The growth of prop forex companies has exploded like mushrooms after a rain, mainly due to the accessibility of global currency markets and the allure of profit without personal financial risk. This rapid proliferation has been further fueled by technological advancements and the ease of setting up online trading platforms, attracting diverse participants worldwide. Of course, traders trade on demo accounts.

INSTANT FUNDING TO MANAGE MONEY - NO CHALLENGES

I explained everything in my video below:

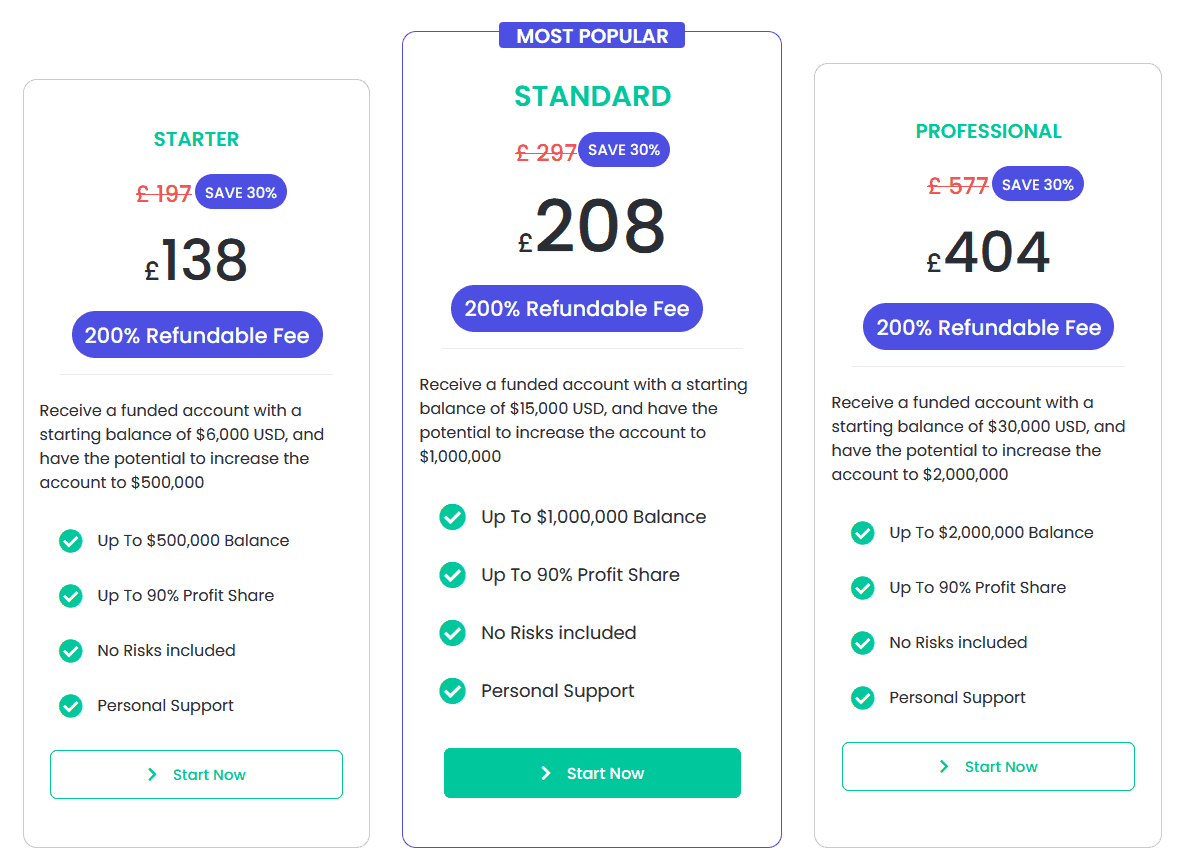

When you visit a proprietary trading company’s website that advertises a “FUNDED ACCOUNT” and “NO CHALLENGES,” it indicates that the company offers traders immediate access to a funded trading account without requiring them to pass a preliminary trading test or challenge. This means traders can start trading with the company’s capital immediately, avoiding the standard evaluation processes many other prop firms require.

The mention of scaling up to “$2,000,000 with weekly payouts” suggests that traders can increase the trading capital allocated to them based on their trading performance and receive their share of the profits weekly. This setup is designed to attract traders confident in their trading skills who seek quick access to substantial capital and the potential for rapid financial rewards.

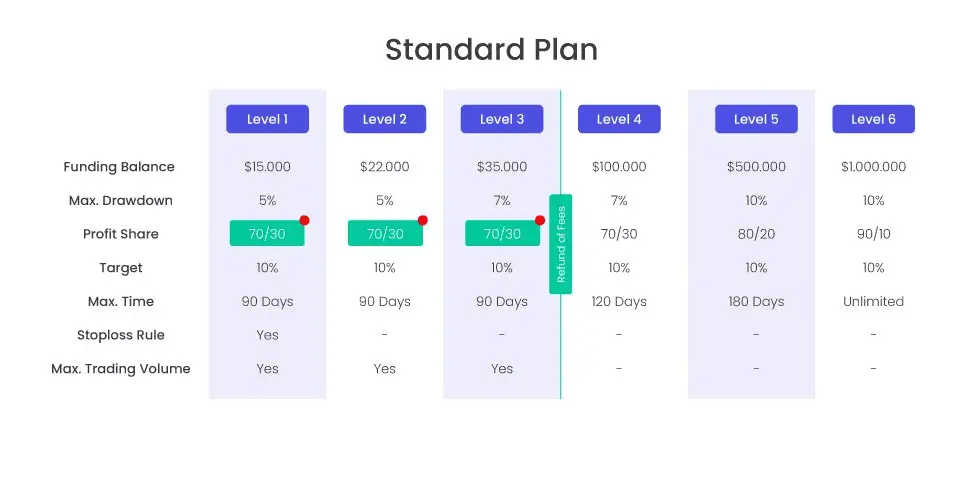

Below is a screenshot of the standard plan:

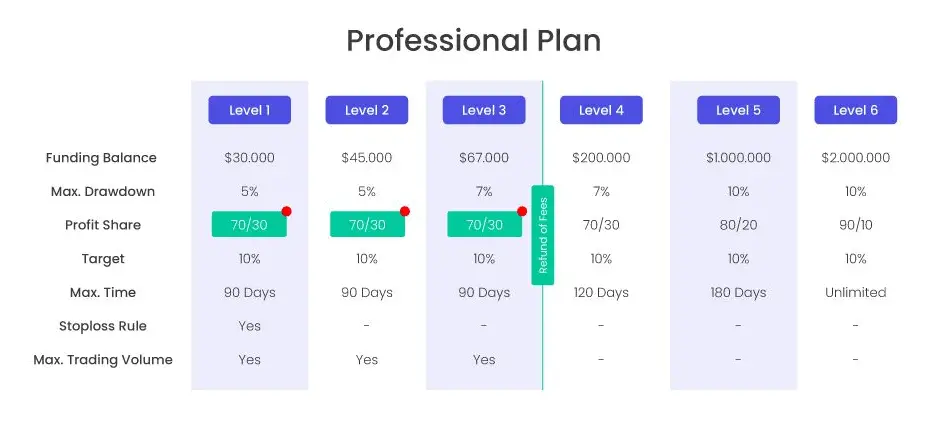

And there is a pro plan:

How to Avoid Instant Funding Prop Firms Trap?

You must carefully manage several lot sizes and your targets to avoid the instant funding prop firms trap. If your target is too big, you can have a problem with violation with instant funding. Prop companies with instant funding must stop traders from hitting targets with only one or two risky positions.

The rules set by forex proprietary trading firms can significantly influence trading strategies and risk management. Let’s discuss the two rules mentioned that may pose challenges for traders with instant funding.

- VTS Rule stipulates that a single day’s profit cannot exceed 25% of the set profit target. For example, with a $15,000 account balance and a $1,500 profit target, the maximum allowable profit in one day is $375. This rule is likely designed to discourage overly aggressive trading or high-risk strategies that could lead to large swings in account balance. While intended to promote consistent and steady trading, it can be seen as a trap for traders who might hit a profitable streak and then be forced to scale back or miss out on potential gains because of this cap.

- Maximum Trading Size: This rule limits the maximum trading size to 0.2 lots for Forex and Crypt and 0.02 for Commodities and Indice per $2,000 account balance. This rule is not applied per trade but is a cumulative limit across all open positions. It aims to control overall exposure and leverage, reducing the risk of significant losses due to over-leveraging in volatile markets. However, this can be restrictive for traders looking to capitalize on specific market conditions or prefer trading more prominent positions. It could limit profitability when a trader leverages market movements through larger trades.

Typically, brokers might restrict traders by setting specific lot sizes they can trade, which can feel limiting if you have a particular trading strategy requiring flexibility in order size. Instead, you suggest that brokers could set a fixed leverage ratio, such as 1:10, to inherently limit risk without forcing traders into rigid lot sizes. This approach would allow traders to choose their lot sizes within the bounds of a safer, more controlled leverage rather than pushing them to potentially overextend themselves with higher leverages like 1:100, which can amplify gains and losses dramatically.

I do not like this rule!

If the prop company wants lower leverage, they can set 1:10 leverage instead of 1:100. It is better to get automated limitation than to monitor that by accident open risky trade.

However, if you adapt your strategy to these 2 rules, you can avoid challenges and get payouts faster.

INSTANT FUNDING TO MANAGE MONEY - NO CHALLENGES

Please check list of all prop companies:

List of Forex Prop Firms

| Prop Company | Visit. Get coupon code | 2-stage 100K Fee | Max DD. | Profit Targets | Platform | Rating |

|---|---|---|---|---|---|---|

| The 5ers | THE 5ERS PROP | $500 | 10%/5% | 8%/5% | Metatrader 5 | 98 |

| FTMO | FTMO | $540 | 10%/5% | 10%/5% | MT4, MT5, cTrader, DXtrade | 96 |

| Alpha Capital Group | ALPHA CAPITAL | $497 | 10%/5% | 8%+5% | MT5, CTrader | 90 |

| Blue Guardian | Blue Guardian | $519 | 10%/4% | 10%/4% | DXTrade, cTrader, MatchTrader | 89 |

| FXIFY | $475 | 10%/5% | 10%/5% | MT4, MT5 | 87 | |

| Fund Your FX | Instant Funding | $500 (for 30K instant) | 6%/4% | 10% | cTrader | 87 |

| AquaFunded | AQUA FUNDED | $495 | 8%/4% | 8%+5% | DXtrade, cTrader | 86 |

| City Imperium | CITY IMPERIUM | $495 | 10%/5% | 8%/5% | Proprietary | 83 |

| Maven | MAVEN FUNDED | $299 | 8%/4% | 8%/5% | Match Trader | 83 |

| Funded Peaks | FUNDED PEAKS | $570 | 12%/5% | 8%/5% | MT4, MT5, DxTrade | 83 |

| Bright Funded | BRIGHT FUNDED | $495 | 10%/5% | 8%/5% | Proprietary | 81 |

| E8 | VISIT E8 | $588 | 8%/4% | 8%/4% | MT5, Match Trader | 80 |

| Lark Funding | LARK FUNDING | $540 | 8%/5% | 10%/5% | DXtrade, cTrader | 80 |

| Funding Pips | $399 | 10%/5% | 8%/5% | Match Trader, cTrader, TradeLocker | 79 | |

| Glove Node | $500 | 10%/5% | 8%/4% | Match Trader | 79 | |

| Goat Funded Trader | GOAT FUNDED TRADER | $541 | 8%/4% | 6%/6% | Match Trader, ThinkTrade | 79 |

| My Funded FX | MY FUNDED FX | $500 | 8%/5% | 8%/5% | DXTrade, cTrader, Match-Trader | 79 |

| Crypto fund trader | CRYPTO FUND | $570 | 10%/5% | 8%/5% | MT5, CFT | 78 |

| Ascendx Capital | ASCENDX PROP | $490 | 10%/4% | 7%+5% | MT5 | 77 |

| For Traders | $399 | 8%/5% | 5%/3% | MT5, DXTrade | 77 | |

| Funded Next | $549 | 10%/5% | 10%/5% | MT4, MT5, cTrader | 77 | |

| Instant Funding | fnyue (discount code) | $479 | 8%/5% | 10%/4% | DXTrade | 77 |

| UWM | UWM | $549 | 8%/4% | 8%/5% | DXTrade, MatchTrader, cTrader | 76 |

| My Flash Funding | FLASH FUNDING | $350 | 8%/4$ | 6%/6% | Match Trader | 75 |

| Funded Trading Plus | FUNDING TRADING PLUS | $547 | 8%/4% | 8%/5% | DXTrade, Match-Trader, cTrader | 74 |

| Funding Traders | FUNDING TRADERS | $550 | 10%/5% | 10%/5% | TradeLocker, MT5 | 72 |

| The Trading Pit | $999 | 7%/4% | 10% | MT5, MT4 , ATAS / Quantower, R/Trader | 72 | |

| Topstep | $99 monthly | 3000/2000 | 1:$6000 | NinjaTrader, Quantower | 70 | |

| Audacity Capital | AUDACITY FUNDED | $779 (120K) | 15%/10% | 10%/10% | MT5,MT4 | 66 |

| Earn2trade | EARN TO TRADE | $315 monthly | $3300/$4500 | 1:$6000 | NinjaTrader, Finamark, | 66 |

| Elite Trading Funding | Elite Funding | $430 monthly | $2200/$3500 | 1:$6000 | NinjaTrader, TradingView | 65 |

| Smart Prop Trader | $497 | 8%/4% | 7%/5% | DXtrade, Match Trader | 65 | |

| Swift Funding | $499 | 8%/5% | 8%/5% | cTrader. Match Trader | 65 | |

| Traddoo | $529 | 10%/5% | 10%/8% | TradeLocker | 65 | |

| Ment Funding | MENT FUNDING | $650 | 6%/5% | 10% | DXTrade, Match Trader | 63 |

| Breakout Prop | $725 | 8%/5% | 5%/10% | Proprietary | 56 |