Investors often calculate a company’s share price from its balance sheet to gauge its financial health and intrinsic value. The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholder’s equity at a specific time, offering insights into its financial stability and ability to generate profits. By comparing the company’s total assets to its liabilities, investors can determine the net asset value, which helps assess whether the stock is overvalued or undervalued.

This calculation, known as the book value, can serve as a baseline for the share price, especially for companies with tangible assets as their primary value drivers. Investors use this method to identify potential investment opportunities where the market price of a stock may not fully reflect its balance sheet value. Ultimately, analyzing the balance sheet with other financial statements and market conditions allows investors to make more informed decisions and identify stocks with growth or value investment potential.

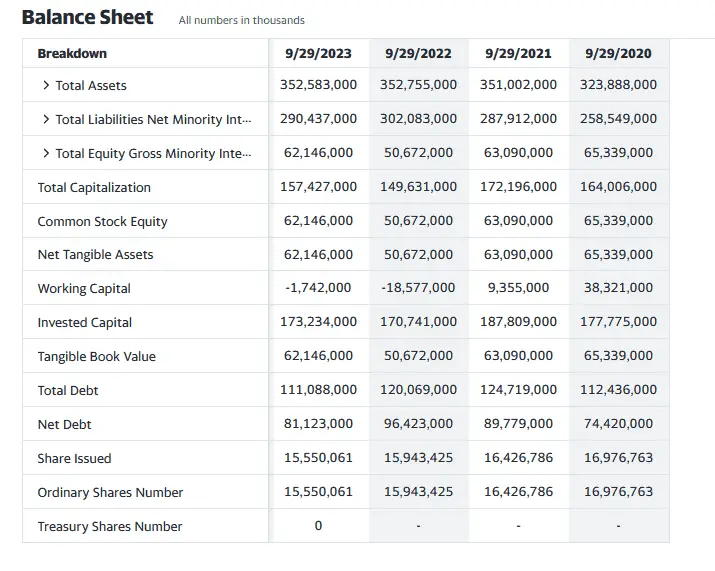

Here below, I will show the latest balance sheet for Apple shares:

How Do You Calculate the Share Price From the Balance Sheet?

To calculate the market price per share, divide the total common stockholders’ equity by the average number of outstanding shares. For example, if the number of common stockholders’ equity is $10 million and the number of outstanding shares is 250 000, the share price from the balance sheet is $40 per share.

Calculating the market price per share from the balance sheet involves understanding and using the financial information it provides about a company’s common stockholders’ equity and the number of outstanding shares. Here’s a step-by-step explanation using a different set of numbers for clarity:

- Locate Common Stockholders’ Equity: Find the total common stockholders’ equity on the balance sheet. This figure represents the amount of money that would be returned to common shareholders if all the company’s assets were liquidated and all its debts were paid off. Suppose this value is $10 million.

- Find the Average Number of Outstanding Shares: Next, look for the average number of shares of common stock that were outstanding during the period. This number is often reported in the company’s annual report or the notes to the financial statements. Let’s say this number is 250,000 shares.

- Divide Common Stockholders’ Equity by Outstanding Shares: To calculate the market price per share, divide the total common stockholders’ equity by the average number of outstanding shares. Using our numbers: $10,000,000 / 250,000 shares = $40 per share.

- Interpretation: This calculated figure estimates the intrinsic value per share from the company’s perspective based on its net assets. It’s crucial to remember that the market price per share might differ due to market conditions, investor perceptions, and other factors not reflected on the balance sheet.

- Use Cases: This method can be beneficial for evaluating stock prices after acquisitions or during transition periods. By reassessing the common stockholders’ equity and the number of shares outstanding after such events, investors can get a sense of how these changes might affect the shares’ intrinsic value.

- Example with Provided Numbers: If a company has a total common stockholder equity of $10 million and its average outstanding common stock is 250,000, the market price per share would be calculated as $10,000,000 divided by 250,000, resulting in a market price per share of $40.

By following these steps, investors and analysts can derive a fundamental value per share from the balance sheet, providing a basis for comparison with the market price to identify potentially undervalued or overvalued stocks.

Please read the top 15 articles explaining share price:

How to find the price per share?

What Happens to Share Price After Buyback?

What makes a share price go up?

What causes share prices to drop?

How do you calculate the share average price?

How do you calculate the share price from the Balance Sheet?

Why do stock buybacks increase share price?

Do stock splits increase share price?

Does dividend reduce share price?

How does debt affect share price?

How does issuing new shares affect share price?

How to calculate the share price of a startup company?

What happens if a share price goes to zero?