Table of Contents

Are you interested in becoming a precious metals dealer? This is an exciting business venture that can offer potentially lucrative rewards. If so, there are several things you’ll need to know before you take the plunge into this industry.

Our previous article described how to get a license to sell precious metals.

How to Become a Precious Metals Dealer?

To become a precious metals dealer, you must pay an annual fee in your State and prepare a budget and business plan. It would help if you were without crime eviction or criminal or administrative investigation to be a precious metals dealer.

We wrote:

Do you Need a License to Sell Precious Metals?

Yes, to sell precious metals in large quantities, you need to have precious metals dealer’s license. Usually, each State will provide you a commission if you do not have a crime eviction or criminal or administrative investigation. However, you must pay an annual fee of up to $200. Additionally, some states, such as Ohio, can require at least 10K net worth.

Here are the steps you can follow to become a precious metals dealer:

- Obtain a Business License: Research and obtain the necessary permits and licenses to operate a precious metal dealership in your area.

- Obtain Adequate Training: Take courses or attend seminars on precious metals trading and investment to gain a better understanding of the industry.

- Create a Business Plan: Develop a comprehensive business plan that outlines your goals, objectives, target market, and financial projections.

- Secure Funding: Secure financing or investment to start your precious metal dealership.

- Establish Relationships with Suppliers: Identify and establish relationships with reputable suppliers of precious metals to source your inventory.

- Obtain the Necessary Equipment: Purchase or lease the necessary equipment, such as scales, safes, and testing equipment, to operate your business.

- Establish a Physical or Online Presence: Choose a location for your store or create an online presence to market your precious metal dealership.

- Advertise Your Business: Advertise your precious metal dealership through various marketing channels, such as social media, print ads, and trade shows.

- Hire Staff: Recruit and hire knowledgeable staff to help you run your business effectively.

- Comply with Legal Requirements: Ensure you comply with all legal requirements, such as registering with regulatory agencies, reporting transactions, and maintaining accurate records.

First and foremost, you’ll need to acquire the appropriate licenses and permits required by your state or country. Depending on where you operate, these requirements may vary significantly from jurisdiction to jurisdiction. For example, some states require special licensing for those who buy and sell precious metals as part of their business operations, while others don’t have such laws. Therefore, it’s essential to research your area’s specific regulations and obtain any necessary documents before engaging in any transactions as a dealer.

In addition, it’s also essential that you familiarize yourself with the different types of products available in this market, such as gold coins and bars, silver coins and bars, platinum coins and bars, palladium coins and bars, and other rare or collectible pieces. Additionally, it’s essential to know the current prices for each item to offer competitive pricing when selling them or make knowledgeable decisions when buying them from customers.

Additionally, you must establish reliable sources of supply for your product inventory; this could include wholesalers and manufacturers who specialize in producing precious metal pieces or even jewelry stores or pawn shops that carry bulk quantities of certain coins or bars. You may also work with mining companies if you want access to raw materials like ore or nuggets for resale purposes. Regardless of your chosen source(s), they must be reliable partners who can provide consistent supplies at affordable prices so that your margins remain healthy over time.

You’ll also need to determine how much physical space is necessary for storing your inventory depending on how large it is (or will become). If possible, find a secure location where items can be locked up safely when not being worked on or shipped out; many dealers opt to use a dedicated room within their home or rent warehouse/storage space specifically for their business operations.

Furthermore – if applicable – consider purchasing insurance policies that cover losses due to theft/burglary, fire damage/losses related to damage caused by natural disasters (e.g., floods), etc., since these events could have devastating effects on both your stock levels as well as your bottom line if not adequately covered financially using such insurance policies.

Finally – once all of these basic steps have been taken care of – work on developing relationships with customers through advertising campaigns (e-mail newsletters/online promotions) as well as networking activities (such as attending trade shows) so that potential buyers become aware of what services are being offered by your business operation(s).

Additionally – when possible – establish partnerships with other businesses involved in related industries (such as reputable coin grading companies), which may bring additional value-added services into play, thus giving your clients more reasons why they should patronize only YOU instead of competitors’ services/products, etc.… All these efforts should increase both the recognition factor associated with YOUR brand name among potential clients AND later help foster customer loyalty towards YOUR own company’s offerings further down the line once solid working relationships have been established between YOUR firm & its customers!

Qualifying for Precious Metals Dealer License

The lucrative market of precious metals trading can be an attractive option for those looking to make a profit – but before you take the plunge, it is essential to understand what is required to qualify for a precious metals dealer license in the United States. To obtain a permit, applicants must meet several requirements that ensure they are financially and legally capable of providing fair and honest services when selling precious metals.

To become an approved applicant and receive a precious metals dealer license, potential dealers must first meet several standards set by the US Department of Treasury’s Financial Crimes Enforcement Network (FinCEN). These include filing Form 8300 with the Internal Revenue Service (IRS) when receiving payments over $10,000 from customers, performing mandatory Know Your Customer (KYC) due diligence procedures on all customers, and complying with anti-money laundering initiatives. Additionally, dealers must prove financial stability by supplying satisfactory evidence that they have adequate funds to cover any obligations or liabilities incurred through their business activities.

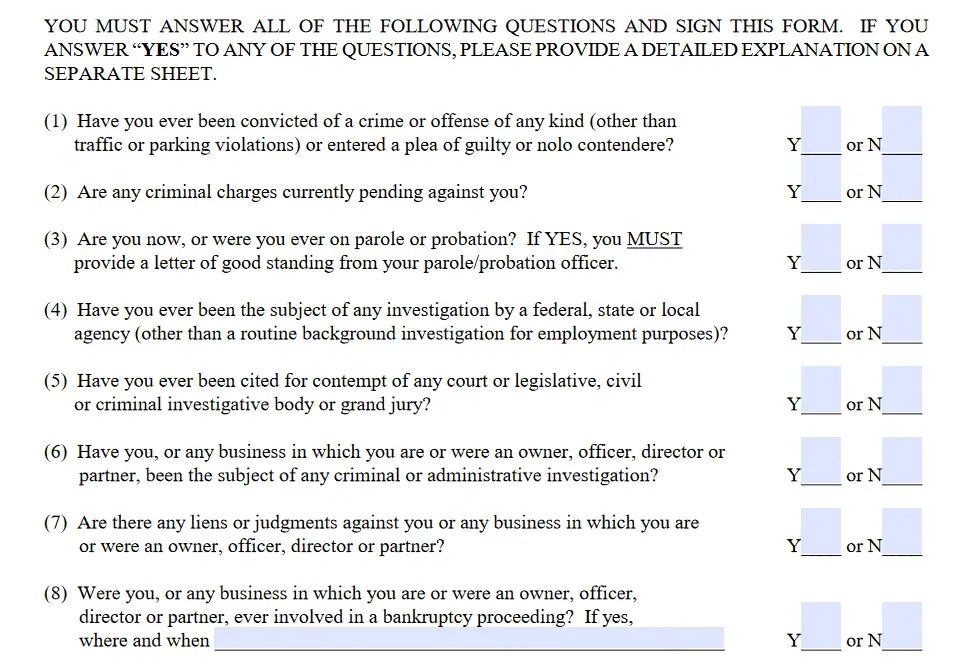

On top of these requirements, each state has its own rules regarding licensing; some states may require additional paperwork or qualification tests related to specific business practices or types of transactions, which must be completed as part of the application process. Furthermore, applicants may need to submit certain other documents, such as credit reports and background checks, to receive approval from local authorities.

It is important to note that even if the Precious Metals Dealer License application is approved, further regulations still apply; for example, metal dealers must keep accurate records on all transactions involving precious metals as well as maintain sufficient insurance coverage against theft or fraud. Additionally, many states require metal dealers to undergo periodic audits to ensure compliance with state laws.

Although it can seem daunting at times, obtaining your Precious Metals Dealer License can open up new opportunities while helping you remain compliant with relevant regulations – so don’t hesitate to take the first step towards making your mark in this competitive industry!

Good Character Requirement

Good character is one of the essential elements when applying for a precious metals dealer license. Good nature means that individuals should have no criminal records or other legal issues preventing them from conducting business properly and lawfully. In addition, the applicant’s employment history and financial background should also be checked thoroughly to ensure they are not involved in any fraudulent activities such as money laundering or embezzlement. This is an essential step in verifying that applicants are fit to handle transactions involving precious metal transactions, as these require trust between all parties involved.

Experience and Net Worth Requirements

Experience working with precious metals is necessary when qualifying for a license, as it shows that applicants have a sufficient understanding of the market and how it works so they can best serve their customers’ needs. It also indicates they can assess the value of different items while trading so they do not get taken advantage of by customers seeking unfair deals or making errmakingwhich could result in losses or further complications with their business operations. Additionally, states may require applicants to have a net worth of at least ten thousand dollars and the ability to maintain that net worth actively using the precious metals license. Having this kind of capital makes it easier for dealers to invest in buying more inventory if needed and handle other costs associated with running their business smoothly without putting themselves at financial risk.

Surety Bond Requirement

The last requirement needed when applying for a precious metals dealer license is submitting proof of surety bond purchase which serves as financial protection against customer disputes or fraud allegations coming from buyers who feel they were mistreated during transactions involving precious metal purchases/sales by dealers. Should such cases arise, this bond provides coverage up to a specified amount defined by state law so affected parties can seek compensation without going through lengthy court processes, which could cause them significant financial losses otherwise.

Conclusion

Securing a license as a precious metal dealer requires fulfilling certain conditions set forth by individual states within US borders, which usually involve demonstrating good character, having experience working with these materials and adequate capital reserves, as well as purchasing surety bonds for added security against customer disputes or fraud allegations caused by malicious behavior from traders’ side. Following these steps will help applicants effectively secure their license to begin operating their businesses safely and with total legality within US jurisdiction boundaries.

If you like bills and coins, you should learn more about Gold and Silver IRAs. You can protect your retirement fund if you invest in IRA precious metals. Investors with gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE

If you do not want to own them in physical form precious metals, you can trade gold, silver, and metals as CFD with the minimum commission: