Table of Contents

The stock market is a dynamic and turbulent environment where prices fluctuate constantly due to many factors. Economic indicators, political events, and company-specific news can all lead to significant market volatility. Industry trends and global events compound this uncertainty, making the market a complex system of interrelated impacts. Investors and traders must navigate these waters carefully, as the potential for risk and reward is high. Understanding the various impacts on stock prices is crucial for making informed decisions in this ever-changing landscape.

I made a list of 23 different impacts that drive the share price.

What Affects the Share Price?

- Stock Market Dynamics: The overall sentiment in the stock market can influence individual share prices. Bull markets tend to lift most stocks, while bear markets can depress them.

- Economic Indicators: Economic health indicators such as GDP growth rates, employment data, and consumer spending can affect investor sentiment and share prices.

- Industry Trends: Shifts in industry trends, such as technological advancements or regulatory changes, can impact companies differently, affecting their share prices.

- Company News: News specific to a company, both expected and unexpected, such as product launches, recalls, or executive changes, can significantly affect its share price.

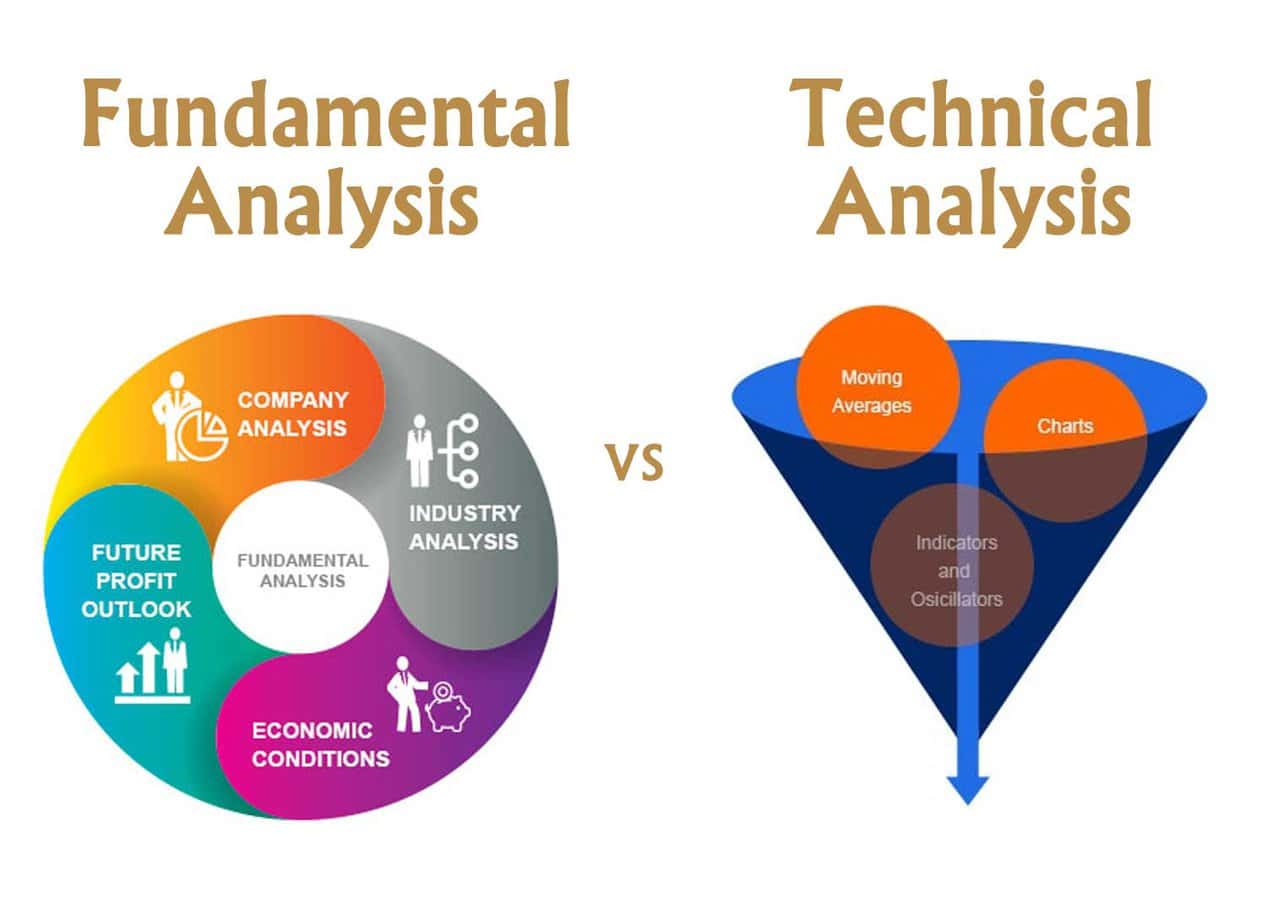

- Fundamental Analysis: Investors use fundamental analysis, examining company financials and market position to assess its stock’s fair value, influencing buying or selling decisions.

- Interest Rates: Changes in interest rates can influence investor appetite for stocks. Lower rates make stocks more attractive than bonds, potentially boosting share prices.

- Company Share Issues: Issuing new shares can dilute ownership and earnings per share, often leading to a decrease in share price.

- Demand and Supply: Basic economic principles of demand and supply apply to share prices. Higher demand versus supply for a stock increases its price, and vice versa.

- Inflation: High inflation can erode purchasing power, affecting consumer spending and companies’ earnings and potentially leading to lower share prices.

- Share Buyback: When a company buys back its shares, it can increase the share price by reducing supply and signaling confidence in its financial health.

- Technical Analysis: Traders use technical analysis, studying chart patterns and volume, to make trading decisions that can influence share prices in the short term.

- Investors: Large investors and institutional investors can significantly move share prices through their substantial buying or selling actions.

- Sellers: Like buyers, large volumes of selling can depress share prices, mainly if driven by negative sentiment or news.

- Government Policies: Changes in government policies, regulations, or taxation can affect specific industries or the economy as a whole, impacting share prices.

- Company Earnings: Quarterly or annual earnings reports that exceed or fall short of expectations can lead to significant price movements.

- Dividends: Announcements about dividend payments, increases, or cuts can influence investor sentiment and share prices as they reflect the company’s profitability and cash flow.

- Exchange Rates: Companies with significant operations abroad can be affected by currency exchange rates, which can influence earnings and, consequently, share prices.

- Political Stability: Political events and stability can affect market confidence and economic conditions, impacting share prices.

- Natural Calamities: Events like earthquakes, hurricanes, and other disasters can have immediate and long-term impacts on companies and their share prices.

- Anticipated Takeover or Merger: Rumors or announcements about potential takeovers or mergers can lead to speculative trading, affecting the companies’ share prices.

- Company-Specific Factors: Factors unique to a company, such as management quality, competitive advantage, or product pipeline, can influence its share price.

- External Events: Events outside the company or its industry, such as geopolitical tensions or global economic shifts, can impact investor sentiment and share prices.

- Management of the Company: Changes in leadership or management strategies can affect investor confidence and the perceived prospects of a company, impacting its share price.

Stock Market Dynamics

Stock market dynamics are fascinating because they encapsulate the cold, complex numbers of finance and the human psychology and sentiment driving those numbers. The overall sentiment in the stock market is a powerful force influencing individual share prices and dictating the market’s direction. This sentiment is often categorized into two phases: bull markets, characterized by rising prices and optimism, and bear markets, marked by falling prices and pessimism.

During bull markets, investors are generally optimistic about the future, expecting the economy to grow and company earnings to increase. This optimism fuels buying activity, which in turn drives up stock prices. Most stocks tend to benefit from a bull market because the positive sentiment and increased buying apply broadly, lifting the market as a whole. Investors are more willing to take on risk in a bull market, betting on the continued upward trajectory of stocks.

Conversely, bear markets are defined by widespread pessimism and declining stock prices. During these periods, concerns about economic downturns, geopolitical tensions, or market bubbles can lead to widespread selling. Fear becomes a dominant force, decreasing demand for stocks and falling prices. In a bear market, even companies with solid fundamentals may see their stock prices decline, as negative sentiment and fear of loss lead investors to pull back from the market.

This cyclical nature of the stock market, oscillating between bull and bear phases, highlights the importance of sentiment in financial markets. It underscores the reactive nature of markets to external stimuli and the proactive strategies investors must employ. Navigating these dynamics requires understanding market sentiment indicators, economic trends, and individual company performance, balanced with a healthy awareness of the psychological factors at play among market participants. This complex interplay makes the stock market both a challenging and rewarding arena for investors.

Economic indicators and share price

Economic indicators are vital metrics that reflect an economy’s health and profoundly impact investor sentiment and, consequently, share prices. These indicators can signal the economic direction, influencing decisions in the stock market. Let’s delve into how specific economic indicators affect share prices with examples:

- GDP Growth Rates: The Gross Domestic Product (GDP) growth rate is a broad measure of an economy’s overall health and growth. A rising GDP indicates economic expansion, which can boost investor confidence and increase share prices as expectations for corporate earnings rise. For example, if the United States reports a higher-than-expected GDP growth rate, it could rally the stock market as investors anticipate more robust financial performance from companies.

- Employment Data: Employment levels are a crucial indicator of economic stability. Low unemployment rates suggest a strong economy, which can increase consumer spending and, in turn, boost corporate earnings. For instance, if the monthly non-farm payroll report in the U.S. shows significant job additions, it can signal economic strength, leading to optimism in the stock market and increasing share prices.

- Consumer Spending: As spending accounts for a large portion of economic activity, increases in this area can signal healthy demand, translating to higher company revenues and profits. Retail sales data can provide insights into consumer spending trends. For example, an unexpected rise in holiday season retail sales might indicate more substantial consumer confidence and spending power, positively impacting the stock prices of retail and consumer goods companies.

- Inflation Rates: Moderate inflation is often seen as a sign of a growing economy, but high inflation can erode purchasing power and negatively affect consumer spending. For instance, if inflation rates rise faster than expected, central banks may raise interest rates to curb inflation, leading to lower stock prices as borrowing costs rise and economic growth slows.

- Interest Rates: The central bank’s interest rate decisions directly impact the economy and financial markets. Lower interest rates stimulate borrowing and investing, leading to economic growth and potentially higher stock prices. Conversely, higher interest rates can cool down an overheating economy and might decrease share prices. For example, if the Federal Reserve announces a cut in interest rates, it could surge stock prices as cheaper borrowing costs encourage more investments into the stock market.

Industry Trends and Share Price

Industry trends significantly shape companies’ landscape, directly influencing their share prices. These trends can encompass various factors, from technological advancements and regulatory changes to shifts in consumer preferences and global supply chain dynamics. Let’s discuss how these elements can impact share prices through industry trends.

- Technological Advancements: Innovations and technological breakthroughs can dramatically alter the competitive landscape of an industry. Companies that lead in adopting or developing new technologies can gain a competitive edge, potentially boosting their market share and profitability. For example, the rise of electric vehicles (EVs) has led to significant interest and investment in companies within the EV space, driving up their share prices as investors anticipate future growth driven by a global shift towards sustainable transportation.

- Regulatory Changes: Changes in regulations can profoundly impact industry operations and costs. New regulations can create opportunities for some companies while posing challenges for others. For instance, stricter environmental regulations might increase operational costs for traditional energy companies but benefit renewable energy companies by increasing demand for cleaner alternatives. Such regulatory shifts can lead to investors reallocating their investments, affecting companies’ share prices differently within the same industry.

- Shifts in Consumer Preferences: Consumer trends can dramatically alter the demand for products and services. Companies that successfully anticipate or adapt to these changes can outperform their peers. For example, the growing consumer demand for online shopping has propelled the e-commerce industry and significantly boosted the share prices of companies that dominate this space, like Amazon, at the expense of traditional retail businesses.

- Global Supply Chain Dynamics: Changes in the global supply chain, whether due to geopolitical tensions, tariffs, or pandemics, can affect industries by altering costs, efficiency, and profitability. Industries reliant on complex global supply chains, such as electronics and automotive, can see fluctuating share prices based on their ability to manage these challenges effectively.

- Emerging Markets and Expansion Opportunities: Trends towards globalization and opening new markets can provide substantial growth opportunities for companies. Industries targeting emerging markets might see their share prices rise as investors anticipate future earnings growth from these new ventures. For example, companies expanding into high-growth regions like Asia or Africa may experience a positive impact on their share prices as they tap into new customer bases.

Company News and Share Price

Whether expected or unexpected, company news influences a company’s share price, directly impacting investor perception and valuation. This news can range from product launches and recalls to executive changes, each with the potential to significantly affect investor confidence and share prices.

- Product Launches: A successful product launch can significantly enhance a company’s growth prospects, increasing investor optimism and share prices. For instance, when Apple Inc. announces the launch of a new iPhone, it often leads to an uptick in its stock price as investors anticipate higher sales and revenue. The announcement reflects innovation and potential market dominance, encouraging investment.

- Product Recalls: Conversely, a product recall can hurt share prices as it reflects product quality or safety issues, potentially leading to financial losses and damage to the company’s reputation. An example was when Toyota recalled millions of vehicles due to accelerator safety concerns. This news led to a significant drop in Toyota’s share price as investors anticipated the recall’s negative impact on sales and the company’s brand image.

- Executive Changes: Changes in a company’s executive team, wildly if unexpected, can affect share prices. A new CEO with a strong track record may boost investor confidence, leading to a rise in share prices, as seen when Satya Nadella took over as CEO of Microsoft and steered the company towards cloud computing, resulting in increased stock prices. Conversely, the departure of a respected CEO can cause uncertainty about the company’s future direction and potentially lead to a decrease in share prices.

- Financial Performance Reports: Earnings reports that exceed or fall short of market expectations can lead to immediate adjustments in share prices. For example, if a company like Amazon reports higher-than-expected earnings, it often results in a positive stock price reaction as investors adjust their expectations for future profitability upwards.

- Regulatory Approvals or Disputes: News regarding regulatory approvals or disputes can also significantly impact a company’s share price. For instance, pharmaceutical companies awaiting FDA approval for a new drug can see their stock prices soar upon approval or plummet if rejected, as these decisions directly impact the company’s revenue potential.

Each of these examples demonstrates how company-specific news can lead to rapid changes in share prices. Investors and traders closely monitor such news as it provides insights into the company’s current performance and prospects, guiding investment decisions in real-time.

Fundamental Analysis Affects Share Prices

Fundamental analysis is a cornerstone of investment decision-making. It involves a deep dive into a company’s financial health, industry position, and market potential to determine the intrinsic value of its stock. This method goes beyond surface-level indicators, such as share price movements, to examine the underlying factors that drive a company’s long-term success. Discuss how fundamental analysis influences buying or selling decisions, with practical examples illustrating its impact.

- Earnings Performance: A key component of fundamental analysis is the examination of a company’s earnings reports. Investors look at earnings growth, profit margins, and revenue trends to gauge a company’s financial health. For instance, a consistent year-over-year increase in earnings might suggest that Apple Inc. is on a solid growth trajectory, potentially making its stock a more attractive buy.

- Balance Sheet Analysis: Analyzing a company’s balance sheet gives investors insight into its financial stability. This includes looking at debt levels, cash reserves, and asset management. A company like Microsoft, with solid cash reserves and manageable debt, is often seen as financially stable, which can positively influence investor sentiment and lead to buying decisions.

- Valuation Metrics: Fundamental analysts use valuation metrics such as price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and dividend yields to compare companies within the same industry. For example, if Amazon has a significantly lower P/E ratio than its historical average or industry peers, it might be considered undervalued, attracting investors looking for a bargain.

- Industry Position and Competitive Advantage: Understanding a company’s position and competitive advantages is crucial. A company that leads its sector or has a unique product or service, like Tesla’s position in the electric vehicle market, may be viewed as a more substantial investment. Investors use this analysis to identify companies likely to sustain long-term growth.

- Macro and Microeconomic Factors: Fundamental analysis also considers broader economic conditions and specific industry trends that could affect a company’s performance. For instance, an investor analyzing a real estate investment trust (REIT) would consider interest rate trends, housing market data, and economic forecasts to make informed decisions.

By employing fundamental analysis, investors can identify stocks that are undervalued or poised for growth, making it a critical tool for investing with a long-term perspective. This approach helps mitigate risk by ensuring investment decisions are based on comprehensive and robust financial analysis rather than speculation or market sentiment.

Interest Rate Impacts on Share Prices

Interest rates set by central banks play a pivotal role in shaping investor behavior and influencing the stock market’s dynamics. These rates determine the cost of borrowing money, which can directly impact economic activity and investor decisions. Let’s delve into how changes in interest rates can affect the stock market, using real-life examples to illustrate these effects.

- Lower Interest Rates Boost Stock Investments: When central banks, like the Federal Reserve in the United States, decide to lower interest rates, it reduces the appeal of fixed-income investments like bonds due to their lower yields. This scenario was evident during the early 2020s when the Fed cut rates to near-zero levels to counteract the economic downturn caused by the COVID-19 pandemic. As a result, investors turned to the stock market, seeking higher returns, leading to a significant rally despite the economic uncertainty.

- Higher Interest Rates and Stock Market Corrections: Conversely, when interest rates rise, the cost of borrowing increases for individuals and businesses. This can lead to reduced spending and investment, impacting company profits and, by extension, their stock prices. For instance, in the late 2010s, when the Fed began increasing rates after years of historically low levels, the stock market experienced increased volatility and corrections as investors adjusted to the higher cost of borrowing and the decreased attractiveness of stocks compared to bonds.

- Real Estate Sector Sensitivity to Interest Rates: The real estate sector is susceptible to interest rate changes due to the impact on mortgage rates. For example, a decline in interest rates can lead to lower mortgage rates, boosting housing demand and benefiting real estate and construction companies. This was observed during the low-interest-rate environment in the early 2020s, where companies like D.R. Horton, a central home construction company, saw increased demand and stock price appreciation.

- Banking Sector’s Mixed Reaction to Interest Rate Changes: Banks can benefit from higher interest rates as they charge more for loans, potentially increasing their net interest margin. However, if rates rise too quickly or too high, it can dampen loan demand and increase payment difficulties among borrowers. For example, during periods of gradual interest rate increases, banks like JPMorgan Chase often report higher earnings, reflecting the positive impact of a broader interest rate margin on their profitability.

- Impact on Consumer Discretionary Stocks: Consumer discretionary stocks, representing non-essential goods and services, can be affected by interest rate changes through consumer borrowing costs. Lower interest rates reduce the cost of credit for consumers, potentially increasing spending on luxury goods, travel, and entertainment. Companies like Nike and Disney have seen their stock prices benefit from such environments as disposable income and consumer spending rise.

These examples underscore the complex relationship between interest rates, investor behavior, and stock market performance. Investors can better anticipate market movements and make informed investment decisions by carefully monitoring interest rate trends and central bank policies.

Technical analysis impacts Share Price.

Technical analysis is a method traders use to evaluate securities and make trading decisions based on the analysis of statistics gathered from trading activity, such as price movement and volume. Unlike fundamental analysis, which examines economic factors and company performance, technical analysis focuses on patterns within market data to forecast future price movements. Let’s explore how technical analysis impacts share prices, with examples illustrating its influence.

Chart Patterns

One of the critical aspects of technical analysis is the identification of chart patterns, which are believed to signal future price movements. For instance:

- Head and Shoulders Pattern: This pattern predicts a reversal in the prevailing trend. If a stock has been in an uptrend, the formation of a head and shoulders pattern might indicate that the trend is about to reverse, leading to a potential sell-off. Conversely, an inverse head and shoulders pattern during a downtrend could signal a reversal to an uptrend, attracting buyers and pushing the price up.

- Cup and Handle Pattern: This is considered a bullish signal, suggesting a stock is gearing up for a breakout. For example, if Apple Inc.’s stock chart shows a cup and handle formation, traders might interpret this as a sign that the stock price is likely to rise, leading to increased buying activity and a subsequent increase in the stock price.

Volume Analysis

Volume plays a crucial role in confirming the strength of a trend. High volume during a price increase suggests strong buying interest, propelling prices even higher.

- Breakouts with High Volume: If a stock breaks out from a resistance level on significantly higher than average volume, it’s a strong buy signal. For example, suppose Tesla’s stock breaks above a known resistance level with high trading volume. In that case, it indicates strong buyer enthusiasm, pushing the stock price higher as more traders jump in to catch the upward trend.

Moving Averages

Moving averages smooth out price data to form a single flowing line, making it easier to identify the direction of the trend.

- Golden Cross occurs when a shorter-term moving average crosses above a longer-term moving average, signaling a potential upward price movement. For instance, if Amazon’s stock’s 50-day moving average exceeds its 200-day moving average, traders might view this as a bullish sign and increase their buying activity, driving the stock price up.

- Death Cross: The opposite of the Golden Cross, a death cross occurs when a shorter-term moving average crosses below a longer-term moving average, potentially signaling a downturn. If observed in Google’s stock chart, this might increase selling, lowering the price.

Momentum Indicators

Indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) help traders gauge the strength of a trend and identify potential reversal points.

- Overbought/Oversold Conditions: If the RSI for Netflix’s stock exceeds 70, it’s considered overbought, suggesting the stock may be due for a pullback. Conversely, an RSI below 30 indicates an oversold condition, potentially leading to a price rebound as traders look to buy in at a perceived low point.

Technical analysis can significantly impact share prices in the short term, as traders worldwide look to these patterns and indicators to make buy or sell decisions. While not consistently predictive of long-term trends, the collective response to these technical signals can drive substantial price movements, illustrating the self-fulfilling nature of technical analysis in financial markets.

Company Share Issues Affect Share Price

When a company decides to issue new shares, it’s essentially creating additional ownership. This move can have several motivations, such as raising capital for expansion, paying down debt, or financing new projects. However, issuing new shares directly impacts existing shareholders and the company’s stock price. Let’s explore this and provide practical examples to illustrate the effects.

Impact on Ownership and Earnings Per Share (EPS)

- Dilution of Ownership: Issuing new shares dilutes the ownership percentage of existing shareholders. For instance, if a shareholder owns 10,000 shares of a company that has 100,000 shares outstanding, they own 10% of the company. If the company issues 25,000 more shares and the shareholder does not buy additional shares, their ownership drops to 8% (10,000 out of 125,000). This dilution often leads to investor apprehension and can decrease share price as shareholders see their stake in future earnings and voting power decrease.

- Earnings Per Share (EPS) Dilution: EPS is a critical metric used to gauge a company’s profitability on a per-share basis. When new shares are issued, the same amount of earnings is spread over more shares, leading to a lower EPS. For example, if Company X reports earnings of $1 million with 1 million shares outstanding (EPS of $1) and then issues 500,000 more shares, assuming the same earnings, the EPS would decrease to $0.67. This decrease can negatively affect the stock price, as EPS is a vital determinant of a company’s valuation.

Let us see a few practical examples:

- Tesla’s Capital Raises: Tesla has periodically issued new shares to fund its rapid expansion, research and development, and infrastructure. While these capital raises have diluted existing ownership, the market often reacted positively in the long run as the funds were used to fuel growth, showcasing that the impact of share issuance can be nuanced based on investor perception of its use.

- Snap Inc.’s IPO and Subsequent Offerings: Snap Inc., the parent company of Snapchat, has issued new shares several times since its initial public offering (IPO). These issuances can dilute existing shareholders, but the proceeds have been used to develop new products and enhance technology, which is vital for its competitive positioning. The immediate reaction to such offerings can be a dip in share price due to dilution concerns, but long-term effects depend on the effectiveness of the use of proceeds.

Supply and Demand and Share Prices

The principles of demand and supply, fundamental to economic theory, play a critical role in determining the prices of stocks in financial markets. This dynamic directly reflects how many shares of a company’s stock are desired by buyers versus how many are available for sale by sellers at any given time. The interaction between demand and supply forces can lead to fluctuations in share prices, with significant implications for investors. Let’s explore this concept more detail and provide examples to illustrate how demand and supply affect share prices.

Demand Influences on Share Prices

When there is high demand for a stock, perhaps due to positive news about the company, anticipated financial performance, or broader market trends, buyers are willing to pay higher prices to secure shares. This increased demand, when not matched by a corresponding increase in supply, leads to higher share prices. For instance, if a technology company announces a breakthrough innovation that could potentially dominate the market, investor interest in its stock might surge, driving up its price as more investors want to buy than sell.

Supply Influences on Share Prices

Conversely, suppose there are more sellers than buyers, perhaps due to negative news, poor earnings reports, or shifting market sentiments. In that case, the increased stock supply, without a corresponding increase in demand, can lead to a decrease in share price. An example could be when a company faces a significant lawsuit or regulatory scrutiny, leading to uncertainty about its future profitability. Shareholders might rush to sell their shares to avoid potential losses, increasing the supply and decreasing the price.

Real-Life Examples

- Tesla Inc.: Demand for Tesla shares has often outstripped supply, driven by optimism about the electric vehicle market and Elon Musk’s leadership. Such high demand, especially during market enthusiasm about green technology, has significantly increased Tesla’s stock price.

- Boeing Co.: After grounding the 737 MAX aircraft, Boeing faced increased selling pressure as investors worried about the company’s financial and reputational impact. The supply of shares in the market increased as investors sold off their positions, leading to a decline in the stock price.

Market Perception and Speculation

The perceived value of a company and speculative trends can also influence demand and supply dynamics. For instance, during a market bubble, the demand for stocks in a particular sector can soar based on speculative interest rather than fundamental value, driving up prices. When the bubble bursts, the demand plummets, and the supply of available shares increases as investors try to liquidate their positions, leading to a rapid price decline.

Inflation and impacts on share prices

Inflation, the rate at which the general level of prices for goods and services is rising, can significantly impact economies, consumer behavior, and financial markets. High inflation erodes purchasing power, meaning consumers and businesses can buy less with the same amount of money. This decrease in purchasing power can lead to changes in consumer spending, investment decisions, and company earnings, all of which can influence stock market performance. Let’s delve into how high inflation impacts these areas and provide examples to illustrate these effects.

Impact on Consumer Spending

High inflation often leads to cautious consumer spending, especially on non-essential goods and services, as people prioritize basic needs due to the increased cost of living. For example, during periods of high inflation, companies in the luxury goods sector or discretionary spending categories, such as Starbucks or high-end fashion brands, may decline sales as consumers cut back on spending. This decline in sales can directly impact these companies’ earnings and, by extension, their share prices.

Impact on Companies’ Earnings

Inflation can increase the cost of raw materials, labor, and other inputs, squeezing company profit margins. Businesses may not always be able to pass these higher costs onto consumers, especially if consumer spending is already constrained. For instance, automakers like Ford or General Motors might face increased costs for steel and labor but find it challenging to increase vehicle prices accordingly without affecting demand, impacting their profitability and stock prices.

Impact on Interest Rates

Central banks often respond to high inflation by raising interest rates to curb spending and borrowing. Higher interest rates can increase borrowing costs for companies, affecting their expansion plans and reducing their earnings potential. For example, real estate companies and those with high debt levels, such as AT&T, may experience increased financial strain due to higher interest expenses, leading to a potential decrease in their share prices as investors adjust their expectations for future earnings.

Examples of High Inflation Impact

- 1970s Oil Crisis: The oil price shocks of the 1970s led to high inflation, significantly affecting consumer spending and company earnings. Energy-intensive industries faced soaring costs, while consumers cut back on spending, leading to economic stagnation and challenging times for stock markets.

- Emerging Market Turbulence: Countries experiencing hyperinflation, such as Zimbabwe in the late 2000s or Venezuela in recent years, provide extreme examples of how inflation can devastate economies, consumer purchasing power, and stock markets. Companies operating in these environments may see their local currency earnings drastically negatively evaluated, affecting them negatively.

Sellers and Buyers Afect Share prices

The actions of large and institutional investors, such as mutual funds, pension funds, and hedge funds, can profoundly impact share prices due to the sheer volume of trades they execute. These entities manage vast sums of money, and when they decide to buy or sell company shares in large quantities, their actions can significantly move the market. Let’s explore how these investors influence share prices through their activities, supported by real-world examples.

Investors: The Influence of Large and Institutional Buyers

- Buffett’s Berkshire Hathaway Buys Apple: When Warren Buffett’s Berkshire Hathaway began accumulating shares of Apple Inc., it signaled strong confidence in the tech giant’s prospects. Buffett is renowned for his value investing approach, focusing on companies with solid fundamentals. As news of Berkshire’s purchases became public, demand for Apple shares increased due to the large volume bought, boosting investor confidence and leading to a rise in share prices.

- SoftBank’s Massive Investment in Technology Stocks: SoftBank’s Vision Fund, known for making sizable investments in technology companies, can significantly impact share prices through investment decisions. For instance, a substantial investment in a company like Uber Technologies at its IPO can increase share prices, signal confidence in its growth trajectory, and bring considerable buying power to the market.

Sellers: The Impact of Large-Volume Selling

- Volkswagen’s Share Price Plunge in 2015: In the wake of the emissions scandal, institutional investors and large shareholders started offloading Volkswagen shares en masse, leading to a steep decline in the company’s stock price. This selling pressure, driven by negative sentiment and the desire to cut losses, showcased how large-scale sales could drastically impact share prices.

- The 2008 Financial Crisis and Bank Stocks: During the 2008 financial crisis, large investors rapidly sold off bank stocks amid fears of insolvency and systemic risk. This led to a dramatic drop in share prices for banks such as Lehman Brothers and Bear Stearns, with Lehman Brothers eventually declaring bankruptcy. The massive selling reflected how negative sentiment and fear can lead to significant market movements.

Market Sentiment and Large Investors

Large investors often set trends that can influence market sentiment and investor behavior. The market closely monitors their buy or sell actions for cues on how to react, often leading to herd behavior that amplifies the impact on share prices.

- Institutional Buying as a Vote of Confidence: When institutional investors take substantial positions in a stock, it’s often seen as a vote of confidence in the company’s prospects, attracting more investors and driving up the share price.

- Selling as a Signal for Concern: Conversely, when these investors start selling company shares, it can be perceived as a lack of confidence, prompting other investors to sell, leading to a rapid decline in the stock’s price.

The influence of large and institutional investors on share prices highlights the importance of monitoring their investment patterns. Their actions can provide valuable insights into market trends and potential movements, given their substantial impact on demand and supply dynamics in the stock market.

Conclsuion

Share prices are influenced by a complex interplay of factors ranging from economic indicators, such as GDP growth rates and inflation, to company-specific news, including product launches and earnings reports.

Please read the top 15 articles explaining share price:

How to find the price per share?

What Happens to Share Price After Buyback?

What makes a share price go up?

What causes share prices to drop?

How do you calculate the share average price?

How do you calculate the share price from the Balance Sheet?

Why do stock buybacks increase share price?

Do stock splits increase share price?

Does dividend reduce share price?

How does debt affect share price?

How does issuing new shares affect share price?

How to calculate the share price of a startup company?

What happens if a share price goes to zero?

The actions of large investors and institutional buyers can significantly move share prices through their substantial trading activities. The principles of demand and supply dictate that higher demand versus supply for a stock increases its price and vice versa. Additionally, industry trends and technological advancements can reshape market landscapes, affecting companies’ prospects and share prices.

Through patterns and volume analysis, technical analysis offers traders tools to predict short-term price movements, though these are subject to the broader market’s interpretation and reaction. Understanding the factors influencing share prices is crucial for making informed investment decisions in the ever-dynamic stock market.