Table of Contents

Automated trading, also known as algorithmic trading, involves using pre-programmed computer algorithms to execute a high volume of trading orders on financial exchanges. This method is a real-time decision-making system, forming a crucial part of Enterprise Information Systems (EIS). With the rapid advancements in telecommunication and computer technologies, the underlying mechanisms of automated trading systems have become increasingly diverse and sophisticated. Both academic researchers and trading firms have dedicated substantial efforts to identify potential factors that could lead to significantly higher profits. This paper reviews various studies on trading systems, categorizing them into three primary methods: technical analysis, textual analysis, and high-frequency trading. We then evaluate the advantages and disadvantages of each method and discuss their prospects.

Automated trading represents financial market methods using a computer program that executes trades based on predetermined entry and exit conditions. Usually, automated trading combines thorough technical analysis with setting specific parameters for positions, such as orders to open, trailing stops, and stop loss and targets. This approach allows trades to be automatically managed from start to finish, reducing the need for constant monitoring and minimizing emotional decision-making.

Automated trading involves predicting the rise or fall of the underlying market price using CFD (Contract for Difference) trades. For example, if trading GBP/USD, you would choose a trading platform and set up your trading strategy parameters. You’d use your trading experience to create a set of rules and conditions, such as buying GBP/USD when the 50-day moving average crosses above the 200-day moving average. (read an article about EA on the MT5 and MT4 platforms).

These parameters typically include the timing of the trade, the price at which it should be opened and closed, and the quantity. Once set, your custom algorithm will apply these criteria and place trades on your behalf. The automated trading strategy will continuously monitor the financial market prices and automatically execute trades when the predetermined parameters are met. This approach aims to execute trades faster and more efficiently, capitalizing on specific, technical market events.

Automated trading advantages are:

- Trade 24 hours per day – execute trades automatically, day or night.

- Reduce the impact of emotional and gut reactions with planned strategies.

- Identify new opportunities and analyze trends with a wide range of indicators.

- Execute multiple real-time trades simultaneously without the effort of manual execution.

- Enhance trading speed and efficiency – algorithms can execute trades faster than humans.

- Backtest strategies with historical data to refine and improve your trading plan.

- Minimize human error in execution by relying on pre-programmed rules.

- Increase consistency in trading by adhering strictly to the predefined criteria.

- Improve risk management with automated stop-loss and take-profit orders.

- Take advantage of market opportunities across different markets and time zones.

How to start Automated trading?

To start algorithmic trading using MT4 and MT5 Expert Advisors (EAs), follow these steps:

- Define Your Trading Rules: Begin by clearly outlining your trading strategy. Decide on the specific conditions that will trigger a trade, such as technical indicators, price levels, and market conditions. For example, you might set a rule to buy GBP/USD when the 50-day moving average exceeds the 200-day moving average.

- Order an EA from a Developer: Once your trading rules are defined, you must turn them into an algorithm. If you have programming skills, you can either develop the EA yourself or hire a developer to code it. Provide the developer with detailed specifications of your trading rules so they can accurately translate them into the algorithm.

- Test the System: After the EA is developed, thoroughly test it using historical data in a backtesting process. This will help you evaluate how the EA performed in past market conditions. Based on the backtesting results, make any necessary adjustments to improve the strategy.

- Start Demo Trading: Run your EA in a demo trading account before going live. This allows you to see how the EA performs in real-time market conditions without risking any actual money. Monitor its performance closely and make further adjustments if needed. It would help if you chose an excellent broker for algo trading.

- Transition to Live Trading: Once you are confident in your EA’s performance in the demo environment, you can transition to live trading. Start with a small amount of capital to minimize risk. Gradually increase your investment as you gain more confidence in the EA’s performance in live market conditions.

I will describe how I and my FxIgor team work in EA and automated trading development.

Case Study: The Impact and Development of Automated Trading Systems

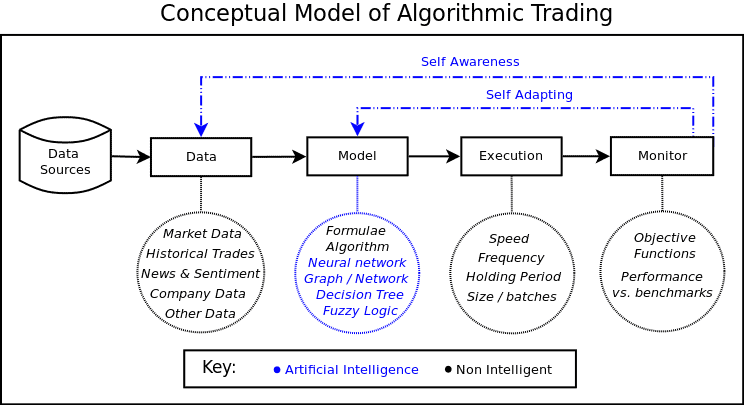

Automated trading systems, a subset of decision-making systems, leverage massive amounts of enterprise information to predict price movements in stock, commodity, and other derivative markets. The effectiveness of these systems is closely tied to the efficiency of extensive data analysis and modeling. The challenge of predicting price movements, influenced by macroeconomic factors and market sentiment, has captivated researchers and investors alike. Models designed to forecast future prices fall into two categories: fundamental analysis and technical analysis.

Fundamental Analysis focuses on the intrinsic value of corporate stocks, considering factors like past performance, future expectations, political climate, and economic environment. On the other hand, Technical Analysis relies on past market data, primarily price and volume, under the assumption that historical patterns will repeat themselves. This method generates specific trading rules using technical indicators, chart patterns, and statistical features.

Despite controversies about the efficiency of technical analysis, it remains widely used in automated trading systems. Technical analysis-based trading systems originated in the 1970s, with algorithms initially replicating human trading behavior using traditional technical indicators such as Moving Average (MA), Relative Strength Index (RSI), and Bollinger Bands (BOLL). However, these indicators often suffer from instability, large drawdowns, poor generalization, and susceptibility to environmental changes. Advanced techniques like Pairs Trading (PST) and machine learning strategies have since emerged to improve performance.

Development Process by FxIgor Team

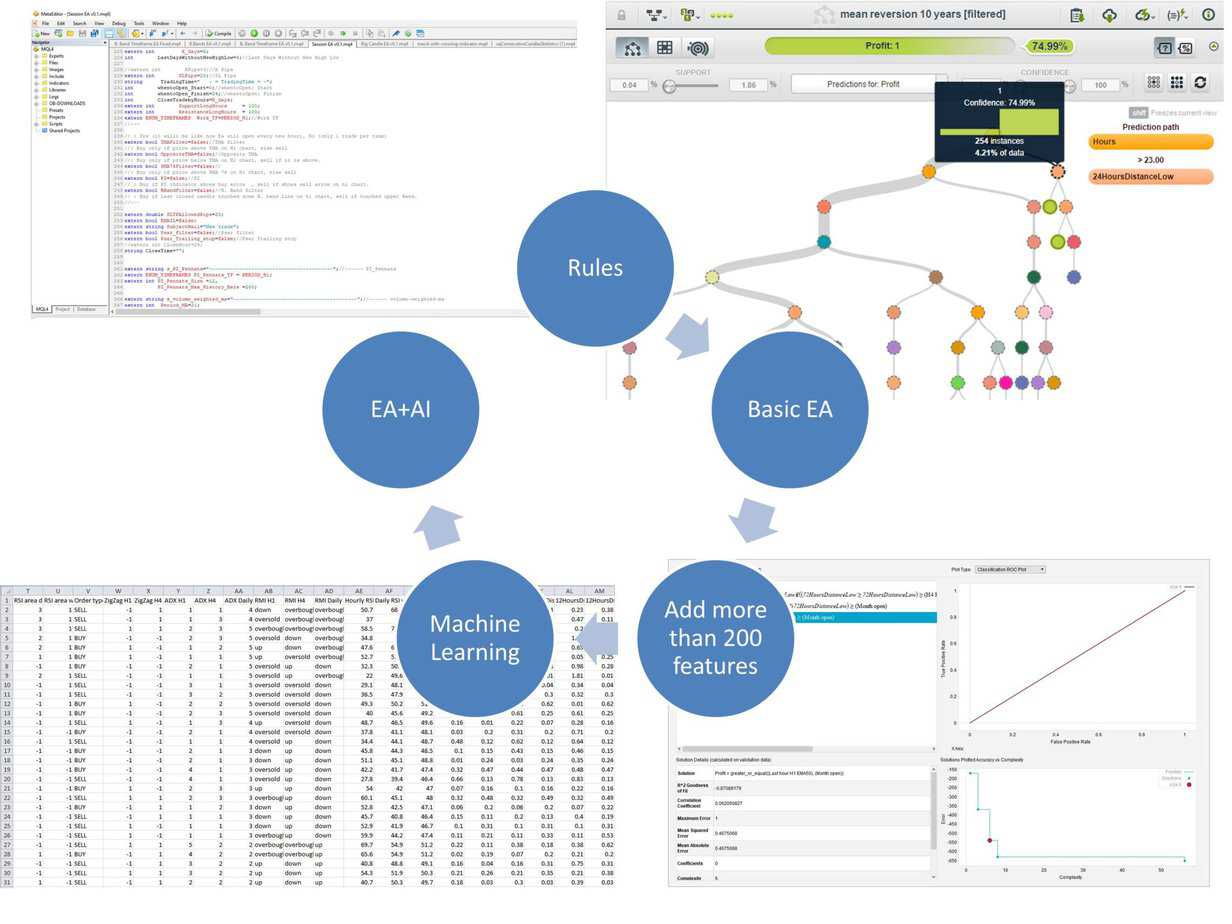

The FxIgor Quant Team specializes in developing robust MetaTrader Expert Advisors (EAs) by employing over 200 features and multiple machine-learning methods. Here’s a step-by-step look at how they develop an automated trading system:

- Defining Trading Rules:

- You provide basic trading rules.

- These rules are integrated with AI-generated strategies to create an EA designed for innovative and data-driven trading decisions, potentially increasing profitability.

- Development:

- The team uses AI to generate more than 200 features, finding the optimal model.

- The initial EA is developed based on your rules and then enhanced with AI-generated rules.

- Testing:

- The system undergoes extensive testing, including backtesting with historical data.

- FxIgor provides an Excel database with over 200 indicators and price levels for each entry position, facilitating further improvements and ideas.

- Deployment:

- Depending on the complexity, the EA is delivered within 72 hours to 10 days.

- It is adaptable to various assets and designed for ease of use, even for those without machine learning or programming knowledge.

Advantages and Disadvantages

Automated trading offers numerous advantages, such as executing trades around the clock, reducing emotional decision-making, and leveraging advanced algorithms for profitable opportunities. However, it also has drawbacks:

- You missed Optimal Trade Closures: Automated systems might miss closing trades for a few pips, potentially impacting profitability.

- Parameter Sensitivity: Relying on preset parameters can lead to losses if market conditions change unpredictably.

- Compounded Losses: The speed and volume of automated trades can quickly compound losses, emphasizing the need for continuous monitoring and adjustment.

Conclusion

Automated trading systems, integrating advanced technical analysis and machine learning, offer a sophisticated approach to trading. While they present significant advantages in efficiency and decision-making, it is crucial to be aware of their potential drawbacks. By understanding and mitigating these risks, traders can effectively harness the power of automated systems for better trading outcomes.

He is an expert in financial niche, long-term trading, and weekly technical levels.

The primary field of Igor's research is the application of machine learning in algorithmic trading.

Education: Computer Engineering and Ph.D. in machine learning.

Igor regularly publishes trading-related videos on the Fxigor Youtube channel.

To contact Igor write on:

igor@forex.in.rs

Related posts:

- How to Activate EA on Metatrader 5 and Metatrader 4 Platform?

- Will My 401k Contributions Automatically Stop at Limit in 2024?

- Is MetaTrader Legit platform?

- What Lot Size Should I Trade When I Trade For a Prop Company?

- What is Difference Between Metatrader 4 and 5? – Metatrader 4 vs. 5

- How to Withdraw Money From Metatrader 4?

- How to Get Funded for Forex Trading?

- Metatrader vs. TradingView

- How Does MetaTrader 4 App Work?

- Can I Download MetaTrader 4 on Laptop?

- Best MetaTrader 5 (MT5) Forex Brokers of 2024!

- How to Change Time in MetaTrader 5?