Silver is one of the most traded metals after gold. Silver or XAGUSD can be easily calculated on the trading platform based on volume size. There are two kinds of brokers and two ways to calculate the silver pip value.

How do you calculate silver pips in Metatrader 4 or MT5?

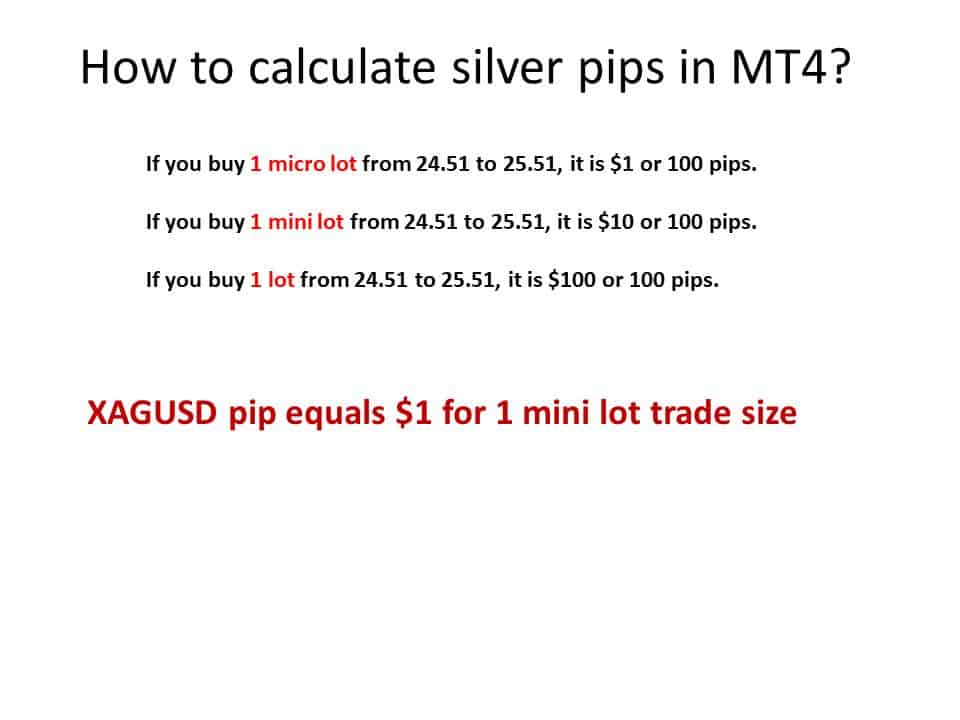

If you trade Silver on the Metatrader platform, 1 micro lot trading size for 100 pips is $1. If you buy 1 micro lot from 24.51 to 25.51, it is $1 or 100 pips. If you buy 1 mini lot from 24.51 to 25.51, it is $10 or 100 pips. If you buy 1 lot from 24.51 to 25.51, it is $100 or 100 pips. Usually, XAGUSD pip equals $1 for 1 mini lot trade size.

Now, I will present to you a video I made on YouTube. Here, you can see how each broker has its different way of silver lot size:

See the image from this video:

Another example:

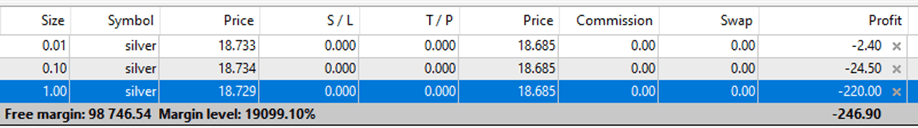

Let us see an example of how to calculate pips on silver when we trade on different Metatrader brokers:

![]()

In the image above, we have a 34.7 pips gain represented. The entry price for silver (XAGUSD) was 24.269, and the closed price was 24.616. It was 34.7 pips gain. As we can see, 1 mini lot and 34.7 pips gain were $34.7, and 1 lot trade gain was 347 dollars.

Let us see

However, there is another way of calculating silver pips. Some trading brokers have different silver pip calculations, such as:

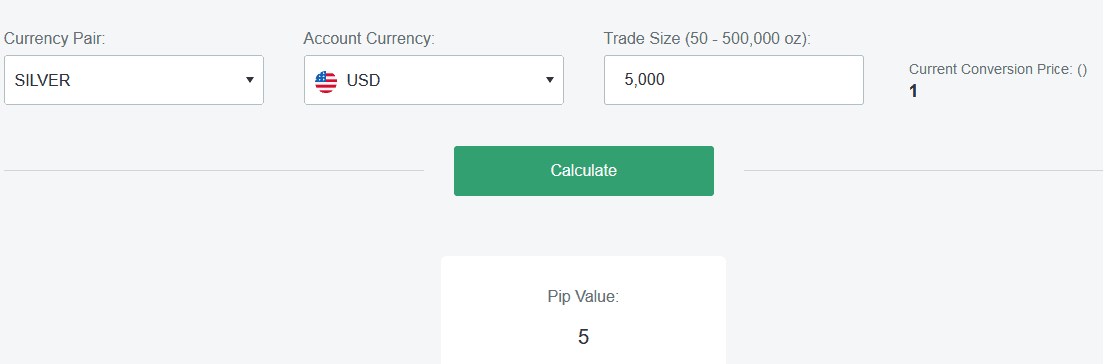

How do you calculate silver pips in ounces?

To calculate silver pips in ounces, you need to know that usually, brokers, 5000 ounces of silver represent one lot. In that case, 1 lot has a $5 pip value.

- 1 lot = 5000 oz. of silver = pip value of $5.00

- 1 mini lot = 500 oz. of silver = pip value of $0.50

- 1 micro lot = 50 oz. of silver = pip value of $0.05

XAGUSD Pip Value

XAGUSD Pip Value can have different values at different brokers. Usually, in MetaTrader, the XAGUSD pip value is worth $1 for 1 mini lot trade size. If you buy 1 mini lot from 28.51 to 29.51, it is $10 or 100 pips. Additionally, if you trade silver in ounces, 5000 ounces are worth $5 XAGUSD pip value.

We suggest traders test their positions on the demo account, create demo trades, and easily see several pips, position size, and a final number of dollars gain or loss.

When we talk about the pip value, we’re referring to the worth of a single pip movement in the currency pair’s exchange rate. The pip value can vary based on the trade size (lot size) and the specific currency pair being traded.

- For MetaTrader Users: In platforms like MetaTrader, which is popular among retail forex and commodity traders, the XAGUSD pip value for a mini lot (which is 10,000 units of the base currency, in this case, silver) is typically $1. This means if you were to trade 1 mini lot and the price of silver moved from 28.51 to 29.51 USD, that’s a 100 pip movement. Given the pip value is $1, this movement would result in a profit or loss of $10.

- Trading Silver in Ounces: The standard contract size is often 5,000 ounces when trading silver by ounce. In such a scenario, a pip value is calculated differently. For instance, if the pip value is said to be $5 for 5,000 ounces, it indicates that for every pip move, the change in value of the contract would be $5.

Why Does Pip Value Vary?

The variation in pip value across different brokers can be attributed to differences in account types, contract sizes, and the specific terms the broker sets. While some brokers might offer standardized pip values, others might provide more flexibility or different contract sizes, leading to variations in how pip values are calculated.

Practical Implications for Traders

Understanding pip values is crucial for risk management. Traders must be aware of how much each pip movement could cost them, as this influences their decision on how many lots to trade. For instance, if a trader has a strict risk management strategy that limits losses to $50 per trade, knowing that the pip value is $1 allows them to calculate that a movement against their position should not exceed 50 pips.

In summary, the XAGUSD Pip Value is a fundamental concept that reflects the value of a pip movement in the price of silver against the US dollar. This value is essential for traders to understand and calculate potential profits or losses, manage risk, and make informed trading decisions. The variability in pip value across different brokers and trading platforms emphasizes the need for traders to familiarize themselves with the specific trading conditions their chosen broker offers.