Table of Contents

A 401k is a popular retirement savings plan for most Americans. It is a valuable investment that helps individuals save for their future, ensuring a financially stable retirement. However, a recession can impact the economy and 401k plans. During these challenging times, individuals may be worried about what happens to their 401k plans and how to navigate through the recession with minimal impact.

What Happens to 401k During Recession?

During a recession, the performance of 401Ks can be negatively impacted, which can cause the balance of the account to decrease. For example, some 401K portfolios can lose up to 56% during a recession, like the 2008 crisis.

Here are some historical 401K portfolio decrease numbers during crises and big recessions in the last 50 years:

- The 1970s saw two significant recessions, one from 1970 to 1971 and another from 1973 to 1975. The S&P 500 index decreased by 14% during the first recession, while it decreased by 37% during the second recession.

- The 1980s saw a recession from 1981 to 1982 when the S&P 500 index decreased by 27%.

- The 1990s saw a recession from 1990 to 1991, during which the S&P 500 index decreased by 20%.

- The early 2000s saw a recession from 2001 to 2002 when the S&P 500 index decreased by 43%.

- The Great Recession of 2008-2009 was among the worst economic downturns in U.S. history. During this time, the S&P 500 index decreased by 56%, which resulted in significant losses for many 401K portfolios.

401K decline case study example

Here are some hypothetical numbers to illustrate this:

Let’s say that an employee has a 401K with a balance of $100,000 at the beginning of a recession. The recession lasts for three years, during which the average annual return of the 401K is -10%. We’ll also assume that the employee continues to contribute an average amount of $10,000 per year. Their employer matches those contributions dollar-for-dollar up to 5% of their salary, which is $50,000 annually.

Here’s how the recession might impact the 401K balance:

- Year 1: The employee contributes $10,000 to their 401K, and their employer matches that with another $5,000. However, due to the -10% return, the account balance decreases by $10,000, leaving a balance of $95,000.

- Year 2: The employee contributes another $10,000 to their 401K, and their employer matches that with another $5,000. However, due to another -10% return, the account balance decreases by $10,500, leaving a balance of $89,500.

- Year 3: The employee contributes another $10,000 to their 401K, and their employer matches that with another $5,000. However, due to another -10% return, the account balance decreases by $10,450, leaving a balance of $84,050.

As you can see, the balance of the 401K decreases each year due to the negative returns caused by the recession. However, by continuing to contribute to the account, the employee can take advantage of dollar-cost averaging, which means they buy more investment shares when prices are lower. This can potentially lead to higher returns when the market eventually recovers.

401K reseccion decline discussion

It’s worth noting that the actual impact of a recession on a 401K will depend on several factors, including the specific investments held in the account and the length and severity of the recession. Therefore, working with a financial advisor or research is essential to understand the potential risks and opportunities associated with investing in a 401K during a downturn.

In times of recession or economic downturns, the stock market takes a hit, and the value of securities and investments may decrease. Given that most 401k plans are invested in securities such as stocks, bonds, and mutual funds, a recession will impact the value of these investments. The overall value of 401k accounts is often dependent on the stock market’s performance, and if the market takes a downturn, the value of investment portfolios can drop significantly.

Firstly, it’s important to note that 401k’s are long-term investments, and short-term fluctuations in the market should not cause unnecessary panic. If an individual is far from retirement age, they have time to ride out the rough patch and recover any losses incurred. However, if an individual is approaching retirement, they may be concerned about how their 401k will be affected and if they can retire comfortably as planned.

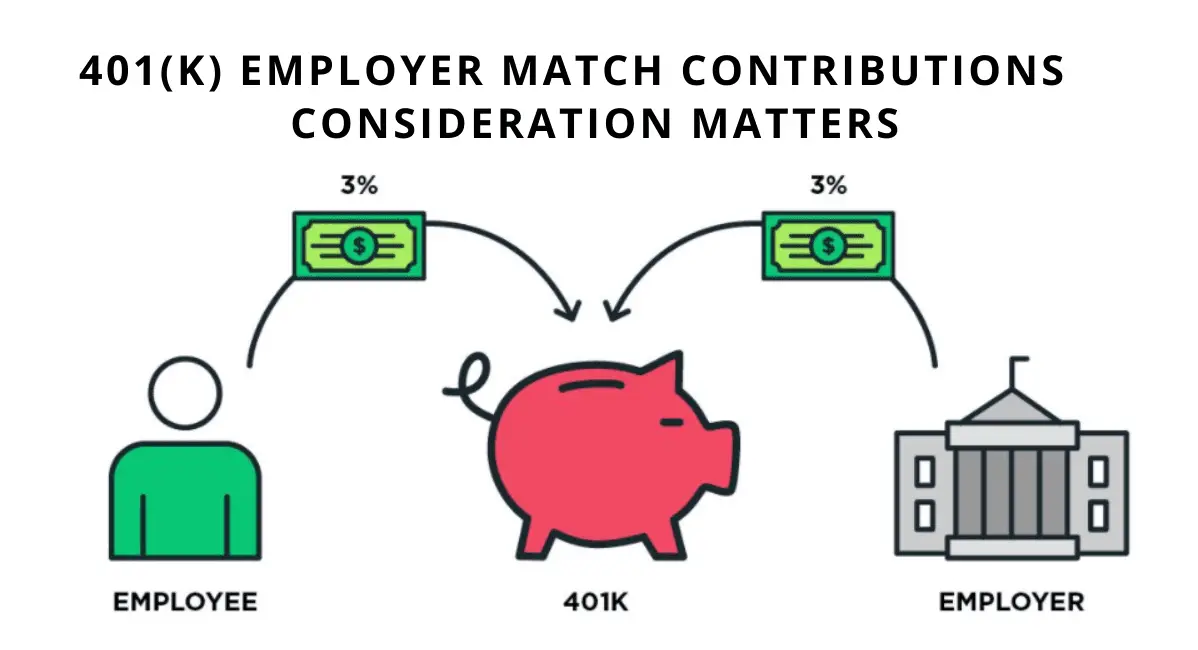

One potential impact of a recession on a 401k is a decrease in employer contributions. During a recession, companies may be forced to cut costs or reduce salaries, resulting in reduced or suspended matching contributions to employees’ 401k plans. This can significantly impact the growth of an individual’s retirement savings, as employer contributions often form a substantial portion of a 401k account balance.

Another effect of a recession is increased volatility in the stock market. Investors often panic during these times and make split-second decisions to sell off their investments, hoping to cut their losses. Unfortunately, this triggers a chain reaction of selling, which can lead to a significant drop in the stock market value. As a result, many 401k investors may experience a loss in retirement savings due to the decline in the value of their investment portfolios.

However, it’s essential to note that no investment is entirely immune to market changes, and diversification is the key to minimizing risks. Investing in a well-diversified 401k portfolio will reduce the risk of total loss in case of volatility in the stock markets. A diversified portfolio should include investments in stocks, bonds, and cash or cash equivalents. The allocation of assets should also be determined based on an investor’s age, financial goals, and risk tolerance.

Conclusion

During a recession, individuals must avoid making hasty decisions with their 401k plans. Selling off investments during a recession is often not the best strategy, as doing so will only lock in the losses incurred. Instead, it’s essential to be patient, ride out the recession, and allow the market to recover. Taking a long-term approach and staying invested in a well-diversified 401k plan is a more reliable way to preserve retirement savings.

In conclusion, 401k plans are an excellent vehicle for individuals to save for retirement. While a recession can impact the value of investments, staying the course and continuing investment in a well-diversified and balanced portfolio is essential. Individuals should avoid making hasty decisions during a recession and maintain a long-term perspective. By doing so, individuals can navigate a recession with minimal impact on their 401k accounts and ensure they are financially stable in their retirement years.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE