Table of Contents

CFA Institute official link.

What is CFA?

CFA Institute or Chartered Financial Analyst Institute is the world’s largest association of investment professionals established in 1947. CFA Institute offices are located in London, New York City, Mumbai, Hong Kong, Beijing, Shanghai, Abu Dhabi, and Charlottesville, Virginia, USA.

What does CFA stand for?

CFA stands for Chartered Financial Analyst. It is a professional designation given by the CFA Institute that measures the competence and integrity of the financial industry, one of the essential designations among investment analysts and financial advisors.

Nowadays, students find different areas of study to settle in their careers. There are so many courses such as CFA, CA, LLB, MBA, and all. But among these all courses, CFA is the most renowned and recognized course many students want to complete. If you’re going to enhance the global financial market and help manage the financial settlement, this profession is perfect. If you are interested, then you should know what CFA is? Let’s check this out in detail:

At first, you should know what does CFA stands for? The complete form of CFA is a Chartered Financial Analyst. For investment professionals, this is one of the best and demanding designations. This particular program is aimed to increase investment management and the global financial management profession. This program is specially designed to give the students knowledge about the essential professional career for them. If you want to qualify for a finance career and establish financial credentials, the CFA exam is a perfect and beneficial opportunity. Through this course, you do not only improve you’re earnings but also get a new aim in your career.

In this examination or course, the students need to qualify for various exams such as ethics, economic, accounting, money management, and security analysis. In addition, you will have to know some of its key factors:

The CFA charter is one of the famous, well-known, and most recognized designations in finance. In the field of investment analysis, it is considered the gold standard. To become a charter holder, students need to pass three different and challenging examinations, the equivalent bachelor’s degree, and four years of experience in the professional field. If you want to give the CFA exam, you need strong dedication, discipline, and considerable learning. It would help if you had diligence, endurance, and willpower as well. Communication skills, focus, self-motivation, and time management are significant to qualify for these examinations and become a Chartered Financial Analyst.

Students who pursue this particular course gain deep knowledge about the investment industry, eventually getting high-paying jobs.

This particular program is very beneficial for those who want to build a long-term career in banking, financial services, and corporate areas. Due to the factors like industrialization and globalization, this course increases its demands in India. From 1963 to 2016, 1,348,103 aspirants sat from this particular Level I examination, and 209,561 aspirants passed the Level III examination.

The aspirants need to study a minimum of 300 hours for each level of examination. It is a complicated exam. The institute of CFA was established in the year 1947. It has emerged as its benchmark in the financial industry as well.

Benefits of CFA examination:

If you want to pursue the CFA course, you will get plenty of career options after passing and completing the three CFA examination levels. In today’s competitive platform, the CFA chartered holders gain the importance of their expertise and skills. In the field of professional finance, this course plays the role of a career enhancer. If you have a CFA degree, then these are such recruitments for you:

Portfolio managers

Private bankers

Relationship managers

Research analysts

Financial advisors

Financial strategists

Requirements of CFA examination:

If you want to clear the CFA exam and earn the degree of CFA charter, then you will have to require these all:

You must have a bachelor’s degree. Four years of experience in the professional working platform.Total of four years of experience in both education and work.

Apart from these, the students need to have all these as well:

The students need to be a member of the CFA Institute. They need to apply for membership in the local CFA society.

If you want to pass the exam, then you should know all these:

The aspirant or the candidate needs to complete all the levels of the CFA examination. After clearing the level of three, the students need to have the work experience as mentioned earlier. It should be prescribed by the CFA Institute as well.

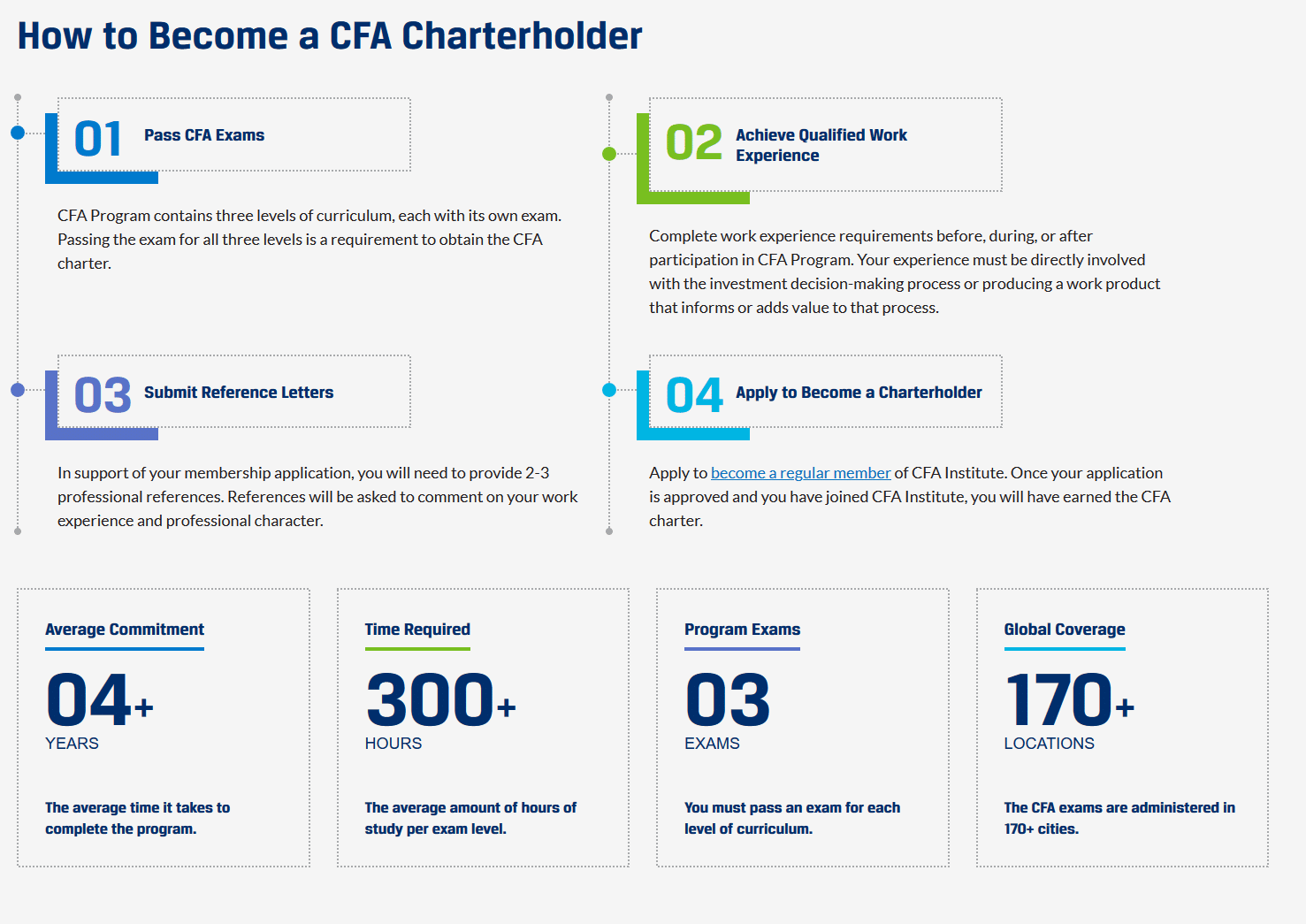

How to become a Chartered Financial Analyst?

If you want to become a CFA holder, the most crucial step is to pass the three-level examination. But before that, you need to enroll in the CFA program. You will have to pay the enrolment fee of $450. It would be best to have an international travel passport as test centers are located worldwide except in Cuba. You need to study the curriculum and take the examinations in the English language. If the student lives in Cuba or the Crimea region of Ukraine, they cannot sit in the examination. Each exam of CFA is administrated once a year. But the CFA examination Level I is only administrated twice a year. If you want to move to level II, you need to pass level I first.

When enrolling for the CFA program, you will have to fulfill the Professional Conduct Statement form. By this, you are affirming the CFA Code of ethics and standard professional conduct.

About the examinations and requirements of CFA:

CFA examination is very much well-known as the most acceptable financial exam in the whole world. This particular test is just for checking your core financial and technical knowledge. So, for holding the CFA charter, you must pass the three levels of examination such as level 1, level 2, and level 3. All the CFA examinations are held in June, but the level 1 examination is also contained in December.

The syllabus for each examination of the CFA program is based on the CFA Institute’s curriculum. Therefore, the students need to read at least 300 hours for each level of examination.

CFA Exam Score Table

| Topic Area | Level I | Level II | Level III |

|---|---|---|---|

| Ethical and Professional Standards | 15 | 10-15 | 10-15 |

| Quantitative Methods | 12 | 5-10 | 0 |

| Economics | 10 | 5-10 | 5-10 |

| Financial Reporting and Analysis | 15 | 10-15 | 0 |

| Corporate Finance | 10 | 5-10 | 0 |

| Equity Investments | 11 | 10-15 | 10-15 |

| Fixed Income | 11 | 10-15 | 15-20 |

| Derivatives | 6 | 5-10 | 5-10 |

| Alternative Investments | 6 | 5-10 | 5-10 |

| Portfolio Management and Wealth Planning | 6 | 5-15 | 35-40 |

| Total | 100 | 100 | 100 |

What does the CFA Level 1 cover?

CFA Level 1 covers the Investment Tools topic where candidates get knowledge (Knowledge and comprehension) of ethical and professional standards.

To register in this program or sit for the level 1 examination of CFA, you need to complete your bachelor’s degree or be the college’s final year student. Apart from this, you need to have four years of experience in full-time professional work. Or else, you may have a combination of college and professional working experience. In the level 1 examination, you need to give the answers to the 240 multiple-choice questions. These questions are divided into two sessions. Each session needs three hours. The pass rate of this level of examination is 43%.

What does the CFA Level 2 cover?

CFA Level 2 covers the Asset Valuation topic, where candidates learn how to apply standards to situations analysts face (Application and Analysis)

For sitting in the Level 2 examination, you will have to pass the Level 1 examination and complete the bachelor’s degree. The structure of the Level 2 examination is different from the Level 1 examination. But the question pattern also has multiple choices. In this level, the exam format is 20 small sets of case studies and six multiple-choice questions for each 20 group. Thus, you need to answer a total of 120 questions. This examination is also divided into two parts- one in the morning and another in the afternoon. The pass rate of this level 2 examination is 45%.

What does the CFA Level 3 cover?

CFA Level 3 covers the Portfolio Management topic where candidates learn the standards in portfolio management and compliance context (Synthesis and Evaluation)

This examination is also held in June every year. In this last exam of the CFA, you will have to answer eight to twelve essay-type questions during the morning session examination. In the afternoon session, you need to complete ten vignettes, followed by six questions. You must pass the Level 2 examination before sitting for the Level 3 examination. The pass rate of this level 3 examination is 56%.

Limitation of the career in CFA:

It is a respected and worldwide famous designation. But it is not guaranteed to reach a high level of richness and glory. Before applying for this course and sitting for the examinations, you need to know the drawbacks of this particular career. After making the CFA career, you cannot quickly fix the earning and earn considerable money from a decent job. It is quite a complicated and time-taking procedure, as well. It would help if you had the patience, diligence, and dedication to pass these challenging levels of examination and pursue your career in this particular field. If you fail in one test and apply for a retake, you must compromise your time and relation with your family, relatives, and friends.

Apart from the time, dedication, and willing power, the monetary problem is also there. You will have to spend a quality amount of money to buy books and study programs. So, before going too further, you will have to consider these facts.

You can get so many tips from the internet. Still, it is better to know the experienced or senior students regarding the CFA curse and gather some practical knowledge. Therefore, some topics from CFA we will cover in our section Finance education.