Table of Contents

Gold asset superannuation accounts provide what benefits? With this investment, you’re essentially converting a portion of your withdrawal savings into gold. It’s up to you to decide whether a gold IRA is best for you. This article will assist you in realizing what to search for in your IRA to determine whether it permits you to establish a first-class retirement nest egg, but not all IRA accounts accept gold deposits.

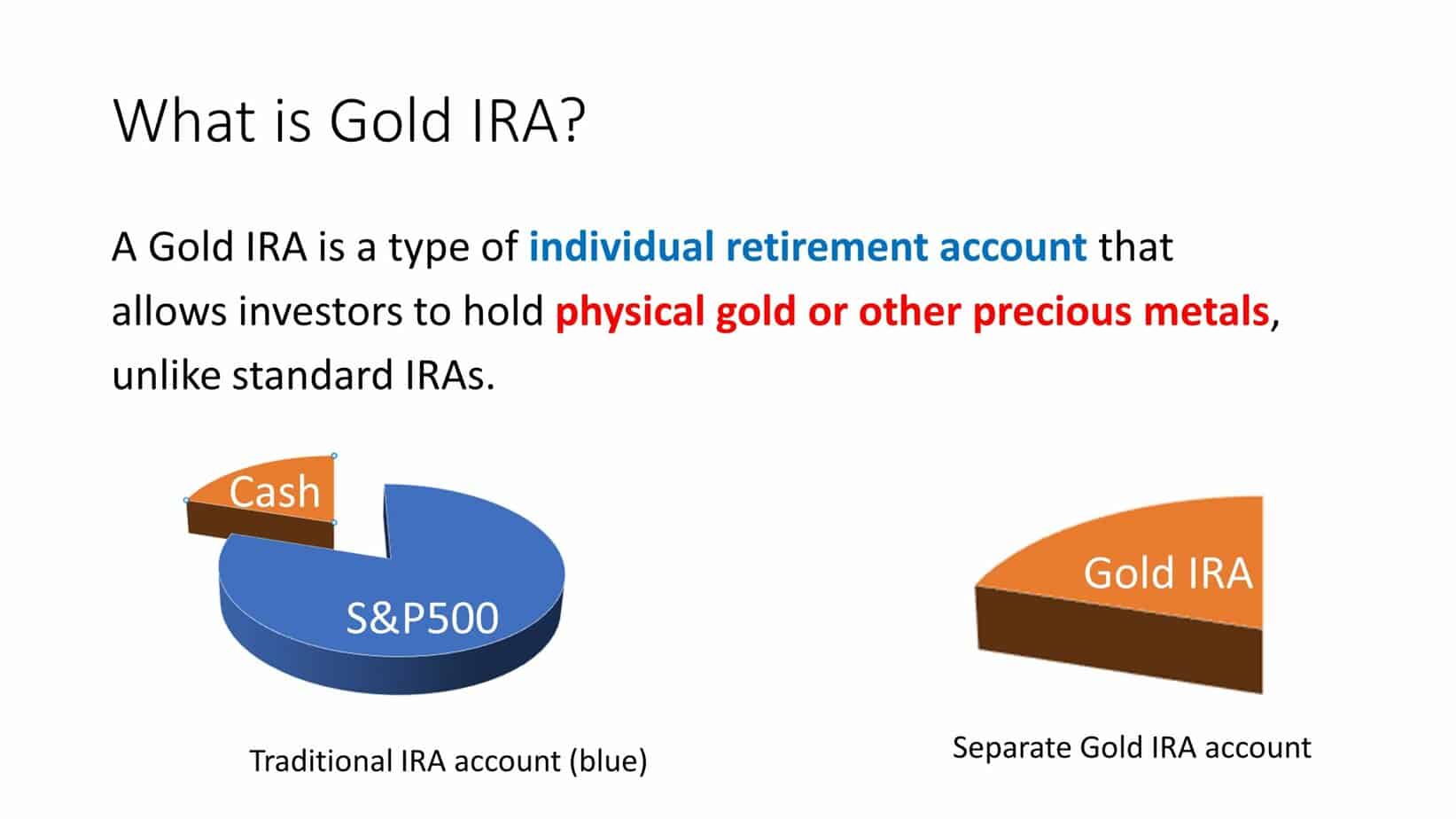

What is Gold IRA?

Gold IRA represents a specialized individual retirement account that allows investors to hold gold as a qualified retirement investment. Gold IRA accounts offer diversification for your investment and protection from potential recession. (Read our Augusta Precious Metals Review article to learn more about company.)

Gold IRA Facts:

- It’s possible to set up a gold IRA, a discrete retirement account that spends on actual gold and other valuable metals.

- There are more extraordinary expenses associated with a gold IRA than with a regular or Roth IRA that only invests in equities, bonds, and shared reserves.

- A gold IRA is a strong inflation hedge focusing on one asset class.

Gold’s Fluctuating Value

From a low of $255 in Sep 1999 to a high of $1,937 in Aug 2020 for the price of an ounce of gold, there has been a wide fluctuation. An ounce of gold was trading for about $1,737 in March 2021. 1 In other words, there has been a lot of expansion, but there have also been a lot of job cuts.

When it comes to traditional individual retirement accounts (IRAs), investors may only hold so much cash, equities, and bonds in a gold IRA before converting it to an annuity or a life insurance policy.

In 1997, Congress paved the way for using gold and other precious metals as IRA assets, according to Edmund C. Moy, Fortress Gold’s chief strategy officer, who supervised the most excellent making of silver and gold coins in the realm as director of the United States Mint.

Gold IRAs: Increasingly Popular

Investors looking for a well-rounded retirement portfolio may be interested in a gold IRA. Inflation protection is provided by a gold IRA as gold charges tend to rise in the reverse trend of paper resources, states Moy. As a long-term investment, an IRA is a wise option because of this balanced approach’s ability to level out risk.

During his time as administrator of the Mint, Moy claims that there was a minimal request for gold IRAs since they involved a complex process the utmost tenacious investors were prepared to pursue.

The IRA must have an executor or defender and an authorized depository. Finally, the gold or costly metal must be purchased and transported to the repository in a manner that the custodian can count. However, IRAs, on the other hand, have grown in popularity since the 2008 financial crisis and the subsequent Great Recession. Participating in a gold IRA has become comprehensive due to the proliferation of organizations that manage and simplify transactions. As a consequence, the value of gold IRAs has increased significantly.

Then there’s the influence of global and economic news. As Moy points out, “the Federal Reserve’s stimulus measures might have an inflationary effect, and there has been a substantial rise in geo-political jeopardy.”

To keep the metal in an IRA, you must meet specific requirements. Rather than the IRA owner, the expensive metal monies or bars kept by the IRA executor must exceed IRS fineness criteria, according to Moy. Keeping the gold in an IRS-accepted stockpile is a requirement.

So, no storing bullion in bank safes, house safes, or even closets is allowed. According to Moy, “all other IRA rules and regulations regarding contributions, distributions, and duties apply.”

It would help if you used an IRS-approved depository to hold the gold in a gold IRA; you can’t put it in a security credit case or a house safe. (Read our article How is Gold Taxed in an IRA? to learn more about this topic.)

Obtaining an Adviser or Defender.

An individual must create Individual Retirement Account (IRA) to invest in gold; this type of IRA is more flexible than a traditional IRA since it allows investors to participate in a more extensive choice of investments. One must have a gold broker to purchase the gold and an account custodian to set up the account. According to Canyon, Texas-based GoldStar Trust president John Johnson, this business will stock or keep your physical bullion.

Please always check the Gold IRA company before any investment.(Read the Gold IRA Scams article to learn more about this topic.)

Individual investors and their financial advisers may rely on asset custody services from banks, trust corporations, credit amalgamations, brokerage organizations, or investments and mortgage organizations authorized by central governments. For their IRA customers, they don’t hand-pick precious metals merchants. This is the duty of the investor. On the other hand, established custodians may be prepared to offer their list of hundreds of dealers around the nation.

The opposite way around is also possible. A custodian may be recommended to specific metal merchants by Johnson. “Consumers are free to conduct their searches for caretakers.”

According to Moy, choosing a business to work with is difficult since it’s a particular activity that most big brokerage companies do not provide. He recalls in his research that “there were some significant factors to me,” he recalls. These are some examples:

- It is essential to know all of your charges upfront to prevent any unpleasant shocks, like secreted dues.

- The Better Business Bureau or the Business Consumer Alliance are good places to start looking for a firm with a good track record from impartial third parties. For further information, Moy suggests looking into consumer feedback and complaints. He was looking for businesses that were “instructive and not making a hard pitch,” as he put it.

- Moy advises investors to look for a flexible firm to meet their wants and ambitions rather than a company with a universal strategy.

- It would help if you only worked with a firm that is appropriately licensed and insured to safeguard your investment. Request that the validity of these certificates and other details be confirmed.

Gold IRA additional costs

Having gold in a gold IRA comes with some additional costs. Investors will incur several charges, including:

- The markup (profit the merchant keeps): The price of gold is fixed, but there are hikes reliant on what kind of gold product you want, according to Sentell. When purchasing from a seller, the markup is a one-time price. While each type of gold has unique selling needs, “as well,” he continues.

- Setting up a retirement account: To open a new Individual Retirement Account (IRA), you will be charged a one-time cost. Because not all financial institutions contract with gold IRAs, this price may be more than the standard startup fee.

- The cost of becoming a custodian: Annual fees for this kind of IRA may be greater than those for other IRAs, particularly if you have to go to a diverse economic establishment than the one where the rest of your money is invested.

- A certified storage facility is required to hold the gold, and storage costs are levied.

- To liquidate a gold IRA by retailing your gold to an unbiased dealer, the dealer will seek to reimburse under what the gold is now worth on the exposed fair.

- Cash-out fees, for this reason, it is possible that you will lose money unless the price has grown considerably since you purchased it.

Some IRA businesses will pledge to purchase back your gold at existing general prices, but you may still drop money if you close the account, unlike with conventional IRAs.

Problems with the Minimum Required Distribution

To maintain a traditional gold IRA, you must take the required minimum distributions (RMDs) at age 72. Because metals aren’t very liquid, you may have to retail your gold to cover those distributions, which would be a loss. To alleviate this issue, you may take your RMDs as your all conventional IRAs.

Checkbook Individual Retirement Accounts (IRAs)

Suppose you don’t want to pay for a custodian. In that case, one option is available: Checkbook IRAs, or self-directed IRAs, may be opened without custodial administration. It’s challenging to set up a checkbook IRA because, among other things, you need to be an LLC and have a professional inspection account.

But as Sentell notes, investors may buy U.S. Funds-minted gold American Eagles for their superannuation funds and keep them themselves instead of paying fees to a custodian or a storage facility. This duty-code exemption, detailed in Internal Revenue Code 408 (IRC), applies to no other currency (m). This sort of IRA is now under investigation by the IRS, so act cautiously.

Gold that has been rolled into coins.

You may transfer IRA and 401(k) money to a gold IRA if you currently have a traditional or Roth IRA. You may roll over any other retirement money. The account is usually created in 24-48 hours following the accomplishment and receiving of the application. (Read our article Gold IRA Rollover to learn more about this topic.)

According to Gottlieb, you may transfer Gold IRA money to another custodian, and You can set up a new account if all parties have signed off on a transfer request. A customer’s precious-metal alternatives will be reviewed by a representative of the new IRA account once reserves are available there. The price is locked in as soon as you tell them precisely what you’re looking for.

The unique dangers of gold

All investments, including gold, have both risks and benefits. According to Moy, the hazards of gold IRAs are similar to those of any other investment. “Gold’s price is prone to swings in either direction. In terms of its future, no one can correctly foresee.”

There is an excellent incentive to invest part of your retirement assets in the yellow substance, notwithstanding the danger, according to Moy. “Gold has been a store of wealth for almost 5,000 years,” adds Moy. As we saw with Lehman Brothers, companies may be wiped out if stocks or bonds collapse or bonds can fail in Argentina or suffer huge reforming as in Greece. The worth of the dollar has decreased with time. Despite this, gold will certainly not be value nothing.”

Moy believes that if the price of gold falls, your paper possessions will likely perform well. The gains of other assets will offset your portfolio’s gold losses if you have a well-balanced portfolio. Traditional IRAs face many of the same dangers.” He argues that gold IRAs do not have the same dangers as ordinary IRAs.

However, there are particular hazards associated with investing in actual gold. Theft may happen to everything that has a physical form. You may steal your gold if the vault is kept breached. To be eligible for gold IRAs, stocks must be covered, safeguarding your investment if you don’t exceed the custodian’s declared account amount.

According to Moy’s analysis, untrustworthy custodians may also take from their clients’ accounts or conduct deception by retailing costly metals that they don’t genuinely have or will acquire. You may minimize this by selecting a defender that provides financial transaction insurance.”

Gold’s Advantages

Gold is revered over the globe for its high monetary worth and long-standing role in many societies. According to financial professionals, the possibility of a planning mistake by the world’s central banks necessitates the consideration of safe-haven possessions like gold. Gold has been famous as a store of value for ages. An IRA filled with gold has several advantages.

- One of the Means of Accumulating Wealth:

Gold’s value has not fluctuated throughout time like that of other assets. Gold is seen as a method to convey and reserve riches from generation to generation.

- Risk-to-Return Ratio:

Even if they don’t generate income, certain assets have a purpose other than financial gain. One of them is gold. No worries at night when you invest in gold. It is a low-risk investment that serves as a kind of insurance for more dangerous ventures. Gold and other precious metals, like silver, may be used to diversify a portfolio and lower overall risk while offering an insurance-like level of protection for firm-grossed money and possessions.

- The US Dollar’s Decline:

Various factors contributed to a reduction in US dollar value, including enormous national duties and economic and trade deficits, a rise in money supply owing to Federal Reserve policies, and a considerable decrease in US currency value.

- The charge of living is increasing. Inflation push gold price higher.

Inflationary pressures tend to drive up the price of gold, making it an excellent inflation hedge. Investors have witnessed gold prices rise, and the stock marketplace falls during periods of rising inflation over the previous 50 years.

- Uncertainty in the geopolitical arena:

Gold’s value is unaffected by both financial and geopolitical instability when purchased. “Crisis commodity” refers to the fact that people rush to it when international tensions increase, and it frequently outdoes other reserves at such times. The European Union issue, for example, had a significant impact on this year’s gold price movement. When people have little faith in their governments, the value of gold tends to skyrocket.

- Gold is a kind of private wealth:

Although we live in a more digitally connected society, the need to protect one’s personal information remains vital. Physical gold may be amassed discreetly, disposed of, and sold over the globe as a type of prosperity that is both palpable and transportable.

Conclusion

To be classified as an “alternative investment,” gold IRAs need to be valued by someone with specialized knowledge, which is why they are not often traded on a public market. Even if gold has an excellent return potential, it’s easy to get seduced by its glimmer. The price of gold might abruptly fall. It’s important to consider if you’d be purchasing at the market peak if you invested in gold at a rising price point. Waiting could be a better option.

It would help if you talked to a financial counselor before you invest in a gold IRA to figure out how the metal fits into your entire investment strategy. You should never put all of your financial eggs in one basket. Sentell recommends investing no more than one-third of your retirement savings into a gold IRA if gold seems to be a sound investment. According to Gottlieb, an overall personal portfolio should not have more than 10% to 15% invested in gold, whether in paper form (which isn’t allowed in a gold IRA) or physical assets.

GET GOLD IRA GUIDE