Table of Contents

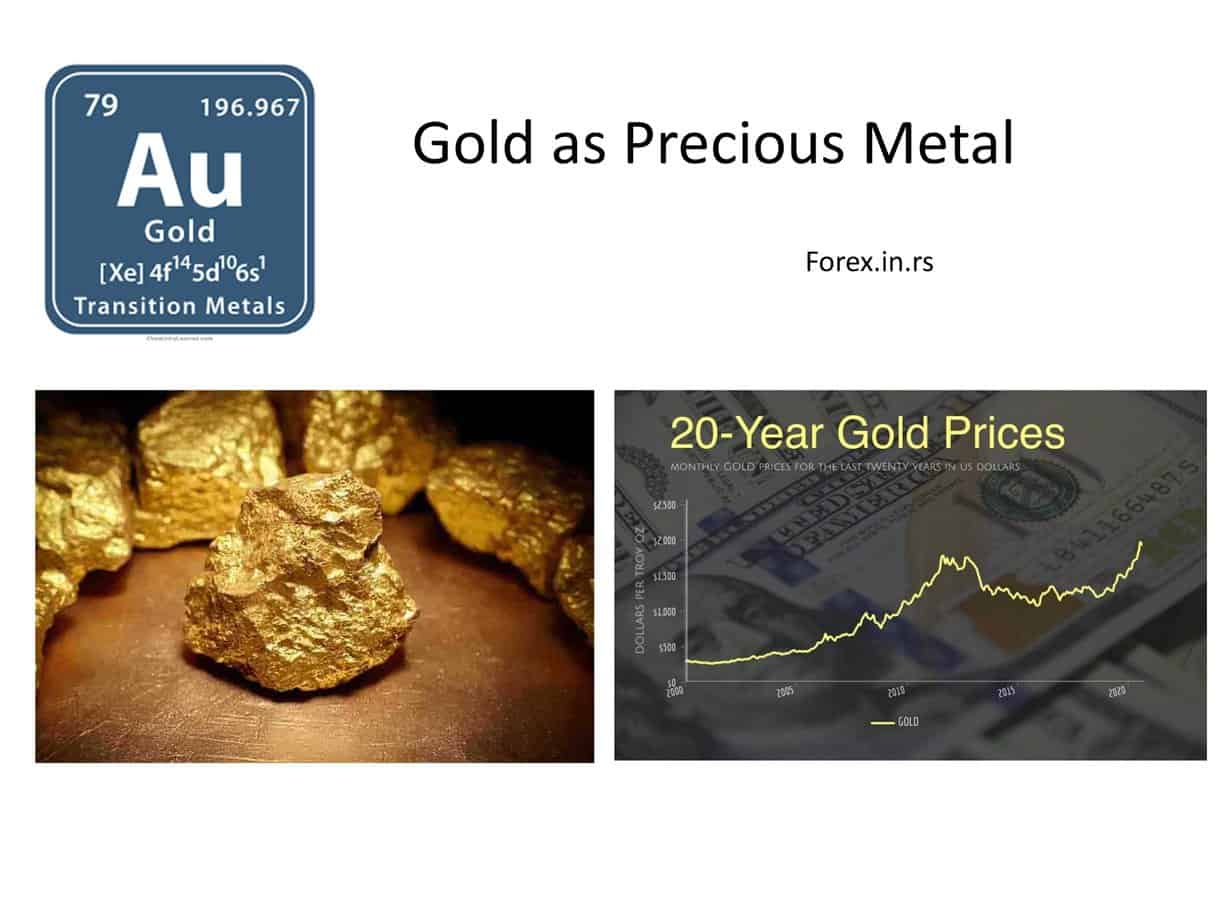

Gold is an attractive option for many, given its historical performance and relative stability compared to other investments, such as stocks, bonds, or real estate. Gold has been traditionally sought after during times of economic uncertainty and periods of high inflation. As a result, it can provide a hedge against market volatility and political risk.

How to invest in gold?

You can invest in gold in one of the following ways:

- Buy physically gold metal in the form of coins, bars, rounds

- Invest in gold Stocks because precious metals mining companies are leveraged to price movements in the gold price.

- Invest indirectly in gold by investing in Mutual Funds leveraged to price movements in the gold price.

- Invest in gold-related ETFs

- Invest in gold futures and options.

- Buy or Sell gold using CFDs brokerage companies starting from a $1 investing amount with a low commission. See an example of how to trade gold and gold.

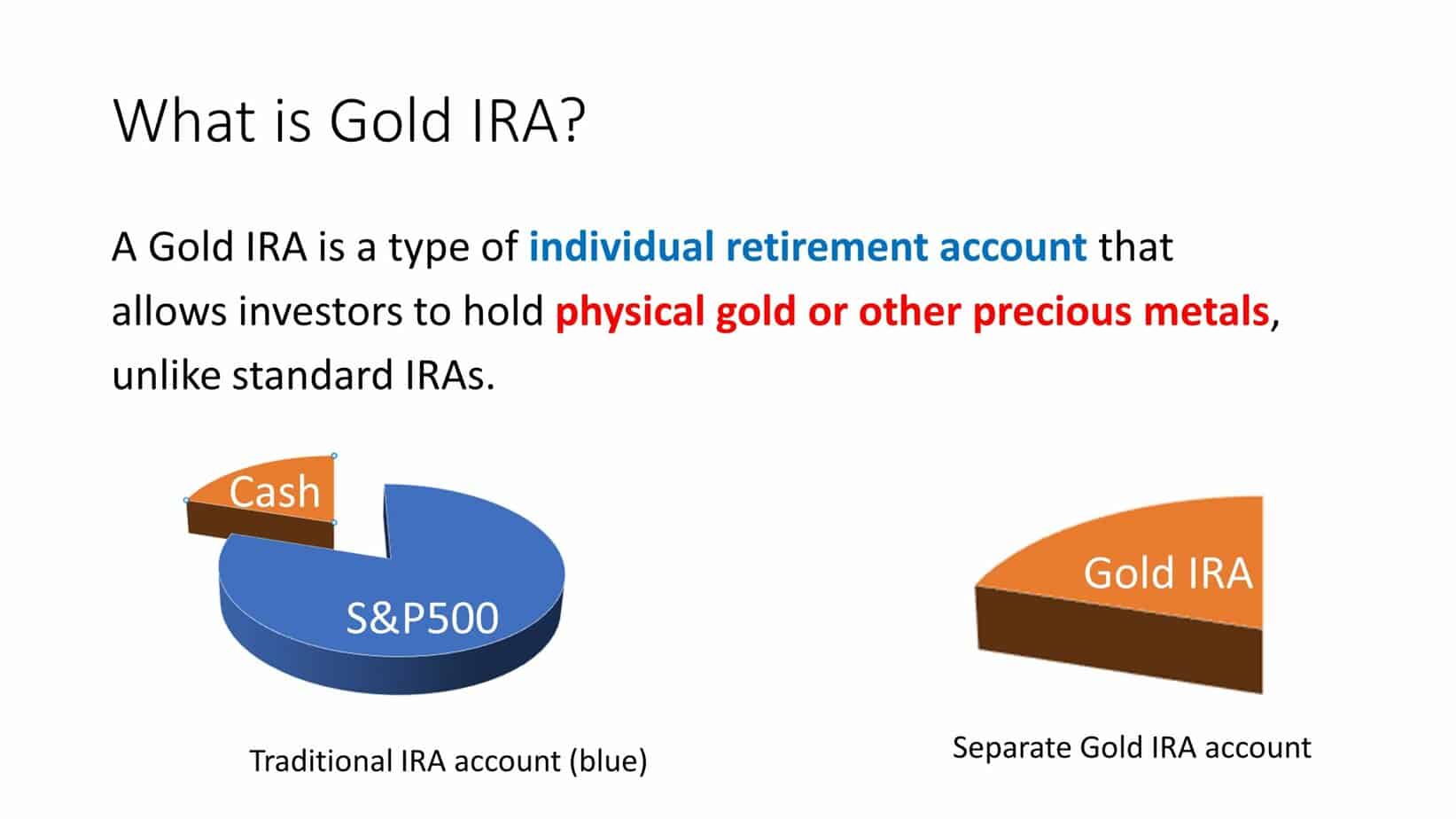

- Invest in gold IRA. In this case, investors use funds from a retirement account to physically invest in gold.

Buy physically gold

Buying physical gold metal in the form of coins, bars, and rounds is an excellent way to diversify and increase your overall investment portfolio. Gold is a hard asset that provides a tangible way to store wealth and protect it from inflation. Before buying physical gold metal, it’s essential to understand the different types of gold products available for purchase, where to buy them, fees associated with their purchase, potential risks involved in owning them, how to store them, and taxes related to them.

Gold Coins

Gold coins are minted by governments worldwide as legal tenders or commemoratives. Examples of legal tenders include American Eagle or Canadian Maple Leaf coins, while commemorative coins have Austrian Philharmonic or British Britannia coins. Gold coins are typically marked with their purity and come in sizes ranging from 1/20th of an ounce (1.555 grams) to one ounce (31.1035 grams).

Gold Bars

Government mints and private companies such as Pamp Suisse or Credit Suisse produce gold bars. The government-produced bars will have higher premiums than private companies due to greater quality assurance and control over the production process. Gold bars come in various weights ranging from 1 gram to 400 ounces (12042 grams).

Gold Rounds

Gold rounds are manufactured by private mints and look similar to coins, except they don’t carry any currency values nor have a face value printed on them as coins do. They are typically smaller than typical gold bars measuring about one inch across but can range from .999 fine gold to 24 karat pure gold, depending on the manufacturer.

You can buy physical gold metal directly from refineries or authorized dealers such as APMEX or JM Bullion or through online auction sites like eBay or other precious metals trading platforms like Kitco Metals Exchange (KMEX). When purchasing through these venues, it’s essential to research the seller/ dealer before making any purchases since there may be a potential for fraud if dealing with someone you don’t trust.

Additionally, when buying online, make sure you use credit cards since most reputable dealers offer fraud protection against fraudulent transactions made with your credit card information and offer additional buyer protections when dealing with them directly, such as guaranteeing product authenticity.

Coupled with doing adequate research before making any purchases, make sure you also check what fees are associated with buying physical gold metal before completing any transactions since there may be storage fees, shipping costs, transaction costs, etc., which could add up significantly if not accounted for ahead of time. Moreover, some platforms may even charge premium prices compared to other options. Hence, doing some due diligence before purchasing anything pays off to save time and money.

When storing physical gold metal, it’s essential to take into consideration factors such as humidity levels, temperature fluctuations, etc. which could affect the condition of your assets over time if not stored correctly, so make sure you set up a secure method for keeping your assets safe whether through acquiring safes specially designed for storing precious metals or using safety deposit boxes located at banks for added security measures against theft, etc. Additionally, factor into account potential tax implications associated with possessing physical gold metal, which varies from country to country and state to state, so consult financial advisors before making large purchases to ascertain what type of tax liabilities you may incur should you decide own large quantities of physical gold metal extended periods time either through simply holding onto your investments long term basis or actively trading them regularly.

Invest in Gold using a CFD broker.

If you want to invest in the gold price with the minimum commission, the best approach is to use the best CFD forex brokers with proper licenses and reputations. For example, you can read everything about HFM brokers.

When looking to invest in gold, there are multiple options available. Investors can purchase physical gold bars or coins, which carry the added benefit of being physically tangible assets that can be stored and kept safe. Alternatively, investors may buy exchange-traded funds (ETFs) or futures contracts that allow them to invest in the price movement of gold without taking physical possession. Companies also offer leveraged trading options for those interested in actively trading gold prices.

Gold is typically seen as one of the safest long-term investments as it tends to maintain its value over time and can act as a store of wealth during tumultuous periods or periods of high inflation since its purchasing power relative to other assets remains relatively stable. Investors need to understand the risks associated with gold, including geopolitical risks, higher management fees for ETFs or futures contracts than for physical gold purchases, and potential liquidity issues with some products not traded on exchanges.

When buying physical gold, investors should consider factors such as purity level (measured by fineness), weight (measured in troy ounces), form (bars versus coins), origin (where it was mined), dealer reputation, premiums associated with certain products, and storage fees if they choose not to take possession themselves. Some dealers will even offer certifications from independent third parties attesting to purity levels which can be helpful when determining value down the road.

Gold can be an attractive option given its historical performance during economic uncertainty and periods of higher inflation when other asset classes may underperform. However, as with any investment decision, investors need to understand their investment objectives and the potential risks associated with different products before making any decisions regarding their portfolio strategy.

Invest in Gold IRA

If you live in the US, you can invest in gold using Gold IRA, your 50K IRA retirement fund.

Investing in gold has long been a smart way to diversify one’s portfolio and protect their finances against market fluctuations. Augusta Precious Metals is an online gold IRA provider that allows investors to safeguard their retirement funds by investing in physical gold and other precious metals. With an Augusta Gold IRA, you can choose from various investment options, including coins, bars, rounds, ingots, and bullion.

When diversifying your retirement portfolio, there are several advantages of investing in gold through an Augusta Gold IRA. The first is that gold can act as a hedge against inflation. Historically, gold prices have gone up over time while the cost of paper money depreciates due to inflationary pressures. Investing in physical gold ensures that your wealth is preserved against economic downturns or currency devaluation.

Another advantage of investing in an Augusta Gold IRA is that it gives investors access to a wide range of precious metal products. From bars and coins to rounds and bullion, Augusta Precious Metals offers a variety of products for serious investors looking to secure their financial futures with hard assets. Moreover, all these items come with authentication documents from third-party testing laboratories, so customers can be sure they are investing in authentic products backed by reliable sources.

Setting up your Augusta Gold IRA is straightforward; all you need to do is open up an account with Augusta Precious Metals and transfer or rollover funds from your existing retirement plan into your new self-directed IRA account. Once complete, you can begin funding your account with investments such as coins, bars, or rounds purchased directly from Augusta Precious Metals or transfer/rollover existing holdings into the new version.

In addition to providing investors with access to precious physical metals such as gold or silver at competitive prices, Augusta Precious Metals also offers customer service support when needed throughout the entire setup and investment process, including guidance on which types of investments may be best suited for each customer’s needs and objectives – helping ensure that each customer makes informed decisions about their assets that are tailored specifically for them.

Overall then, investing with an Augusta Gold IRA provides both short-term gains as well as long-term security for those looking for stability over time; plus, it allows customers access to physical gold, which helps diversify their portfolios far more than paper assets alone could ever do – thus ensuring that you protect yourself financially no matter what curveballs life throws at you!

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: