Table of Contents

For instance, if you think the euro will have increased value, you won’t simply purchase euros. You will need to look out for other currencies against which you consider euros to appreciate well. Thus, you can buy EUR/USD, which is a bet that the euro appreciates well in value against the U.S. dollar. People exchange currency every single day, in real life or business.

What is the Gain/Loss in Foreign Exchange?

Before moving on straight to calculate forex gain or loss, we must firmly understand Gain/Loss in Forex. When someone sells services and goods in foreign currency, there is a possibility of profit or loss in foreign exchange. While it gets converted to local seller currency, the foreign currency’s total value varies depending on the exchange rate. When the currency value inclines after converting, the seller gains foreign currency.

However, the seller incurs a foreign exchange loss when the currency value declines post-conversion. When it becomes impossible to find present exchange rates while the transaction is recognized, the available exchange rate is further used to calculate the conversion outcome.

Gain on the foreign exchange income statement.

A foreign exchange gain in the income statement occurs when an individual or company buys or sells in a foreign currency during currency price fluctuation (i.e., EURUSD, GBPUSD, etc. ) between invoice date and payment date.

All gains and losses can be realized and unrealized.

Realized vs. unrealized gains on foreign exchange

Realized gains and losses are losses and gains that are completed. This would mean the customer gets settled for the invoice before the accounting period’s closure. Unrealized profit or losses refer to profits or losses that have occurred on paper, but the relevant transactions have not been completed. Gains and losses in realized and unrealized form through forex transactions vary, whether the entire transaction is finished or not, until the end of the total accounting period.

For example, let’s assume that the customer buys items worth $1000 through the U.S. seller, and the invoice gets valuation at $1,100 on the invoice date. The customer then settled the invoice 15 days after sending it, and the total valuation was $1200 while it was converted to USD at the present exchange rate.

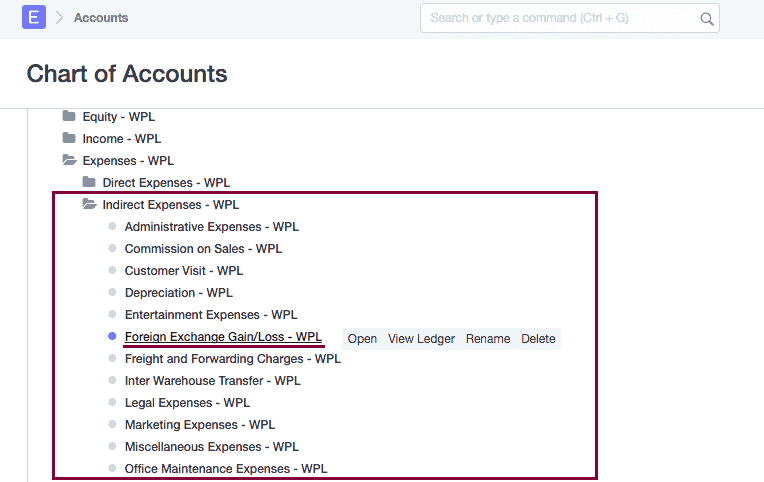

Let us see the foreign exchange gain or loss chart of accounts:

In this case, the seller would have realized gains from foreign exchange of $100 ($1,200 – $1,100). Currency gain gets recorded in the income section’s income statement.

How do you calculate foreign exchange gain or loss?

To calculate forex gain or loss, subtract the original value of the account receivable in seller currency from the converted seller currency value at the time of collection. A positive result represents a foreign exchange gain, while a negative impact represents a loss.

Let us see how to calculate forex gain or loss in this foreign exchange gain or loss accounting example:

Foreign exchange gain or loss accounting example:

An example of a foreign exchange gain or loss accounting is when the EUR customer pays the invoice to the US seller. Let the seller from the US post an invoice for 100 EUR to a German customer. On the invoice date, 100 EUR is worth 125 USD; on the payment date, the value of 100 EUR rises from $125 to $130. In this case, there will be a realized forex exchange accounting gain of $5 ($130-$125=$5).

Let us see another example.

Motorcar Parts of America is a business operating from the U.S. specializing in manufacturing parts for motor vehicles FIAT (for example). The company has sold its parts to distributors across Germany and the United Kingdom. The MPA company sold spare parts worth 100,000 EUR to German distributors in the previous financial year and parts worth GBP 100,000 to distributors.

While sending invoices, 1 GBP was at 1.5 USD, while 1.3 USD was for 1 EUR. Upon receiving invoice payments, one GBP was equal to 1.4 USD, while one Euro value was 1.35 U.S. Dollars.

Therefore, to know how to calculate forex gain or loss in conversions, we need to apply the following:

Sales in Germany

= (1.35 x 100,000) – (1.3 x 100, 000)

= 135,000 – 130,000

= $5,000 (Foreign currency gain)

Total sales in the UK

(1.4 x 100, 000) – (1.5 x 100, 000)

=140,000 – 150, 000

= -$10,000 (Foreign Currency loss)

Gains and losses that the seller expects to earn while the invoice gets a settlement are unrealized, but the customer fails to pay the invoice after the accounting period’s closure. The gains and losses calculated by the seller would be sustained when the customer pays the invoice by the end of the accounting period.

Suppose the seller sends invoices worth 1,000 EUR; the total invoice’s valuation will remain at 1,100 USD as of the invoice date. If the customer doesn’t pay invoices as of the accounting period’s last day, the invoice is valued at $1,000.

Upon preparing financial statements for the accounting period, the whole transaction gets recorded as a $100 unrealized loss when the payment is to be received. The unrealized losses or gains are recorded in the balance sheet in the owner’s equity section.

Foreign exchange gain loss accounting entry

Foreign exchange gain loss accounting entry can be created when the account is a liability or equity account. In that case, an unrealized gain or unrealized loss report represents a currency gain for liability or equity account. In the next step, credit the unrealized currency gain account (or unrealized currency Gain ) and enter an equal debit amount for the exchange-associated liability or equity account.

How to audit foreign exchange gain?

The foreign currency gain can be audited in the income section of the income statement. The profit or loss was determined by taking all revenues and subtracting all operating and non-operating activities.

While preparing yearly financial statements, companies must report their home currency transactions to make it simple for all stakeholders to know all financial reports. This would mean that all foreign currency transactions must be converted into home currencies at current exchange rates when businesses recognize transactions.

Although the little math applied here to calculate forex gain or loss would first appear daunting, calculating losses and gains in foreign exchange is just like converting one currency to another from time to time.

How do you calculate foreign exchange gain or loss in Excel?

- Begin by opening a new spreadsheet in Excel.

- Next, enter the account receivable value into the first column of your spreadsheet in seller currency units. For example, if you are working with a foreign currency account receivable valued at USD 100,000, enter “100000” into the spreadsheet corresponding to this amount.

- In the second column of your spreadsheet, enter the converted seller currency value of this account receivable at the time of collection. For example, if your foreign currency account receivable is collected in Japanese yen (JPY) and is valued at JPY 2 million at that time, enter “2000000” into the corresponding cell in your spreadsheet.

- To calculate forex gain or loss, subtract the original account receivable value from the converted seller currency value at collection time. A positive result represents a foreign exchange gain, while a negative impact represents a loss. For example, if you have an account receivable worth USD 100,000 collected for JPY 2 million worth USD 119739 based on current conversion rates, you would have a forex gain of $19739 in this transaction.

Please download the foreign exchange gain or loss in the Excel template!