Table of Contents

This article will write about spreads, forex commissions, and non-commission offers. The best choice for all traders is to choose reputable, big brokers that offer tight spreads for significant forex pairs and “fair” spreads for other instruments.

Simplifying Spread and Commission in Forex Trade

Regarding forex trading, there are several costs related to gaining from trade and when you wish to exit.

As you know, in the Stock market, you need to pay the commission and a spread on the trade you execute. You will have to pay when to enter and exit the market. We’ll simplify the notion of forex commission vs. noncommission.

As for forex markets, diverse pricing models find the application. The charges levied on you may not be clear, but as we move forward, we’d explain how forex brokers charge for your trading and the most plausible choices for you.

Fixed spreads, Variable spreads, and Commission

Fixed spreads are the most accessible model that appears to be quite beginner-friendly, although it has some concealed drawbacks. A fixed spread will imply requotes if your broker uses the instantaneous execution model at a time of enhanced volatility in currency prices. It will also mean slippage if your broker operates using the market execution. In these two situations, your trading procedure will be disrupted, making you miss any trade or even land a trade that is not similar to the already planned one. Nonetheless, a fixed spread permits precise trading cost scheduling and safeguards you from trades that might otherwise have been much more costly. I believe that fixed spreads are appropriate for short-term dealers, including scalpers.

Variable spreads – This model modifies the ask/bid difference almost every tick. It moreover implies that the traders are going to experience wider spreads in normal circumstances at the time when the market is calm. Regrettably, it will lead to extensive spreads when there is a low liquidity phase or high volatility. This kind of trading charge is appropriate for long-term merchants since they have the luxury of less limited timing while opening their positions.

Commission (zero spread) – Commission represents a zero spread variant for traders where traders instead spread pay a fixed commission as an amount per lot. It is a conventional compensation model intended for trading mediators within non-spot Forex; it is a less well-known scheme in the retail FX industry. Depending on the trade volume, some commission is associated with 0-spread accounts plus ECN accounts featuring non-zero spreads. Traders operating at the time of news or phases of low liquidity usually prefer this sort of fee. Paying commissions that are pretty high on most occasions safeguards these merchants from vast spreads, slippage, and requotes.

I will show you an example from my research. Here is a Table made from HFM commission values when traders choose zero spread. Instead, spreads traders pay a commission amount per lot :

An essential feature of trading in any asset will be the cost of the sale and purchase of that asset. This also includes currencies. One considerable cost in currency trading is derived from the trade commissions. Therefore, it will be imperative for traders to evaluate and measure the size and types of commissions to figure out their prices and prospective profits on every trade.

Forex Commission vs. Non-Commission Forex trading

When we compare forex commission and noncommission brokers, we are talking about fixed spread brokers, variable spreads brokers, and commission brokers. Non-commission brokers are not cheaper than commission brokers. Usually, a broker with a tight spread and a small commission beats a non-commission broker regarding the trade’s overall cost.

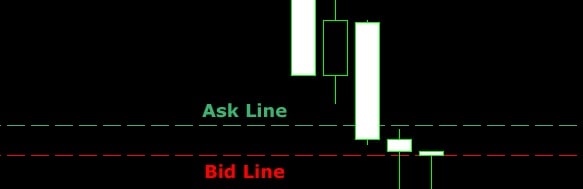

In FX trading, the commissions are generally paid according to what the dealers and brokers refer to as “the spread.” Currencies will be traded in pairs; these are usually offered at a “bid” price and an “ask” price on the trading platforms. This implies that the dealer or broker will sell the currency at a special price to a merchant (ask price) and purchase the identical currency at a lower price from the trader (bid price). Spread is the difference between the two prices.

Just commissions are paid on a fixed spread of 2 or 3 “pips” between the bid and ask prices. A pip will be termed 1/100th of a % point of any particular currency quote for almost every currency.

The spread between the two prices can modify the demand in the present market for the currency with a flexible rate commission. The spread usually becomes widened under this particular model once there is more market liquidity.

When it comes to the percentage-based commission, it’s a minor percentage made into the tighter spread. In this situation, the broker takes the percentage, which might amount to just a tiny portion of a pip. Following this, he leaves the rest of the spread to a more significant market maker with whom he works. Sometimes, this kind of commission will allow any trader to shell out a lower price of probably just a single pip for making a trade on a specific currency pair.

Traders experienced with equities, options, or futures will be acquainted with commissions. Brokers frequently charge these in these markets at a flat rate for every trade, irrespective of the asset’s volume, which alters hands. According to the dealer or broker used them, the currency traders will come across several commissions, including variable commissions, fixed commissions, and percentage-based per-trade commissions.

Forex commission vs. spread

Forex commission trading is better for high-frequency traders whose primary goal is zero spread during automated trading. Spread trading is an excellent choice if you are a swing or long-term position trader when the spread is not a crucial segment and expanse of your strategy.

The commission is an additional cost that a broker charges for each trade that you execute through them. It is typically based on a certain percentage of the total transaction value or as a flat fee based on your position size. Commissions vary significantly across different brokers and should be considered when selecting a broker for your trading needs.

The spread, on the other hand, represents the difference between what your broker is offering you to buy a currency pair and what they are asking you to sell it at. This difference is commonly referred to as “the bid-ask spread,” It represents part of their profit margin when acting as an intermediary between buyers and sellers in this market. The amount of this spread varies depending on factors such as liquidity levels available in each currency pair. It may differ from one broker to another due to each firm’s internal pricing strategies.

When deciding which type of cost structure best suits your trading strategy, it can be helpful to consider commissions and spreads together rather than separately. Suppose a trader has a good understanding of both commission rates and spreads offered by different brokers. In that case, they can build a tailored strategy that suits their needs better, considering both the upfront cost of trading and long-term profitability objectives.

It’s essential for investors looking at Forex markets not just to assess their risk/return profile but also to understand how much in commissions they are paying relative to spreads they could be getting elsewhere; this could effectively reduce returns if traders aren’t careful! For example: if two brokers provide similar liquidity on EUR/USD pairs, but one offers cheaper commissions than another, then it would make sense for an investor choosing between them to factor this into their decision-making process when deciding who they should use as their execution partner in this market segment!

Another factor worth considering is whether there are minimum funding amounts required before traders can access commission-free deals via certain brokers; often, these deals come with hidden conditions or restrictions attached, which could potentially impact profitability over time – so again, making sure these details have been thoroughly researched beforehand will help ensure maximum returns from any given position taken!

Finally, it’s essential for traders not just to focus on commission rates but also pay attention to whether any fees are associated with withdrawals or deposits. Often, these costs can add up quickly if large sums get moved around frequently! Ultimately, understanding commissions versus spreads and their associated costs will help inform investors’ decisions about who best suits their individual needs when investing in foreign exchange markets – something worth bearing in mind before committing hard-earned capital towards taking those first steps towards trading success!

See example – no commission forex trading – zero spread.

The market doesn’t work in a way, as discussed in the preceding paragraphs. Typically, market makers have an order book they’re trying to compare to because they make the market and actively participate in trade elsewhere.

The market maker can contemplate the incoming traders. They can target traders, and they will experience a profound gain when the target traders are not affected by the market. The market maker realizes a direct profit. An apparent disagreement of interests emerges.

Which broker to choose? You have 100% liberty as a retail trader. However, there are necessary conditions that a broker should fulfill. The requirements will mention what a broker should offer you.

Generating profits

The amount of commission shelled out might prove critical in determining the amount of profit or deficit registered by a trader on a specific trade. In every case, a currency pair’s cost will be forced to move about the commission/spread prices to generate revenue for a trade.

When it comes to spreads, the trader will come across different situations. For instance, on most occasions, highly traded currency pairs will be offered at wider spreads.

However, the volume of revenue or deficit, which can be realized, will not depend only on the spreads. For instance, currency pairs having low spreads might display reduced volatility and offer lesser opportunities for more significant profits or losses.

Selecting a commission structure and a dealer or broker

You’ll come across various sorts of commissions that are charged among dealers and brokers at present. Therefore the traders might find it quite helpful to evaluate what kind of trading they intend to perform before selecting what dealer or broker to work with. Several might offer features like analytical tools that aid in justifying higher commission costs or spreads. Traders might also like to consider whether they want to work with lower commission costs and spread and large volumes in more liquid and conventional markets; or take the risk of trading in more volatile markets where there is a high possibility for profit losses.

Advice: You need to see your history of trades and see an average number of trading positions per month. Based on your research, you can choose the best broker option. In my case, typical spreads that offer big brokers are enough for my trading style.