The Great Recession of 2008-2009 caused a significant blow to the global economy, particularly the US. It left a lasting impact on every aspect of life, and many individuals were forced to tighten their wallets and re-evaluate their investments. Among those investments was the popular 401k retirement savings plan. Many individuals watched as the value of their 401k accounts plummeted, and they wondered if their retirement savings were forever lost. So, the question is, does the 401k recover after a recession? The answer is yes, it does, but the recovery is often not immediate.

Does 401k Recover After Recession?

Based on the last 45 years’ data, 401K recovers after recessions. For example, after the previous crisis 2008, 401K recovered 200% after ten years. However, if you rebalance your portfolio during a problem, you can protect 401K during the recession and improve future results.

Based on my research, we can see the following recovery percentages after recessions in the last 50 years:

- 1970-1971 recession: S&P 500 index decreased by 14%. It recovered by 37% in the next year.

- 1973-1975 recession: S&P 500 index decreased by 37%. It recovered by 71% in the next three years.

- 1981-1982 recession: S&P 500 index decreased by 27%. It recovered by 76% in the next three years.

- 1990-1991 recession: S&P 500 index decreased by 20%. It recovered by 68% in the next three years.

- 2001-2002 recession: S&P 500 index decreased by 43%. It recovered by 102% in the next five years.

- During the 2008-2009 Great Recession, the S&P 500 index decreased by 56%. It recovered by 200% in the next ten years.

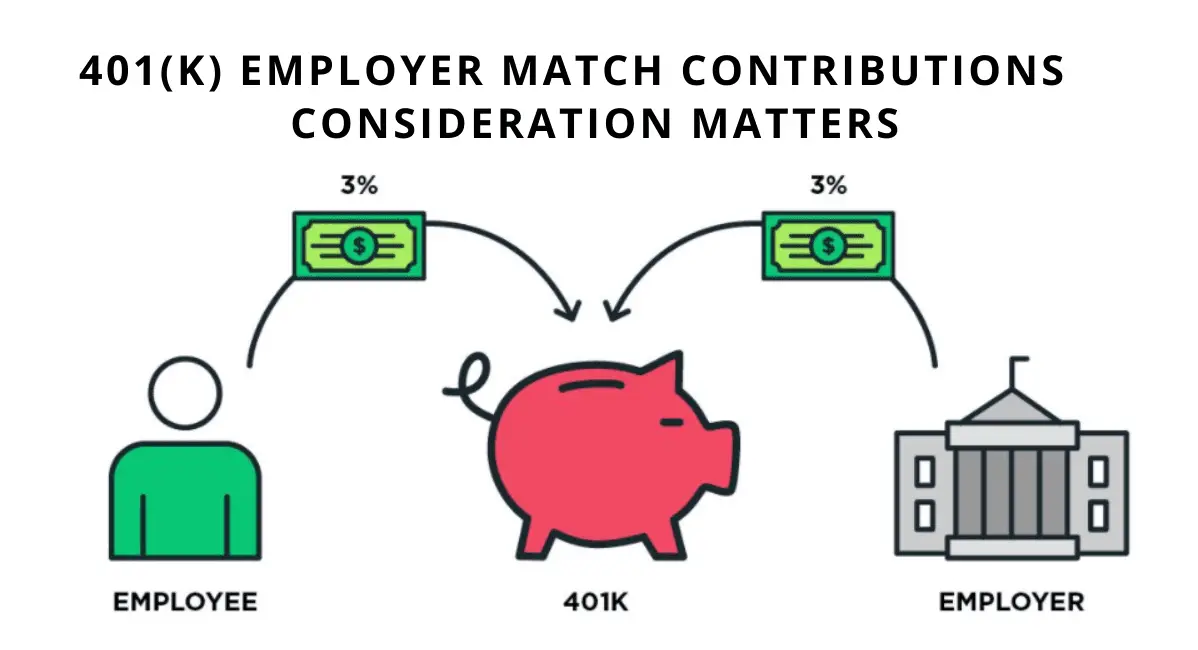

First, it is essential to understand what a 401k is and how it works. A 401k is a retirement savings plan sponsored by an employer, allowing employees to save money for retirement through pre-tax contributions. These contributions are then invested in mutual funds, stocks, and bonds, depending on the individual’s risk tolerance and investment goals. Over time, the contributions and earnings in the account grow tax-deferred until withdrawal during retirement. A 401k account’s value fluctuates with the performance of the investments, which is why staying invested for the long term is essential.

During a recession, the stock market experiences a significant decline in value, and 401k investments are not immune to this decline. The many consequences of a recession, such as rising unemployment rates, decreased consumer spending, and declining GDP, can leave investors with a significantly reduced 401k account balance. The account balance may take years to recover to pre-recession levels, but staying the course and not panic-divest is essential.

401k values recover after a recession because of the well-understood concept of market cycles. Markets go through periods of peak performance followed by periods of decline. The latter is often called market corrections, and severe market corrections are called bear markets. Although bear markets can be painful in the short term, they are not permanent, and markets often rebound relatively quickly once a recovery begins. Therefore, it is essential not to panic throughout the correction as selling off stocks would lock in losses.

Another reason 401k values recover is companies’ continued growth. In the long run, well-established companies recover from the recession and continue to generate revenue, which translates into stock price growth. As stock prices grow, the 401k accounts invested in those companies increase in value and, therefore, the account balances.

It is important to note that contributing to a 401k is a long-term investment. A level head and avoiding short-sighted decisions with long-term implications is essential during market turbulence. Selling off mutual funds, stocks, and bonds in a panicked state during a recession means that one may “lock in” their losses and then miss the subsequent recovery that may occur.

Great recession and 401K

Nearly ten years after the Great Recession, from September 2007 to June 2009, many workers and employers continue to feel its impacts. According to a Transamerica Center for Retirement Studies (TCRS) survey, 58% of workers and 49% of employers reported that they are still recovering from the economic downturn. This persistent effect underlines the depth and enduring nature of the recession’s impact on the workforce and businesses.

Despite these ongoing challenges, the TCRS report from September 2018, which compares to 2017, presents positive developments, particularly in retirement savings and planning. One notable aspect is the stability in 401(k) plan participation rates. The data shows that from 2007 to 2017, the rate of workers participating in these plans has remained relatively constant at 80%. Despite the economic fluctuations, this suggests a sustained commitment to retirement savings among employees.

Furthermore, there has been a modest increase in the contributions to these plans. In 2007, the median contribution was 8% of an employee’s pay, which rose to 9% in 2017. This small increment indicates a growing awareness or capability among workers to invest more in their retirement savings.

Another positive trend highlighted in the report is the utilization of professionally managed investments by more than half of the surveyed 401(k) participants. These investments include target-date funds, strategic allocation funds, or managed accounts. Adopting such professionally managed investment options reflects a sophisticated approach to retirement savings, potentially leading to better investment outcomes for participants.

Moreover, there has been a significant increase in the amounts held in retirement savings accounts. In 2007, the estimated median value in these accounts was $47,000, which rose to $70,000 in 2017. This growth is even more pronounced among baby boomers, who reported a median of $157,000 in 2017. This increase in savings is a crucial indicator of improved financial preparedness for retirement among a broad segment of the population

Conclusion

In conclusion, the 2008-2009 recession significantly impacted 401k account balances. However, the values did recover, and contributions and earnings can grow long-term. Even during significant market disruptions such as a recession, it is essential to have a long-term investment strategy and to stay invested in the market. Over time, markets often rebound, and investments in mutual funds, stocks, and bonds can recover their pre-recession values. They are consulting with a financial advisor, and monitoring investments continuously investing in IRA precious metals is essential.

Protect your 401K. Investors with Gold IRAs can hold physical metals such as bullion or coiPDF. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE