Table of Contents

The year 2024 is right around the corner, and with it comes a new set of trading days. Knowing how many trading days are in a given year is essential for those involved in the stock market or foreign exchange to plan their strategies. So, what exactly can traders expect out of the following year?

In this article, we will play with numbers. We will explore changes in the number of trading days, which determines the trading program, and other variables that may impact how frequently you trade since knowing the number of trading days alone is insufficient information. But first, let’s define a trading day. But first, let us calculate trading days in a year.

How many days in a year exactly?

There are 365.242199 days in a year exactly. However, in practice, there are 365 days in a non-leap year and 366 days in a leap year. There are always at least 52 weeks in a year. In a non-leap year, there are 52 weeks and one day.

How many weekdays in the year 2024.?

There are 262 weekdays in 2024 and 366 days because it is a leap year. If the year is a leap, there is one additional day, usually one additional working day.

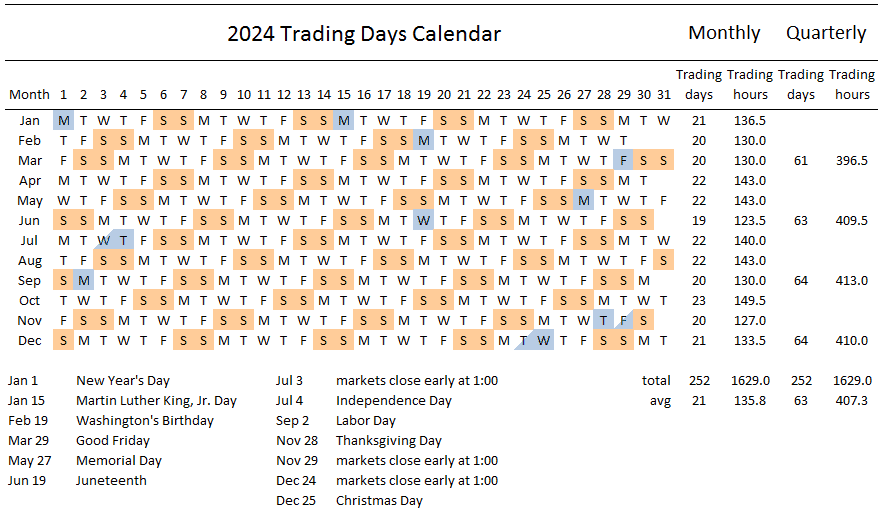

In 2024, the working calendar comprises 252 workdays, factoring in 104 weekend days and 11 public holidays, leading to an average of 19 to 23 workdays per month, with variations depending on the specific month. February, the shortest month, has the fewest workdays in the year, aligning with itsfewerf total days.

How many trading days in the year 2024?

In 2024, the year comprises precisely 252 trading days, allowing for consistent planning and strategy development for market participants. February and April have a limited number of trading days, 20 and 22 days each, offering a narrower window for trading activities than other months. March and August are the busiest months, each featuring 23 trading days, providing the maximum opportunities for transactions and investments in the market. Therefore, the average number of trading days each month is around 21, culminating in 63 trading days per quarter, while the weekends, totaling 105 days, see the forex and stock exchanges closed.

While stock exchanges may not be open for business on weekends and holidays like Christmas Day or New Year’s Day, some brokers may still offer trades throughout these times, depending on individual policies. Additionally, large brokers offer extended hours during certain times like earnings season so they don’t miss out on any lucrative opportunities.

Two hundred fifty-two working days is the average amount of working days in a year, which breaks down to an average of 21 working days per month and 63 working days every quarter. The sum of business days varies from one year to the next. For comparison’s sake, in 2019, there were 252 trading days out of 365 days, and 253 trading days in 2020 (out of 366 days) were due to the leap year.

The total of market days in a year in the United States is typically determined as follows:

Whole business days in a year equal the number of calendar days minus the sum of weekends and holidays. The stock markets are not open for business on 104 weekends and nine market holidays. So, here’s how we’ll figure out how many business days we had in total:

252 days = 365 – 104 – 9

Trading days calendar 2024.

Below is the trading days calendar for the year 2024:

How many trading days in a year on average?

The average number of trading days in the year is 253. This number can be calculated based on information that there are from 365.25 (days on average per year) * 5/7 (proportion of workdays per week) – 6 (weekday holidays) – 3*5/7 (fixed date holidays) = 252.7.? 253. The holidays when the stock exchange is closed in the U.S. are New Year’s Day, Martin Luther King Jr, and Christmas.

How many trading weeks in a year?

There are 52 trading weeks yearly because there are no non-working trading weeks. There are no examples of trading companies staying closed for a whole week in the trading industry. Only several international and domestic holidays are non-working days in the trading business.

Any day the stock exchange is exposed for trade is considered a trading day for that market. Unless a holiday or other big event precludes trading for the day, the marketplace is exposed each weekday from Monday through Friday. Unlike automated or protracted trading hours, the market is only open during “regular trading hours” (RTH) on any particular trading day (ETH).

Nasdaq Exchange and New York Stock Exchange (NYSE) usual trading hours are 9:30 am to 4:00 pm. The opening bell signifies the beginning of trade, while the closing bell signifies the end of trading for the day. The last chime of the closing bell signifies the end of the trading day and a temporary halt to all share transactions until the following trading day.

Although stock markets are usually open throughout the weekdays (Monday through Friday), there are occasions when trading is suspended. For instance, the market is closed on days when public holidays or official events, such as the state burial of a head of state. As a result of these and other exceptional circumstances, the market may shut at 1:00 pm instead of 4:00 pm on a given day.

What days are trading days?

A year that comprises 12 months typically has 250+ Trading Days. 201, for instance, consists of 252 trading days (2020 has 253 trading days, 2021 has 252 trading days) out of a total of 365 days in a year, mathematically translating to around 4.85 trading days a week. Please see our Bank Holidays Calendar.

How many forex trading days in a month? There is an average of 21 trading days a month; February has the fewest, 19, and March had 23 trading days in 2021.

Who decides when markets open and close?

A country’s primary stock exchange determines the trading hours for the stock market. The New York Stock Exchange (NYSE) determines the days and hours of trading in the United States, and other exchanges generally adhere to this timetable. The New York Stock Exchange (NYSE) used to open for business on Saturdays for two hours, except Monday through Friday, but this practice was discontinued in 1952. Since then, the NYSE and other United exchanges have kept to a Monday-Friday dealing timetable that begins at 9:30 at morning Eastern Time and ends at four past morning

Those who desire to trade on the NYSE but live in a different time zone must adhere to the NYSE’s trading day timetable based on New York time. Electronic trading systems allow participants to interact distanceively, but only during trading hours. Those who aren’t in the Eastern Schedule Zone will need to time their trading visits to coincide with the NYSE’s hours of operation (9:30 am to 4:00 pmET.). If you are in California, you may shop between 6:30 am and 1:00 pm.

The question of why the sum of business days varies yearly is addressed.

As we said before, there is often some variation in the number of business days from year to year. The average number of days in a year is 252; however, this number may range from 253 to 251, depending on the circumstances. The following are examples of potential variables that impact the total number of trade days each year:

- Important events

- The holidays

- Weekends

- Extra day in a leap year

Do I Trade All Those Days?

No, I trade only when the market favors my daily traps. Starting with a 1% goal daily is achievable, whatever the strategy. Note that it is different on the demo on your first trading day. If you are new, try out your approach whenever an opportunity arises. In demoing, you learn the D.O.s and DON’Ts, meaning you should bring in the VOT (Volumes of trades) you can.

When you are set to go live, ensure your live demo! Live Demoing is turning into a machine that involves trading with no emotions. It would help if you stuck to setting your 1% goal and not read when the market is not right—aim to reach that goal daily and then close for the day. Please stay away from trading in excess because it will hurt you. That is a lesson I have learned over the years.

If you lose nothing on a particular day, be glad for that victory, for so many newcomers quit in barely one week or more. The risk-to-reward ratio plays another role in it.

Let me reiterate that you need to trade any minute if possible,e but don’t develop a habit of doing so every time. You must balance life and do some work elsewhere to supplement your income. There are weeks I trade for just a few days to ensure that my 4-5% is assured weekly. My trading involves perfect setups alongside stacked confirmations. I usually call the major energy points. I fix an alert in a small number of pips to 10 to let me jump on the charts to assess whether or not to take that trade.

This enables me to go on with other essential activities for my life as I deem necessary without spending 24/5 on the chart.

The average number of trading days in a year

How many stock trading days in a year on average?

The NYSE and NASDAQ average about 253 trading days a year. The average number of trading days a year can be calculated as 365.25 days because every fourth year is a leap year. Based on that, we can calculate the average number of trading days in any year using the formula:

365.25 * 5/7 (proportion workdays per week) – 6 (weekday holidays) – 3*5/7 (fixed date holidays) = 252.75 = 253.

Does the stock market close on weekends?

Yes, stock markets are closed on weekends. Stock markets are closed not just in the U.S. over the weekend; this practice exists worldwide. All world stock markets are closed during the weekend. The U.S. stock market is open Monday through Friday, 9:30 am to 4:00 pm Eastern time.

What Becomes of the Forex Market? When are the Holidays?

Other currencies respond pretty slowly to most holidays. However, only U.S……. holidays have significant interest, not mainly because I reside in the U.S.S.S.The U.S.. dollar influences many other currencies, so other currencies do not match when the USD moves slowly.

What Transpires During Holidays?

Based on the country with the holiday, trading volume is low y. When banks are not operational, the spreads are, however, it. It does not imply that you should not be involved in trading. Instead, you should be careful and choose alternative currencies without any correlation with the country being closed.

Can you trade forex on weekends?

Retail traders that use forex brokers can not trade during weekends because forex brokers are closed. However, institutional traders can do one-weekend trading through central banks and other organizations.

The ThU.S.S. forex market closes on Friday at 5 pm E.S.T. and opens on Sunday at 5 pm E.S.T. Besides, trading in crypto with some brokers can be a good option for you during the weekend.

I was fond of doing it in my newbie years, but it was during the hay days of Bitcoin. So, it helped me to get a few corrections while riding on the Bitcoin wave. I am not trading cryptocurrency, but I will again when my strategy gives me the go-ahead.

Banks and similar financial organizations continue to have the right to enter the currency market, so they exist on Sundays when markets open. So Friday is when I close, and Monday is when I return looking for re-entry.

This also provides an avenue for another strategy to trade the gap at the weekend. This strategy is pretty well-known and could be worth your interest.

Holidays

Even though many U.S. federal holidays fall on weekends, the stock market is nevertheless open on some of them. The market is open on non-federal holidays, including Columbus Day and Veterans Day, although it is closed on Good Friday. There are a total of nine annual holidays recognized by the stock marketplace.

- January 1st (New Year’s Day)

- The third Monday of January (Day Honoring Dr. Martin Luther King, Jr.)

- The third Monday in February (Presidents’ Day)

- The Friday before Easter Sunday (Good Friday)

- The last Monday of May (Memorial Day)

- July 4th (IndependenceDayy)

- The first Monday in September (The Labor Day Holiday)

- The fourth Thursday of November (Day of Thanks)

- December 25th (Christmas day)

If a holiday is on the weekend, trading will be closed on the Friday before or the Monday after.

Weekends

We’ve already established that the U.S. marketplace closes for nine recognized holidays yearly. Sinceesimilare holidays are celebrated annually, why does the sum of business days change yearly? The solution is to look at the calendar and see how many Fridays, Saturdays, and Sundays there are each year.

Depending on the first weekend of the year, there may be more than 104 weekend days in a given year. Even though there would be one extra trading day in a leap year, the sum of trading days would be less on the condition the year began on a Saturday. Annual trade schedules do not always include market closures due to national emergencies. For example, on December 5th, 2018, the U.S. stock marketplace was closed in honor of the passing of the prior head of state, George H.W. Bush. The market was closed for four days in 2001 after the September 11th terrorist attacks and 2-days in 2012 because of Hurricane Sandy.

A leap year occurs once every four years, with one additional day. If this other day occurs during the week, it will increase the sum of business days in the year. In 2020, for instance, a leap year, there were 253 business days. For a leap year to not add trade day, the year must begin on the weekend, specifically a Saturday.

Can you make trades on all market days?

Now that you know how many business days there are in a year, ask yourself honestly if you can use each. This is quite rare, even if you are a day broker. There are a lot of reasons that will often bind the sum of dealing days you engage in during the year, including the following:

Different trading strategies, time away from the market, unforeseen events, and losing streaks may all affect financial performance.

How many days per year is the stock market open?

The stock market is open 253 days yearly because weekends and holidays are non-working days. However, this number can vary from 252 to 253 trading days yearly.