Table of Contents

As the world grapples with economic downturns and recessions, one of the biggest concerns for employees is whether or not to reduce their 401k contributions. While it may seem like a logical move, the truth is that reducing contributions to your retirement savings plan during a recession is not a wise decision in the long run.

Should I Reduce 401k Contribution During Recession?

In general, you should not reduce 401K contributions during a recession because you can lose on compounding interest (cheaper stocks) and lose tax benefits. However, because the recession reduces 401K, you can rebalance your portfolio using Gold IRA and bonds.

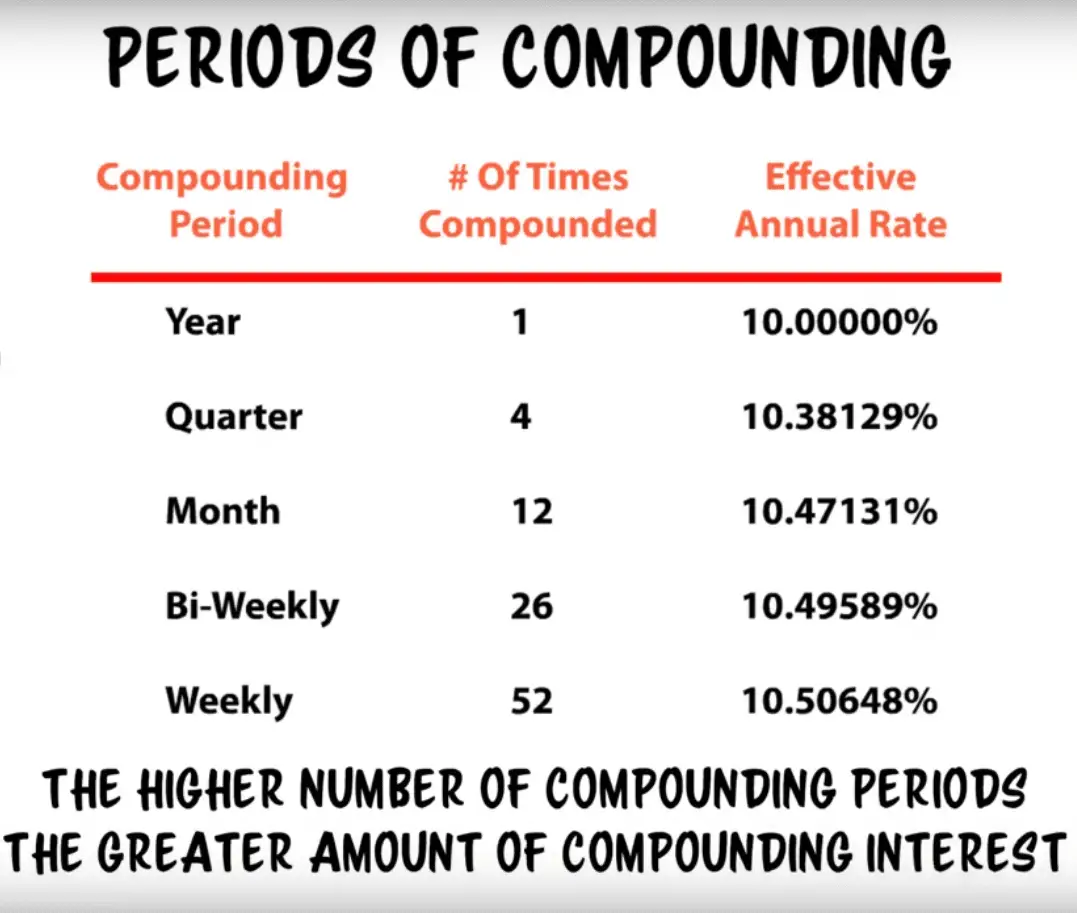

Firstly, by reducing your contributions, you essentially give up the opportunity to benefit from compounding interest. Saving for retirement is a long-term strategy, and by reducing contributions, you reduce the amount of time your money has to grow. Compounding interest is one of the most powerful tools when it comes to retirement savings, and by withdrawing your contributions, you are giving up a crucial element of this growth potential.

Secondly, reducing your 401k contributions means that you are not taking advantage of a valuable tax benefit. Contributions to a traditional 401k plan are tax-deductible, which means you can reduce your taxable income by the amount you contribute. This reduces your current tax bill and helps your money grow tax-free until you withdraw it in retirement. Unfortunately, you’re missing out on this valuable tax benefit by reducing your contributions.

Thirdly, it’s important to remember that stock prices are often lower than usual in a recession. So while it may seem like the wrong time to invest in stocks, it’s an opportune moment. By continuing to contribute to your 401k during a downturn, you are buying stocks at a lower price, meaning that your money will have more significant growth potential once the market recovers.

Lastly, it’s important to remember that recessions are temporary. Although you may have to tighten your budget temporarily, reducing your 401k contributions should not be a part of it. Contributing consistently, even during tough times, can help ensure that you are prepared for retirement and have enough savings to live the life you want once you retire.

401K Reduced Contribution Example

Let’s say that during a recession, an employee who typically contributes $10,000 per year to their 401K decides to reduce their contributions to $5,00annuallyar to free up some cash for current expenses. We’ll assume that the recession lasts for three years, and during that time, the employee’s employer matches their contributions dollar-for-dollar up to 5% of their salary, which is $50,000 per year.

Here’s how reducing contributions during the recession can hurt the employee’s 401K in the future:

- Year 1: The employee contributes $5,000 to their 401K, and their employer matches that with another $5,000. Their total contribution for the year is $10,000.

- Year 2: The employee contributes another $5,000 to their 401K, and their employer matches that with another $5,000. Their total contribution for the year is $10,000.

- Year 3: The employee contributes another $5,000 to their 401K, and their employer matches that with another $5,000. Their total contribution for the year is $10,000.

Now let’s compare that to what would have happened if the employee had continued to contribute $10,000 per year during the recession:

- Year 1: The employee contributes $10,000 to their 401K, and their employer matches that with another $5,000. Their total contribution for the year is $15,000.

- Year 2: The employee contributes another $10,000 to their 401K, and their employer matches that with another $5,000. Their total contribution for the year is $15,000.

- Year 3: The employee contributes another $10,000 to their 401K, and their employer matches that with another $5,000. Their total contribution for the year is $15,000.

Suppose both scenarios earn an average annual return of 7% over the next 30 years until the employee retires. Here’s how the two scenarios compare:

- Employees who reduced their contributions during the recession will have a 401K balance of approximately $583,540 at retirement.

- The employee who continued to contribute $10,000 per year during the recession will have a 401K balance of approximately $938,450 at retirement.

As you can see, reducing contributions during a recession can significantly impact your 401K balance in the future. However, even if you can’t contribute as much as you usually would during a recession, it’s still essential to donate what you can to take advantage of the power of compound interest over the long term.

401K Normal Contribution with Rebalancing Example

Let’s say that during a recession, an employee contributes an average of $10,000 per year to their 401K. However, they also take steps to diversify their investments by using a Gold IRA, investing in bonds, and regularly rebalancing their portfolio. We’ll assume that the recession lasts for three years, and during that time, the employee’s employer matches their contributions dollar-for-dollar up to 5% of their salary, which is $50,000 per year.

Here’s how average contributions during a recession, along with diversification and rebalancing, can benefit the employee’s 401K in the future:

- Year 1: The employee contributes $10,000 to their 401K, and their employer matches that with another $5,000. They also invest $5,000 in a Gold IRA and $5,000 in bonds. They rebalance their portfolio to maintain their target asset allocation. Their total contribution for the year is $20,000.

- Year 2: The employee contributes another $10,000 to their 401K, and their employer matches that with another $5,000. They also invest $5,000 in a Gold IRA and $5,000 in bonds. They rebalance their portfolio again to maintain their target asset allocation. Their total contribution for the year is $20,000.

- Year 3: The employee contributes another $10,000 to their 401K, and their employer matches that with another $5,000. They also invest $5,000 in a Gold IRA and $5,000 in bonds. They rebalance their portfolio again to maintain their target asset allocation. Their total contribution for the year is $20,000.

Now let’s assume this scenario earns an average annual return of 7% over the next 30 years until the employee retires. Here’s how it might compare to the previous example:

- Employees who contributed their usual amount during the recession and diversified and rebalanced their portfolio will have a 401K balance of approximately $1,287,280 at retirement.

As you can see, regular contributions during a recession, along with diversification and rebalancing, can significantly impact your 401K balance in the future. Investing in Gold IRA bonds and regularly rebalancing your portfolio can increase your returns and reduce your risk over the long term.

Conclusion

Reducing 401k contributions during a recession may seem like a practical short-term solution, but it’s a decision that could ultimately harm your long-term retirement savings. For example, suppose you’re currently contributing to a 401k plan. In that case, it’s essential to remember the numerous benefits this savings vehicle provides, including compounding interest, tax benefits, and the opportunity to purchase stocks at a lower price. So, consider other ways to save money or reduce expenses instead of reducing your contributions during a recession. In the end, maintaining a consistent contribution to your 401k plan is one of the best ways to secure a comfortable retirement.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE