Table of Contents

Protecting your 401k from a recession can be tricky, but it is essential to ensure that your retirement savings remain safe during economic downturns. This article will explore various strategies and tactics to help you protect your 401k from recession.

Before we begin, it is essential to understand what a 401k is and how it works. A 401k is an employer-sponsored retirement savings plan that allows you to contribute a portion of your income to a tax-deferred account. This account is then used to invest in a range of assets, such as stocks, bonds, and mutual funds, to grow your savings and provide income for your retirement.

During a recession, the stock market can experience sharp declines, causing the value of your 401k to plummet. However, to protect your savings from these downturns, there are specific steps you can take to safeguard your investments.

401K and Recession

A recession is a period of economic decline characterized by a significant contraction in economic activity, often marked by a decrease in GDP, employment, and industrial production. Various factors, such as a decrease in consumer spending, a decrease in business investment, or a decrease in government spending can cause recessions.

The impact of a recession on a 401K depends on the investments within the 401K portfolio. During a recession, the stock market and other assets, such as bonds and real estate, may experience significant declines in value, resulting in a reduction in the value of the 401K account. This can be particularly challenging for those close to retirement with less time to recoup losses.

Moreover, the job market may become more volatile during a recession, with increased layoffs and lower job security. This can make it more difficult for individuals to continue contributing to their 401K plan or to maintain their current contributions. Additionally, those forced to withdraw from their 401K due to job loss or financial hardship may face significant penalties and tax consequences.

Recession can significantly impact a 401K, reducing the portfolio’s value and making it more challenging to save for retirement. Therefore, it’s essential for individuals to regularly review their investment strategy, diversify their portfolio, and seek a financial professional’s advice during economic uncertainty.

How to Protect Your 401k From Recession?

To protect 401K during the recession, the best decision is to rebalance your portfolio, to add bonds and precious metals that can diversify the portfolio and potentially reduce overall investment risk.

The main ideas that you can use to protect 401K are:

- First, review your 401K investments and make sure they are diversified across different asset classes.

- Consider investing in safe-haven assets such as gold, which may hold their value or increase during a recession.

- Consider increasing your 401K plan contributions during a recession to take advantage of the lower stock prices.

- Rebalance your 401K portfolio to reallocate your investments into sectors expected to perform well during the recession.

- Consider moving some of your investments into defensive sectors such as healthcare, consumer staples, and utilities, which may perform well during a recession.

- Review your 401K fees and expenses and make sure they are reasonable.

- Stay informed about the economic conditions and their impact on 401K investments.

- Consult with a financial advisor to develop a plan considering your financial situation and goals.

- Avoid making emotional decisions and stick to your long-term investment strategy.

- Avoid taking early withdrawals from your 401K plan, which can result in significant penalties and tax consequences.

How do bonds and gold protect 401K?

Bonds and gold are often seen as haven assets that can help protect a 401K during a recession. Here’s how:

Bonds:

- When stocks and other investments experience significant declines in value during a recession, bonds may hold their value or even increase in value.

- Bonds typically pay fixed interest rates, which can provide a steady income stream even during economic uncertainty.

- Treasury bonds, in particular, are considered among the safest investments available and may provide a reliable source of income and stability during a recession.

- Including a mix of different types of bonds in a 401K portfolio can help diversify the portfolio and potentially reduce overall investment risk.

Gold:

- Gold is often seen as a haven asset that may hold its value or even increase during a recession, while traditional investments such as stocks and bonds may decline in value.

- Gold has historically performed well during times of economic uncertainty and inflation.

- Gold can provide a hedge against currency fluctuations and inflation, making it an attractive investment option during a recession.

- Including a small allocation of gold in a 401K portfolio can help diversify the portfolio and potentially reduce overall investment risk.

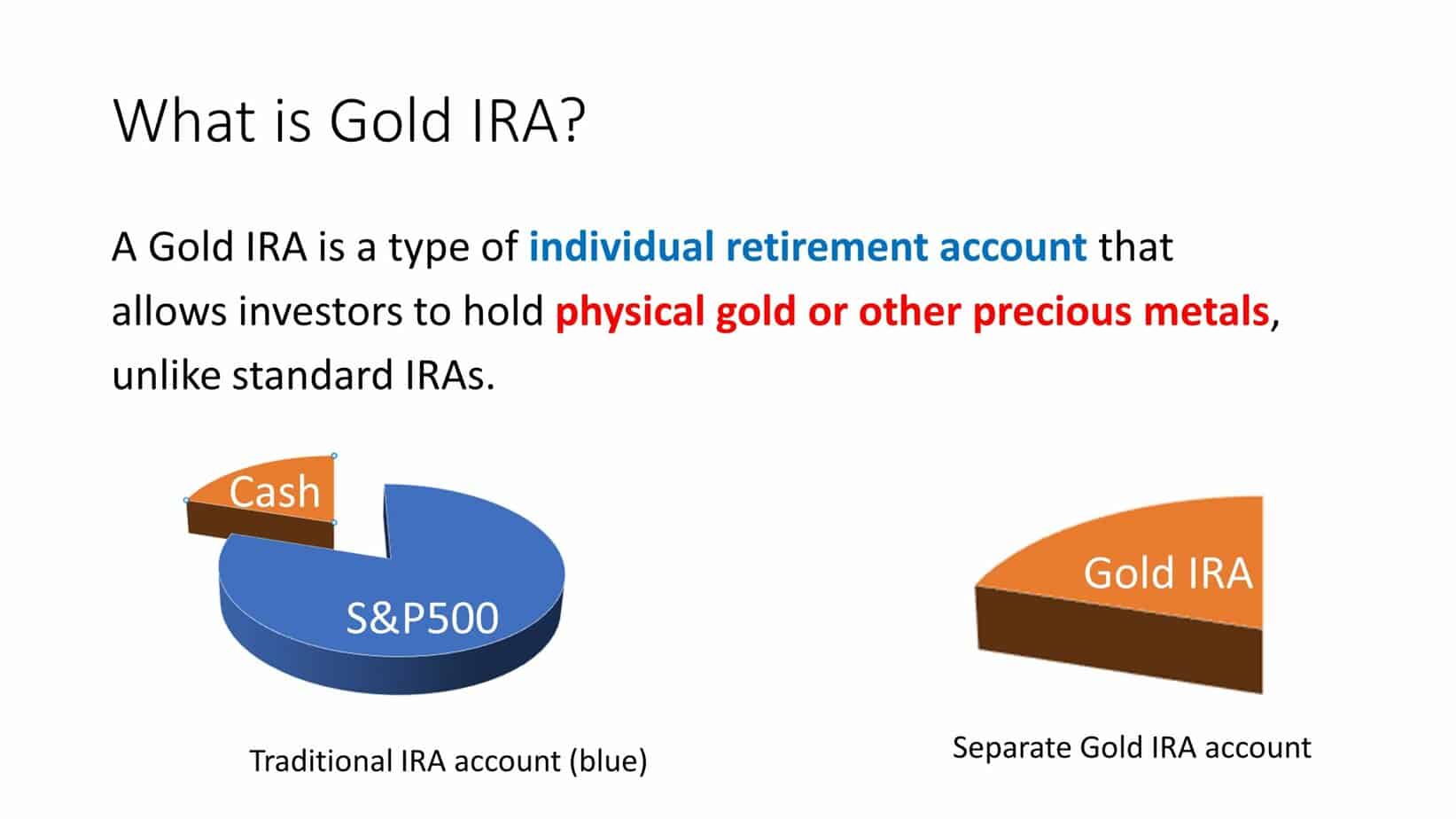

Gold IRA protects 401K during the Recession.

A Gold IRA can protect a 401K during a recession in several ways. Here’s how:

- Gold is often seen as a haven asset that may hold its value or even increase during a recession, while traditional investments such as stocks and bonds may decline in value. By including a Gold IRA in a 401K portfolio, an investor can potentially mitigate some of the risks associated with a recession and preserve their retirement savings.

- Diversifying a 401K portfolio with a Gold IRA can reduce the investment risk. For example, during a recession, traditional investments such as stocks and bonds may experience significant volatility and decline in value. Investing in gold can add a non-correlated asset class to its portfolio, which may help reduce the overall portfolio risk and improve its resilience during economic downturns.

- Gold is a tangible asset that an investor can physically possess. This means that, unlike stocks or bonds, gold cannot be manipulated by corporations or governments. In addition, gold is an internationally recognized asset valued for thousands of years, making it a reliable investment option during economic uncertainty.

- Gold IRA can provide tax advantages similar to traditional 401K plans, such as tax-deferred growth and the ability to contribute pre-tax dollars. This can provide investors additional flexibility when managing their retirement savings during a recession.

See my image related to Gold IRA:

Including a Gold IRA in a 401K portfolio can provide investors with a hedge against inflation, diversify their portfolio, and potentially reduce overall investment risk during a recession. It’s important to note that investing in gold comes with its risks. Investors should carefully consider their investment objectives and consult a financial professional before making investment decisions.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade Gold, silver, and metals as CFD with the minimum commission:

Diversify Your Portfolio

One of the most effective ways to protect your 401k from a recession is diversification. By investing in a range of assets, you can spread the risk of your portfolio and reduce the impact of any losses. For example, you can invest in a mix of stocks, bonds, and mutual funds of different sectors and asset classes. This will ensure that your portfolio is not too heavily weighted in one area, which can be risky during a recession.

Diversifying a 401K portfolio can help protect the portfolio during a recession by reducing overall investment risk. Here’s how:

- A diversified portfolio includes different asset classes, such as stocks, bonds, and alternative investments like real estate or commodities. By spreading investments across various asset classes, an investor can potentially reduce the overall risk of their portfolio.

- During a recession, different asset classes may perform differently. For example, stocks may experience significant declines in value while bonds may hold their value or even increase in value. By diversifying a 401K portfolio with a mix of asset classes, an investor can potentially offset some of the losses in one asset class with gains in another.

- Diversification can help smooth out the ups and downs of a portfolio and improve its resilience during economic downturns. By including non-correlated assets, such as gold or real estate, in a portfolio, an investor can reduce the overall portfolio risk and improve its performance during a recession.

- Diversification can also help investors achieve their investment goals over the long term. By including a mix of asset classes in a portfolio, an investor can potentially earn a higher return with a lower overall risk than if invested in a single asset class.

Practical Example of 401K Portfolio Balancing

Here’s an example of how diversifying your 401(k) portfolio using stocks, bonds, and gold during a recession can help minimize losses:

Suppose you have a 401(k) portfolio worth $100,000 before a recession. Your portfolio consists of 100% stocks, and you’re worried about the impact of a recession on your investments. To diversify your portfolio, you decide to allocate your investments as follows:

- 50% in stocks

- 40% in bonds

- 10% in gold

During the recession, the stock market experiences a significant decline, causing your stock investments to lose 40% of their value. However, your bond and gold investments experience gains due to their safe-haven status during economic downturns.

Suppose your bond investments gain 10% during the recession, and your gold investments gain 30%.

Using these investment returns, we can calculate the new value of your portfolio using the diversification example:

- Stock investments: $100,000 * 50% * (1 – 40%) = $30,000

- Bond investments: $100,000 * 40% * (1 + 10%) = $44,000

- Gold investments: $100,000 * 10% * (1 + 30%) = $13,000

Total portfolio value after the recession: $30,000 + $44,000 + $13,000 = $87,000

While this portfolio still experienced losses in the stock investments, the gains in the bond and gold investments helped to offset these losses, resulting in a minor overall loss. In this example, the diversified portfolio only lost 13% of its value, compared to the 40% loss in the non-diversified portfolio.

This example highlights the importance of diversification in a 401(k) portfolio using a mix of stocks, bonds, and gold during a recession. It can help reduce the impact of market volatility on your overall portfolio.

Rebalance Your Portfolio

Rebalancing your portfolio is another effective strategy to protect your 401k from a recession. This involves adjusting your asset allocation to ensure consistency with investment goals and risk tolerance. For example, during a recession, the value of certain assets may decline while others may rise. Rebalancing will ensure you buy low and sell high, which can help minimize losses during a recession.

Rebalancing a 401K portfolio can help protect it during a recession by ensuring it remains aligned with the investor’s investment goals and risk tolerance. Here’s how:

- Rebalancing is the process of adjusting a portfolio’s asset allocation to bring it back in line with the investor’s investment goals. For example, suppose an investor has a target asset allocation of 60% stocks and 40% bonds, but the stock market experiences a significant decline. In that case, the investor’s portfolio may become over-allocated in bonds. Rebalancing would involve selling some of the bonds and using the proceeds to purchase stocks, bringing the portfolio back in line with the target asset allocation.

- Rebalancing can help investors avoid taking too much risk or missing out on potential gains. For example, during a recession, the stock market may experience significant declines in value, but it may also rebound quickly when the economy recovers. By rebalancing a 401K portfolio, investors can take advantage of buying opportunities when stock prices are low and possibly reduce their exposure to declining asset classes.

- Rebalancing can also help investors avoid making emotional investment decisions. For example, during a recession, investors may be tempted to sell their stocks and move their investments into more conservative assets like bonds or cash. However, this may not be the best long-term strategy. By sticking to a disciplined rebalancing strategy, investors can potentially avoid making rash investment decisions and stay aligned with their investment goals.

Invest in High-Quality Bonds

During a recession, investors typically flock to safe-haven investments, such as high-quality bonds. Companies issue these bonds with low credit risk and often have a strong credit rating from agencies likey yours and Standard & Poors. SoPoor’sprotect your 401k from a recession, consider investing in high-quality bonds. These bonds can provide a reliable income source and help cushion your portfolio from any losses.

High-quality bonds can protect a 401K during a recession in several ways. Here’s how:

- High-quality bonds, such as U.S. Treasury bonds, are among the safest investments. During a recession, when other assets, such as stocks, may experience significant declines in value, high-quality bonds may hold their value or even increase in value. This can provide a stable source of income and preserve the value of a 401K portfolio.

- High-quality bonds typically pay fixed interest rates, which can provide a steady income stream even during economic uncertainty. This can be particularly important for those close to retirement who rely on their 401K portfolio for income.

- High-quality bonds are often considered a low-risk investment option, which can help reduce overall investment risk in a 401K portfolio. In addition, by including a mix of high-quality bonds in a portfolio, an investor can potentially offset some of the risks associated with other asset classes, such as stocks.

- High-quality bonds are often less volatile than other investments, which can help investors stay invested and avoid making emotional investment decisions during a recession. This can be particularly important for those who may be tempted to sell their investments during times of market volatility.

Maintain a Long-Term Perspective

Finally, it is essential to maintain a long-term perspective regarding your 401k. Recessions are part of the natural cycle of the economy, and while they can be challenging to endure, they are usually temporary. By maintaining a long-term perspective, you can avoid panic selling during a recession, which can hurt your portfolio’s value in the long run.

In conclusion, protecting your 401k from a recession requires a proactive approach and careful consideration of your investment strategy. By diversifying your portfolio, rebalancing regularly, investing in high-quality bonds, considering alternative investments, and maintaining a long-term perspective, you can safeguard your 401k from economic downturns. Remember, investing in your retirement is a marathon, not a sprint, and protecting your 401k during a recession is just one part of the journey.

Consider Alternative Investments

Alternative investments, such as real estate and commodities, can provide diversification and protection during a recession. In addition, these assets often have a low correlation with stocks and bonds, which means that they can provide a hedge against market volatility. However, it is essential to understand the risks and costs associated with these investments before investing. The best alternative investments are Gold IRa, Silver IRA, and Roth IRA.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE