur 30 minutes before release.

Below you can see the peak during the news release:

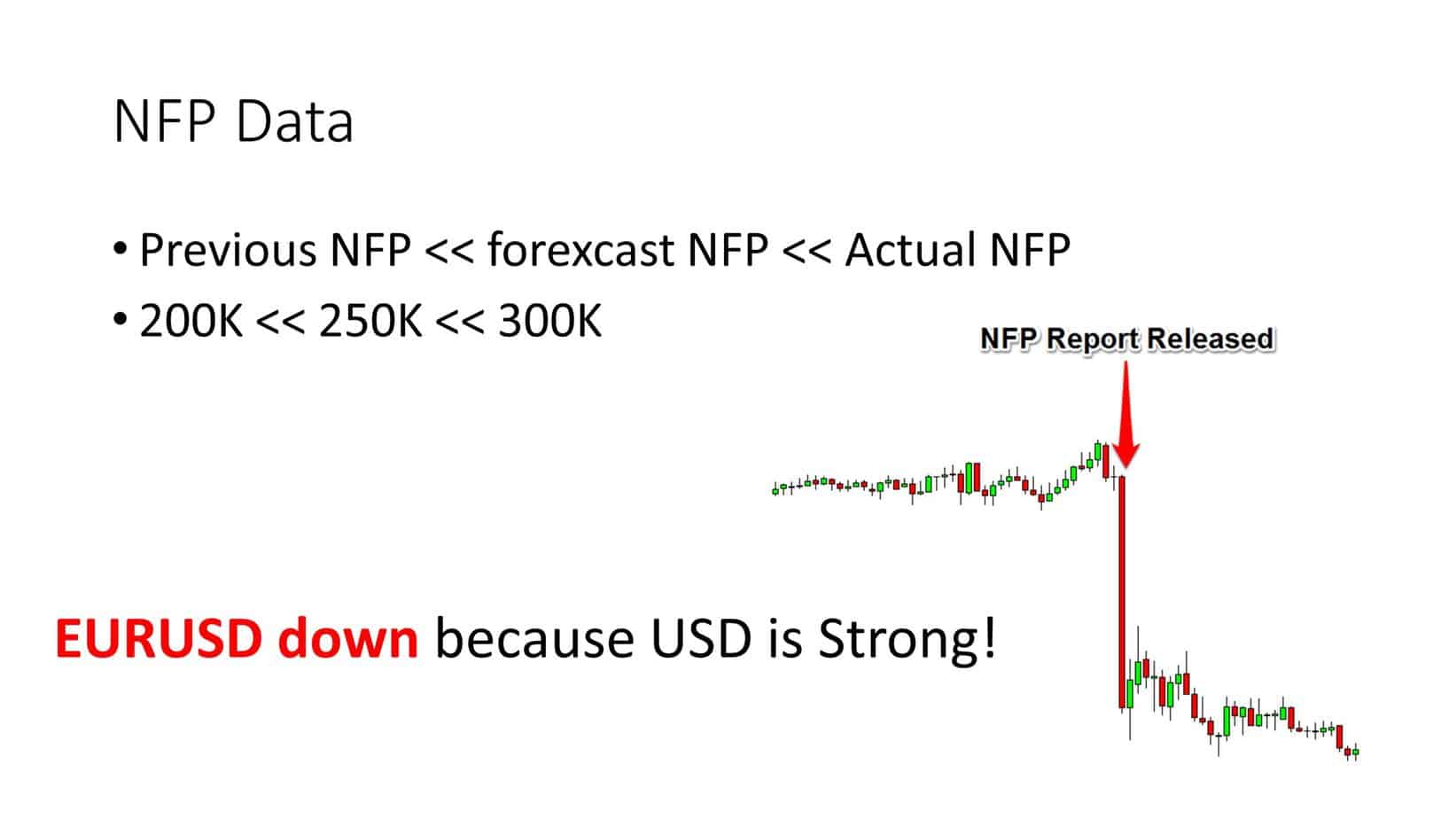

So let us see one example of when an NFP report is perfect for confirming a trend:

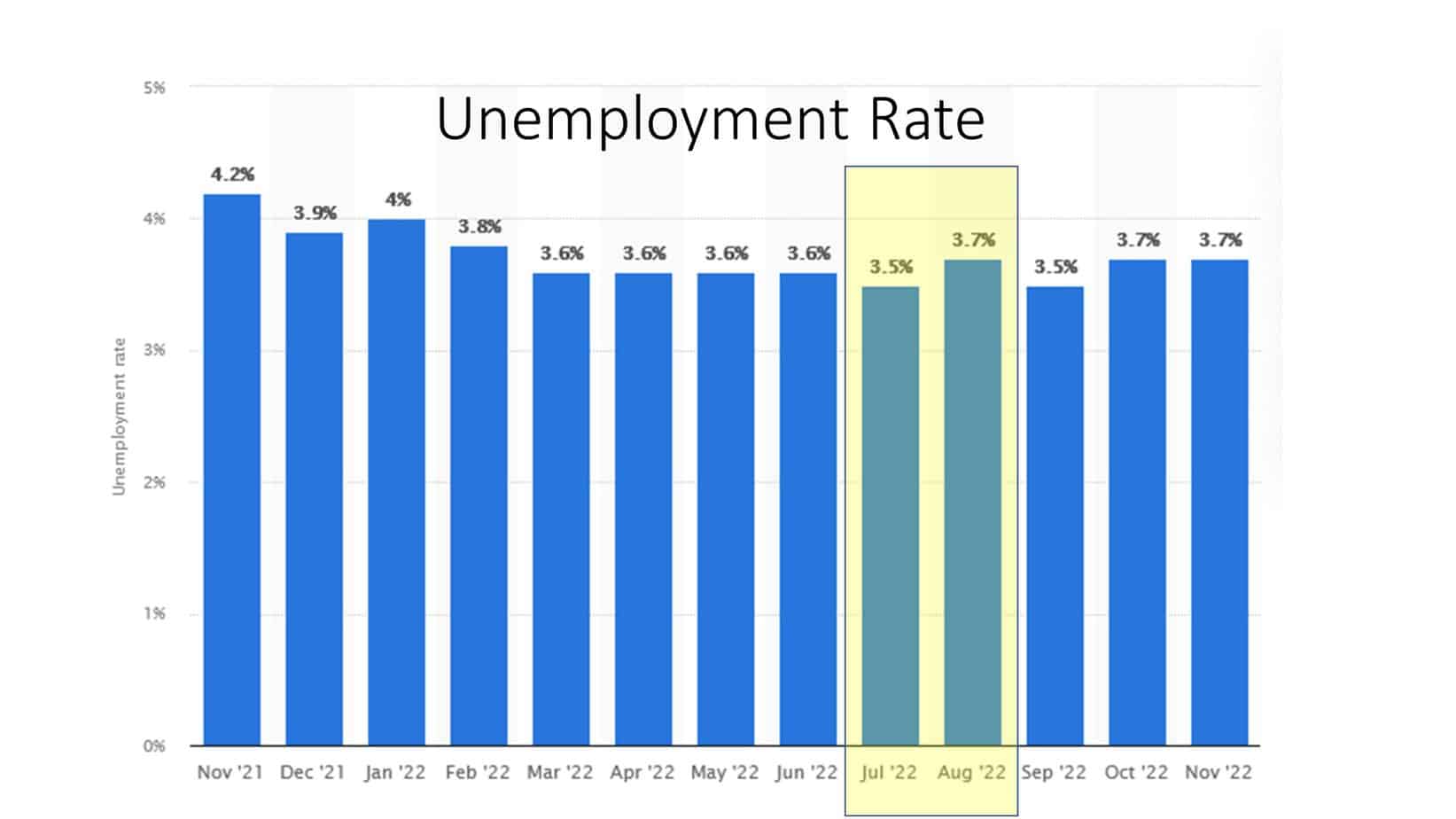

As we can see, it is essential to analyze the NFP report together with the unemployment rate because mixed results can generate different directions:

Conclusion

Non-Farm Payroll Report is an essential indicator that can cause intense volatility for US-related forex pairs. In that case, always analyze NFP and the unemployment rate because mixed results can form unexpected trends.