Table of Contents

A concept of exchange applied by W.D. Gann or William Delbert Gann, as he is admired, gives a feel of chicanery and charisma. W.D. Gann is well known for his market analysis, just like Gann’s square of 9, which includes a combination of mathematical strategies and geometry. He was a believer of God and commenced trades when he turned 24. W.D. Gann was a foreman of 33rd degree, and due to these people’s attributes, his skills in maths and ratios.

For the significant section, W.D. Gann’s job was accessible to analyze. Hence, if you wish to deal using Gann’s technique, you need to have sharp skills and better intelligence.

How to trade with the Gann method?

The Gann method can be used in trading using angles, price, and time as triggers. If the price breaks an angle, then the price will usually rotate to the next angle. In that case, traders can forecast the next target price. Angles help traders to define the direction of the trend and how the trend is strong. For example, if the price is trading above the 1:1 (45 degrees) angle, the trend is strong while below 45 degrees is weak.

They are using W.D. Gann’s method does not prove to be as simple as other indicating techniques where buying and selling seemed feasible. And the reason is simple; it takes some time to learn a new approach. Just applying some movement to the chart and taking it further doesn’t work.

Another objection is that no particular Gann dealing techniques with professionals from which one can study. And the question is, why are dealers still sticking with a strategy derived in the 20th century?

We believe that as it is too complex to decode, it makes you feel that there might be something significant that one can use. For example, the Gann Square of 9 is well known amongst all other Gann approaches.

Download Gann Square of 9 indicators MT4 and Gann box indicator

The three most basic geometrical shapes like Circle, triangle, and square, forms the base for major Gann’s method.

Gann’s square and wheel are some of the most familiar operations and form a pillar. Square of 9, Hexagon, and Square of 144 are a few famous methods of Gann.

What is Gann Square of 9 in Trading?

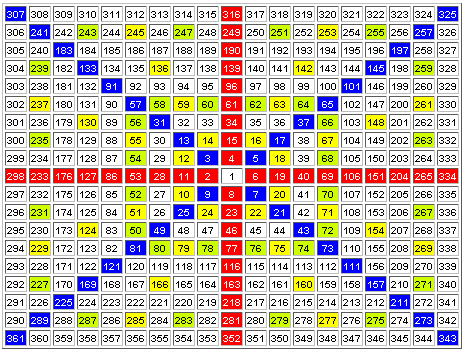

The Gann Square of 9 in trading represents a square of 9 is a spiral of numbers with an initial value “1” starting at the center used to measure key elements, such as pattern, price, and time.

This method of Gann Squares rates and duration. Gann’s square of 9 is named based on the pattern it forms as represented in the above-given chart. As you look more precisely, number 9 will denote the fulfillment of the 1st square.

With “1” commencing from the center, The square of nine makes a spiral of digits. Initiating from this rate, the numbers ascend as we move further in a clockwise direction. Thus, every cell into Gann’s square of 9 serves a fluctuating point as per the professionals.

How to Calculate the Square of Nine?

Digits inside the Gann square of 9 follow a constant arrangement. For instance, you choose 54 from the above-given square, the rate to its right, which is 29, is achieved as follows:

Get the square root of the digit and minus 2, and re-square the answer.

Example: 54 is the actual number

The square root of 54 = 7.348469

7.348469-2 = 5.438469

(5.438469)2 = 29 rounded off

To resolve the number to the left, rather than eliminating 2, the number is supplemented. Hence, we add 2 to the square root of 54 (7.348469), we receive the value 9.348469. We then square this answer to get the number 87.

Working of Gann Square

The Gann square of 9 tries to recognize adjustment of duration and rate to analyze the future values.

As we talk about Gann Square of 9, the below-mentioned key numbers are crucial.

0 or 360 degrees: 2, 11, 28, 53….

45 degrees: 3, 13, 31, 57, 91…

90 degrees: 4, 15, 34, 61, 96…

180 degrees: 6, 19, 40, 69…

Cardinal Cross and Ordinal Cross

Another set of crucial digits counts under the ordinal cross and the cardinal cross.

An image underneath represents the cardinal cross, highlighted by the blue vertical and horizontal lines. The ordinal cross values are shown in the yellow cells.

Values that are inside the cells show the ordinal and cardinal cross are significant backing and protections. Though both are very crucial, the ordinal cross is less critical and can intrude as per time. At every forty-five degrees, actual numbers take place. Individual degrees serve to display time.

The chart seen before is a general 1×1 chart. For instance, if rates go up to 54 in a day and then come down, the upcoming backing is 29 because it is the nearest number in the entire square of 9.

Circle Around the Square

A circle joining all four edges of a quadrilateral welcomes the idea of angles into existence. Angles that can be measured in terms of degrees can spot adequate backing and defense when rates move at an angle.

The Gann Square application

If you wish to use the Gann chart, change the initiating digit 1 with another number of your selection and needed step value. The increment in the example provided above is one, although you can place bigger or smaller values.

As a result, the numbers you receive are the major defense and backing levels of cardinal and ordinal numbers.

Depending upon the data, dealers can keep an eye on purchasing or disposing of at the earliest backing or defensive level.

W.D. Gann’s square of 9 is also applicable in global moves and degree of rates depending upon the circle.

Analysis and exchanging are two different concepts. For instance, an analysis that says Emini S&P500 will grow to 2100 in a specific duration. But the research will not say whether the movement till 2100 is inline or not, or if the value drops by a large number of points, how will that happen.

As a matter of analysis, it might look a bit pointless, yet they can determine the nature of a deal, whether it’s a win or a loss.