The Australian Dollar and Japanese Yen (AUD/JPY) currency pair is an attractive choice for forex traders looking to capitalize on their forecasts of price movements. The AUD/JPY is heavily influenced by the changing global economic environment, providing traders ample opportunity for profit. As such, knowing the best time to trade AUD/JPY can significantly impact your bottom line.

Commodity prices predominantly drive the Australian Dollar, while the Japanese Yen reflects economic trends in Japan and abroad. Currency pairs like the AUD/JPY are susceptible to events that affect both sides of the equation, creating ample opportunities for savvy traders.

Best Time to Trade AUDJPY

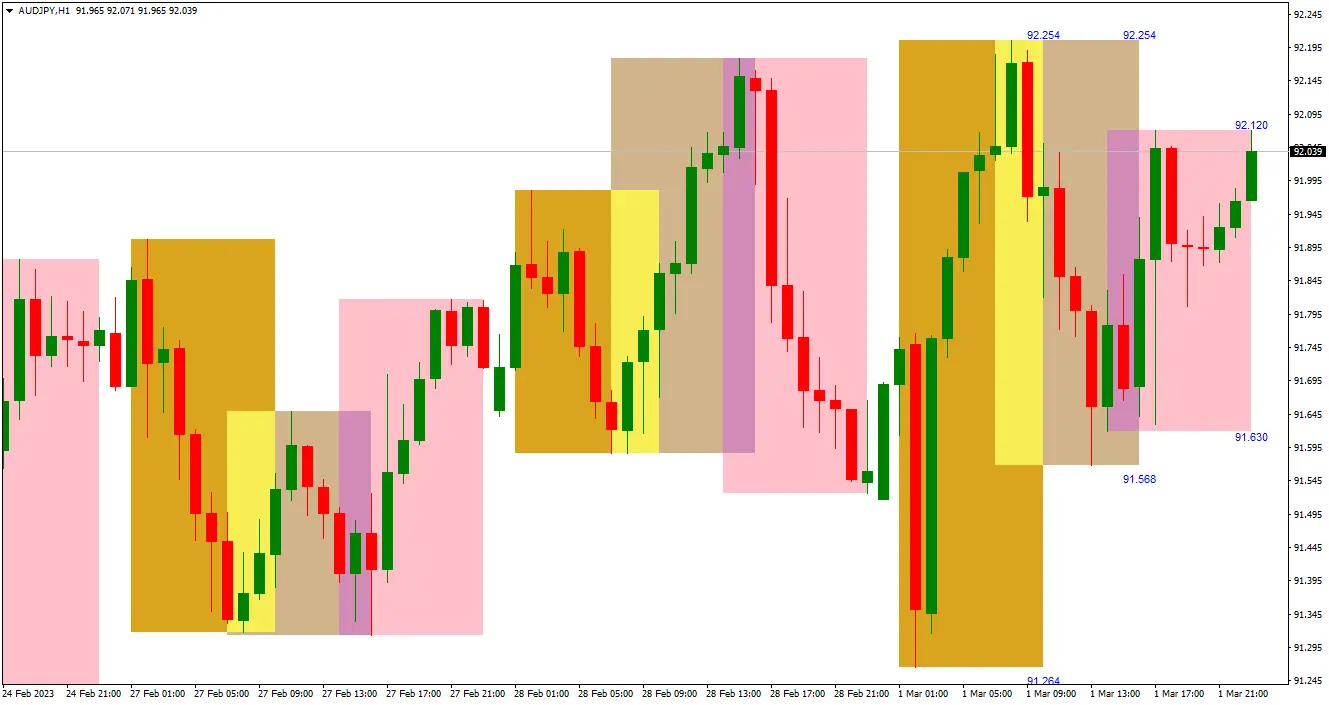

The best time to trade AUDJPY using a range trading strategy is during the Asian session. However, if you use a trend-following strategy and high liquidity and volatility trading, the best time is after the US open trading time, when the US and EU markets overlap, from 8 a.m. to noon EST.

Generally, the AUDJPY pair tends to have higher volatility than major currency pairs like EURUSD or USDJPY. This is because both currencies in the pair are considered high-beta currencies, meaning they are more sensitive to changes in risk sentiment and global economic conditions. As a result, the AUDJPY pair can be more volatile and experience sharp movements in both directions.

In terms of liquidity, the AUDJPY pair is considered to be moderately liquid. While it may not have as much trading volume as significant currency pairs, it still has sufficient liquidity for most traders to enter and exit positions without substantial slippage.

It is important to note that the volatility and liquidity of the AUDJPY pair can change over time and can be affected by various factors, such as changes in global economic conditions, monetary policies, and market sentiment. As such, traders should continuously monitor the latest developments and adjust their trading strategies accordingly.

Regarding trading AUD/JPY, there is no one-size-fits-all answer as it depends mainly on what type of strategy you choose to employ, whether range trading or trend following. Range trading relies on buying and selling with limited risk exposure during periods of low volatility when prices remain within a defined range over a long period. On the other hand, trend-following strategies require high liquidity and volatility to maximize potential profits from price movements.

For range traders, the best time to trade AUD/JPY is usually during Asian session hours (the session begins at 23:00 GMT and lasts until 8:00 GMT on the next day). During this time frame, price movements tend to be less volatile than other trading sessions as market participants take a break from trading activity in Europe and North America. However, suppose you’re looking for higher liquidity and more volatile price action. In that case, it’s generally advised to focus on the overlap between the US Open (8 a.m. EST) and EU close (5 p.m. GMT), which typically provides suitable conditions for profitable trades due to increased liquidity and volatility.

In addition to understanding when it’s best to trade AUD/JPY, several factors need to be taken into consideration before making any decisions regarding entry and exit points: current political climate in Australia & Japan; economic indicators released by both countries; news-related events; central bank policy changes; technical analysis; etc. All these elements will directly impact the currency pair’s performance, so consider them before entering or exiting any positions.

Ultimately, selecting the optimal time for trading AUD/JPY requires an intimate knowledge of these markets and a deep understanding of how different market conditions can influence its performance over short or long-term periods. However, armed with a sound strategy based on fundamental analysis backed up by technical insights, plenty of opportunities should be available for those who want to make money trading this currency pair regardless of whether they use the range or trend-following strategies.