Table of Contents

In this article, we will talk about the forex tester. A forex tester program is a tool that exposes trade prospects by simulating actual market conditions leveraging historical data.

What is forex backtesting?

The forex backtesting software recreates exchange activity, responds to a forex trading plan, and uses the gathered information to calculate and maximize the program’s success in the market. Backtesting techniques operate under the premise that trades that have effectively worked in the past would function similarly somewhere in the future.

Forex backtesting is a method used by traders to evaluate the effectiveness of a trading strategy by applying it to historical data. Backtesting involves simulating a trading strategy using past forex market data to determine how well the strategy would have performed. Here are key aspects of forex backtesting:

- Historical Data:

- Backtesting requires historical forex market data, including prices, volumes, and sometimes even news events, depending on the complexity of the strategy.

- Trading Strategy Rules:

- The tested strategy needs clear rules for entering and exiting trades. These rules are applied to the historical data to simulate trades.

- Simulating Trades:

- The backtesting process involves simulating trades that would have been made in the past according to the strategy’s rules. This includes determining entry and exit points, position sizes, and applicable stop-loss or take-profit orders.

- Performance Metrics:

- The outcomes of these simulated trades are then analyzed to evaluate various performance metrics such as profitability, drawdown, risk-to-reward ratio, win-loss ratio, and other relevant financial metrics.

- Identifying Strengths and Weaknesses:

- Backtesting helps identify the strengths and weaknesses of a trading strategy under different market conditions. This includes understanding how the strategy performs in trending markets, range-bound markets, or during high volatility periods.

- Refining Strategies:

- Based on backtesting results, traders can refine their strategies, adjusting parameters to improve performance or reduce risk.

- Overfitting Risk:

- One of the challenges of backtesting is avoiding overfitting, where a strategy is too finely tuned to past data and does not perform well in real trading.

- Limitations:

- While backtesting can provide valuable insights, it has limitations. Past performance does not always indicate future results, and simulated trading does not account for factors like market liquidity or trader psychology.

- Complementary to Live Testing:

- Traders often use backtesting with forward testing (testing a strategy in real-time with a demo account) to validate a strategy’s effectiveness.

The digital tool that helps us verify outcomes electronically and build faith in our methodology nowadays used to take months and years throughout history. Moreover, new technologies have streamlined the whole thing for all of us. The mechanism has progressed ever since, though not necessarily for the better. Many of those who add caution and rational thinking to currency trading approaches for linear regressions are typically more likely to be compensated with significant returns.

On the other hand, significant losses are sustained by traders who add computational resources and leave human reasoning out of the scenario. No technology can substitute a human brain when analyzing the market and forex strategies, particularly those associated with the correct tool.

Free Forex Backtesting Software

The best free forex and stocks backtesting software are:

- MetaTrader Strategy tester

- TradingView free Strategy tester

- TrendSpider Trial

- Ninja trader

- MS Excel

Metatrader 4 Free Backtesting Software

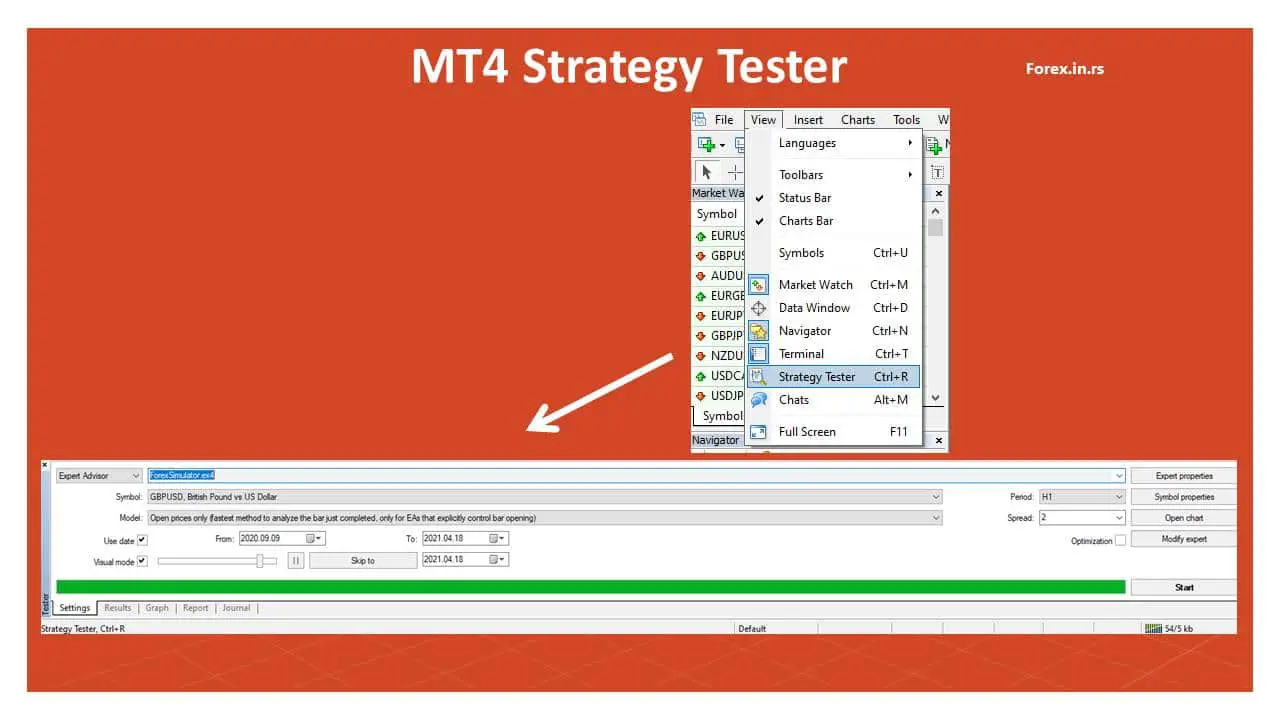

Metatrader Strategy Tester is a free testing tool in MetaTrader software that you can run using the View/Strategy Tester option.

Download the MT4 strategy tester platform.

Automated backtesting entails creating programs that dynamically join and leave transactions at your behest. Such programs are eligible for download for free on the web, with paid models purchasable. A few of the main benefits of these instruments are that they take emotions out of the investing. In addition, some traders use specific techniques to copy investment strategies to increase their performance odds.

See my video about backtesting in MT4:

Remember that the software must be tailored to your lifestyle and risk tolerance. Furthermore, not all trade approaches are compatible with automatic trading techniques.

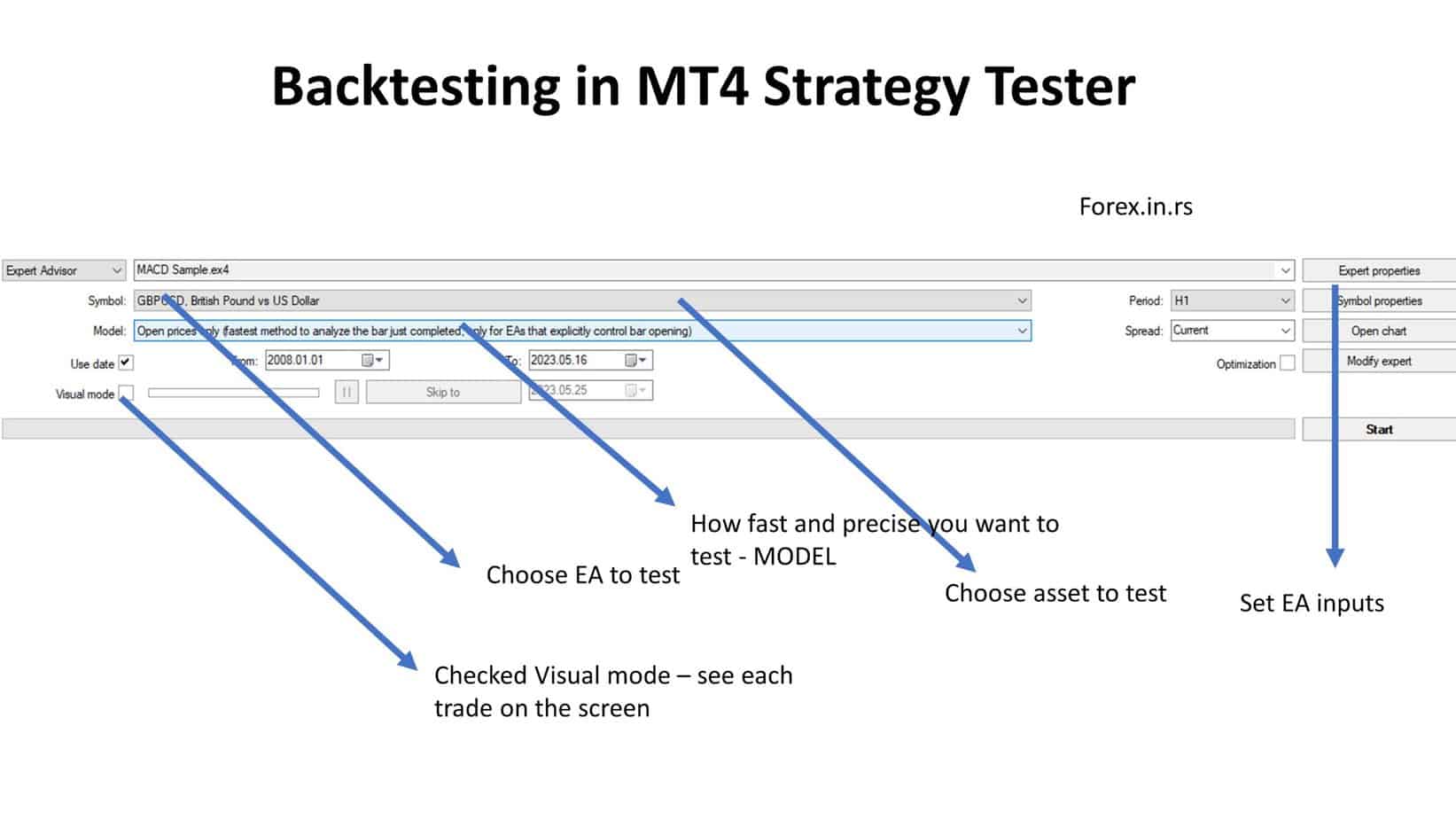

Automated backtesting is available in MT4 (MetaTrader 4) & MT5 (MetaTrader 5). Since they are established and stable, these MT4 and MT5 are standard electronic trade systems for dealing with capital markets. Because of the extra functionality that improves the investor’s experience, the MT4 Supreme Version add-on is preferred. MT4 is famous for FX backtesting with its built-in’ Strategy Tester.

How does backtesting Work on MT4 Strategy Tester?

The MetaTrader 4 app features Forex Simulation, which helps sellers scroll back time on their graphs and recreate markets from any specific period. Orders may be put, updated, and terminated as they could be in a live system. When you trade on historical information, it saves much time compared to Demo trading and other modes of Forex trading. You can also adjust the simulation’s pace, ensuring that you focus on the most critical periods.

Furthermore, you can expand your MT platform’s trading capability by installing the MT Supreme Version add-on, which ultimately costs less. This fantastic add-on improves the trader experience and exposes you to Trading Central’s research work, market trading reports, international sentiment notifications, professional trading tips, innovative charting features, etc.

Properties of the Free Metatrader 4 Forex Simulation software

Once you’ve downloaded MT4, go to the File menu “View” from the drop-down list and select the “Strategy Tester” feature. Conversely, you may use the keyboard shortcut CTRL+R and click on the ‘tester’ icon.

Strategy Tester available online has a range of main features, including:

- It’s among the most popular trading simulators, incorporating the charting tools of Metatrader 4, high-quality tick-by-tick results, and an economic calendar. This is perfect for backtesting investment techniques.

- Indicators, drawing software, and templates can all be included for offline graphs.

- Remote databases of elevated tick data can be downloaded. With adjustable spreads, we can browse nearly ten years of tick information.

- The above technique tester is available online from Metatrader 4 and could be implemented as a cost-free FX simulator backtesting software on Mac for practicing Forex trading.

- You may open several graph frames at the same time.

- An economics calendar can also display relevant news stories throughout simulations.

- It gives you access to all of MT4’s built-in and customizable indicators.

Simulations can be copied to a file and recovered at a later point in time. The graph has a toggle that helps you return to time bar after bar. This is necessary to retrieve everything from trades, pending orders, stop losses, gains, lingering stops, and transaction stats. You could also save the trading account history in Excel for in-depth research.

Apart from the other significant Forex pairs, users could continue to simulate crude oil as the Forex simulator is among the most effective online and offline channels for backtesting foreign exchange investment strategies. It’s also placed in demo mode by nature. On Metatrader 4, reports on Expert Advisor (EA) research findings have lately been substantially enhanced.

Investors could now evaluate ratios like the recovery factor, position holding periods, the Sharpe ratio, etc. The ‘Strategy Tester’ study can examine about 40 unique attributes. Cash and equity charts could determine the duration of financial gains, losses, and actions held over days, weeks, or even months.

‘Forex Tester’ is another common MT4 backtesting choice for forex strategies. Unlike the Strategy Tester, the FX Tester is not cost-free and could be implemented for manual and automatic dealing. Investors will use this automated backtesting program to get pre-made techniques. It has ten manual programs, five specialist experts, six years of price history info, a risk assessment system, and a financial planning table.

- Five price-action-based EAs with specific guidance are included with the Forex Tester.

- Acquire backtesting knowledge with ten basic manual trading techniques.

- An Excel spreadsheet with a Forex financial planning chart.

- The Forex Tester version 3 helps investors install infinite significant currencies to compare simultaneously.

- The Foreign Exchange Testing 2 and 3 apps have pre-programmed shortcut keys for each feature, making for quicker Forex preparation.

- Graphical methods for interpretation and graph markup, like waves, lines, Fibonacci, and even shapes.

- The FX 3 simulator technology is used on several displays simultaneously. This also provides for immediate error detection.

MetaTrader 4 has become one of the most incredible Currency trading software applications for achieving steady gains, and it also helps you easily backtest Forex techniques. Once you’ve imported the historical info, press “Start Test” to begin backtesting tactics; that “Start Test” key will immediately shift to “Stop Test.”

The moving bars may appear on the graph right away. Place orders to test the tactics and how they work in the markets. You should adjust the pace or bring new bars to manipulate the frequency. Click the “Pause” icon if you’d like to take a break and think about something. The FX Tester enables new backtesting techniques to be programmed in languages such as Delphi and C++.

How to backtest on Tradingview?

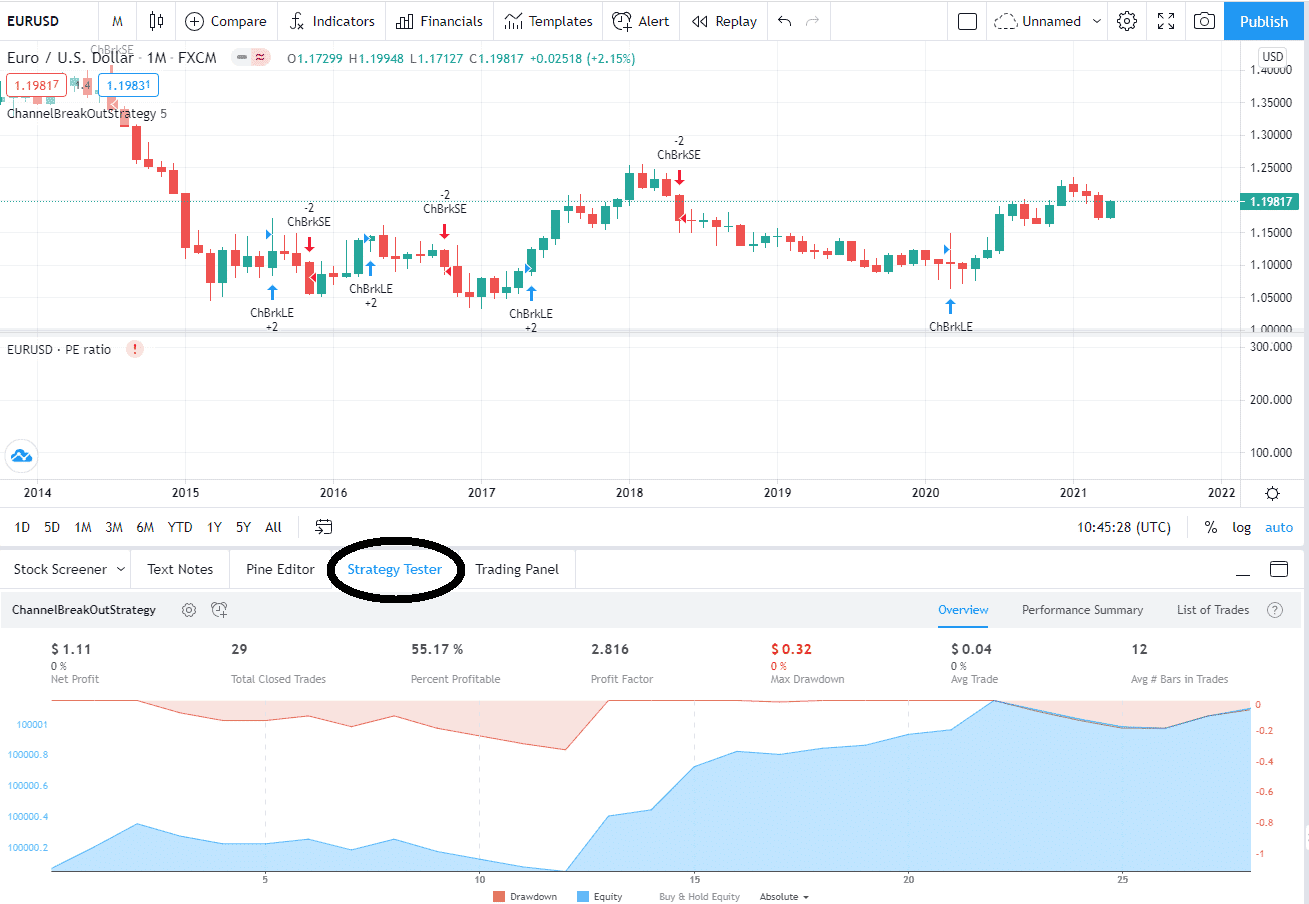

TradingView free chart platform offers a free strategy tester on each featured chart.

VISIT TRADINGVIEWTo run the backtest, choose the “Strategy Tester” option below the chart and choose indicators for testing. Please see the image below:

The TradingView application, introduced in 2011, is a decent choice as a cost-free Forex backtesting application. The enhanced charting capabilities are the most well-known feature of this program. Accurate information and browser-based graphs allow analysis from almost anywhere because there’s no software to update and no complicated setups to worry about. In addition, it’s a networking forum that will enable you to post, watch, and connect with other dealers and release your plans on social network sites like Reddit, Twitter, etc. Finally, the Bar Replay Feature is amongst this app’s most popular backtesting features.

VISIT TRADINGVIEWPlease take the following moves to get it implemented.

Bar Replay: Use the menu on the top of the page to enable Bar Replay.

Change Setups: A new toolbar may surface on the working graph, along with a central red line at which the mouse is. The red line denotes the start of that same replay. Return to the stage where you’d like to begin by scrolling backward.

Tap the Play Button: To enter the replay phase, tap on the chart; next, press this play icon to begin the replay.

Please note that the replay function is perfect for seeing how the charts appeared on a particular day before implementing a plan. On the other hand, the currencies you test must have sufficient historical evidence. The TradingView software has several shortcomings that you must note, including the following:

- It’s a reality that Japanese Candlestick Charts aren’t an alternative.

- Specific map alternatives have restricted historical details.

- The incompatibility of the ‘Continuous Futures’ table against ‘Bar Replay.’

- Test or demo orders are not possible throughout this process.

Backtesting using Trendspider

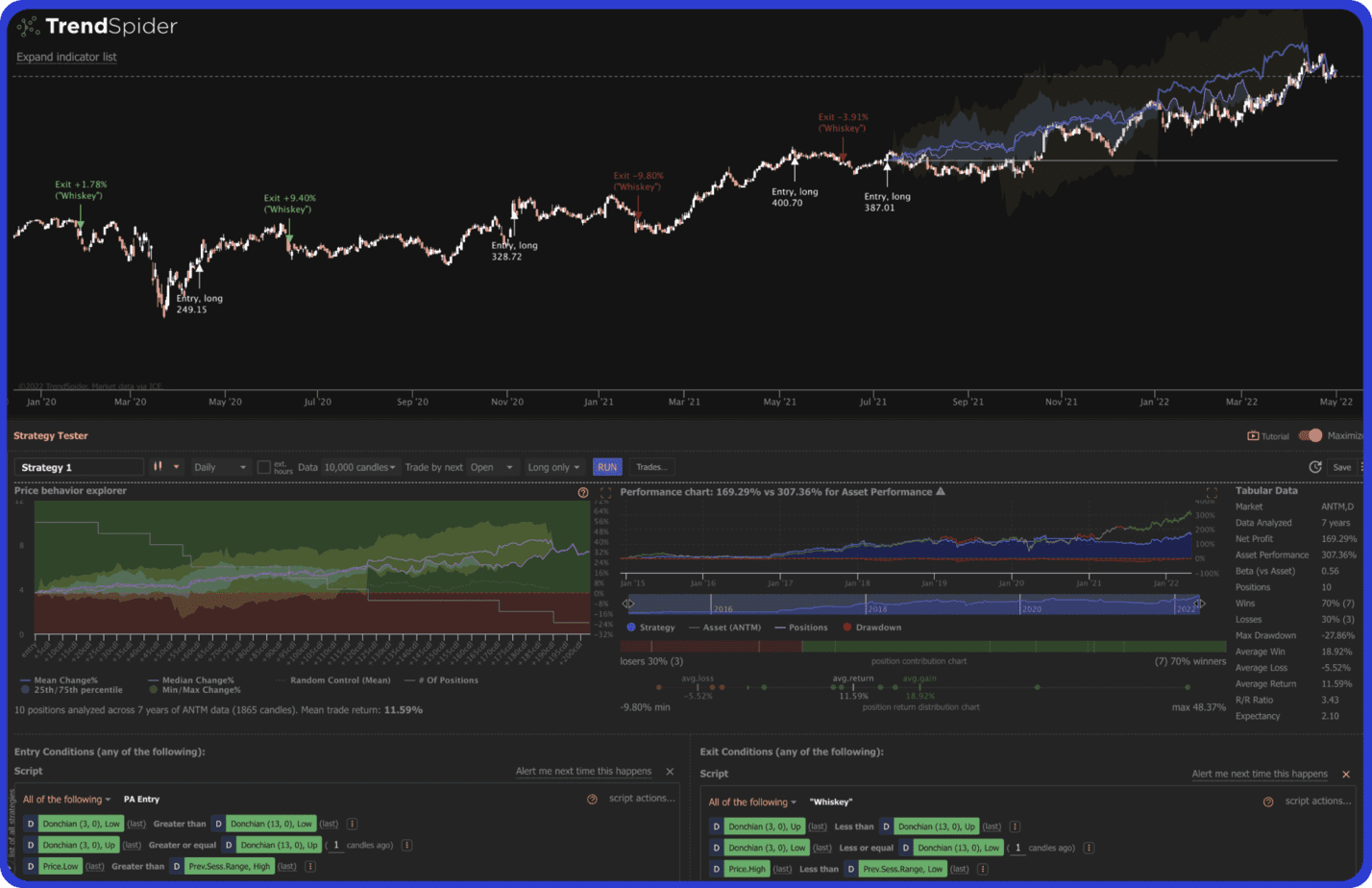

The backtesting architecture in TrendSpider is a fascinating tool. One-minute, daily, and monthly charts are available for historical testing. It’s possible to do so in various financial marketplaces and with multiple types of financial assets.

Trendspider is the fastest and easiest method for forex backtesting! Below is presented Trendspider backtesting option:

VISIT TRENDSPIDER

NinjaTrader Backtesting Free software

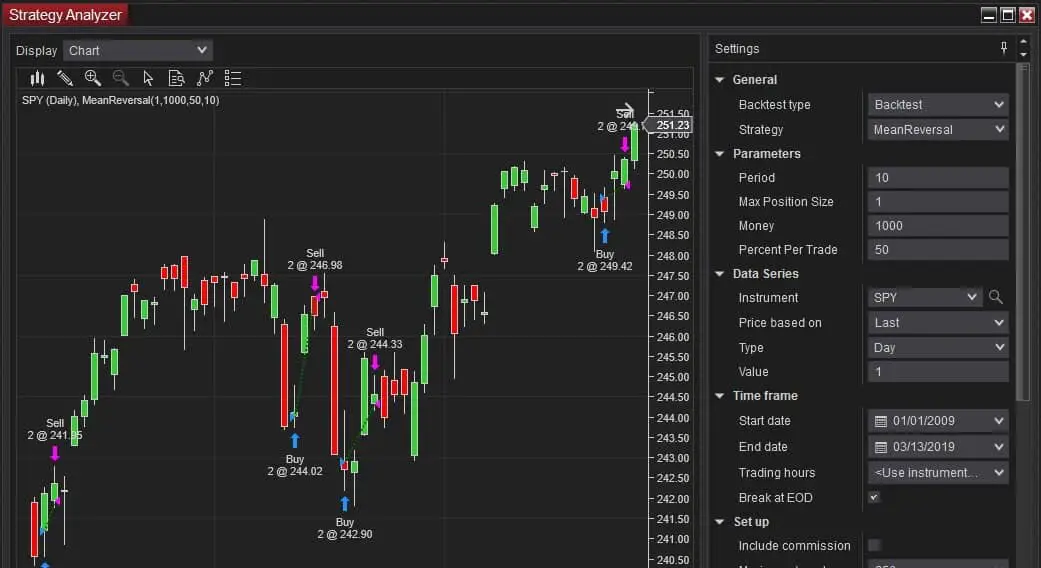

Ninja Trader Backtesting free software offers Period, position size, percent, and data series in settings. Consumers merely insert account size, optimal entrances, withdrawals, take-profit thresholds, trailing stops, profit expectations, backtesting hours, profit expectations, slippage cost, etc. As a result, the device generates comprehensive gross net profit ratios. Below are a few of the benefits of the Gain Finder.

- It is used for any tool, technique, or technological predictor.

- This automatically recognizes an investment’s entry and exit points.

- It completes a wide variety of dynamic equations in a couple of seconds.

- This measures each position’s gain and cost levels and offers relevant and accurate knowledge about the success of trading techniques, metrics used, and data quality management.

There are several corporate online Forex backtesting applications to explore in addition to consumer backtesting sites like TradingView or Meta Trader 4.

Forex Backtesting using MS Excel

Most traders assume they needn’t become developers or experts to backtest a plan. This approach gets us down to its very fundamentals that everybody should use. Spreadsheet applications, including Excel, are the easiest ways to back up Currency trading techniques for free. We need a publicly accessible database, like ‘date and time,’ ‘opening data,’ ‘ the highs and lows of prices,’ etc. The time aspect is necessary when you are checking the intraday Forex strategy. One can use Google Finance and Yahoo Finance to get the info.

There is an “Enter the Symbol or Company Name” area, and type in the logo for the currencies you want to see. As in the “Quotes” area, you can notice a choice to get a historical value for the logo. Kindly share the time frame for this. Scroll down a bit of the site and press “Download to Spreadsheet.” The “Sort” method in the Excel Data list plans the details.

Below is a peek at identifying what day of the week produced the highest profits. I guess we plan to purchase when opening and sell at the closing.

- Column A is for the date.

- Column B is for the opening price.

- Column C is for the closing price.

- Next begins the trick of choosing the method that would yield the most robust outcome.

- In the Column D, use the given equations: = IF(WEEKDAY($A2,2)=D$1,$C2—$B2, “”). The formula must be mirrored from D to H through all the columns.

Whereas,

- ($C2-$B2) – Closing price minus Opening price is the real aspect that makes one a gain or a loss.

- (“) – The incorrect portion of the sentence, as in the manner of double quotes, does not provide any consequence as to what day of the week is not matched.

If the day of the week, when converted to a value of 1 and 5, corresponds to Monday to Friday and seems the same as the days of the week for the front row of that column (D$1), then the outcome would be as anticipated. We may also add sum and average functions to the base of the “Weekday” line to determine the most efficient day to execute this technique over time.

It is indeed a backtesting technique that uses the manual alternative. It and other phrases and conditional equations can evaluate Forex techniques. Each form, however, is repetitive and time-consuming. Though TradingView is one piece of a program that will be appropriate for doing the backtesting manually.

Backtesting Tools for Organisations

Organizational backtesting programs are commonly used for proprietary brokerage firms, mutual funds, and family companies. Once the customer has acquired a license for using such applications, is it authorized?

Despite their high price tag, they have a comprehensive solution kit for information gathering, Foreign exchange strategy testing, historical backtesting, and interactive implementation of high-ranking strategies through various techniques. Moreover, since these devices are more event-driven, their backtesting framework will replicate live trading conditions more accurately. Such instances are as follows:

Deltix-QuantOffice

Utilizing Dot Net or C# QuantOffice by Deltix helps visualize unified EMS techniques’ creation, backtesting, and monitoring. Numerous intra-day, tick, and custom-designed durations can be used to build patented order execution architectures. In addition, time series for backtesting and simulations are accessible due to the ‘TimeBase’ server.

The following are some of its highlight characteristics:

- Complex Event Processing (CEP) is allowed by the TimeBase server relation. To build inferences for research, use the ‘OnBarClose,’ ‘OnBarOpen,’ or ‘OnTick’ functions.

- Rapid Visual Analysis (RVA) can be extended to any tool or portfolio.

- Exceptional charting skills and the quick presentation of trading outcomes such as indications, trading alerts, instructions, execution, and income and loss statements will provide speedier strategy assessment and rerunning.

- For such a diverse range of techniques, years of tick information could be backtested in seconds.

- The Backtesting model’s process times are amazingly rapid. TimeBase incidents can be pre-loaded into the program’s cache memory, increasing the total operation.

- Increasingly advanced methods could be used to design personalized time-based bars. For example, such bars are saved on TimeBase in actual time and can be viewed properly.

- The system uses innate, adaptive, and brute-force frameworks for parameter optimization.

- Sub-strategies of meta-strategies may be classified as sub-strategies of meta-strategies.

- Dynamic optimization will also decide whether or not sub-strategies should be activated.

- Highly optimized approach models are implemented in their current state, with no chance of re-engineering in a production trading scenario.

- With the QuantOffice Currency trading simulator, you can fine-tune your trade expectations. This ensures that comparable returns are achieved in both development and backtesting.

- Users may use C# to build custom prototypes or C++ to incorporate current models further into the QuantOffice setting.

QuantDEVELOPER

The institutional-grade app ‘QuantDEVELOPER’ helps developers construct, refine, backtest, and deploy quantitative techniques to live trading contexts. Users may also test, modify, or boost the performance of the selected parameters in a specific process. Finally, users will compare technique outcomes with the aid of helpful stats.

Below are some of the app’s significant aspects:

-

- It has a built-in market data converter with low latency.

- It has a pre-defined collection of elements for creating strategies.

- It facilitates the implementation of several sub-strategies under the umbrella of a single meta-strategy.

- There is no need for scripts.

- It will assess accounting schemes for different asset types and currencies.

- It has the potential to test over 500,000 ticks every second.

- It involves backtesting based on incidents.

- This has an extensive collection of technical indicators.

- Several time frames of auto-execution and a one-click transition from a simulator to an actual trading function are supported.

- Backtesting of the framework is possible at all portfolio stages.

Backtesting Benefits

Forex backtesting is a historical fact-based trading technique whereby traders use historical data to analyze whether a strategy will work. A backtesting framework concept is a collection of technological guidelines represented by a set of past market data and a corresponding review of the results that would have been produced by a Forex strategy across a given timeframe. That is a valuable notion of forex strategy tester software.

For Currency traders, backend checking has a variety of advantages, such as:

Insight of Strategies: Forex backtesting’s important element seems to be that traders may assess if the tactics chosen can produce their anticipated returns.

Practice: Forecasting could help traders pinpoint investment options by analyzing past price fluctuations and relative positions. In other terms, it allows traders to improve their knowledge in research work.

Confidence: Currency backtesting is a successful way to create trust since traders obtain expertise by testing prior market knowledge from dealers. When they begin trading in real, it helps develop their morale.

Each of these variables eventually converges to enable traders to gain more significant progress in their trade.

How do we analyze backtesting results?

I was wondering how to do backtesting in forex in actuality. Below is how it all plays a part with Forex backtesting software technology.

Market data collection is added to forex trading techniques, and transactions are replicated using the same information. In addition, traders will use this information to measure any unintended deficiencies in their existing strategies. Put another way, trying innovative techniques before including them in live markets is often possible.

Investors may receive a wide variety of indications based on the types of backchecking tools being used in Forex trading, such as:

| Total Equity Return (ROE): | Income as a percent of the overall equity occupied. |

| Cumulative Profit and Loss (P/L): | Overall profit and loss produced by a method calculated as a fraction of the equity invested. |

| Overall Gain/Loss Ratio: | A proportion between how trades and also how many losses contributed to profits. |

| Annualized ROE: | The cumulative gain for the current calendar year is prone to be affected by just a Currency approach. |

| Volatility: | The market dynamics work in bullish momentum and downtrends for the methodologies. |

| Risk-Adjusted Returns: | In terms of the risk implicated in a method, calculate your yields. |

All these indicators give you information regarding the success of your Foreign exchange investment strategies.

How do you effectively backtest trading strategy?

You must choose a long testing period to backtest any forex trading strategy effectively. Your strategy must be tested in bearish and bullish trend periods and low and high volatility periods, and you must create various tests.

Forex’s best backtesting program focuses on some factors that can control the result of the whole operation. Therefore, the following three aspects that determine trading strategies must be known.

- Data Quality and Source

In backtesting, the validity and precision of value are critical. This has to be proportional to the methodology, too. Notice that not all data is represented equally in the over-the-counter (OTC) market. Around the exact moment in time, electronic forex traders and bankers have separate pricing details.

- Determinism

How would the approach work when that method is implemented quite a few times on a data set? Strategies for backtesting ought to be completely deterministic. Each moment you backtest a Foreign exchange policy for a structured data set, you must get similar findings. While this could also be an excellent idea, sometimes it doesn’t happen.

- Trade Execution Logic

How reasonable and accurate is the business logic integrated into the back tester? Backtests cannot reflect the actual markets exactly. You might overlook significant factors such as latency, rejections, slippage, or even requotes. Bar information or tick data also becomes essential to remember. Tick information can enable your data to be almost perfectly historically simulated. When adding bar info, this method is slower. Through bar info, you get four price points for each timeframe. The greater the timeframe, the more precise the outcomes will be.

Please remember that sometimes, the finest backtest software cannot promise potential earnings. Very and far between, liquidity in the Foreign exchange markets is a recurrent issue. Different exogenous variables regulate this, and it is pretty hard to model.

There are indeed a variety of backtesting tools available on the market today. Each program seems to have its way of assessing Forex investment strategies. Forex backtesting can be divided into two types. The first is manual and then comes automatically.

As a trader, you can also potentially exchange risk-free for a trial brokerage account. It ensures that dealers can stop placing their money at risk but select whether they want to switch to live to trade. In addition, many broking companies offer traders access to high-quality and real-time market analysis, the opportunity to exchange with digital currencies, and exposure to new trading tips from experts.

- Manual Backtesting Method

It requires a decent amount of effort; however, this is inevitable. Throughout the Forex backtesting guide, we consider historical data and walk it through. The charting technique can assist you in shifting bars by bars, meaning that you can always track market behavior and associated success indicators all along the road. The benefits of manual backtesting usually involve the following:

- That thought that everyone could do it.

- So, you can understand how the forex trading program functions when you do every deal. You’ll recognize what should be changed, and you can also build an automatic plan later.

- Manual backtesting simplifies live price signals, like joining or leaving trading, controlling risks, etc.

- Manual backtesting procedures may be successful when you start using automatic apps. Using an Excel sheet to backtest forex techniques is a popular approach for this form of backtesting.

- Backtesting Techniques Rules

- Consider the trading program’s exact parameters to predict when it will stop operating.

- However, if the device is automatic, you can constantly update it daily to see if market circumstances have improved.

- It’s appropriate for a prolonged period if the risk exposure thresholds allow it.

- And there is no certainty that the backtesting technique can succeed in real-world trading. These, like manual tactics, must be checked in advance.

- One must have a basic knowledge of coding. For example, your plan could backfire if a single punctuation mark is lost in the text.

- Automatic backtesting tools aren’t appropriate for all trading strategies.

- In live trading conditions, curve-fitting approaches often struggle.

- Successful Excel skills are needed for strategic planning and analysis in whatever approach you choose.

Conclusion

If the markets are shut, you should conduct Forex trading tactics. It is an excellent way to hone your expertise in real-time investing. In addition, these are generally advised when selling various assets in various markets.

You may achieve self-assurance in your tactics. You would be better positioned to cause trades until you grasp how your method operates, how much it performs, and the disadvantages. You’ll also be able to tell when it’s necessary to exit.

Once you begin trading on active foreign exchange accounts, it’s better to set up an account with a brokerage licensed and controlled by the Financial Conduct Authority (FCA) and also protected by MiFID. This way, you will get actual backtested outcomes.