Table of Contents

With the current state of the economy, many people wonder if they should continue contributing to their 401k during a recession. Unfortunately, the question is valid, given the uncertainty and fluctuations in the stock market.

Before we delve into whether or not you should stop contributing to your 401k, it’s essential to understand what a 401k is and how it works. A 401k is an employer-sponsored retirement savings account that allows employees to save and invest a portion of their paycheck before taxes are taken out. The money in the account grows tax-free until retirement, and depending on the plan, employers may offer matching contributions.

Why is a 401K contribution essential?

401(k) contribution is essential for several reasons:

- Tax Benefits: Contributions to a 401(k) are tax-deferred, meaning you don’t have to pay taxes on the money you contribute until you withdraw it in retirement. This can lower your taxable income and save you money on taxes.

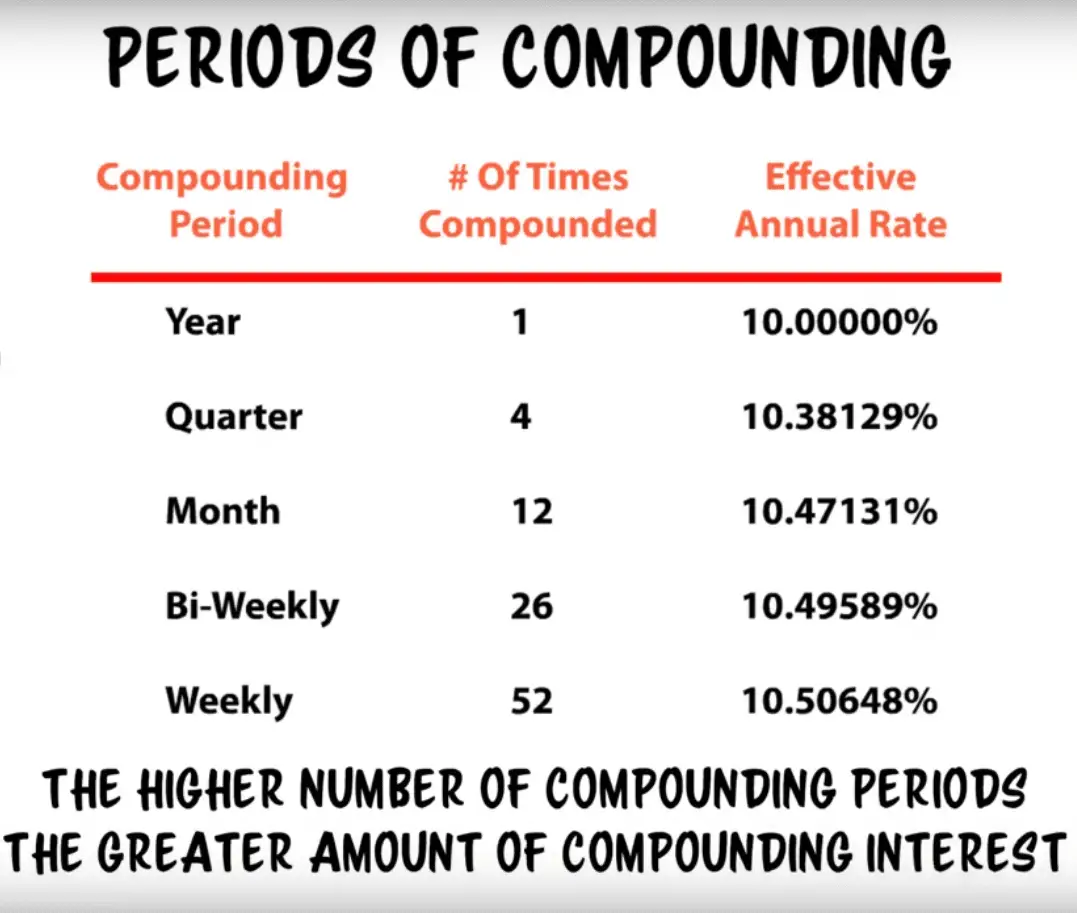

- Retirement Savings: 401(k) plans are a way to save for retirement and build wealth over time. By contributing regularly, you can take advantage of the power of compound interest, which allows your money to grow exponentially over time.

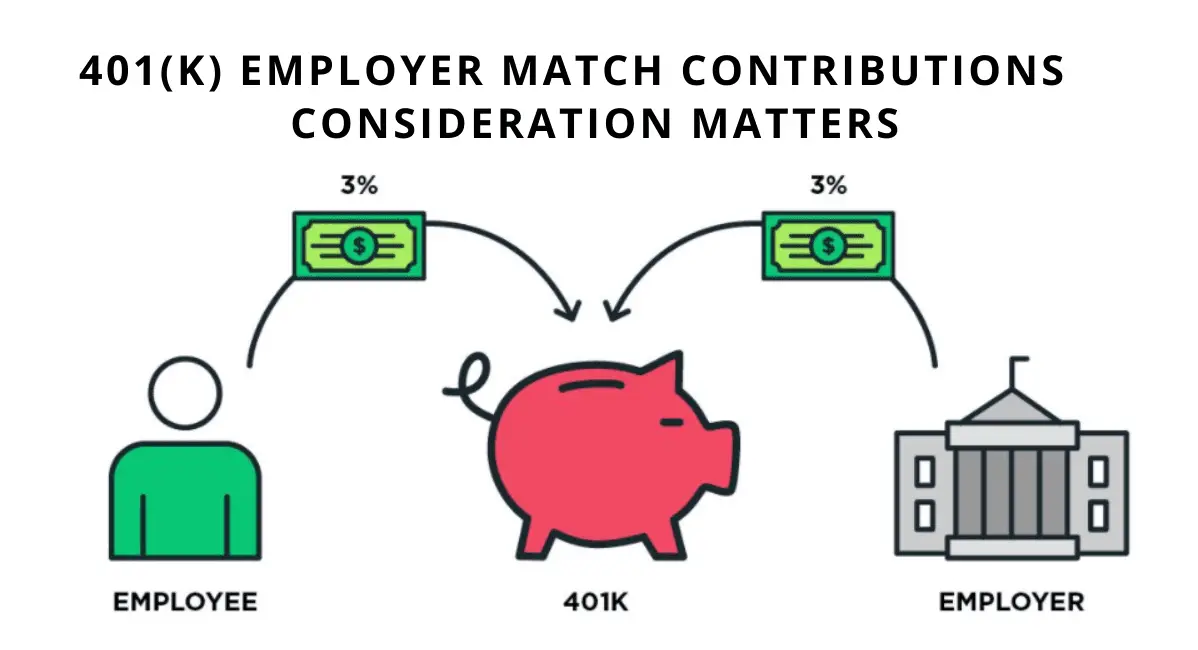

- Employer Match: Many employers offer a 401(k) match, which means they will contribute a percentage of your contributions to the plan up to a specific limit. This is essentially free money; not taking advantage of it is like leaving money on the table.

- Automatic Savings: 401(k) contributions are automatically deducted from your paycheck, making saving consistently over time more accessible. This helps build good savings habits and ensures you’re regularly contributing.

- Long-Term Financial Security: Contributing to a 401(k) can help you build a secure financial future by providing a source of income in retirement. Knowing that you have a solid retirement plan can help alleviate financial stress and provide peace of mind.

Should I Stop Contributing to My 401k During Recession?

You should not stop contributing to 401K during a recession because it can cause you to miss out on potential investment gains when the market eventually recovers (cheap stocks during the recession). Second, it can disrupt your long-term savings plan, potentially derailing your retirement goals. Finally, it can be difficult to resume contributions once you stop, as other financial priorities may take precedence, leaving you with a smaller retirement nest egg.

It would help if you learned how to protect 401K during the recession and how to rebalance your 401K portfolio.

It’s generally recommended to continue contributing to your 401(k) during a recession, as it can help you build long-term financial security and provide peace of mind. However, it would help to rebalance your 401K portfolio to avoid recession impacts.

Long-term perspective: While a recession may result in short-term losses in the stock market, it’s important to remember that a 401k is a long-term investment for retirement. Historically, the stock market has always made a recovery and continued to rise in value over time. Therefore, by continuing to contribute to your 401k during a recession, you buy stocks at a lower price, increasing your potential for long-term gains.

Employer matching: Many employers offer matching contributions to employee 401k plans. If you stop contributing to your 401k, you may miss out on the funds your employer is willing to match. This is essentially free money to help you reach your retirement savings goals faster.

Tax benefits: Contributing to a 401k also provides tax benefits, as the money is invested pre-tax, which reduces your taxable income. This means you pay less in taxes now, and your retirement savings grow tax-free until you withdraw the funds.

Diversification: It’s essential to have a diversified investment portfolio that includes a mix of stocks, bonds, and other assets. By stopping your 401k contributions during a recession, you may miss out on the potential diversification benefits of the stock market. Additionally, many 401k plans allow for investment options, such as target-date funds, that automatically adjust to become more conservative as you get closer to retirement.

Of course, there may be situations where stopping 401k contributions temporarily makes sense, such as facing a job loss or having high-interest debt. However, for most financially stable individuals, continuing to contribute to your 401k during a recession is a smart move.

Rebalance 401K using Gold IRA during the recession

- Evaluate your current portfolio: Look at your 401(k) portfolio and assess how your investments have performed during the recession. Determine which investments have lost value and which have gained importance.

- Determine your target allocation: Based on your investment goals and risk tolerance, determine what percentage of your portfolio you want to allocate to gold IRA, bonds, and stocks.

- Adjust your portfolio: Once you know your target allocation, adjust your portfolio by buying or selling investments to get closer to your desired mix of gold IRA, bonds, and stocks. For example, if you want to increase your exposure to gold, you can sell some stocks and buy gold ETFs or mutual funds.

- Rebalance regularly: During a recession, the performance of your investments may change quickly, so it’s important to rebalance your portfolio to maintain your desired allocation regularly. This may involve selling some assets that have performed well and buying others that have underperformed.

- Consider tax implications: Selling your 401(k) investments may trigger taxes or penalties. Hence, consulting with a financial advisor before making significant changes to your portfolio is essential.

- Stay focused on your long-term goals: Remember that rebalancing aims to maintain a balanced portfolio and stay on track toward your long-term investment goals, even during a recession. Avoid making emotional decisions based on short-term market fluctuations and instead focus on building a diversified, balanced portfolio that will provide long-term financial security.

Practical Example of 401K contribution during Recession

Assume you have a 401(k) account with a balance of $100,000, and you are currently invested in 100% stocks. You want to maintain a balanced portfolio during the recession, so you decide to allocate your investments as follows:

- 40% in stocks

- 40% in bonds

- 20% in gold IRA

You’ll need to rebalance your portfolio by selling some of your stock investments and buying bonds and gold IRA investments to achieve this allocation.

You contribute $10,000 to your 401(k) each year. The following year, during the recession, the stock market experienced a significant decline, causing your stocks to lose 30% of their value. However, your bond and gold IRA investments experience gains due to their safe-haven status during economic downturns.

Assuming your bond investments gain 5% during the recession, and your gold IRA investments gain 25%, we can calculate the new value of your portfolio using the rebalancing example:

- Stock investments: ($100,000 – $10,000) * 40% * (1 – 30%) = $20,800

- Bond investments: ($100,000 – $10,000) * 40% * (1 + 5%) = $39,200

- Gold IRA investments: ($100,000 – $10,000) * 20% * (1 + 25%) = $22,000

Total portfolio value after the recession: $20,800 + $39,200 + $22,000 = $82,000

By continuing to contribute to your 401(k) during the recession and rebalancing your portfolio into stocks, bonds, and gold IRA, you were able to maintain a diversified portfolio and reduce the impact of market volatility on your investments. While your stock investments experienced losses, your gains in the bond and gold IRA investments helped to offset these losses, resulting in a minor overall loss.

This example highlights the importance of contributing to your 401(k) during a recession while rebalancing your portfolio to maintain a diversified, balanced portfolio that can help you achieve long-term financial security.

It’s important to remember that investing always carries some risk, and the stock market can be unpredictable. However, by focusing on a long-term investment strategy, taking advantage of employer matching, and maximizing tax benefits, contributing to your 401k during a recession can help you meet your retirement savings goals.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE