Table of Contents

In the glossy pages of our latest financial feature, we dive into the corporate world where profits are not just numbers on a balance sheet but a source of reward for those who have invested their faith and funds in listed companies. Amidst the traditional cascade of cash dividends, a sophisticated player emerges as an alternative avenue for shareholder remuneration: the share buyback.

This mechanism, less understood by the everyday investor, offers a compelling twist on how companies distribute their wealth. Through our expert analysis, we unfold the layers of share buybacks, revealing how this strategy can benefit shareholders and enhance the company’s market standing. As we navigate the complexities of financial strategies, our narrative illuminates the intricate dance between corporate decision-making and shareholder value. Join us as we explore the benefits of share buybacks, an investment ballet where every move can turn profits into a more personal shareholder triumph.

What is Share Price Buyback?

Share buyback represents the process by which a company repurchases its shares from the marketplace, leading to the cancellation of those shares and a subsequent reduction in the company’s share capital. Share price buyback decreases the total number of shares available for trade, effectively increasing each remaining shareholder’s proportionate ownership in the company and potentially enhancing their share of future dividends.

The strategy of stock buybacks, also known as share repurchases, is an intriguing financial maneuver where a company opts to buy back its shares from the stock market, thereby reducing the total number of shares outstanding. This approach effectively reconfigures the distribution of company profits, allocating a more significant portion to the remaining shareholders. Such a move signals a company’s belief in its undervalued shares and presents a method to enhance shareholder value without the immediate tax implications of dividend payments.

Deploying cash for a stock buyback is one of several options a company has. Others include reinvesting in operational growth, reducing debt, acquiring other businesses, or distributing profits directly through dividends. The decision to buy back stock involves issuing a “repurchase authorization,” which outlines the scope of the Buyback in terms of share quantity, a percentage of outstanding stock, or a specified dollar amount. This process may involve direct cash utilization or borrowing funds in more leveraged strategies, though the latter introduces additional financial risk.

In executing a buyback, companies typically make their purchases on the open market, allowing any shareholder to sell their shares at the prevailing market price. This ensures an equitable process where no particular group of investors is privileged over another. Notably, while a company may announce a buyback plan, it retains the flexibility to adjust, postpone, or cancel the initiative based on shifting priorities, financial health, or unforeseen economic events.

This flexibility underscores the tactical nature of stock buybacks, which are at the discretion of a company’s management and reflective of its current strategic needs and outlook on future growth. As such, while buybacks can be a powerful tool for increasing shareholder value, they are subject to the vicissitudes of corporate strategy and market dynamics, making their execution and timing critical to their potential success.

What Happens to Share Price After Buyback?

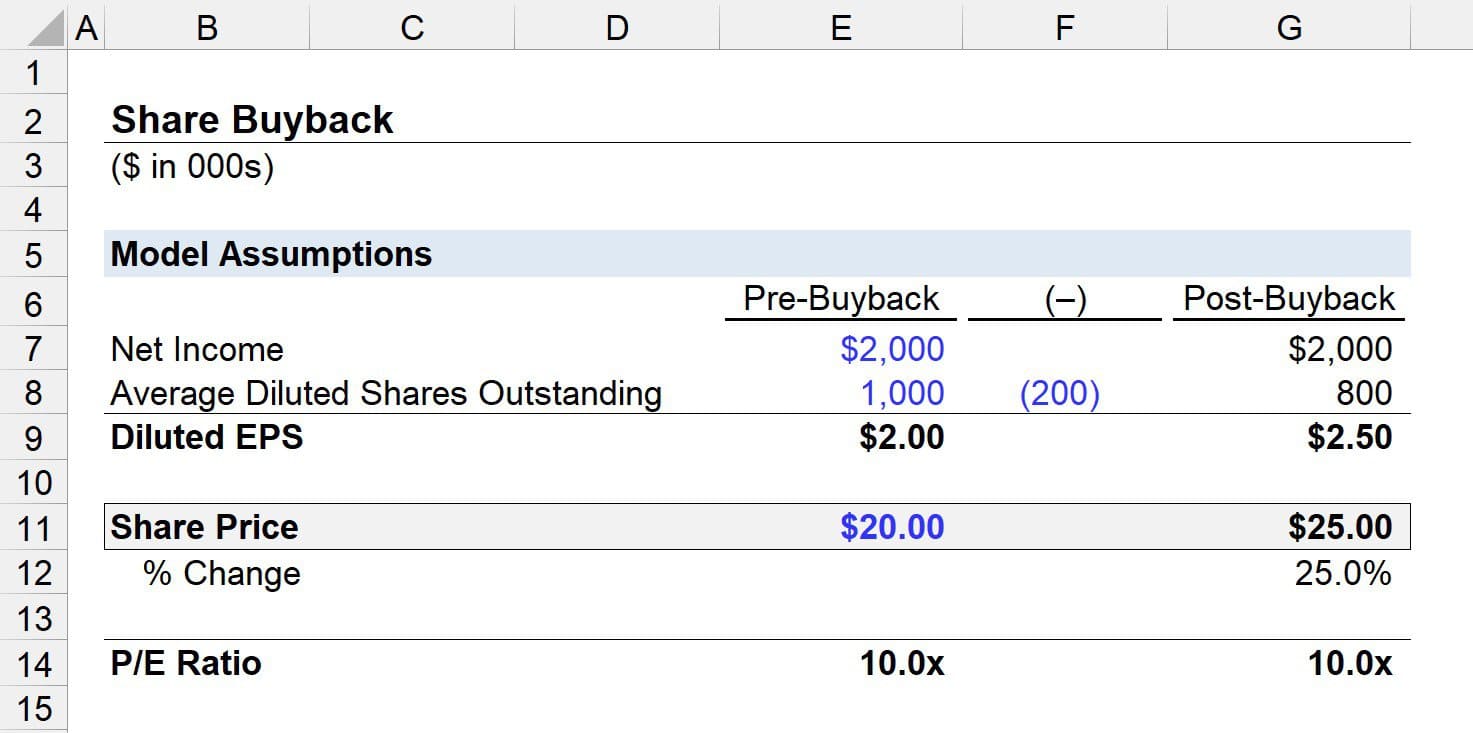

After a buyback, the stock’s earnings per share (EPS) increase, and its price-to-earnings (P/E) ratio decreases, making the shares more attractive by suggesting a stronger financial position and potential for growth. Therefore, fewer are available when a company buys back its shares. This makes the shares more valuable, often increasing their price and making the company look financially strong to investors.

Here are some of the critical benefits of share buybacks for shareholders, illustrated with adjusted figures for clarity:

- Initially, with the company’s overall value unchanged but the number of shares decreased, the price of each share is likely to rise, though this can vary with market dynamics.

- Next, the earnings per share (EPS) are expected to rise since fewer shares are available, meaning shareholders own a larger piece of the profit pie.

- A buyback often doesn’t require shareholders to sell their shares, making it a transaction free from tax implications under many jurisdictions.

Share buybacks serve as a mechanism for companies to enhance shareholder value. When a company uses its earnings to repurchase shares, it aims to bolster the share price.

Let us provide a practical example of what happens with share price after Buyback:

Consider a scenario where a company has 1,200 outstanding shares, and a single shareholder owns 120 (10%). If the company initiates a buyback and purchases 120 shares, the total shares drop to 1,080. This action elevates the shareholder’s relative ownership from 10% to 11.11%, increasing their share of the company’s profits and potentially making the stock more attractive to new investors due to a higher price per share and perceived financial health.

Dividends After Buybacks

After a buyback, there are fewer shares, which could allow a company to pay higher dividends per share if it chooses to distribute dividends.

When a company opts for a share buyback over distributing dividends, it can indirectly impact the dividends per share in the future. With fewer shares in circulation after a buyback, the company has more flexibility in managing its cash flow. It can potentially increase the amount of dividends per remaining share, assuming it decides to distribute dividends.

This reduction in the total number of shares can lead to a higher earnings per share (EPS) ratio, which might allow the company to increase dividend payouts. However, this scenario depends on the company’s dividend policy and commitment to maintaining or increasing dividend levels. For investors who prioritize regular income, dividends offer predictable returns, whereas buybacks can increase the underlying value of their remaining shares but do not guarantee immediate cash payouts.

Ultimately, while buybacks can enhance shareholder value by making each share represent a larger slice of the company, their effect on dividends depends on its financial health, strategic priorities, and the expectations it has set with its investors.

Who Benefits from Share Price Buyback?

Stock buybacks offer a range of benefits across the corporate and investor spectrum, though the advantages can vary based on individual circumstances and market conditions. For companies, executing a stock buyback can bolster the stock price by reducing the number of shares available in the market, making the stock appear more valuable on a per-share basis. This strategy can also help a company consolidate ownership, enhancing control for existing stakeholders and potentially making the company more resilient to external takeover attempts. Additionally, buybacks provide an alternative to dividends to return capital to shareholders, offering a method that can be perceived as offering tax advantages or more flexibility compared to regular dividend payments.

On the investor side, those who sell their shares back to the company benefit directly by receiving cash, often at a premium to the market price. However, the benefits to remaining investors are more nuanced. At the same time, the reduction in shares outstanding can lead to higher earnings per share (EPS) and potentially increase the stock’s price; the actual benefit to each investor depends on the company’s future growth, the effectiveness of the Buyback in enhancing shareholder value, and the tax implications for the individual.

In some cases, if a buyback is perceived as a company using its cash reserves without a clear strategy for growth, it might not be seen as beneficial by the market.

Share Price Buyback examples

In 2023, several significant corporations announced substantial stock buyback programs, showcasing their financial strength and commitment to enhancing shareholder value. Apple Inc. led the charge on May 4, 2023, by earmarking an impressive $90 billion for repurchasing 3.4% of its outstanding shares, demonstrating confidence in its future growth prospects. Following closely, Chevron Corp. announced on January 25, 2023, a massive buyback plan of $75 billion, targeting a significant 21.7% of its shares, signaling future solid expectations for the energy sector.

Salesforce, Inc., committed to buying back 10.9% of its shares with a $20 billion allocation on March 1, 2023, reflecting its strategic decision to return value to its shareholders while potentially boosting its stock price. Applied Materials took a similar path on March 13, 2023, with a buyback program of $10 billion, aiming to repurchase 9.7% of its shares, a move likely influenced by a positive outlook on the semiconductor industry.

United Parcel Service (UPS) also joined the trend on January 31, 2023, by announcing a $5 billion buyback initiative, targeting 3.0% of its shares. This decision highlights UPS’s effort to optimize shareholder returns amidst the evolving logistics and delivery landscape. Each of these buybacks reflects a strategic move by the companies to manage their capital allocation efficiently, invest in their stock, and signal their confidence in their financial health and operational performance to the market.

Disadvantages of share Prices Buyback

- Poor Use of Cash: Stock buybacks can prioritize short-term share price gains over potentially more beneficial investments like research and development or saving cash for future uncertainties, potentially neglecting long-term value creation.

- Debt-fueled Buybacks: Leading up to the Covid-19 pandemic, many buybacks were financed through debt due to low-interest rates, aiming to boost short-term stock prices. Critics argue this approach is shortsighted and increases financial risk.

- High Stock Prices of Cash-rich Companies: Companies with significant cash reserves often have high stock valuations, making their buybacks potentially less valuable to shareholders than other uses of their cash.

- Concealing Executive Compensation: Buybacks can offset the dilution caused by stock-based compensation to executives, obscuring the impact on the company’s share count and potentially prioritizing executive interests over broader shareholder value.

Stock buybacks are generally seen as a sign of confidence from a company in its future, often driving up stock prices with the expectation of bullish market behavior. However, these transactions come with their own set of risks and considerations. When a company, flush with cash from a successful period, decides to repurchase its shares, there’s a real danger it may do so at inflated prices. This can lead to the company acquiring a smaller portion of itself when its stock price is at or near a peak, potentially leading to reduced financial flexibility and less cash available during economic downturns.

Moreover, if a company’s leadership initiates a buyback to manipulate financial metrics such as earnings per share (EPS), this could be a red flag for investors. Such strategies may artificially inflate the company’s perceived performance without reflecting genuine growth or operational success. Investors, therefore, should approach companies that aggressively use buybacks to polish their financial ratios with caution, as these moves may not always signal a solid long-term investment opportunity.

Please read the top 15 articles explaining share price:

How to find the price per share?

What Happens to Share Price After Buyback?

What makes a share price go up?

What causes share prices to drop?

How do you calculate the share average price?

How do you calculate the share price from the Balance Sheet?

Why do stock buybacks increase share price?

Do stock splits increase share price?

Does dividend reduce share price?

How does debt affect share price?

How does issuing new shares affect share price?