Table of Contents

Gold is one of the most common and rewarding metals you can trade. With the right trading strategy and spread-betting platform, trading Gold more or less resembles Forex trading. You can read our gold price prediction article.

Gold trading strategies are diverse and primarily encompass fundamental, sentimental, and technical analysis. In addition, Gold is usually priced in US dollars, which helps in market analysis. Therefore, we will examine why you should trade Gold and some strategies to exploit for maximum returns.

I made a video where I described how to calculate gold pips in a fast way – please check:

One of the biggest problems for new traders is calculating the Gold and pip value for Gold.

Pips in Gold

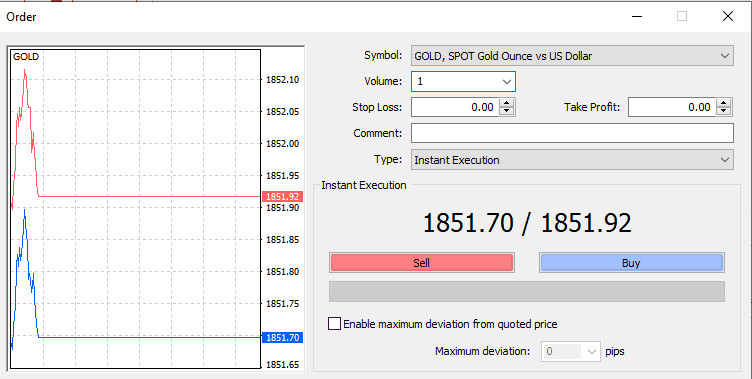

Pips in gold assets represent a price movement of 0.01 for most MT4 and MT5 brokers, while for currency pairs, a pip price movement is 0.0001. For example, when gold prices moved from 1851.70 to 1851.71, there was a 1 pip movement.

Below is presented 22 pips of the difference between the bid and the ask price for gold assets.

How to calculate gold pips?

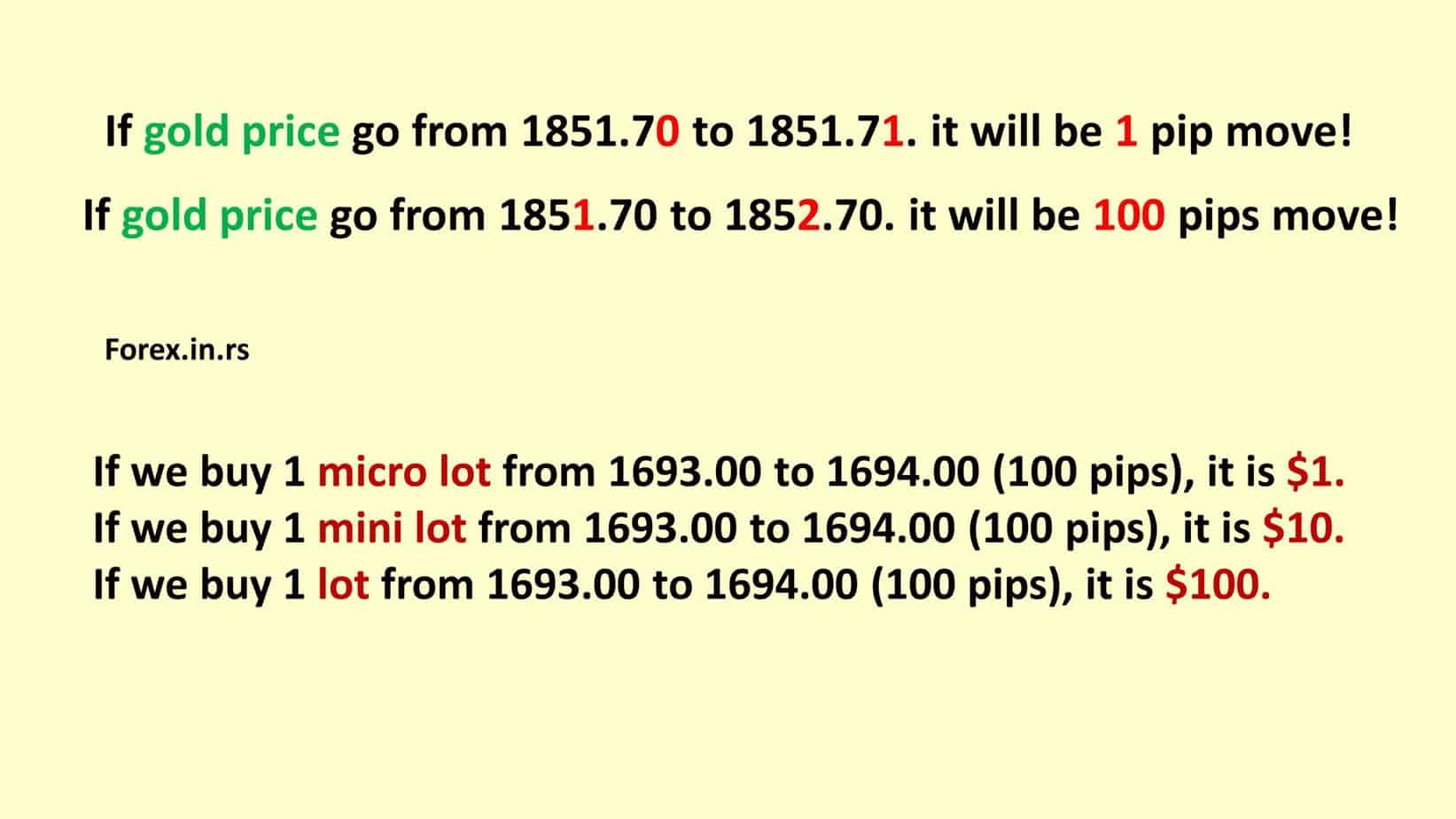

To calculate gold pips, you must know that 1 pip gain represents a 0.01 move in the gold asset. For example, when the price of Gold changed from 1851.70 to 1851.71, it was 1 1-pip move. However, if the price moves from 1851.00 to 1852.00, it is a 100-pip move.

As you can see, when we calculate gold pips, the last number (the second number after the decimal place) is a number with a one-pip move. If the last number before the decimal place increases, we calculate the hundreds of pips. See the image below for a better explanation of what I created:

Calculating pips for Gold involves calculating the number of pips in the first step. For example, for Gold or XAUUSD, 1 pip has a value of 0000.01 for 5-digit brokers, but it is different for 4-digit brokers. So, how do we read Pips on Gold?

How do you read Pips on Gold on the MetaTrader Platform?

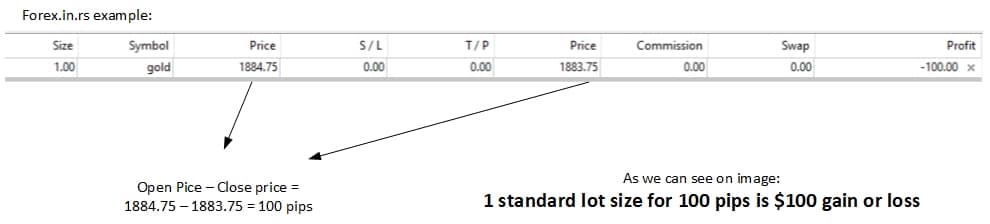

If we trade Gold on the Metatrader platform, one micro lot trading size for 100 pips is $1. If we buy one micro lot from 1693.00 to 1694.00, it is $1 or 100 pips. If we buy one mini lot from 1693.00 to 1694.00, it is $10 or 100 pips. Finally, buying one lot from 1693.00 to 1694.00 is $100 or 100 pips.

XAUUSD pip count Table:

| XAUUSD pip count | Pip value per 1 standard lots | Pip value per 1 mini lot |

|---|---|---|

| XAUUSD | 1 USD | 0.10 USD |

| XAUEUR | 1 EUR | 0.10 EUR |

When we trade the Gold, instead of calculating the number of pips and XAUUSD pip count, we ask how many cents (dollars) XAUUSD or Gold is going up or down. In Metatrader, traders calculate gold pips based on dollars and lots.

Calculating the dollar for gold trading is easy when changing the number of pips and lots.

One of the best tools for Gold Pips analysis and prediction calculation is TrendSpider Machine Learning’s automated technical analysis software.

The above presentation shows how Trendspider detects gold price trends.

How do you calculate gold pips when Gold is traded in ounces?

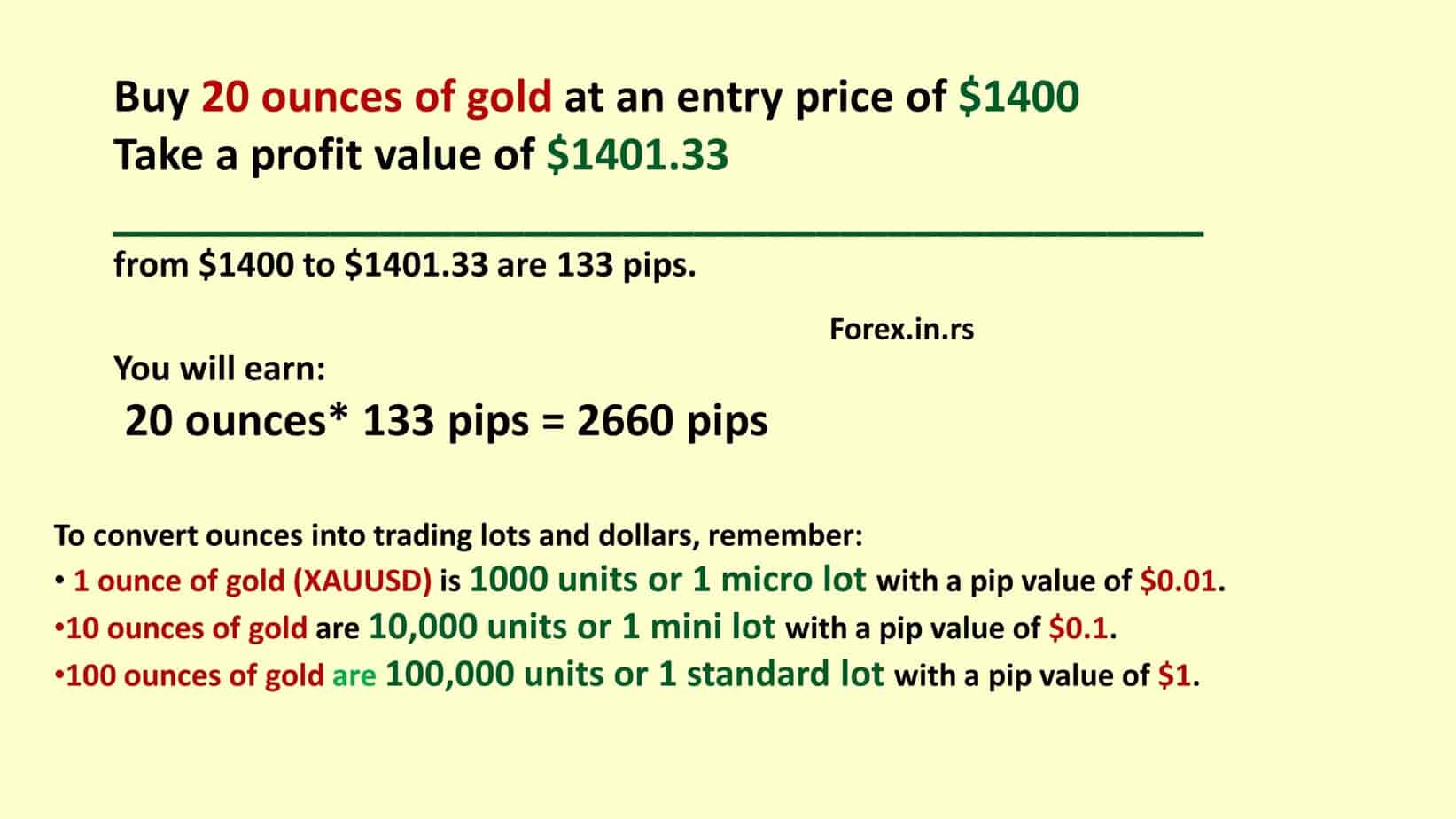

Gold can be traded in ounces on some trading platforms instead of lots. For example, if you buy 20 ounces of Gold at an entry price of $1400 and take a profit value of $1401.33, you can earn 20 ounces* 133 pips = 2660 pips because from $1400 to $1401.33 are 133 pips.

To convert ounces into trading lots and dollars, remember:

- 1 ounce of Gold (XAUUSD) is 1000 units or 1 micro lot with a pip value of $0.01.

- 10 ounces of Gold are 10,000 units or 1 mini lot with a pip value of $0.1.

- 100 ounces of Gold are 100,000 units or 1 standard lot with a pip value of $1.

If we trade Gold on different platforms than Metatrader, where trading is not in lots but in ounces (oz), then we have:

- For Gold: Position Value in GBP / Price of Gold / 100 oz = Volume or contract size in lots

- For Silver: Position Value in GBP / Silver / 5000 oz Price. = volume or contract size in lots

Gold: Using the given formula: Position Value in GBP / Price of Gold / 100 oz = Volume or contract size in lots

Given: Position Value = £50000 Price of Gold = £1293.40 per oz

Plugging in these values: = £50000 / £1293.40 / 100 oz = 38.64 (rounded to two decimal places)

Therefore, the contract size for Gold = 0.39 lots (rounded to two decimal places)

Silver: Using the formula: Position Value in GBP / Price of Silver / 5000 oz. = volume or contract size in lots

Given: Position Value = £50000 Price of Silver = £19.5340 per oz

Plugging in these values: = £50000 / £19.5340 / 5000 oz = 0.5113 (rounded to four decimal places)

Therefore, the contract size for Silver = 0.51 lots (rounded to two decimal places).

So, based on the given data and formulas:

- For Gold: A £50000 position for £1293.40 per oz would equal 0.39 lots.

- For Silver: A £50000 position for £19.5340 per oz would equal 0.51 lots.

Similarly, crude oil pips can be calculated as described in our article.

Gold (XAUSUD) pip calculator

The gold pip calculator is presented below. Please add the size and the number of gold pips to see the worth in dollars:

If you are a trader and want to calculate pips in Gold and manage your risk, drawdown, and average position, you can download my risk calculation position size MT4 indicator.

How do you count pips on Gold?

The best way to count pips on Gold on Metatrader is to remember that $1 is 1 micro lot for 100 pips. So, using the same logic, 1 mini lot trading size for 100 pips is $10, and 1 lot trading size for 100 pips is $100. So, for example, 1 lot goof ld forex trading size for 1 pip is worth $0.1.

Let us give one example:

How to count 50 pips in Gold?

To count 50 pips in Gold, remember that the target for 1 micro lot for 50 pips is $0.5. Thus, 1 mini lot for a 50 50-pip target is $5, and 1 lot for a 50 50-pip target is $10. Most forex MT4 brokers have this calculation. However, some brokers calculate gold pip in different ways.

How do you calculate pips for XAUUSD?

To calculate XAUUSD (Gold) pips, you need to know that 1 pip gain represents a 0.01 move in XAUUSD (Gold). For example, when the XAUSUD price changes from 1834.00 to 1834.01, it is 1 1-pip move. However, if the price moves from 1834.00 to 1835.00, it is a 100-pip move.

How to calculate 1 lot XAUUSD?

If you buy one lot of XAUSUD, you can count it as $0.1 for one pip move. So, for example, if you buy one lot of XAUSUD and the price goes from 1800.99 to 1801.99 (100 pips gain), you will make $100.

How do you calculate the ot size for Gold?

If you calculate the size of one lot of Gold in Metatrader, it has 100,000 units, and one pip of movement is worth $1. For example, when the gold price goes from 1800.00 to 1800.01, this one-pip move for one lot is worth $1. If the price goes from 1800.00 to 1801.00, this 100-pip move for one lot of Gold is worth $100.

What is XAUSUD leverage?

The XAUSUD leverage is the minimum margin requirement for the trader. If your leverage is 1:100, you can borrow 100 dollars for every dollar in your Gold trading account. For example, if your leverage is 1:100 and you have $1000, you can control your $100,000 investment.

Why trade Gold?

Times have changed, and so has the gold trade. Before, traders had to buy and resell the metal, which proved challenging. Futures and options were introduced, where traders traded without ending up with a complete set of valuables. As time progressed, Gold exchange-traded funds came, making trading more comfortable.

Spread-betting platforms have made gold trading one of the most straightforward ventures. Like currency trade, you must buy or sell, depending on the price predictions. One of the gold trade advantages is that, unlike currency, you are dealing with a physical commodity. Another reason you should trade Gold is that it is mainly used as a store of value. Finally, unlike the currency, it is not subject to many government regulations.

Gold trading strategies

There are several strategies you can employ when trading Gold. Some of the most common include studying the market forces, positioning of gold traders, technical analysis, which is quite demanding, and using a gold chart in the research. However, the best strategy combines technical analysis, fundamental analysis, sentiment analysis, and the gold chart.

The sentimental analysis allows traders to spot trends, whereas the gold table determines when to enter and exit a trade.

Trading Gold in Different Ways

As we have mentioned earlier, you can always trade Gold physically. But if you plan to do it electronically, there are different ways. You can trade gold ETFs or Exchange-Traded Funds, gold CFDs, futures contracts, and more. If you are doing electronic trading, you must find a good trading platform to enter a trade and profit. If you plan to do it in a significant volume or are new to it, it is advisable to work alongside a broker.

Please check the Gold market opening times today.

Conclusion

When we trade gold, knowing how to calculate pips for gold and calculate profit in dollars is crucial because it is not the same as when trading forex. You should, however, consider some things before buying and selling Gold. I am sure, therefore, that you use both fundamental, sentimental, and technical analysis techniques.