Table of Contents

Managing a 401k plan during a recession can be daunting, but there are steps you can take to mitigate potential losses and ensure that you are maximizing your investment returns. A 401k plan is a crucial component of many people’s retirement savings, but it’s important to remember that it’s not immune to the effects of a recession.

How to Manage 401k During a Recession?

To manage 401K during a recession, you must rebalance your portfolio using precious metals and bonds to increase portfolio stability. Additionally, you must apply the dollar-cost averaging methodology of regularly investing a fixed amount to buy cheaper stocks for your portfolio.

Managing your 401(k) during a recession can be challenging, but there are several steps you can take to help minimize your losses and position yourself for long-term growth. Here are some tips for managing your 401(k) during a recession:

- Don’t Panic: One of the most important things you can do during a recession is to avoid panic selling. History has shown that the stock market tends to recover over the long term, and selling during a downturn can lock in your losses and prevent you from participating in any potential future gains.

- Rebalance Your Portfolio: If your 401(k) is heavily invested in stocks, you may consider rebalancing your portfolio to include more bonds or other fixed-income investments. This can help reduce your exposure to market volatility and stabilize your portfolio.

- Consider Dollar-Cost Averaging: If you’re still contributing to your 401(k) during a recession, consider using a dollar-cost averaging strategy. This involves regularly investing a fixed amount of money, regardless of market conditions. This can help you take advantage of lower stock prices and potentially boost your long-term returns.

- Evaluate Your Investment Options: Some sectors and industries may be hit harder than others during a recession. So look at the investment options in your 401(k) plan and consider shifting your allocations to areas that may be more resilient during a downturn.

- Consult with a Financial Advisor: If you’re unsure how to manage your 401(k) during a recession, consider consulting with a financial advisor. They can help you navigate market downturns and develop a long-term investment strategy that aligns with your goals and risk tolerance.

Remember, managing your 401(k) during a recession requires a long-term perspective and a willingness to ride out short-term market fluctuations. However, staying disciplined and sticking to your investment strategy can help position yourself for long-term success.

The first step to managing your 401k during a recession is to review your portfolio and make strategic adjustments. It’s important to remember that while some sectors may be experiencing losses, others may be performing well. Consider diversifying your portfolio to include both domestic and international investments, as well as different asset classes. This will help spread out your risk and reduce the impact of any sector’s performance on your overall portfolio.

In addition to diversifying your portfolio, reviewing your investment options and choosing those best suited for your risk tolerance and investment goals is crucial. For example, during a recession, it’s essential to prioritize investments that offer long-term growth potential rather than short-term gains. This may mean investing in stocks or mutual funds with a solid performance history during economic downturns, such as healthcare or consumer staples.

Another critical step in managing your 401k during a recession is to stay informed and aware of market trends and risks. This may mean working closely with a financial advisor or regularly monitoring your investments and adjusting your portfolio as needed. It’s also essential to resist the urge to make emotional decisions based on short-term market volatility. Instead, focus on your long-term investment goals and stick to your strategy.

Finally, it’s important to remember that a recession is not permanent. While it may be tempting to withdraw funds from your 401k plan during a downturn, this can negatively affect your retirement savings. Instead, focus on maintaining a long-term investment strategy and weathering the storm until the markets recover. This can be challenging, but with the right mindset and investment strategy, managing your 401k plan effectively during even the most difficult economic times is possible.

Should I panic about my 401k during a recession?

No, you should not panic about your 401K during a recession because history has shown that the stock market tends to recover over the long term. Selling from 401K during a downturn can lock in your losses and prevent you from participating in potential future gains.

As an investor, it’s natural to feel uneasy and stressed during a recession; this is especially true about your 401K. However, it’s important to remember that you should not panic during a downturn, as history has shown that the stock market tends to recover over the long term. Selling 401K stocks during a downturn can lock in your losses and prevent you from participating in any potential future gains.

During a recession, key stock markets indexes such as the Dow Jones Industrial Average and the S&P 500 tend to experience sharp declines, causing many investors to sell off their stock holdings. This is often driven by fear and uncertainty and can cause a significant shift in the market. Unfortunately, by selling your holdings, you’ll likely lock in losses and miss out on potential gains when the market eventually rebounds.

The good news is that history has taught us that the stock market naturally experiences fluctuations, but it tends to trend upward over the long term. While there’s no guarantee of future returns, investors who are patient and able to wait out market downturns are often rewarded with attractive returns in the long run. Indeed, even after significant market downturns over the past few decades, such as the 2008 financial crisis, the stock market has ultimately recovered and achieved new highs.

As a 401K investor, you have the benefit of time on your side, which is one of the most significant advantages of investing. As a retirement vehicle, 401K accounts are intended for long-term investing over several decades. This means you shouldn’t panic during a recession but instead focus on your long-term goals. In addition, by remaining patient and continuing to invest in your 401K through a market downturn, you’re likely to benefit from the long-term upward trend of the stock market.

It’s also essential to ensure that your 401K portfolio is appropriately diversified and that you properly allocate stocks, bonds, and other asset classes. By diversifying your holdings, you can hedge against downturns in one particular asset class and potentially reduce the impact of market volatility on your overall portfolio.

Lastly, it’s essential to remember that there are other factors to consider, such as inflation and taxes. Inflation is the increase in the cost of goods over time, and it can impact your retirement savings by eroding their value. Tariffs, on the other hand, can affect the overall return on your investments. Therefore, it’s essential to factor in these considerations when deciding about your 401K.

By focusing on your long-term goals, diversifying your holdings, and considering other factors such as inflation and taxes, you can stay the course and potentially reap significant rewards in the future. But ultimately, it’s important to remember that investing in a 401K is a long-term investment that requires a patient and disciplined approach.

401K Dollar-cost averaging strategy

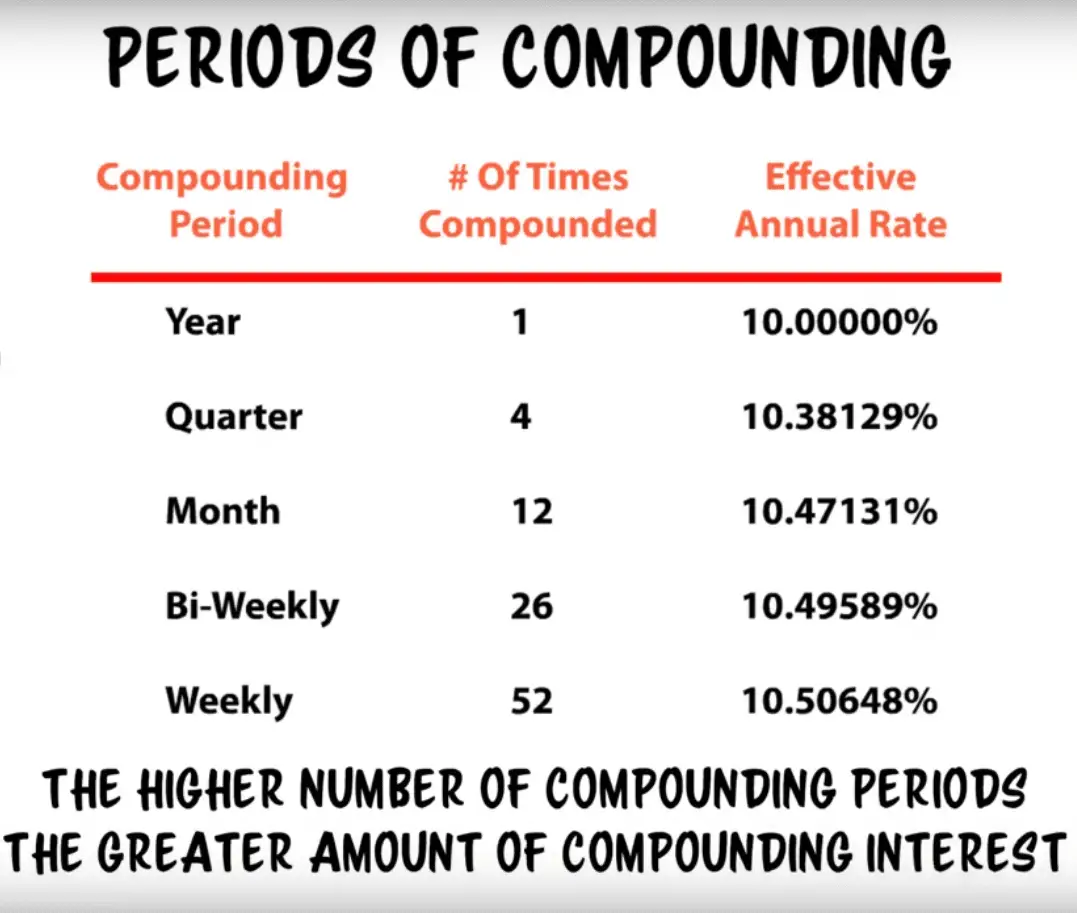

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This can effectively take advantage of lower stock prices during a recession and potentially boost long-term returns. Here’s how to apply the dollar-cost averaging methodology during a recession:

- Set a Fixed Investment Amount: First, determine how much you want to invest regularly. This could be a fixed dollar amount, such as $500 per month or a percentage of your income.

- Choose a Regular Investment Schedule: Next, choose a regular investment schedule. This could be weekly, biweekly, monthly, or quarterly. The key is to invest consistently and stick to your plan.

- Invest Regardless of Market Conditions: The idea behind dollar-cost averaging is to invest regardless of market conditions. This means you’ll buy stocks when prices are high and low. Over time, this can help smooth out market volatility and potentially reduce risk.

- Rebalance Your Portfolio: As you continue to invest regularly, your portfolio will naturally rebalance over time. This means you may need to periodically adjust your investments to ensure your portfolio aligns with your long-term goals and risk tolerance.

- Stay Disciplined: Finally, it’s crucial to stay disciplined and stick to your investment strategy, even during periods of market volatility. Remember, dollar-cost averaging is a long-term strategy, and it’s essential to remain focused on your goals and avoid making knee-jerk reactions to short-term market fluctuations.

Dollar-cost averaging can effectively take advantage of lower stock prices during a recession and potentially boost long-term returns. In addition, investing a fixed amount on a regular schedule can help smooth out market volatility and position yourself for long-term success.

Gold IRA 401K Rebalancing

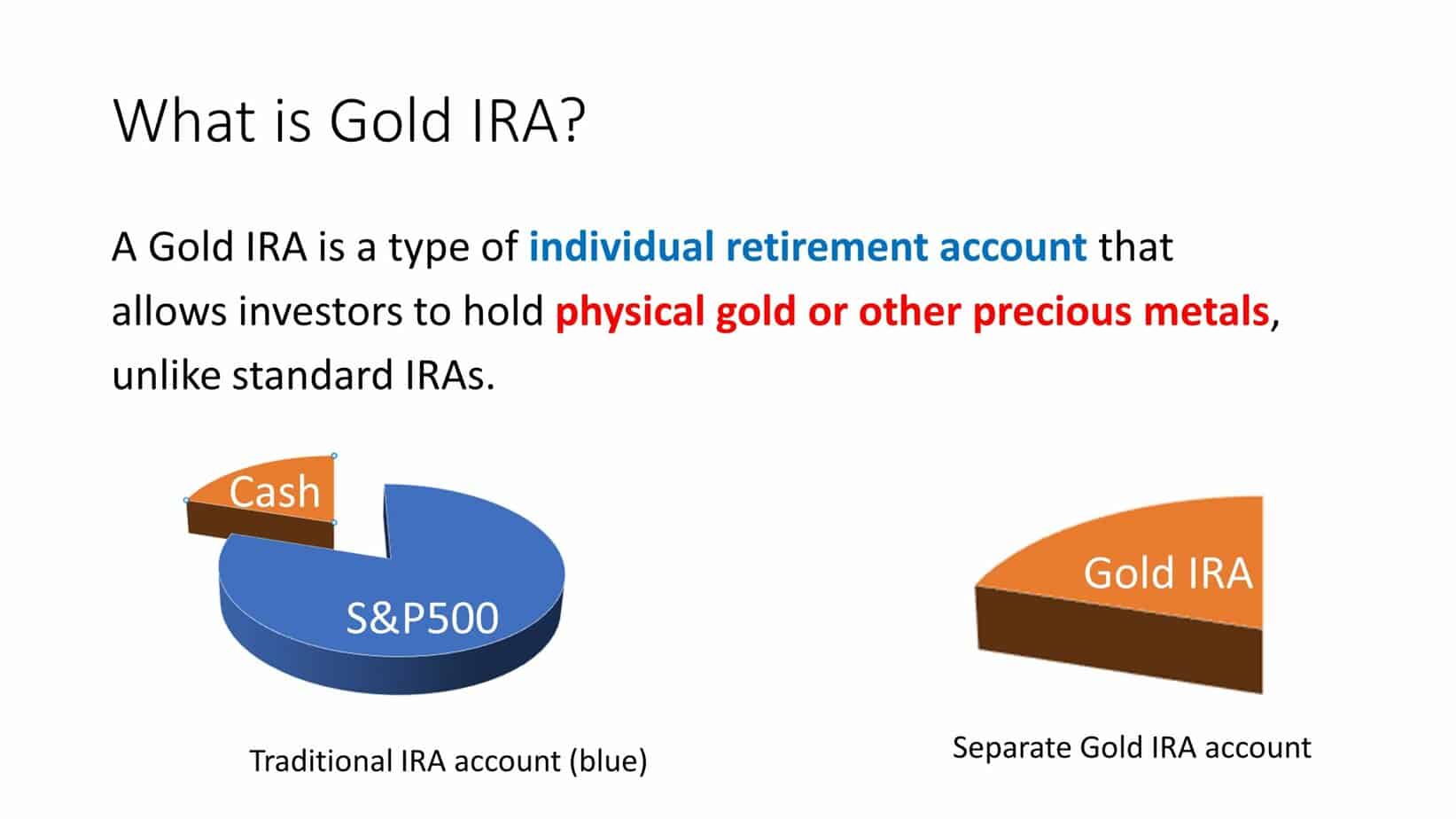

A Gold IRA is an individual retirement account that allows you to invest in physical Gold or other precious metals rather than traditional stocks, bonds, or mutual funds. A 401(k) is an employer-sponsored retirement plan that allows employees to save for retirement on a tax-deferred basis.

GET GOLD IRA GUIDERebalancing, on the other hand, is the process of adjusting a portfolio’s asset allocation to maintain a desired level of risk or return. This can be done by buying or selling assets to bring the portfolio back into balance.

Gold IRA 401(k) rebalancing refers to adjusting the allocation of assets in a retirement portfolio that includes both a Gold IRA and a 401(k) plan. This may involve selling or buying Gold or other precious metals to maintain the desired level of risk or return in the portfolio and adjusting the allocation of assets in the 401(k) plan.

Rebalancing is an essential part of portfolio management, as it helps to ensure that your investments remain aligned with your long-term financial goals and risk tolerance. By regularly rebalancing your Gold IRA and 401(k) portfolio, you can help to mitigate the risks associated with market volatility and potentially maximize your long-term returns. It is essential to consult with a financial advisor or tax professional before making any changes to your retirement portfolio.

Conclusion

Managing a 401k plan during a recession requires careful planning and strategic decision-making. By diversifying your portfolio, choosing the able investment options, staying informed and aware of market trends, and maintaining a long-term investment strategy, you can help mitigate potential losses and maximize your investment returns. While a recession can be challenging for investors, it’s important to remember that with the right approach, you can successfully manage your 401k plan and build a strong foundation for your retirement savings.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE