Table of Contents

A recent article showed how oil trading works and how to calculate gold pips. But let us start from the beginning.

Try the US Oil pip calculator:

Crude Oil Profit & Lot Size Calculator for MetaTrader:

USOIL Pip Calculator outside Metatrader:

What is Crude Oil?

Crude oil represents a natural fossil, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Crude oil can be refined to produce usable gasoline, diesel, and various other petrochemicals. The most famous types of crude oils are WTI Crude Oil and Brent Crude Oil.

The difference between Brent crude and WTI crude oil is that WTI originates from U.S. oil fields, and Brent Crude originates from oil fields in the North Sea. Usually, WTI is slightly “sweeter,” “lighter,” and lower in price than Brent.

WTI Crude Oil

WTI, or the West Texas Intermediate, is a grade or a mix of crude oil. Its spot and futures prices are used as a benchmark in oil pricing. Its grade is light crude oil due to its relatively low density. In addition, the presence of sulfur makes it the sweetest. Therefore, it refers to the New YorkMercentile Exchange WTI Crude Oil futures price.

What is USOIL in forex?

USOIL in forex platforms such as Metatrader represents light-sweet Crude Oil. Usually, the Metatrader USOIL symbol is WTI (West Texas Intermediate), USOIL, or Crude Oil.

There are various ways crude oil can be traded; our focus will be on retail forex trading platforms for this instrument. Let us see how to calculate oil in the WTI forex platform Metatrader.

US Oil Price – US WTI Crude (XTIUSD) Chart

Lot Size of Crude Oil – oil pips in MetaTrader

The minor price change for Crude Oil is 0.01 or 1 pip. So when the price rises from 40.00 to 40.01, it is 1 pip.

If we trade oil on the Metatrader platform, 1 micro lot trading size for 1 pip target is $0.01. If we buy 1 micro lot from 40.00 to 40.01, it is $0.1 or 1 pip. If we buy 1 mini lot from 40.00 to 40.01, it is $1 or 1 pip. If we buy 1 lot from 40.00 to 40.01, it is $10 or 1 pip. When traders calculate oil pips than 1 lot oil trading size, 1 pip move equals $10.

Let us see one example.

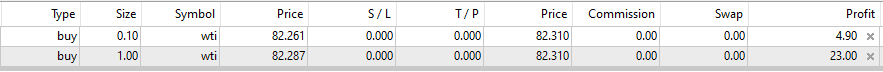

In the first case, we have 4.9 pips and 1 mini lot where profit is $4.9.

In the second case, we have 2.3 pips distance and 1 lot size volume, and profit is $23.

Below is a screenshot from the MT4 platform where I have 1 mini lot size and 1 lot size position:

Many brokers give you 1:500 leverage on this instrument. 1:500 leverage means you can operate a capital of $500 in the market for every dollar you invest. This is what you need to open a 10-barrel position.

Other than the capital required to open a position, it would help if you had marginal capital to support any floating losses. You will lose 5 pips as soon as you open a position as it is its spread.

The leverage offered by brokers is not always this high. Some brokers offer leverage as low as 1:40. You will need more significant capital to open a position and support floating losses in such cases.

Pip Value of Crude Oil

A pip denotes the slightest change in the price of an instrument. It helps identify how a tool in the market has witnessed much fluctuation. For example, a crude oil pip is considered $0.01 by most trading platforms. Remember that 1 lot oil trading size, crude oil 1 lot price, and 1 pip move are equivalent to $10.00.

How to Calculate Profit and Loss using Oil Pips in the Metatrader Platform

Using the information that 1 lot oil trading size for 1 pip move equals $1.00, traders can easily calculate the oil forex trading size position in Metatrader. This principle will help traders learn how to trade crude oil on the Forex MetaTrader platform.

The trader bought 1 lot at 40.55 and closed the trade at 40.90. In this example, the trader generated 45 pips profit. Because the trader had a position size 1 lot, his gain was $45.

Buy 1 lot, gain 45 pips, profit $450.

Buy 10 lots, gain 45 pips, profit $4500.

How to Calculate Profit and Loss when we have barrel contract

Let’s calculate oil pips for barrel contracts for the smallest position.

In a 10-barrel contract, the oil pip value would be $0.01*10 barrels = $0.10.

This oil pip value is stationary as the U.S. dollar is the quote or counter currency in the crude oil and U.S. dollar pair.

Let’s understand how profits and losses are calculated using crude oil signals by referring to this example:

Suppose you buy 200 barrels of crude oil at $50 each, and your profit is $55 each.

The easiest way to find out your profit is by using a simple arithmetic equation:

(Profit gained at one barrel – the cost of one barrel) * Number of barrels bought = Total Profit

($55 – $50)*200 = $1000

You can also calculate the total profit and loss using the pip value of $0.10. You can multiply the number of pips by $0.10, then multiply by the lot. The result will again be $1000.

Crude Oil and Related Instruments

The oil price is a crucial fundamental factor that can manipulate the value of a currency, especially if the country is a significant exporter or producer of oil and oil products. For example, Canada exports much of its petroleum products to the U.S. The Canadian dollar (CAD) is stronger when the traded oil prices are higher. However, a drop in oil trade volume or an increase in the instrument’s prices will negatively reflect its currency and subsequent currency pairs like USD/CAD. The Danish Krone (DKK) and the Norwegian Krone (NOK) are other currencies correlated to the trading oil prices.

How do we analyze Oil prices outside MT4?

If you need to analyze Oil prices, calculate pips, predict trends, and test Oil trading strategies, you can use the Machine Learning platform TrendSpider.