Table of Contents

Google parent Alphabet did a 20-for-1 stock split. Alphabet stock doubled in two years, going from an $1110 low in 2020. up to almost $3000 in November 2021.

In my opinion, the Google stock split 2022 was the perfect move because the new split made Google stock more affordable for more investors. Now smaller investors, like me, can buy a few shares of the biggest technology company Google.

According to the earnings statement, Alphabet plans to split Class A, B, and C shares. In that case, on July 1, 2022. As a result, shareholders can receive 19 additional shares (after splitting) for each share of the same class of stock they own.

As of July 1, All Alphabet shareholders will receive 19 additional shares. So, for each share of Alphabet you own, you would get 19 other claims. The 20-for-1 stock split took effect after closing business on July 15. Trading begun on a split-adjusted basis on July 18.

Do share prices go up after a Google split?

In theory, the Google Stock split or any other company share split doesn’t significantly impact share prices over time. Share splits don’t tend to affect the broader trading market much, either.

Why should Google split stocks?

The stock split is a way for Google to increase its overall liquidity. For example, suppose the Google share price becomes more affordable for smaller investors. In that case, more investors will participate in trading and investing, so google stock’s overall liquidity would also increase.

Google stock chart:

[stock_market_widget type=”chart” template=”basic” color=”#5679FF” assets=”GOOG” range=”1mo” interval=”1d” axes=”true” cursor=”true” range_selector=”true” display_currency_symbol=”true” api=”of”]

The Google Stock Split in 2022 is expected to be a significant event for the global stock markets. On March 30th, 2021, Google announced that it would split its stock on a 2-for-1 basis beginning April 20th, 2022. This split will result in each company’s current shareholders owning two shares of Google for every share they currently hold.

This announcement surprised many investors, as the company has not split its stock since 2014. Before then, Google had been trading between $800 and $900 per share with an all-time high of $1090. When the news of the upcoming split became public knowledge, the price surged by over 5%, closing at $1253.

The primary impetus behind this decision is to make its shares more attractive to retail investors due to the lower cost per share after the split occurs. While institutional investors can afford more significant investments in higher-priced stocks such as Google, individual investors often prefer smaller and more affordable investments like those that would become available after the split takes place. Furthermore, with the proposed split now looming just over 12 months away, analysts are already projecting that Google’s stock could reach even higher levels than before due to investor enthusiasm about owning more shares at an improved price point.

In addition to making its shares more attractive to retail investors, Google also believes that splitting its stock will increase liquidity and make it easier for traders and institutions who use algorithmic trading strategies like arbitrage opportunities or automated market makers (AMMs) to invest in their open market shares. By allowing these strategies access to a giant float of lower-priced shares and improved liquidity, analysts anticipate an increase in both volume and overall participation in trading GOOGL shares on public exchanges due to increased accessibility and opportunity for profit-taking before buying or selling GOOGL during any given day or week.

Another potential benefit of this move is increased visibility among smaller investors who may have been discouraged from buying into Google at prices above $1000 per share but may now look favorably upon purchasing less expensive increments of GOOGL’s equity stakes post-split. These new owners could potentially become future shareholders who invest additional funds into larger chunks of GOOGL’s equity holdings over time as their investments grow within their portfolios after profiting off their initial purchase of GOOGL post-split and subsequent trades prioritizes optimization through accurate analysis rather than speculation without correct pricing information available beforehand.

Ultimately, although some experts are warning against jumping into any trades involving GOOGL too soon — citing potential volatility caused by excessive speculation preceding the actual date when shareholders begin receiving new stock certificates reflecting their adjusted ownership agreement — other experts believe this is likely one of only several catalysts soon driving up gains in GOOGL’s stock price leading up until April 20th, 2022 when shareholders receive their new ownership stake(s). Whether you’re investing as an individual or institution, there is no doubt that you should pay close attention to how things unfold during 2021 if you have any interest at all in maximizing your gains within your portfolio before April 20th next year when we see what kind of impact this move has on all those involved with investing or otherwise trading on the exchange where GOOGL is listed.

History of Google in the stock market

Google is one of the biggest companies in the world. So let us start from the basics: What is the stock ticker symbol for Google? Alphabet’s (Google) stock ticker symbol is GOOGL.

The internet search engine Google had its Initial Public Offering (abbreviated as IPO) more than 17 years ago, on August 19, 2004. At the time of the IPO, a share of google was available for purchase for $85.Currently, the price of these google shares, with the symbol GOOGL, company Alphabet, is more than $1734, resulting in more than 1000% for the stock’s initial investors.

The history of Google in the stock market

Google stock history was:

- Google had its IPO on August 19, 2004, and 19,605,052 shares were sold.

- Later, a two-for-one share split was announced to create a new category without non-voting rights.

- On the second of October 2015, Alphabet Inc, the umbrella company of Google, started to include different side projects which are not directly part of Google.

- Google Split in summer 2022. (20 for 1)

- Investors can invest in GOOGL shares using the top online brokers recommended for stock traders with limited experience.

When did Google begin listing in the stock market?

Alphabet Inc was earlier known as Google. The company sold 19,605,052 shares on August 19, 2004, as part of its IPO. A year later, Google sold an additional 14,25,265 shares on August 18, 2005. In June 2005, the valuation of Google was approximately $52 billion. After a second lot of Google shares were sold on August 18, 2005, the cash reserves of Google doubled to $7 billion. In 2017, the net sales of Alphabet were over $90 billion, and its profit was $19.4 billion. This was significantly higher than the sales of $968.1 million and net income of $105.6 million in 2003.

When will google shares split?

History of the stock split by Google

Before Facebook announced its IPO in 2014, Google announced its stock split, which led to controversy. The company announced the stock split to create a new category of non-voting shares. In this two-for-one stock split, the Google shareholders received one more additional share without any voting rights for every share of the Google stock they owned. Experts claim that the stock split was announced mainly because of the IPO of Facebook, another large internet company. In addition, experts claim that Google used the stock split to inform investors that they continue to be the world’s leading tech stock.

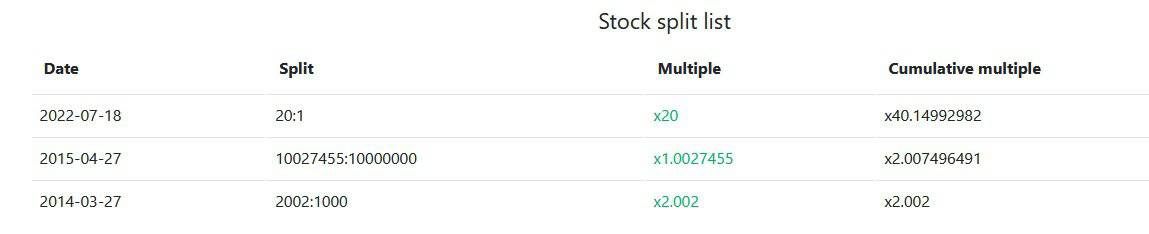

Google split history:

| Date of split | Split ratio |

|---|---|

| GOOGL 3 April 2014 | 1998/1000 |

| GOOG 27 April 2015 | 2.7455/ 1000 |

Larry Page has a voting power of 26.1%; Sergey Brin has 25.2% voting power.

Alphabet stock

The founder of Google, Larry Page, claimed that the new products being developed are likely to be used extensively. Hence they would generate new revenue sources for Google and its partners, just like search is the primary income source for Google. Larry Page has big dreams for google. Hence he converted Google into a larger company Alphabet Inc. The detailed note from Larry Page describes how Google has grown as a company. He also explained how Google would begin a new phase in its history and become a company controlled by Alphabet.

The formation of the parent company, Alphabet, was pretty simple. Google had many side projects like driverless cars, contact lenses for sensing glucose levels, anti-aging, and longevity products, which were hundreds in number. As part of the restructuring of Google announced in October 2015, all these projects were split into separate companies from Google. So Alphabet is now the parent company for all these different smaller companies. Though there is a lot of online information on these smaller companies, a simple way is to list their names.

A list of the business units of Alphabet is provided below.

Calico: This unit specializes in biotech-related research development. It is involved in studying humans’ lifespans and developing anti-aging products.

GV: Google ventures, the venture capital unit of Google

CapitalG: This is a growth equity fund that invests in companies worldwide. CapitalG focuses on companies that use technology uniquely and plan futuristic products and services.

Verily: This is the research unit of Alphabet, mainly focusing on life science-related studies.

Waymo: is an independent automotive development company specializing in self-driving cars.

Nest Labs: A company focusing on home automation

X: A research & development company that tries to find solutions to the most challenging problems in the IT, computer science, and associated fields

Sidewalk Labs: A company that focuses on designing and building innovations for urban areas to help large cities overcome their many problems

Fiber: Provides high-speed internet over a broadband connection

Google: the leading internet company, Google, exists, though some features/options like Google+ have been closed since they were not very popular online. Google includes search, ads, Android, apps, maps, and YouTube.

Should an investor purchase GOOGL stock?

After reading the history, many stock investors want to determine whether it is worth investing in Alphabet. Some investors hope that Alphabet will offer a stock split since the stock prices will fall after the split is announced. This will make the shares more affordable for investors, especially those with a limited budget. However, most stock market experts who monitor Alphabet closely claim that it is doubtful that the company will announce any stock split for many years.

In 2017, the Alphabet stock price rose to its highest levels ever. In the previous year, the share prices increased by over thirty percent. Hence Alphabet shares are expensive. With shares priced at more than $1000 each, it is difficult for most small investors even to consider purchasing a few shares of GOOGL. However, Alphabet remains a highly diversified company, investing in many futuristic technologies, including broadband cable, driverless cars, and research in the life sciences. Hence the company has a large number of opportunities available to it. In addition, the company has a leadership team that dreams big and has massive plans for growth. All this makes Google one of the best stocks for investors in the stock market. However, investors should be able to afford high GOOGL prices.