Stock splits are a financial strategy publicly traded companies employ to increase the number of outstanding shares by issuing more to current shareholders. This maneuver does not affect the company’s market capitalization or the total value of an investor’s holdings. Still, it lowers the trading price of individual shares, making them more accessible to a broader range of investors.

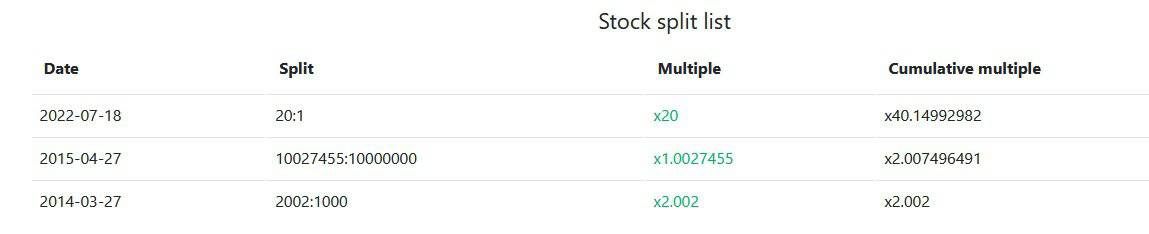

See the example of Google stocks split:

Typically, splits are executed in ratios such as 2-for-1 or 3-for-1, meaning shareholders receive two or three shares for every one they owned before the split. Companies may opt for a stock split to signal confidence in their future growth prospects, aiming to attract more investors by the increased affordability and liquidity of their shares. Although the company’s intrinsic value remains unchanged, splits can lead to a perception of affordability that might stimulate trading activity. This strategy is often seen as a milestone for companies, indicating a solid performance history and optimism for continued success.

But will we see a share price increase after the stock split?

Do Stock Splits Increase Share Price?

No, based on multiple scientific studies, stock splits do not increase share price in the first several months. However, we can see a positive return on the day the split is approved, but it isn’t strong enough to be considered statistically significant.

Therefore, let us analyze some research studies on this topic.

This research article, published by David L. Ikenberry, Graeme Rankine, and Earl K. in the Journal of Financial and Quantitative Analysis, delves into the implications and investor reactions surrounding two-for-one stock splits. Analyzing a sample of 1,275 such splits, the study discovers notable excess returns of 7.93 percent in the year following the split and 12.15 percent over three years, surpassing the initial announcement return of 3.38 percent. This indicates that the market tends to ignore the news of a stock split. The findings suggest that while stock splits adjust share prices to a more accessible trading range, the decision by management to enact a split is influenced by their expectations of the company’s future performance. Moreover, the study observes an inverse relationship between the stock’s performance before the split and the excess returns following the split, arguing against the notion that these results are merely a continuation of existing momentum. Essentially, this research underscores that stock splits are not just cosmetic changes but may signal management’s confidence in the company’s future growth, leading to an underappreciated increase in shareholder value.

Lyroudi, Dasilas, and Varnas (2006) delve into the enduring intrigue surrounding the relationship between stock splits and stock prices, highlighting how stock splits often produce a positive reaction in stock prices upon announcement. Yet, the subsequent price behavior remains somewhat enigmatic. They point out that, theoretically, a stock split is seen as a mere arithmetic rearrangement—lowering the par value of shares and increasing their number without providing tangible benefits to shareholders, aside from some incurred costs. However, this perspective doesn’t fully explain why corporate managers frequently undertake splits, suggesting that splits may offer perceived or actual benefits beyond the arithmetic.

The inception of stock splits is traced back to a strategy to facilitate individual investments by avoiding broker penalties on “odd lot” purchases and to attract individual, presumably more loyal, investors by maintaining accessible share prices. This notion is supported by the trading range hypothesis, proposing that splits adjust share prices to a preferable range, thereby enhancing liquidity and marketability, even though empirical evidence on this improved liquidity post-split is mixed.

Authors like Guo et al. (2005) and others extend the discussion by offering additional motivations behind stock splits, such as making shares more accessible to individual investors who might be wealth-constrained, altering the composition of ownership towards more individual and less institutional investors, and influencing trading costs, which notably can deter institutional investors due to widened bid/offer spreads post-split.

Contrastingly, Carlson (2007) explores why some companies abstain from stock splits, rounding out the discourse by pointing to the multifaceted and nuanced considerations companies navigate in deciding whether to split their stocks, encompassing both the strategic benefits of appealing to individual investors and the broader implications on market behavior and ownership structures.

Masse, Hanrahan, and Kushner (1997) discuss findings from various studies about how stock splits impact the performance of stocks. They mention a study by Charles in Canada, which showed that stocks that split outperformed the market by 59% in the 49 months leading up to the split announcement. However, after the split, they performed similarly to the market in the first year and underperformed by 7% in the second year. Another study they refer to, by Kryzanowski and Zhang, found that on the day a stock split is announced, there’s a noticeable, positive bump in the stock’s return, but the positive return seen on the day the split is approved isn’t strong enough to be considered statistically significant.

In their research, Masse and colleagues used a method focused on specific event dates to analyze how the market reacts to stock adjustments like regular splits, reverse splits, and stock dividends. They observed that the market responded well to regular stock splits, showing a 4.3% increase in value right after the announcement. They also noted that while the market tends to predict these splits, they usually underestimate their positive impact on stock value.

They also discussed findings from Arbel and Swanson (1993), who looked at how stocks on the New York Stock Exchange (NYSE) and American Stock Exchange (AMEX) reacted to split announcements. Their study found that splits led to positive reactions from the market, especially when the announcements were not mixed with other significant news from the company. This supports the idea that splits can make stocks more appealing because they suggest a stock is in a desirable price range (the trading range hypothesis) and grab more attention from investors (the attention hypothesis).

The report discusses theories that explain how and why stock prices and the market behave the way they do, including the Efficient Market Hypothesis, which says that stock prices reflect all available information. It also mentions newer theories like the Adaptive Market Hypothesis and the Incomplete Revelation Hypothesis, which offer alternative explanations for market and price behaviors around events like stock splits.

Why do companies split stocks?

Companies choose to split their stocks primarily to adjust the trading price to an optimal range, making shares more accessible and affordable for a broader base of investors. This concept suggests that lower share prices can increase the number of traders and trade volume. This strategy aims to attract more investors, including those from the middle and lower economic classes, and boost the company’s trading activity.

Mack (1995) and other researchers like Baker and Powell (1993) indicate that stock splits are often implemented when a company’s board believes the share price is too high, potentially alienating mid-level investors and keeping the stock from trading within a preferred range. Arbel and Swanson (1993) also found that the primary goal of stock splits is to maintain the stock price within a “normal” trading range, emphasizing the desire of firms to make ownership more feasible for the average person.

Beyond adjusting for an optimal trading range, stock splits are a positive signal to the market, suggesting that a company is performing well and has bright prospects. This aligns with the signaling hypothesis proposed by Brennan and Copeland in 1988, which addresses the information asymmetry between the company’s management and its investors. In this context, stock splits are viewed as a transmission of favorable information from the company to its shareholders. Supporting this, Baker and Powell (1993) and Klein and Peterson (1989) found that companies undergoing splits often see adjustments in earnings forecasts, further suggesting improved future performance.

The motivations behind stock splits are twofold yet interconnected: to make shares more accessible to a broader range of investors by maintaining them within an optimal trading range and to signal the company’s strong performance and positive future outlook. This strategic move caters to attracting more investors and serves as a communication tool, highlighting the company’s confidence in its continued growth and success.

Please read the top 15 articles explaining share price:

How to find the price per share?

What Happens to Share Price After Buyback?

What makes a share price go up?

What causes share prices to drop?

How do you calculate the share average price?

How do you calculate the share price from the Balance Sheet?

Why do stock buybacks increase share price?

Do stock splits increase share price?

Does dividend reduce share price?

How does debt affect share price?

How does issuing new shares affect share price?

How to calculate the share price of a startup company?

What happens if a share price goes to zero?