Table of Contents

Twin trading forex definition

The twin trading risks minimization technique is based on opening n number of trades each 1/n size. For instance, suppose you open a business to buy a lot of 1 size. But if you open two trades to buy two lots of 0.5 or four trades of 0.25 size instead of one trade of 1 size, then it will be twin trading.

Many forex traders use this technique today, but it is not new. Unfortunately, most traders have ignored it earlier because of its simple looks and doubtful effectiveness.

Example:

Let us have a single 1 lot size forex trade BUY EURUSD at 1.3, stop loss 1.297, target 1.303.

Stop loss is: 30 pips

Target is 30 pips.

Risk: $300

Reward: $300

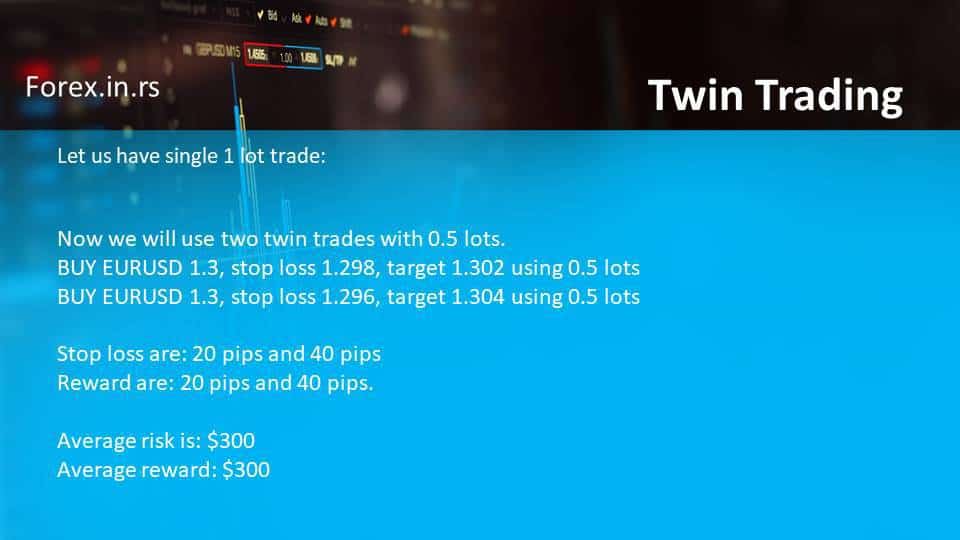

Now we will use two twin trades with 0.5 lots.

BUY EURUSD 1.3, stop loss 1.298, target 1.302 using 0.5 lots

BUY EURUSD 1.3, stop loss 1.296, target 1.304 using 0.5 lots

Stop-loss is: 20 pips and 40 pips

The rewards are 20 pips and 40 pips.

The average risk is: $300

Average reward: $300

Using the same logic, the trader can open n different trades of the same size.

The power of twin trading

The power of twin trading is in diversification because splitting the trade into many smaller trades is a way to reduce the risk of losses as you can set different positions to exit from various trades according to the progressing market’s direction. By the time the trade with the longest exit closes, all the trades with shorter exit positions will be closed.

Reasons to use Twin-trading strategy

The main reason behind opening several trades of equal smaller lot sizes instead of one trade of the size of the entire lot is to combat uncertainty in forex trading. The forex market is very uncertain. So when deciding on forex trading, forex traders that use the technique of twin trading are considered competent in this market. Therefore, twin trading is used by forex traders for getting two things – locking profits and minimizing risks.

Locking profits

When several trades of lots of equal sizes are opened with different positions to exit, and ten pips are set for each trade, the exit position for every trade will be 10 pips more than the previous one. Now you can lock the profit of the exit position of 10 pips even if the market reverses after moving to a 20 pips position. Similarly, you will lock the profits of 10 pips position and the position of 20 pips even if the market reverses even after moving up to 20 pips. In this way, you can get some profit by the time the trade moves to your last exit position on each trade.

Management of risks

The management of risk is the best thing in twin trading. You can cover up the losses of the positions that are still open with the help of the profits you have locked for the positions that have been closed by that time. For instance, you have opened three trades of lots of 0.33 sizes each and opted for exit positions at ten pips, 20 pips, and 30 pips as your stop loss position. When the market moves to the 30 pips, your first and second exit positions will be closed, and their profit will be locked. You can use that profit to cover the losses if you lose the trade at 30 pips stop loss position.

Thus, twin trading in forex helps lock profits and reduce the risk of losses.