Table of Contents

Forex brokers can be categorized based on various criteria, such as their business model, regulatory status, and the range of services they offer. Here’s a list of the different types of forex brokers:

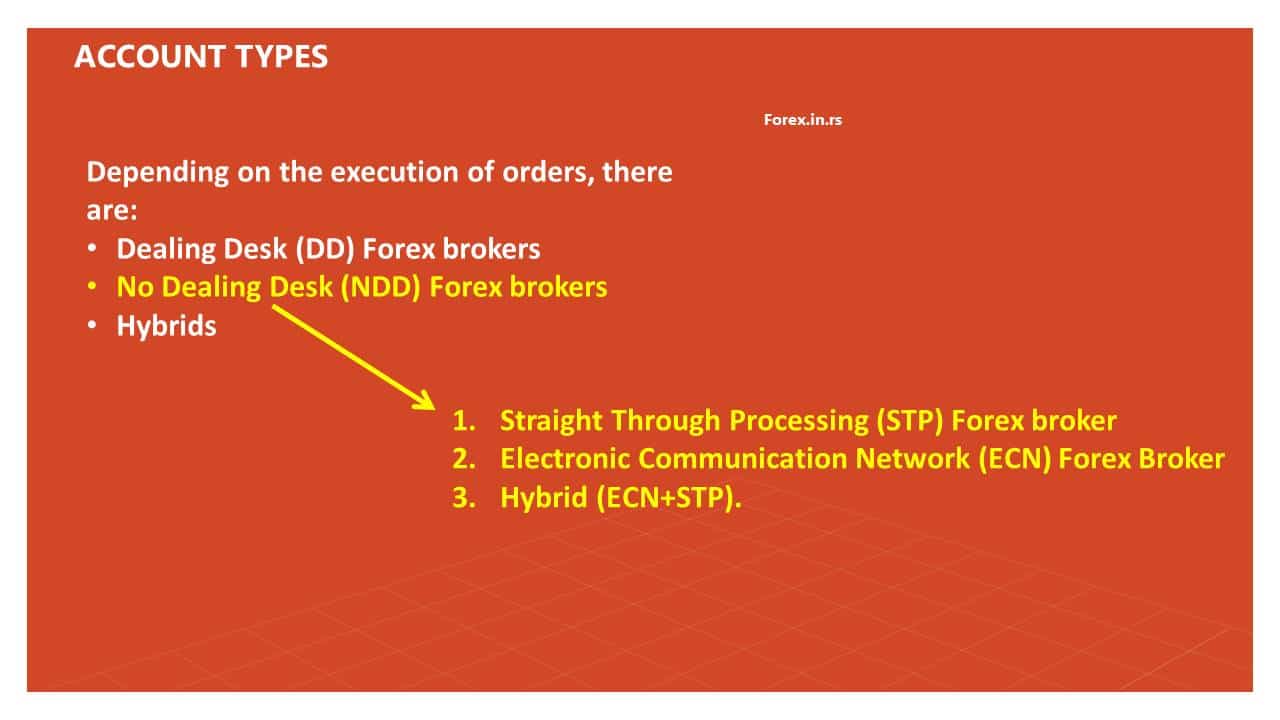

Types of Forex Brokers Based on the Business Model

Dealing Desk (DD) Brokers

Dealing Desk (DD) Brokers, commonly called “Market Makers,” play a pivotal role in the foreign exchange market. Their primary function is to provide liquidity by offering buy and sell prices for a currency pair, thereby ‘making the market.’ In essence, they create an internal market for their clients. This article delves deep into Dealing Desk Brokers’ operations, advantages, and criticisms.

How Do Dealing Desk Brokers Operate?

- Creating an Internal Market: DD Brokers typically have many clients. By aggregating these clients’ trades, they create an internal trading environment. This means they can often match one client’s buy order with another client’s sell order.

- Taking the Opposite Side: When buying and selling orders are imbalanced, the broker will take the opposite side of the trade. So, if a trader decides to buy a particular currency pair, the broker will sell it, and vice versa. This doesn’t mean they are betting against the trader but are filling the liquidity gap.

- Setting the Spread: The difference between the buying and selling price, known as the spread, is set by the DD Broker. This spread often represents the broker’s primary source of income.

Advantages of Dealing Desk Brokers

- Fixed Spreads: Unlike No Dealing Desk (NDD) brokers, who offer variable spreads that can widen during volatile market conditions, DD Brokers often provide fixed spreads, giving traders predictable trading costs.

- Instant Order Execution: Since trades are executed within the broker’s internal system and not in the broader interbank market, order execution can be quicker.

- No Commissions: Many DD brokers only earn from the spread and do not charge additional commissions for trade execution.

- Lower Entry Requirements: Many DD Brokers have lower minimum deposit requirements, making it accessible for newbie traders to start.

No Dealing Desk (NDD) Brokers

They bridge the client and the real interbank market. They don’t take the opposite position to the traders. NDD brokers can be further divided into:

- STP (Straight Through Processing) Brokers: Directly route orders to liquidity providers like banks and other brokers.

- ECN (Electronic Communication Network) Brokers: Offer a platform where market participants, including banks, traders, and other investors, can trade against each other by submitting competing bids and offers into the system.

- Hybrid (STP + ECN) Brokers: Combine STP and ECN models, often allowing traders to choose based on their trading strategy and size.

No Dealing Desk (NDD) brokers represent a significant shift from the traditional brokerage model. Unlike Dealing Desk (DD) brokers, NDD brokers do not create an internal market for their clients. Instead, they act as intermediaries, connecting traders with the broader forex interbank market. Here’s a deep dive into the operations, types, and characteristics of NDD brokers.

How NDD Brokers Operate

At its core, an NDD broker links traders and various liquidity providers in the interbank forex market. When a trader places an order, the NDD broker forwards it to these liquidity providers. Since NDD brokers do not take the opposite position in a trade, there’s no inherent conflict of interest, as seen with some DD brokers.

Types of NDD Brokers

- STP (Straight Through Processing) Brokers:

- Operation: STP brokers forward client orders directly to their liquidity providers, typically central banks, financial institutions, and sometimes other brokers. The best available price is chosen automatically based on the order specifics and the offers from liquidity providers.

- Revenue: They usually earn from the spread, and sometimes, they might add a markup to the spread offered by the liquidity provider.

- Pros: Faster order execution and, often, more competitive spreads.

- Cons: There’s still a slight markup in prices, and the range of liquidity providers can affect the quality of the execution.

- ECN (Electronic Communication Network) Brokers:

- Operation: ECN brokers offer a platform where various market participants, including banks, traders, and other brokers, can interact directly. Orders are matched with the best available prices in real time.

- Revenue: They usually charge a commission on trades rather than earning from the spread.

- Pros: Transparent pricing, as traders can see the market depth. Also, traders might get spreads below zero (negative spreads) during high liquidity times.

- Cons: Commissions can be high, and there’s usually a higher minimum deposit requirement.

- Hybrid (STP + ECN) Brokers:

- Operation: These brokers offer the best of both worlds. Depending on the account type or platform the trader chooses, the broker routes the order via STP or ECN.

- Revenue: They might earn from both spreads (with a markup in the case of STP) and commissions (for ECN).

- Pros: Flexibility for traders in choosing their preferred trading environment.

- Cons: The benefits come with the complexities of understanding the different pricing models and choosing the right one for a trader’s strategy.

Types of Forex Brokers Based on Regulation

- Regulated Brokers: Operate under the supervision of regulatory bodies from the countries they’re located in, such as the CFTC in the US, FCA in the UK, ASIC in Australia, etc.

- Unregulated Brokers: They do not hold a license from any regulatory body. Trading with these brokers can be risky as they don’t offer the same protection to traders as regulated ones.

Regulation is one of the most critical factors to consider when choosing a forex broker. It can significantly influence the safety of your funds and the integrity of your trades. This article delves into the intricacies of regulated and unregulated brokers, offering insights into their operations and the implications for traders.

Regulated Brokers

Regulated brokers are financial entities that operate under the jurisdiction and oversight of a recognized regulatory body.

Critical Aspects of Regulated Brokers:

- Licensing: These brokers are granted a license by regulatory authorities after meeting specific criteria concerning financial stability, transparency, and good practices.

- Oversight: They are continuously monitored to ensure they adhere to the stringent rules and standards set by the regulatory body.

- Capital Adequacy: They must maintain certain capital reserves, ensuring they have the financial strength to withstand adverse market conditions.

- Client Fund Segregation: To safeguard traders, regulated brokers are often mandated to hold client funds in segregated accounts, separate from the broker’s operational funds.

- Compensation Schemes: In the case of broker insolvency, many regulatory authorities have compensation schemes to protect traders. For instance, the UK’s Financial Services Compensation Scheme (FSCS) covers traders up to £85,000.

Notable Regulatory Bodies:

- CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association) regulate US forex brokers.

- FCA (Financial Conduct Authority): Oversees forex brokers in the UK.

- ASIC (Australian Securities and Investment Commission): Regulates brokers in Australia.

- CySEC (Cyprus Securities and Exchange Commission): Regulates brokers based in Cyprus, a popular location for many European forex brokers.

Unregulated Brokers

Unregulated brokers operate without a valid license from a recognized financial regulatory authority.

Critical Aspects of Unregulated Brokers:

- No Oversight: They are not bound by regulatory guidelines or standards, giving them significant operational autonomy.

- Operational Risks: Without regulatory oversight, these brokers can engage in practices that might be detrimental to traders, such as price manipulation or delayed withdrawals.

- Lack of Transparency: There’s no guarantee of transparency in their operations, financial reporting, or trade execution.

- No Compensation: If the broker becomes insolvent, traders do not have any protection or compensation schemes to recover their funds.

Why Do They Exist?

- Geographical Presence: Some brokers might cater to regions or countries where forex trading is not yet regulated.

- Operational Flexibility: These brokers can offer higher leverage or bonuses to attract traders without regulatory restrictions.

- Cost: Obtaining and maintaining a regulatory license can be costly. Some brokers might opt to operate unregulated to save on these expenses.

Types of Forex Brokers Based on Trading Platforms

- MetaTrader Brokers: Offer the widely-used MetaTrader 4 or MetaTrader 5 platforms.

- cTrader Brokers: Offer the cTrader platform, known for its intuitive interface and algorithmic trading capabilities.

- Proprietary Platform Brokers: Have their own in-house developed trading platforms.

Forex trading platforms are the gateway for traders to access the currency markets. The choice of platform can influence a trader’s experience, strategy, and even profitability. Brokers often differentiate themselves by the trading platforms they offer. This article examines the main types of forex brokers based on their trading platforms.

MetaTrader Brokers

MetaTrader, developed by MetaQuotes Software, is one of the most popular trading platforms in the forex industry. Brokers offering MetaTrader can be further subdivided into:

- MetaTrader 4 (MT4) Brokers: MT4 has been a staple in the forex world for years.

- Features: Offers real-time market access, technical analysis tools, scripting language for automated strategies (Expert Advisors), and a user-friendly interface.

- Popularity: Its robustness, ease of use, and broad customization capabilities have made it a favorite among retail traders.

- MetaTrader 5 (MT5) Brokers: An advanced version of MT4, MT5 is not just an upgrade but an entirely new platform.

- Features: Includes economic calendars, more timeframes, additional order types, and the ability to trade a more comprehensive range of financial instruments beyond forex.

- Difference from MT4: Although it offers more features, it hasn’t replaced MT4, mainly because of the non-compatibility of some custom MT4 scripts and indicators with MT5.

cTrader Brokers

cTrader is a platform developed by Spotware and is gaining traction as a formidable competitor to MetaTrader.

- Features:

- Intuitive User Interface: Modern design with detachable charts and customizable layout.

- Algorithmic Trading: Offers advanced back-testing capabilities and the cAlgo interface for algorithmic trading.

- Level II Pricing: Displays a deeper market depth, showing the full range of executable prices coming directly from liquidity providers.

- Cloud Integration: Allows users to save their workspace on the cloud, enabling seamless trading across devices.

- Popularity: Known for its transparency and direct market access, it’s becoming increasingly popular among advanced retail traders and those keen on algorithmic trading.

Proprietary Platform Brokers

Some brokers develop their in-house trading platforms tailored to their services and clientele.

- Features:

- Unique Offerings: Often come with specialized tools, features, or interfaces that distinguish the broker from competitors.

- Integration: Seamless integration with the broker’s other services, like news feeds, research, or education portals.

- Customization: This cThe broker can be more adaptable to feedback, making quick adjustments based on user needs.

- Considerations:

- Learning Curve: As these platforms are unique to the broker, a trader might need some time to familiarize themselves.

- Dependency: If a trader becomes accustomed to a proprietary platform and wishes to change brokers, they may miss specific tools or features they’ve grown used to.

Types of Forex Brokers Based on Offered Services

- Full-Service Brokers: Offer various services, including research, advice, portfolio management, and trading execution.

- Discount Brokers: Offer essential trading execution services at a lower cost, without additional services such as research and advisory.

- Social Trading Brokers: Allow traders to follow and copy the trades of professional and experienced traders.

Forex brokers can be categorized based on the range and nature of their clients’ services. The depth and breadth of these services can significantly influence a trader’s experience, from the guidance they receive to the costs they incur. Let’s delve into the distinct types of brokers based on their offered services.

Full-Service Brokers

Full-service brokers provide a comprehensive suite of services to cater to a trader’s various needs.

- Features:

- Research: Regularly supply in-depth market analysis, forecasts, and reports.

- Advice: Offer tailored trading recommendations based on the trader’s profile and market conditions.

- Portfolio Management: Some may offer automated or manual portfolio management services.

- Education: Often provide extensive educational resources, webinars, and training programs for beginners and experienced traders.

- Account Managers: Dedicated personnel to help manage the trader’s account and provide personalized assistance.

- Pros: Comprehensive support can be invaluable, especially for novice traders or those who prefer a more hands-off approach.

- Cons: Typically, the added services come with higher fees or broader spreads than discount brokers.

Discount Brokers

These brokers are streamlined to provide the essentials of forex trading without the frills.

- Features:

- Essential Trading Execution: Allows traders to execute trades on their platforms.

- Minimal Extras: Limited, if any, research, analysis, or advisory services. The primary focus is on keeping operational costs low.

- Pros:

- Lower Costs: Reduced spreads or commissions due to the lack of added services.

- Simplicity: Suitable for experienced traders who prefer making their own decisions and don’t need extra services.

- Cons: Traders are on their own and must seek research, analysis, and education from other sources.

Social Trading Brokers

An evolution in the trading world, social trading combines traditional trading with elements of social networking.

- Features:

- Follow and Copy: Enables traders to observe and replicate the trades of experienced professionals.

- Trader Rankings: Brokers often rank traders based on performance, helping newcomers choose who to follow.

- Interactive Platforms: Allows for discussions, feedback, and sharing of strategies among the trading community.

- Automated Copying: Some platforms automate the copying process, adjusting the trade size based on the follower’s account balance.

- Pros:

- Learning Opportunity: Novices can learn by watching professionals.

- Potential for Passive Trading: Users can earn without actively managing their trades by copying successful traders.

- Cons:

- Dependency: Over-reliance on other traders can inhibit the development of personal trading skills.

- No Guarantee of Profit: Past success doesn’t guarantee future performance.

Types of Forex Brokers Based on Client Type

- Retail Forex Brokers: Cater primarily to individual small traders.

- Institutional Forex Brokers: Cater to large financial institutions, hedge funds, and professional traders with more considerable trading capital.

Brokers often differentiate their services based on the primary client type they target. This categorization ensures that each client segment receives services tailored to its specific requirements. Here’s an in-depth look into the primary types of forex brokers based on client type:

Retail Forex Brokers

Retail forex brokers primarily serve individual traders who engage in forex trading as a hobby, secondary income source, or even a primary profession.

- Features:

- Accessible Platforms: These brokers offer user-friendly platforms designed for traders of all experience levels.

- Micro/Lot Trading: They allow trade in smaller lot sizes, making it feasible for traders with smaller capital.

- Leverage: Often offer higher leverage, allowing retail traders to control more prominent positions with less capital.

- Education and Support: Provide educational resources, customer support, and sometimes even personal account managers to assist traders.

- Regulation: Many are regulated in jurisdictions that specifically focus on protecting retail traders, ensuring safety and transparency.

- Pros: Designed to be beginner-friendly, offer demo accounts, and typically have lower initial deposit requirements.

- Cons: Might offer slightly wider spreads compared to institutional brokers due to the smaller trading volume.

Institutional Forex Brokers

Institutional forex brokers cater to prominent financial players like banks, hedge funds, multinational corporations, and professional traders with substantial trading capital.

- Features:

- Direct Market Access (DMA): They offer direct access to the interbank forex market, ensuring faster execution and more liquidity.

- Customized Solutions: Catering to institutions, they often provide tailored trading solutions, platforms, and interfaces.

- Lower Spreads: Due to the large trading volumes, institutional clients often benefit from tighter spreads and more favorable trading conditions.

- Dedicated Support: Institutions typically have dedicated account managers or teams ensuring smooth operations and quick problem resolution.

- Advanced Technology: Offer more robust and technologically advanced platforms that can handle large trading volumes and integrate with other institutional infrastructure.

- Pros: More competitive pricing, faster execution speeds, and a more comprehensive range of instruments to trade.

- Cons: High initial deposit requirements might not be as user-friendly to individual traders due to the focus on professional clients.

Types of Forex Brokers Based on Leverage

- High Leverage Brokers: Offer substantial leverage, sometimes as high as 1000:1, 1:500, and 1:400.

- Low Leverage Brokers: Offer more conservative leverage ratios to minimize risk.All forex brokers up to 1:100.

While selecting a forex broker, traders should consider their individual trading needs and goals, understand the associated costs, and always choose brokers regulated by reputable authorities.