Losing your hard-earned retirement savings can be terrifying, especially during a recession. The stock market can be unpredictable during economic downturns, leading many to worry about the safety of their 401k investments.

A 401k is a retirement savings plan sponsored by an employer. It allows employees to save and invest a portion of their paychecks before taxes are taken out. The money in a 401k account grows tax-deferred, meaning you don’t have to pay taxes on the earnings until you withdraw the funds in retirement.

During a recession, the value of stocks and other investments can plummet, causing many to worry about the safety of their 401k investments. While it may be true that your 401k can lose value during a recession, the vital thing to remember is that you don’t necessarily lose the money in your account. Your investments’ value may decrease, but you still own the same number of shares. Therefore, as the market rebounds, the value of your assets will increase.

Can you Lose Your 401k in a Recession?

Theoretically, any investment can go to zero, and you can lose your 401K in a recession. However, historically, your 401K can only drastically decline during recession years, but your portfolio can recover after the stock market recovers.

Most 401K investors invest in mutual funds, such as index, large-cap and small-cap, foreign, real estate, and bond funds.

While the market historically tends to trend upward over time, there are no guarantees. If you panic and sell your investments during a recession, you may lock in your losses and miss out on potential gains when the market recovers.

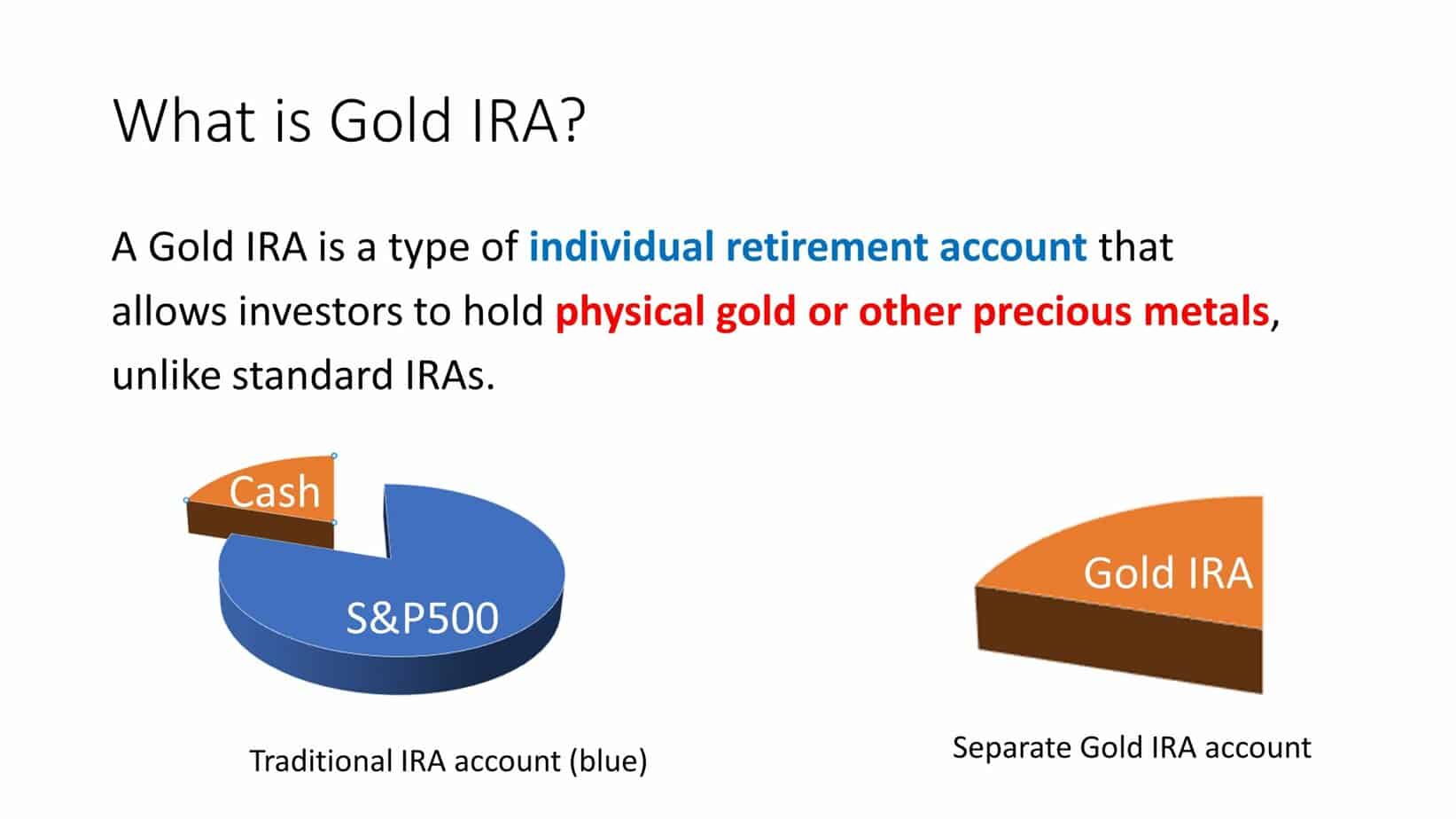

During a recession, you can protect your 401K by allocating 10%-15% of your portfolio to Gold IRA.

For example, you can try Gold IRA asset allocation.

For example, if you have 55 years and 1 million dollars in your 401K portfolio, you can allocate 10% up to 15% into Gold IRA like in the image below:

There are steps you can take to protect your 401k during a recession. First and foremost, it is essential to have a well-diversified portfolio. Diversification means spreading your investments across different asset classes, such as stocks, bonds, and real estate. This can help mitigate the risk of losing savings if one investment performs poorly.

It is also important to stay invested during a recession. While it may be tempting to sell your investments and move your money to a safer haven, such as cash or bonds, this strategy can also be risky. For example, if you move your money out of the stock market, you may miss out on potential gains when the market rebounds. Instead, consider rebalancing your portfolio to ensure that you’re invested in a way that aligns with your long-term goals and risk tolerance.

Finally, it is essential to have a solid retirement savings plan in place. This means regularly contributing to your 401k, taking advantage of employer matching contributions, and avoiding taking loans or withdrawals from your account unless necessary. Following these strategies can help protect your retirement savings, even during a recession.

401K and Recession

There have been several instances in the past 50 years where the stock market has declined during recessions. Here are a few practical examples:

- The 2008 Financial Crisis: The stock market declined significantly during the Great Recession of 2008, with the S&P 500 losing nearly 50% of its value between October 2007 and March 2009. The housing market collapse and the failure of major financial institutions like Lehman Brothers triggered the recession.

- The Dot-com Bubble Burst: The early 2000s saw the stock market decline during the Dot-com Bubble Burst, where many technology companies saw their valuations plummet. The NASDAQ Composite Index lost over 78% of its value from its peak in 2000 to its trough in 2002.

- The 1990-1991 Recession: During the early 1990s recession, the stock market declined due to the Gulf War and the resulting oil price shock. The S&P 500 lost 20% of its value during this period.

- The 1980-1982 Recession: During the early 1980s recession, the stock market experienced a significant decline due to high-interest rates and a weak economy. The S&P 500 lost nearly 27% of its value during this period.

- The 1973-1975 Recession: During the mid-1970s recession, the stock market declined due to high inflation, oil price shocks, and economic weakness. The S&P 500 lost over 40% of its value during this period.

These examples demonstrate how the stock market can decline significantly during recessions as investors become more risk-averse and economic conditions worsen.

In conclusion, while the value of your 401k investments may fluctuate during a recession, you don’t necessarily lose the money in your account. By staying invested, diversifying your portfolio, and having a solid retirement plan, you can help protect your savings and prepare for a secure retirement. It is essential to consult with a financial advisor to ensure that your investment strategy aligns with your goals and risk tolerance, particularly during economic downturns.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE