Table of Contents

A lot of times, traders experience hindrances in terms of getting a desired or expected rate. It happens due to the vibrancy and frequency of the financial field and many technical factors involved in it. This is quite a common phenomenon in the trading world.

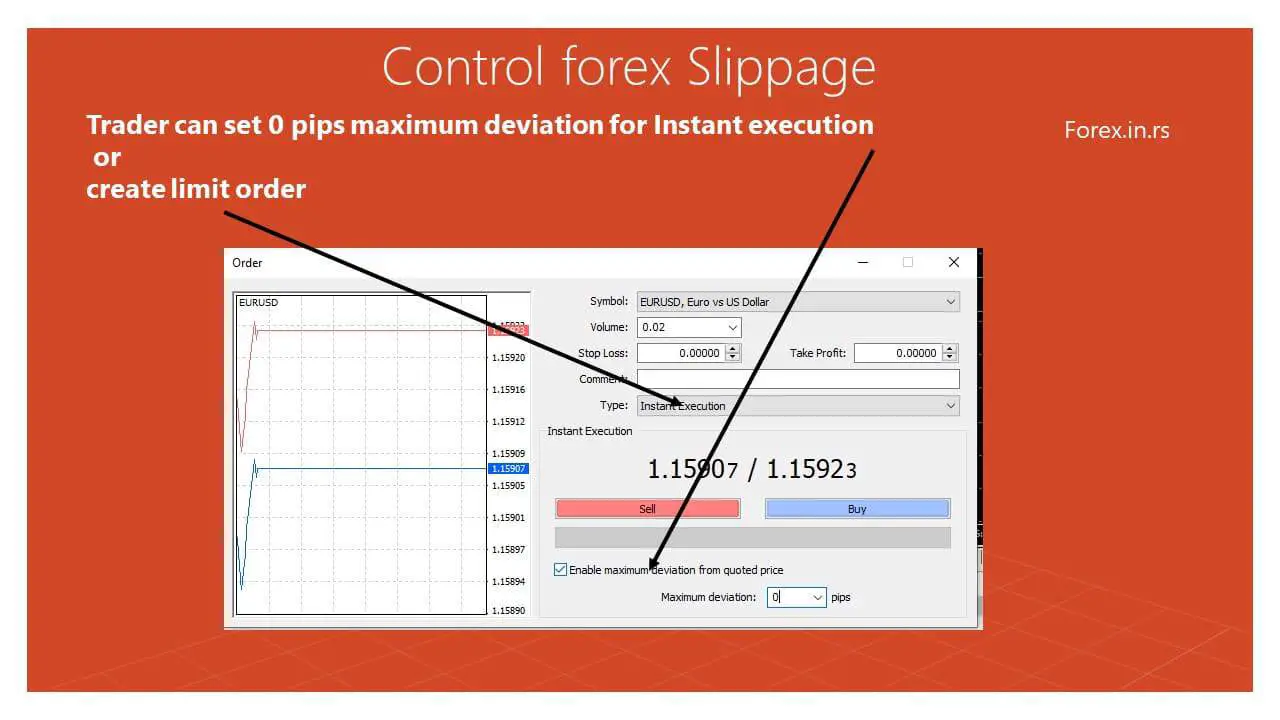

Slippage represents the difference between the expected price of a trade and the price at which the trade is executed and happens when a trader places an order but gets it executed at a different price. Slippage can occur at any trading time but is most prevalent during periods of higher volatility. Traders can perform forex slippage control using Limit order or using Instant execution where the maximum deviation is 0 pips. The limit order defines the exact price where the trader wants to enter into trade and prevents slippage. However, there is no guarantee that the trade will be executed. On the other side, Instant execution where the maximum deviation is 0-1 pip allows the slippage to be brought to a minimum.

Slippage example: It can happen at any time (placing a buy order or a sell order.) There are various types of slippages, like forex slippage, stock slippage, etc. For example, suppose a stock you want to trade is having a bid-ask span of $22.10 to $22.11. You want to buy this stock, expecting it to get executed at $22.11, but the stock market doesn’t wait or stay still, so your order gets executed at $22.13; it can also be $22.09 if you get lucky. That is called slippage, and $22.13 or $22.09 is called the slippage price.

In small trades, slippage doesn’t impact that much, but a small slippage can cost millions when it comes to larger or institutional orders. Thus, according to the financial market, you are trading in, slippage controls, i.e., forex slippage control becomes vital and essential.

The Relationship Between Types of Order and Slippage

Typically, a slippage happens when a trader places an order using “Market Order.” A market order is the current market price at which a trader buys or sells stocks or currencies. It is used to enter or exit the market. To eliminate the unpredictability here, a trader can utilize the option called “Limit Order.”

A limit order provides a trader with the option to select his/her preferred trade price. It doesn’t get fulfilled on the market price and gives a good forex slippage control or stock slippage control to the trader. Though an important thing about limit order is that it doesn’t get executed until the price you entered has triggered, and sometimes it leads to missing out on trades.

For example, if you want to place a buy order for stock ABC at $10.25, it has the current market price of $10.30. So, you place a limit order to buy this stock at $10.25. It would save you from your order getting placed at a higher price than $10.25, but also, it would only get executed if the price falls to the level of your limit price.

Entering and Exiting the Market

To enter the market (to buy) a stock or currency pairs, limit order and stop-limit orders are used. A stop-limit order is a combination of a limit order and a stop-loss; the loss is limited to a stop-loss price here, but it is different from the traditional stop loss.

For example, now, if you want to sell the stock ABC, the current market price is $10.30; you want it to get sold at a higher price, but the financial market can change the game any time and thus, you want to save yourself from the downside risk. So, you put a stop-limit order at $10.10.

So, now, if the price of the stock ABC falls beyond $10.10, your stop-limit order would stop the selling execution below $10.10. But, if it had been a stop-loss order, it could have been sold at a price more slumped than $10.10. In falling stock condition, a stop-loss order becomes a market order.

Many times traders use a market order to get their position sold and book profit. In such cases, they lose the slippage control but save themselves from larger losses. For example, in the example given above, placing a stop-limit order would stop selling your stock at a price lower than $10.10, but what if the price continues to fall? Your losses would get wider and wider.

Whereas if it had been a stop-loss order, your losses would have been less than the stop-limit order as stop-loss becomes the market sell order if the price keeps on falling. It would have cost the slippage but would also have stopped the widening of losses.

Placing a market order lets you trade, while placing a limit or stop-limit order ensures that you have the forex slippage control or stock slippage control over your market positions. It saves you from the slippage costs. However, stop-limit orders work better if the trade is in your favor. It can be learned eventually with practice as market movements are real-time and rapid.

How Significant Can the Slippage be?

When any huge events occur or news breaks, the chances of significant slippages are higher. Thus, it is recommended that traders not to trade when big news is expected to be announced. Big news can also reward with big profits, but that is not guaranteed as you can’t know in advance what is going to be announced, i.e., a company’s earnings call. As a day trader, you may expect the annual earning’s report to be great this year, you can predict a little, and it can come true, but what if, along with that, the company announces an M& A. The price would witness a huge unpredictability, and you would face huge slippage costs.

The same thing can happen in the forex market if a nation announces a rise/cut in its interest rate. Even after using forex slippage control tools, you would be prone to downside risk. Thus, traders always recommend having an eagle eye on the events happening across the globe.

Also, taking a position after the news break can give traders opportunities to make a profit. But during that time, using forex slippage control or stock slippage control like stop loss is always recommended. It is like having the option to apply brakes while driving a car.

Though applying slippage control tools doesn’t mean you are saved from losses, as you won’t have the slippage costs, you would have the downside selling risk if the situation gets out of control. Though, your losses would definitely be less extensive compared to not using slippage tools. Managing the risk is very crucial for traders, after all.

Slippage is Nothing New

Slippages are not new and happen all the time. Though apart from using the slippage control tools, as a trader, you can save your trades in a few different methods as well.

For example, if you are trading in the stock market in the U.S, try to trade when the major U.S. markets are open; also, if you are into forex, trade while the major forex markets like London or the U.S. are open. It would give you some forex slippage control as most trades would be highly liquid, and you can get your desired prices.

It is important to note that a trader cannot completely avoid slippages; it is the variable cost that a trader pays to conduct the trade, just like in a business. Thus, it is recommended to use slippage control tools like a limit order, stop loss, etc. Though the market is too volatile, a market order is recommended for easy entry and exit.

As a trader, you are your own savior; thus, trade accordingly and with enough knowledge about what you are getting into. Keep yourself updated with the news around the world, and use your own prudence for trading. Also, remember that sometimes the best trading strategy and slippage control tool is not to trade at all. The market is a violent and fascinating place, so you have to be firm and emotion-free in your trades.