Table of Contents

When starting in the Forex market, knowing which currency pairs to trade can be confusing. There are so many different combinations! This article will list the most common currency pairs and briefly describe each.

In our article What is the largest forex market in the world, we analyze the forex market and see the forex pairs list. In another article, we wrote about forex market volume, and here, we will analyze only the most traded currencies.

Major forex pairs list:

- EUR/USD (Euro/United States Dollar)

- It is the most traded currency pair in the world.

- Represents the two largest economies: the European Union and the United States.

- High liquidity and low spreads.

- Prices are influenced by economic data releases, interest rate changes, and political events in Europe and the United States.

- USD/JPY (United States Dollar/Japanese Yen)

- It’s the second most traded currency pair.

- Reflects the economic relationship between the United States and Japan.

- They are known for volatility, especially during Asian trading sessions.

- Sensitive to changes in U.S. interest rates and Japanese economic policies.

- GBP/USD (British Pound/United States Dollar)

- She was known as “Cable,” which originated from the transatlantic cable used to transmit the GBP/USD exchange rate.

- Represents the economy of the United Kingdom relative to the United States.

- Factors like Brexit, Bank of England and Federal Reserve policies, and U.K. economic indicators influence it.

- USD/CHF (United States Dollar/Swiss Franc)

- Often considered a “safe-haven” currency pair.

- Represents the relationship between the U.S. dollar and the currency of Switzerland, a country known for its financial sector and stable economy.

- They are influenced by global risk sentiment and changes in the financial markets.

- AUD/USD (Australian Dollar/United States Dollar)

- Represents the exchange rate between Australia and the United States.

- Australia’s economy is heavily influenced by commodity prices, making this pair sensitive to changes in commodity markets.

- Indicators to watch include Reserve Bank of Australia decisions, commodity prices, and U.S. economic data.

- USD/CAD (United States Dollar/Canadian Dollar)

- Known as “Loonie,” referencing the loon on the Canadian one-dollar coin.

- Represents the economic relationship between the United States and Canada.

- The oil price significantly influences Canada’s economy, as it is a significant oil exporter.

- NZD/USD (New Zealand Dollar/United States Dollar)

- Known as the “Kiwi,” referencing the kiwi bird native to New Zealand.

- Represents the exchange rate between New Zealand and the United States.

- New Zealand’s agricultural exports and commodity prices, especially dairy, influenced her.

- EUR/JPY (Euro/Japanese Yen)

- Represents the exchange rate between the Eurozone and Japan.

- A famous pair for carry trades, where traders borrow in a low-interest-rate currency (JPY) to invest in a higher-interest-rate currency (EUR).

- Influenced by economic indicators from both the Eurozone and Japan, as well as differences in monetary policy between the European Central Bank and the Bank of Japan.

These major pairs are a focal point for traders due to their liquidity, tight spreads, and abundant economic news and data that can drive price action. Trading these pairs requires an understanding of the economic fundamentals and indicators that influence each country’s currency value and a grasp of technical analysis and market sentiment.

Except for significant forex pairs, how many can traders trade strictly?

How many currency pairs are in forex?

There are 154 different currencies from 221 countries based on the United Nations Treasury. In theory, we can create 11781 currency pairs – all forex pairs computed combinations. In the forex industry, traders often trade around 70 forex pairs, and forex brokers offer up to 130 currency pairs.

Over 95% of traders trade 30 major forex pairs from the world’s biggest economies. Usually, traders look for volatility and liquidity, stable trends that can help them to make profitable trades.

Most traded Currency Pairs.

There are many currencies in the world. Every country’s currency holds a different status, as some are more powerful than others. However, only a few are truly valuable for trading in the Forex market. There are only a few that are actively traded. Currencies must be politically and economically stable; otherwise, they will not be popular trading options on the market. These currencies are in demand and retain their strength in the market.

The United States dollar is one of the strongest and most traded currencies. Forex markets are used for trading two or more currency pairs. All types of trading on the market, whether buying or selling, will always be completed through currency pairs. Some of the top currency pairs include the USD and Euro.

Currency pairs are two currencies that are coupled for forex trading. Both currencies have specific exchange rates. The following pairs are the most commonly traded in the Forex market today.

Any country’s currency can trade; however, specific pairs are repeatedly traded. Primary pairs always contain the USD. The following pairs are also widespread trades.

7 Most traded currencies are:

- EUR

- GBP

- CAD

- AUD

- NZD

- CHF

- JPY

How many major currency pairs are there?

Most traded currency pairs are:

EURUSD

GBPUSD

USDCAD

USDJPY

AUDUSD

NZDUSD

USDCHF

EURCHF

EURGBP

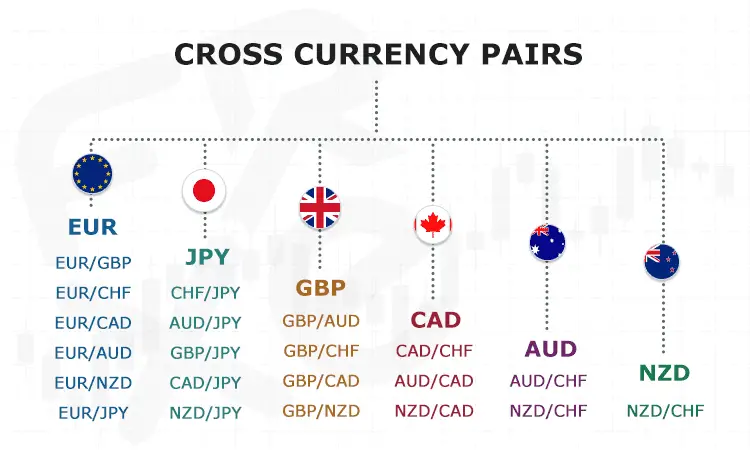

It is crucial to take note of the most common pairs. Cross-currency pairs are pairs that do not trade against the USD. Typically, cross-currency pairs use the Euro and Japanese Yen. As stated previously, currencies are always traded in pairs. A total of 27 different pairs are created from only eight currencies. A total of 18 highly traded pairs represent most of all Forex trading. Trading is more accessible and less hectic with a controlled number of options. If hundreds of currency pairs traded consistently, maneuvering the market would be more complicated and intense. These 18 pairs are an excellent way for traders to trade daily effectively.

Why are These Pairs Commonly Traded?

The above-listed pairs are most commonly traded due to their economic and political status. Economically stable, financially stable, and liquid currencies are likely to be traded. For a currency to rank amongst these, it must be economically and financially sound. As stated, any currency pair can be traded on the market; however, only a select few are constantly traded. This makes them more valuable and a more significant asset to trade.

The USD is a widespread currency that is involved in almost every trade. Some regard the USD as a virtual currency. Selling, buying, and trading take place using a currency pair. Trading currency pairs can be complex initially; however, most traders develop their skill set over time. By gaining experience in the market, traders can make more profitable trades in the future.

Currency pairs list:

Financial instrument

AUD/CAD

AUD/CHF

AUD/CZK

AUD/DKK

AUD/HKD

AUD/HUF

AUD/JPY

AUD/MXN

AUD/NOK

AUD/NZD

AUD/PLN

AUD/SEK

AUD/SGD

AUD/USD

AUD/ZAR

CAD/CHF

CAD/CZK

CAD/DKK

CAD/HKD

CAD/HUF

CAD/JPY

CAD/MXN

CAD/NOK

CAD/PLN

CAD/SEK

CAD/SGD

CAD/ZAR

CHF/CZK

CHF/DKK

CHF/HKD

CHF/HUF

CHF/JPY

CHF/MXN

CHF/NOK

CHF/PLN

CHF/SEK

CHF/SGD

CHF/TRY

CHF/ZAR

DKK/CZK

DKK/HKD

DKK/HUF

DKK/MXN

DKK/NOK

DKK/PLN

DKK/SEK

DKK/SGD

DKK/ZAR

EUR/AUD

EUR/CAD

EUR/CHF

EUR/CZK

EUR/DKK

EUR/GBP

EUR/HKD

EUR/HUF

EUR/JPY

EUR/MXN

EUR/NOK

EUR/NZD

EUR/PLN

EUR/SEK

EUR/SGD

EUR/TRY

EUR/USD

EUR/ZAR

GBP/AUD

GBP/CAD

GBP/CHF

GBP/CZK

GBP/DKK

GBP/HKD

GBP/HUF

GBP/JPY

GBP/MXN

GBP/NOK

GBP/NZD

GBP/PLN

GBP/SEK

GBP/SGD

GBP/USD

GBP/ZAR

JPY/CZK

JPY/DKK

JPY/HKD

JPY/HUF

JPY/MXN

JPY/NOK

JPY/PLN

JPY/SEK

JPY/SGD

JPY/ZAR

NOK/CZK

NOK/HKD

NOK/HUF

NOK/MXN

NOK/PLN

NOK/SEK

NOK/SGD

NOK/ZAR

NZD/CAD

NZD/CHF

NZD/CZK

NZD/DKK

NZD/HKD

NZD/HUF

NZD/JPY

NZD/MXN

NZD/NOK

NZD/PLN

NZD/SEK

NZD/SGD

NZD/USD

NZD/ZAR

USD/CAD

USD/CHF

USD/CZK

USD/DKK

USD/HKD

USD/HUF

USD/JPY

USD/MXN

USD/NOK

USD/PLN

USD/SEK

USD/SGD

USD/TRY

USD/ZAR

World currencies list

See the list of all 154 world currencies from 221 countries:

| Country | Currency | Description |

|---|---|---|

| Afghanistan | AFN | Afghanistan Afghani |

| Albania | ALL | Albania Lek(e) |

| Algeria | DZD | Algerian Dinar |

| American Samoa | USD | US Dollar |

| Andorra | EUR | Euro |

| Angola | AOA | Angolan Kwanza |

| Anguilla | XCD | E.C. Dollar |

| Antigua and Barbuda | XCD | E.C. Dollar |

| Argentina | ARS | Argentine Peso |

| Armenia | AMD | Armenian Dram |

| Aruba | AWG | Aruban Guilder |

| Australia | AUD | Australian Dollar |

| Austria | EUR | Euro |

| Azerbaijan | AZN | Azerbaijan Manat |

| Bahamas | BSD | Bahamian Dollar |

| Bahrain | BHD | Bahraini Dinar |

| Bangladesh | BDT | Bangladesh Taka |

| Barbados | BBD | Barbados Dollar |

| Belarus | BYN | Belarusian Ruble |

| Belgium | EUR | Euro |

| Belize | BZD | Belize Dollar |

| Benin | XOF | CFA Franc |

| Bermuda | BMD | Bermuda Dollar |

| Bhutan | BTN | Bhutan Ngultrum |

| Bolivia | BOB | Bolivia Boliviano |

| Bosnia and Herzegovina | BAM | Bosnia and Herzegovina Convertible Mark |

| Botswana | BWP | Botswana Pula |

| Brazil | BRL | Brazilian Real |

| Brunei | BND | Brunei Dollar |

| Bulgaria | BGN | Bulgarian Lev |

| Burkina Faso | XOF | CFA Franc |

| Burundi | BIF | Burundi Franc |

| Cambodia | KHR | Cambodian Riel |

| Cameroon | XAF | CFA Franc |

| Canada | CAD | Canadian Dollar |

| Canary Islands | EUR | Euro |

| Cape Verde | CVE | Cape Verde Escudo |

| Cayman Islands | KYD | Cayman Is. Dollar |

| Central African Republic | XAF | CFA Franc |

| Chad | XAF | CFA Franc |

| Chile | CLP | Chilean Peso |

| China | CNY | Chinese Renminbi |

| Colombia | COP | Colombian Peso |

| Comoros | KMF | Comoros Franc |

| Congo | XAF | CFA Franc |

| Congo, Dem. Rep. | CDF | Congo Franc, Dem. Rep.of |

| Cook Islands | NZD | New Zealand Dollar |

| Costa Rica | CRC | Costa Rica Colon |

| Cote d'Ivoire | XOF | CFA Franc |

| Croatia | HRK | Croatia Kuna |

| Cuba | CUP | Cuban Peso |

| Cyprus | EUR | Euro |

| Czech Republic | CZK | Czech Koruna |

| Denmark | DKK | Danish Krone |

| Djibouti | DJF | Djibouti Francs |

| Dominica | XCD | E.C. Dollar |

| Dominican Republic | DOP | Dominican Peso |

| East Timor | USD | US Dollar |

| Ecuador | USD | US Dollar |

| Egypt | EGP | Egyptian Pound |

| El Salvador | USD | US Dollar |

| Equatorial Guinea | XAF | CFA Franc |

| Eritrea | ERN | Eritrea Nakfa |

| Estonia | EUR | Euro |

| Eswatini, Kingdom of | SZL | Lilangeni |

| Ethiopia | ETB | Ethiopian Birr |

| Fiji | FJD | Fiji Dollar |

| Finland | EUR | Euro |

| France | EUR | Euro |

| French Guiana | EUR | Euro |

| French Polynesia | XPF | CFP Franc |

| Gabon | XAF | CFA Franc |

| Gambia | GMD | Gambian Dalasi |

| Georgia | GEL | Georgian Lari |

| Germany | EUR | Euro |

| Ghana | GHS | Ghana Cedi |

| Greece | EUR | Euro |

| Greenland | DKK | Danish Krone |

| Grenada | XCD | E.C. Dollar |

| Guadeloupe | EUR | Euro |

| Guam | USD | US Dollar |

| Guatemala | GTQ | Guatemala Quetzal(es) |

| Guinea | GNF | Guinean Franc |

| Guinea-Bissau | XOF | CFA Franc |

| Guyana | GYD | Guyana Dollar |

| Haiti | HTG | Haiti Gourde |

| Honduras | HNL | Honduras Lempira |

| Hong Kong | HKD | HongKong Dollar |

| Hungary | HUF | Hungary Forint |

| Iceland | ISK | Iceland Krona |

| India | INR | Indian Rupee |

| Indonesia | IDR | Indonesia Rupiah |

| Iran | IRR | Iranian Rial |

| Iraq | IQD | Iraqi Dinar |

| Ireland | EUR | Euro |

| Israel | ILS | Israel Shekel |

| Italy | EUR | Euro |

| Jamaica | JMD | Jamaican Dollar |

| Japan | JPY | Japanese Yen |

| Jordan | JOD | Jordanian Dinar |

| Kazakhstan | KZT | Kazakhstan Tenge |

| Kenya | KES | Kenyan Shilling |

| Kiribati | AUD | Australian Dollar |

| Korea, D.P.R. of | KPW | Korean Won, North Korea |

| Korea, Republic of | KRW | Korean Won, South Korea |

| Kuwait | KWD | Kuwaiti Dinar |

| Kyrgyzstan | KGS | Kyrgyzstan Som |

| Lao, People's Dem. Rep. | LAK | Laos Kip |

| Latvia | EUR | Euro |

| Lebanon | LBP | Lebanese Pound |

| Lesotho | LSL | Lesotho Loti |

| Liberia | LRD | Liberian Dollar |

| Libyan Arab Jamahiriya | LYD | Libyan Dinar |

| Liechtenstein | CHF | Swiss Franc |

| Lithuania | EUR | Euro |

| Luxembourg | EUR | Euro |

| Macao | MOP | Macao Pataca |

| Madagascar | MGA | Malagasy Ariary, Madagascar |

| Malawi | MWK | Malawi Kwacha |

| Malaysia | MYR | Malaysia Ringgit |

| Maldives | MVR | Maldives Rufiyaa |

| Mali | XOF | CFA Franc |

| Malta | EUR | Euro |

| Marshall Islands | USD | US Dollar |

| Martinique | EUR | Euro |

| Mauritania | MRU | Mauritania Ouguiya |

| Mauritius | MUR | Mauritius Rupee |

| Mexico | MXN | Mexican Peso |

| Micronesia | USD | US Dollar |

| Moldova, Republic of | MDL | Moldovan Leu |

| Monaco | EUR | Euro |

| Mongolia | MNT | Mongolia Tugrik |

| Montenegro | EUR | Euro |

| Montserrat | XCD | E.C. Dollar |

| Morocco | MAD | Morocco Dirham |

| Mozambique | MZN | Mozambique Metical |

| Myanmar | MMK | Myanmar Kyat |

| Namibia | NAD | Namibia Dollar |

| Nauru | AUD | Australian Dollar |

| Nepal | NPR | Nepalese Rupee |

| Netherlands | EUR | Euro |

| Netherlands Antilles | ANG | Netherlands Antilles Guilder |

| New Caledonia | XPF | CFP Franc |

| New Zealand | NZD | New Zealand Dollar |

| Nicaragua | NIO | Nicaragua Cordoba Oro |

| Niger | XOF | CFA Franc |

| Nigeria | NGN | Nigeria Naira |

| Niue | NZD | New Zealand Dollar |

| North Macedonia, Rep. of | MKD | Denar |

| Northern Mariana Islands | USD | US Dollar |

| Norway | NOK | Norwegian Krone |

| Oman | OMR | Oman Rial |

| Pakistan | PKR | Pakistani Rupee |

| Palau, Republic of | USD | US Dollar |

| Panama | PAB | Panama Balboa |

| Papua New Guinea | PGK | Kina |

| Paraguay | PYG | Paraguay Guarani |

| Peru | PEN | Sol |

| Philippines | PHP | Philippine Peso |

| Poland | PLN | Poland Zloty |

| Portugal | EUR | Euro |

| Puerto Rico | USD | US Dollar |

| Qatar | QAR | Qatari Rial |

| Reunion | EUR | Euro |

| Romania | RON | Romanian Leu |

| Russian Federation | RUB | Russian Rouble |

| Rwanda | RWF | Rwanda Franc |

| Saint Helena | SHP | St.Helena Pound |

| Saint Kitts and Nevis | XCD | E.C. Dollar |

| Saint Lucia | XCD | E.C. Dollar |

| Samoa | WST | Samoa Tala |

| San Marino | EUR | Euro |

| Sao Tome and Principe | STN | Sao Tome Principe Dobra |

| Saudi Arabia | SAR | Saudi Riyal |

| Senegal | XOF | CFA Franc |

| Serbia | RSD | Serbian Dinar |

| Seychelles | SCR | Seychelles Rupee |

| Sierra Leone | SLL | Sierra Leone Leone |

| Singapore | SGD | Singapore Dollar |

| Slovakia | EUR | Euro |

| Slovenia | EUR | Euro |

| Solomon Islands | SBD | Solomon Is. Dollar |

| Somalia | SOS | Somali Shilling |

| South Africa | ZAR | South Africa Rand |

| South Sudan | SSP | South Sudanese Pound |

| Spain | EUR | Euro |

| Sri Lanka | LKR | Sri Lanka Rupee |

| St. Vincent and the Grena | XCD | E.C. Dollar |

| Sudan | SDG | Sudanese Pound |

| Suriname | SRD | Surinamese Dollar |

| Sweden | SEK | Swedish Krona |

| Switzerland | CHF | Swiss Franc |

| Syrian Arab Republic | SYP | Syrian Pound |

| Tajikistan | TJS | Tajikistan Somoni |

| Tanzania, United Rep. of | TZS | Tanzania Shilling |

| Thailand | THB | Thai Baht |

| Togo | XOF | CFA Franc |

| Tokelau Islands | NZD | New Zealand Dollar |

| Tonga | TOP | Tonga Pa'anga |

| Trinidad and Tobago | TTD | Trinidad and Tobago Dollar |

| Tunisia | TND | Tunisian Dinar |

| Turkey | TRY | Turkish Lira |

| Turkmenistan | TMT | Turkmenistan Manat |

| Turks and Caicos Island | USD | US Dollar |

| Tuvalu | AUD | Australian Dollar |

| Uganda | UGX | Uganda Shilling |

| Ukraine | UAH | Ukraine Hryvnia |

| United Arab Emirates | AED | United Arab Emirates Dirham |

| United Kingdom | GBP | U.K. Pound |

| United States of America | USD | US Dollar |

| Uruguay | UYU | Uruguay Peso |

| Uzbekistan | UZS | Uzbekistan Sum |

| Vanuatu | VUV | Vanuatu Vatu |

| Venezuela | VES | Bolivar Soberano |

| Viet Nam | VND | Viet Nam Dong |

| Virgin Islands (UK) | USD | US Dollar |

| Virgin Islands (USA) | USD | US Dollar |

| Wallis and Futuna Islands | XPF | CFP Franc |

| Yemen, Republic of | YER | Yemeni Rial |

| Zambia | ZMW | Zambia Kwacha |

| Zimbabwe | ZWL | Zimbabwe RTGS dollar |