Table of Contents

Forex market hours in India

Forex market hours in India are related to India’s Standard Time (IST), so the market opens on Monday in the early morning and closes on Saturday in the early morning. India Standard Time is 5.5 hours (5 hours 30 minutes) ahead of Greenwich Mean Time (GMT+5.5), which is why the time difference between Europen forex brokers’ market hours and Indian forex market hours.

What are forex market timings in India?

For MetaTrader traders, forex market timings in India start on Monday morning (2:30 am IST) and go up to 01:30 or 02:30 am IST on Saturday. However, Indian stock market traders follow Indian exchange market timings from 9:15 am till 15:30 IST.

As a forex trader in India, you can trade CFDs using the best forex brokers 24 hours per day except on weekends. However, if you trade on the Indian Exchange market (nseindia.com), you can trade only from 9:15 to 15:30 IST.

Forex Market Timings in India Table presented in IST (Indian Standard Time):

| Trading session | Opening Indian Standard Time (IST) | Closing Indian Standard Time (IST) |

|---|---|---|

| Wellington (Pacific session) | 3:30 AM | 10:15 AM |

| Sydney (Pacific session) | 5:30 AM | 12:30 PM |

| Tokyo (Asian session) | 5:30 AM | 2:30 PM |

| Hong-Kong and Singapore (Asian session) | 6:30 AM | 2:30 PM |

| Frankfurt (European session) | 11:30 AM | 7:30 PM |

| London (European session) | 12:30 PM | 8:30 PM |

| New York (North American session) | 5:30 PM | 2:30 AM |

Forex trading hours are from Monday to Friday and are 24 hours daily in India and worldwide. Forex trading hours in India are related to IST – India Standard Time. So you need to add 5 hours and 30 minutes on GMT to calculate the forex market open and close based on this table:

Region Open and Close Times

Sydney Open 10 PM GMT (summer) / 9 PM GMT (winter)

Sydney Close 7 AM GMT (summer) / 6 AM GMT (winter)

Tokyo Open 11 PM GMT (summer) / 11 PM GMT (winter)

Tokyo Close 8 AM GMT (summer) / 8 AM GMT (winter)

London Open 7 AM GMT (summer) / 8 AM GMT (winter)

London Close 4 PM GMT (summer) / 5 PM GMT (winter)

NY Open 12 PM GMT (summer) / 1 PM GMT (winter)

NY Close 9 PM GMT (summer) / 10 PM GMT (winter)

Here’s the converted IST timetable for the forex market open and close times based on the provided GMT timetable:

- Sydney session IST time

- Summer: Opens at 03:30 AM IST and closes at 12:30 PM IST

- Winter: Opens at 02:30 AM IST and closes at 11:30 AM IST

- Tokyo session IST time

- Open: 04:30 AM IST (both summer and winter)

- Close: 01:30 PM IST (both summer and winter)

- London session IST time

- Summer: Opens at 12:30 PM IST and closes at 09:30 PM ISTThe PM IST and closes at 10:30 PM IST

- New during this period York (NY) session IST time

- Summer: Opens at 05:30 PM IST and closes at 02:30 AM IST

- Winter: Opens at 06:30 PM IST and closes at 03:30 AM IST

This schedule adjusts the original GMT times by adding 5 hours and 30 minutes to convert them to Indian Standard Time (IST)

The most-traded asset in India is Gold. If you are from India, you can trade gold and silver using this broker’s link. To learn more about the Silver Price forecast, read our analysis.

The Best Forex Trading Time in India

If you trade US dollar-related currency pairs such as EURUSD, GBPUSD, USDJPY, etc., India’s best forex trading time is from 17:30 IST to 20:30 IST. The EU and US trading sessions overlapped during this period, resulting in the most significant market trading volume.

However, if you trade only Indian Rupee forex pairs, the best forex trading time is during the Indian Stock exchange from 9:15 till 15:30 IST.

Suppose we use the unique TrendSpider automated technical analysis software platform to analyze India’s forex trading time. In that case, we can see that liquidity rises when EU and US sessions overlap, and the price usually follows the daily trend.

What is the trading time in the Indian Exchange Market?

Trading time in India in the Indian exchange market starts from 9:15 to 15:30 IST. Indian National Stock Exchange market (nseindia.com) has a pre-open session from 9:00 to 9:08, a regular trading session from 9:15 to 15:30, and a closing session from 15:40 to 16:00.

You can trade Foreign Indian Rupee currency pairs, including Forex Derivatives. Additionally, you can trade national Indian stocks, indices, etc.

Non-working days in India when the Indian Exchange market is closed:

| Indian Holiday Date | Day in the week | Holiday name |

|---|---|---|

| 26-Jan-22 | Wednesday | Republic Day |

| 1-Mar-22 | Tuesday | Mahashivratri |

| 18-Mar-22 | Friday | Holi |

| 14-Apr-22 | Thursday | Dr.Baba Saheb Ambedkar Jayanti/Mahavir Jayanti |

| 15-Apr-22 | Friday | Good Friday |

| 3-May-22 | Tuesday | Id-Ul-Fitr (Ramzan ID) |

| 9-Aug-22 | Tuesday | Moharram |

| 15-Aug-22 | Monday | Independence Day |

| 31-Aug-22 | Wednesday | Ganesh Chaturthi |

| 5-Oct-22 | Wednesday | Dussehra |

| 24-Oct-22 | Monday | Diwali * Laxmi Pujan |

| 26-Oct-22 | Wednesday | Diwali-Balipratipada |

| 8-Nov-22 | Tuesday | Gurunanak Jayanti |

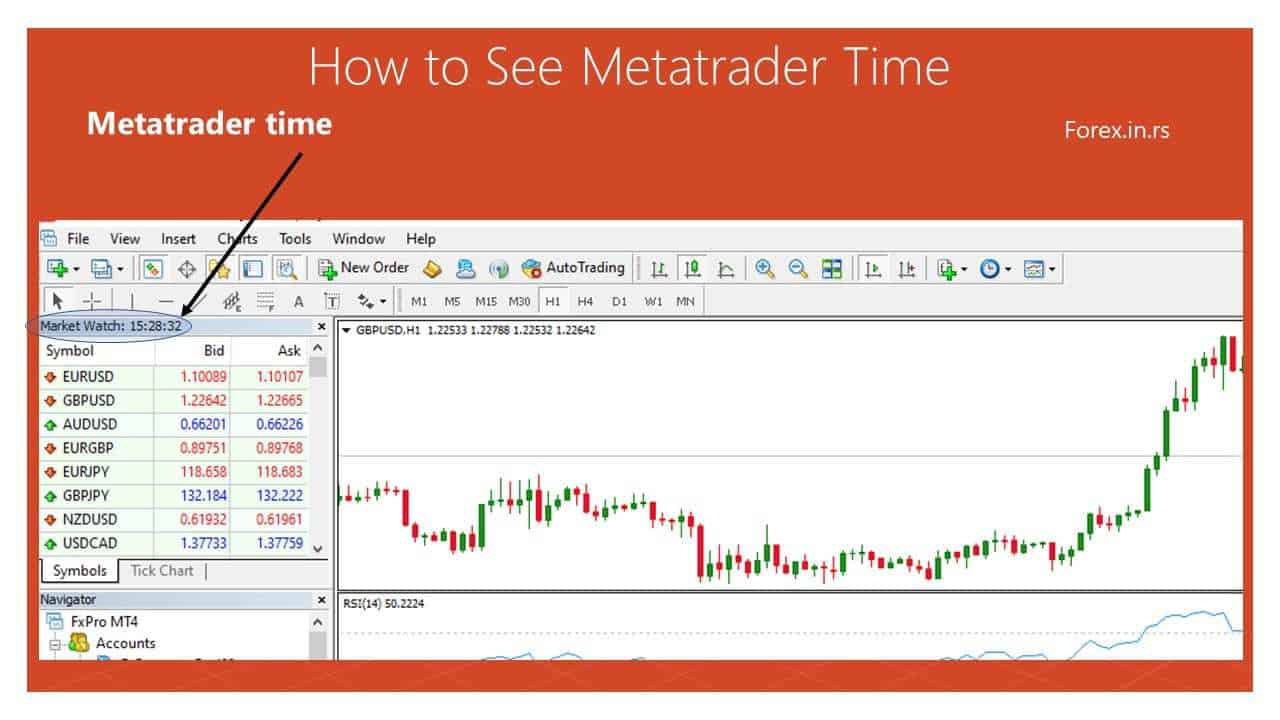

MetaTrader Trading time in India

The forex market opens Monday morning (2:30 am IST) and closes at 02:30 am IST (Indian Standard Time) on Saturday for MetaTrader traders. The US market opens in India at 7:00 pm IST.

Please watch the video below to understand more about market timing in India:

When does the Indian exchange market open?

The Indian exchange market opens at 9:00 IST, and regular NSE currency trading hours are between 9:00 am and 17:00 IST, Monday to Friday.

Forex trading hours in India

Forex market trading is related to open and close sessions in NY, Sydney, Asia, and Europe. You now understand the various sessions and why trading through high liquidity is significant. In addition, we can now understand the Forex market clock, including the opening and closing hours throughout the week. Usually, traders have quite a challenge after the market opens to start the week, and as the prices switch back and forth throughout the day, traders need to be aware of this.

Some newer traders may find the market’s exact timings challenging, but this will become second nature. Additionally, traders may get impatient waiting until Sunday as the Sydney market opens, and it may be even harder to keep track of when the trades close on Friday when the week’s span ends.

Forex trading is usually closed most weekends (Saturdays and Sundays). However, the trading hours for Forex vary on the weekends in different regions. Remember that the Forex market begins trading throughout the week at 9:00 pm or 10:00 pm GMT, depending on time zones between countries and summer or winter (see table above for specifics). For instance, markets begin to trade on Sunday in some parts of the world. In other places, such as Australia and India, markets begin to trade on Monday, whereas Forex will open very early on Monday morning in India.

The market closes at the end of the week and occurs at 9:00 pm/10:00 pm (GMT) on Friday. The trader’s broker is from country to country; closing occurs on Friday or early Saturday morning. The ability to time trades correctly is another reason to learn about the closing days quickly, times, and time zones. Additionally, depending on the weekend, it could be significant that traders fully understand their open and close periods when important market news occurs, making timing an essential factor.

India trading time Facts

The currency market closing time in India

The currency market closes in India on Friday at 17:00 IST. For MetaTrader traders, the forex market closes at 02:30 a.m. IST (Indian Standard Time) on Saturday.

In India, forex trading involves both domestic currency pairs (such as GBP-INR, EUR-INR, USD-INR, and JPY-INR) and cross-currency pairs (like EUR-USD, GBP-USD, and USD-JPY). The trading hours for these pairs are distinct and tailored to maximize overlap with key global forex markets, enhancing liquidity and volatility.

Indian Rupee Currency Trading Hours

For currency pairs involving the Indian Rupee (FCY-INR):

- Opening Time: 9:00 a.m.

- Closing Time: 5:00 p.m.

These hours are designed to align with major forex market openings globally. Specifically:

- The Indian forex market opens three and a half hours after Japan and two hours after Hong Kong, Australia, and Singapore.

- When the Indian market closes at 5:00 p.m., it overlaps significantly with the European markets, including Germany and the UK. This overlap tends to influence the liquidity and volatility of pairs like GBP-INR and EUR-INR.

Cross-Currency Trading Hours

For cross-currency pairs (EUR-USD, GBP-USD, USD-JPY):

- Opening Time: 9:00 a.m.

- Closing Time: 7:30 p.m.

These pairs are available for trading longer than INR pairs to ensure overlap with the trading hours of major global markets such as the UK, the US, and Germany, thereby facilitating better liquidity. However, it’s important to note that liquidity can still vary.

Summary of Key Overlaps

- Japanese Market: Opens before the Indian market, influencing early trading sessions.

- Hong Kong, Australia, Singapore Markets: Open a few hours before the Indian market, affecting the mid-morning session.

- European Markets: Overlap with the closing hours of the Indian market, particularly influencing GBP-INR and EUR-INR pairs.

XAUUSD opening time India

Traders from India can trade XAUUSD and other metals from 9:00 to 17:00 IST. If you use Metatrader, India’s gold market opens from Monday at 02:30 a.m. IST to Saturday at 02:30 a.m. IST (Indian Standard Time).

During the regular Indian forex market hours, trading is available from 9:00 AM to 5:00 PM Indian Standard Time (IST). This window is aligned with the general operational hours of the Indian forex market, during which traders can execute trades on various currency pairs, including precious metals like gold (XAUUSD).

However, the trading window for XAUUSD and other metals extends well beyond India’s typical forex market hours, thanks to international markets. Specifically, when using platforms like MetaTrader, Indian traders can access the gold market from early Monday at 02:30 AM IST until Saturday. This extended timeframe is possible because the global forex and metals markets operate 24 hours a day, five days a week, starting from the opening of the Australian market on Monday morning (local time) to the close of the US market on Friday evening (New York time).

This nearly continuous trading period is facilitated by the successive opening and closing of global financial markets, including Sydney, Tokyo, London, and New York. As a result, Indian traders can participate in trading XAUUSD almost any time during the week, taking advantage of price movements in the gold market as influenced by global economic indicators, geopolitical events, and market sentiment.

The ability to trade from early Monday to Saturday morning IST offers significant flexibility for Indian traders, allowing them to respond to market news and events as they happen in real-time, regardless of their geographic location or local time. This is particularly advantageous for trading gold, as its price can be susceptible to factors such as changes in the US dollar strength, interest rate decisions by central banks, and economic uncertainties.

US market opening time in India time

The US market opens in India at 19:00 IST, and the US stock exchange (NYSE and NASDAQ) closes at 01:30 IST.

| Name | Opening time (in IST) | Closing time (in IST) |

|---|---|---|

| NYSE timings in India | 7 PM | 1.30 AM |

| NASDAQ timings in India | 7 PM | 1.30 AM |

| London Stock Exchange timings in India | 1.30 PM | 10.00 PM |

| Hong Kong Stock Exchange timings in India | 6.45 AM | 1.30 PM |

| Shanghai Stock Exchange timings in India | 7 PM | 12.30 PM |

| SIX Swiss Exchange timings in India | 1.30 PM | 10.00 PM |

| Taiwan Stock Exchange timings in India | 6.30 AM | 11 AM |

| Japan Exchange Group timings in India | 5.30 AM | 11.30AM |

When does the European market open in IST?

In India, the European market opens at 13:30 IST, and the London exchange market closes at 22:00 IST.

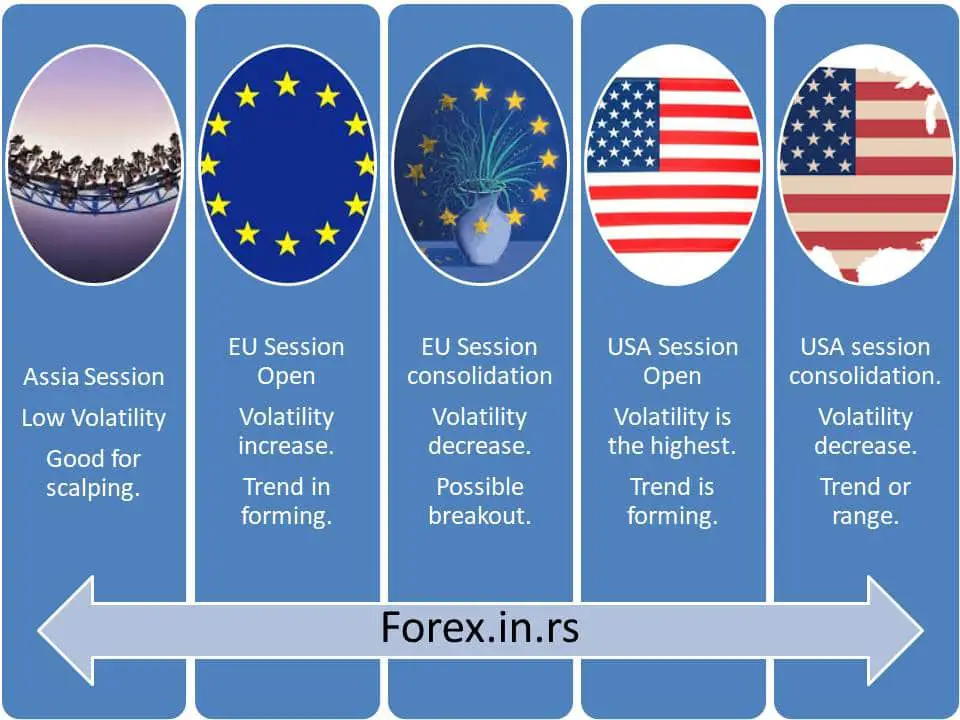

Forex Trading Day’s High and Low Volatility

As previously mentioned, volatility within the market will range from high to low depending on the Forex market clock. Therefore, it could be beneficial to download clock software with built-in timings to stay current. However, do not forget to convert it into your time zone.

Generally, within the first trading hour of opening each week, it provides the lowest liquidity but higher volatility, particularly when vital news is received during the weekend. Afterward, things settled back down, including the volatility; however, compared to other sessions, it was usually lower throughout the Sydney session. When the Tokyo session starts, which has the same time zones as China, Singapore, and others, they also join in trading, which means that the volatility will be higher for traders in the Asian time zones during this period.

The volatility lingers until the time for it to rise again; usually, that occurs as the London session starts and other central banks, including hedge funds. Then, even larger investors throughout Europe will get in on the trading. The early sessions are when traders are anxious to start trading as there is more likely to be much more activity with irrelevant trading. Over the following several hours, the volatility will remain high.

Finally, the New York session opens, and trading starts peaking. The New York and London sessions will open during this time. Volatility will be highest for 3 to 4 hours while traders from significant regions trade against each other during the busiest market times. After this, the London session will close, and volatility will gradually decrease. As the New York session closes, volatility goes down to its lowest again.

When trading in the Forex market, traders must remember the hours and cycle (clock). However, since the opening and closing hours depend on the time zones between regions and countries, it can be difficult and complex to understand fully. Still, these are why it is so important to have it embedded into the brain, as it will make it easier to conduct your trading while staying with the market flow. Additionally, many traders have a broker located in their region who can match up trading hours and improve the convenience of market trading.

Overview

Currencies are necessary worldwide for many governments and institutions, including global businesses, international trade, and central banks. Thus, to fully satisfy the requirements and needs of conducting transactions throughout the many different time zones, a 24-hour market is essential. Furthermore, throughout the open Forex market hours, from Mondays to the weekend closing, we believe it is safe to assume there’s potentially no period during an open market when no currencies are being traded. Therefore, traders from India need to know their broker’s trading time, Monday market opening time, and Friday market closing time.