Table of Contents

The forex market is regarded as one of the biggest markets in the world. Forex is one of the ways a small or growing investor can get a fortune in trading with little starting capital. However, how much do experts in forex trade make?

Before we write about this topic, we need to divide traders into three to 3 different categories.

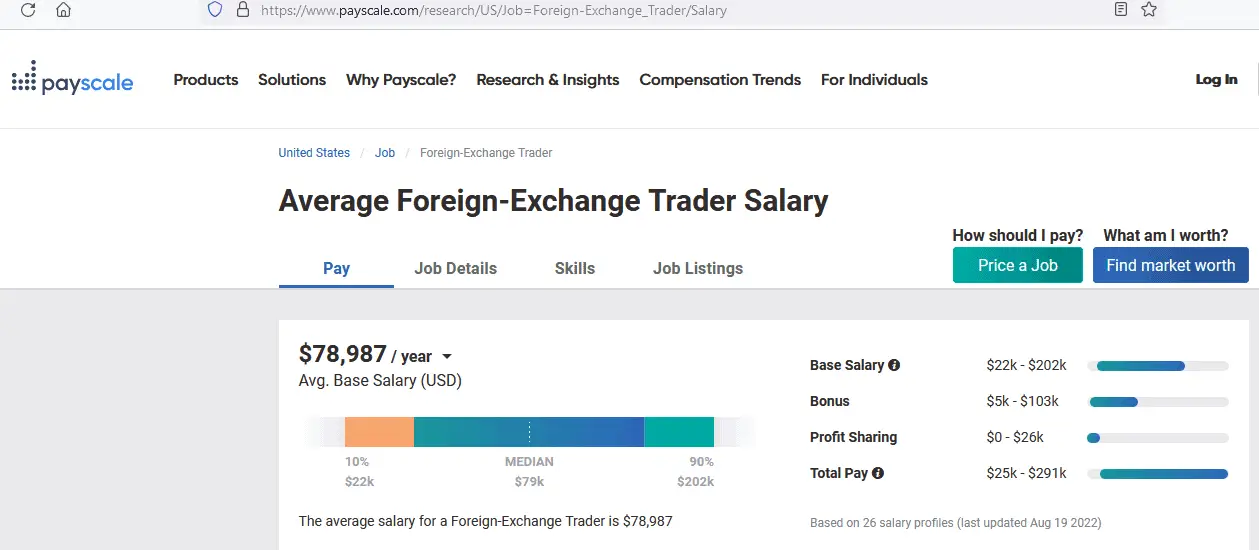

- Traders who trade in investment companies and hedge funds and manage millions of dollars with low risk represent the most common category because of their salaries. You can learn when you visit any job-related website like payscale and see the average wage. Currently, it is around $ 79,000 in the US. There are approximately around 10% of all traders in this group. Learn more in the book Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To Win by Noble DraKoln.

- Traders who trade for prop companies and prop shops as remote traders. Thousands of traders worldwide trade for small prop companies and manage up to millions of dollars. Usually, they manage around $ 100,000 and make from $500 up to $ 10,000, depending on capital size. There are 15% of traders in this category.

- Retail traders that trade forex using their own money. Around 90% of all retail traders lose money trading the forex, while only a few percent can earn a profit from $500 up to $5000 on average every month. (Read more in The Retail Spot Foreign Exchange Market Structure and Participants )

How Much Do Forex Traders Make?

Professional forex traders in big corporations may earn $6600 monthly on average, prop company traders can make from $500 up to $ 10,000 monthly. In comparison, 10% of retail forex traders (that professionally trade forex while 90% lose money) can earn an average of $500 up to $5000 monthly salary. In companies, traders’ monthly salary depends on fund size, profit-sharing ratio, commission, and bonuses.

In this article, read more about how forex trading functions and factors that may contribute to a forex trader’s pay. We also explain how much an expert in forex trading earns on average.

The forex market is guided by supply and demand rules. That is to say, the value of a currency goes up when there is demand, and consequently, the value drops when there is no demand. To gain forex, one should ideally buy when the currency is low value and sell when it is high value.

If a trader is on a downward trend while trading, it may be necessary to short-sell assets, which means borrowing, selling, repurchasing, and returning the borrowed asset.

In this, the trader makes money if the asset price goes up when selling and down when buying. Note that one is likely to lose a lot of trading with just luck. It is essential to know how the forex market works.

What Makes Professional Forex Traders Different From Beginners?

Beginner traders are still like learners in the forex world; they sometimes will trade with luck and prediction. Beginner traders analyze the data and the markets and use technical indicators to aid themselves and get technical analysis.

Professional traders do not trade with luck but with what they see. They do not need to spend most of the time analyzing the market; instead, they use fundamental analysis to compare and confirm the charts derived from their technical analysis.

Trading For A Hedge Fund

Forex traders who work or trade for a company get a base salary. It also comes with bonuses based on work performance.

Strategy and software tools are available when working for a hedge fund. The software tools are very effective, giving traders essential and valuable information quickly, and with such effectiveness and speed, it does not come cheap.

These traders can also have access to complete training and mentoring programs to learn from trading pros. Another interesting point is that when a trader makes a lot of money and delivers significantly for the company, the trader can get paid more and higher performance bonuses.

However, a slight disadvantage of working with a hedge fund is that one could have long work hours and very demanding clients, and if the company targets are not met, one could lose the job.

Traders Who Work For Themselves

A few forex traders prefer to work for themselves, either by a condition or choice. An advantage of working by yourself is the choice of working hours; as you have no one to boss you around and to answer to, you also get to keep all the money you make, which is different from working with a company because you only get a percentage of the money earned.

The disadvantage to working by yourself is there is no base salary, and you could end up frustrated when money is risked and lost, especially if one does not have any other source of income. Also, affording software to aid in trading could be quite expensive. Traders working for themselves may depend on news, online updates, or paid data streams.

Also, there are six types of traders classified according to how they trade, which are:

- Scalpers: A scalp is a short-term trader whose strategy involves holding positions for periods ranging from a few seconds to a few minutes. A scalped traded frequently throughout the day, poised to make slight gains from the busiest periods in the market. Scalpers are continually challenged with processing new information and reacting to market changes. So, to be a successful scalped, one needs to be adaptive, sharp, and quick-witted but calm under pressure.

- Day Trader: Day Traders are pretty similar to Scalpers. The critical difference between them is that a day trader’s daily routine may not be as fast-paced, and they close all positions on or before the end of the trading day. This means the trades cannot be affected by adverse events that may cause prices to fluctuate before or after the market closes. Being successful as a day trader may demand adaptability and working knowledge of the techniques necessary for this type of trading.

- Swing Trader: They characteristically hold onto trades for over a day, possibly weeks. Throughout this period, swing traders would prefer technical analysis rather than stick with the fundamentals while still knowing about news events that could bring about volatility.

- Position Trader: These traders hold trades for long periods, ranging from weeks to years. They are the traders that work with the most prolonged holding period, and as such, they are more focused on the performance of an asset over longer timeframes.

- Algorithmic Trader: These traders rely on software to place trades at the best possible prices. The algorithm traders can purchase existing software or code the software using high-frequency trading algorithms as a guide.

- Event-Driven Trader: These traders use fundamental analysis to determine decisions more than reading technical charts. Event-Driven Trader’s leading source of profit comes from spikes caused by political and economic events, such as GDP, employment figures, elections, etc. This type of trading can be best suited for people who like to keep up with world news and global events and people who will understand how said events can impact markets. These traders have to be curious and critical forward thinkers. They also must be skilled at processing new information and predicting how major global and local events may play out in the markets.

How Much Do Professional Forex Traders Make

Factors that determine how much a professional forex trader earns are:

- Fund size

- Profit share

- Seniority.

- Company Type

- Performance.

- Location.

Let us discuss some points:

- Fund size is the most critical factor because the profit cannot be the same if you manage 10 million and $ 10,000.

- Seniority: When working for a hedge fund, there are positions like analysts, junior traders, and senior traders. Most traders working for hedge fund companies are likely to begin as analysts. The analyst’s job is primarily to assist junior and old traders. After a few years, the analyst gets promoted to a Junior trader based on merit and performance. Junior traders may earn an average of $300,000 to $3,000,000 annually (including bonuses and commission). The senior traders can make up to $10,000,000 yearly (including bonuses and commissions). However, the figures may increase or decrease based on performance.

- The company they work for: Estimates from Glass Doors show that a trader in the U.S. could earn an average of $100,000. This amount is the average because companies vary in salary and bonuses. Examples include J.P. Morgan traders, who make an average of $95,995 as a base salary, and Goldman Sachs traders, who earn $120,024 as the base salary. Citibank traders earn $158,166, and HSBC, among banks with high base salaries, pays traders $197,029. (Please note that the figures are just salaries and do not include commission and bonuses)

- Location: The location dramatically determines how much a forex trader earns. Examples could be the differences that a Citibank trader earns in the UK to a Citibank trader’s amount in the US due to the location. A trader for Citibank UK makes 58,951 pounds, while another who works for Citibank U.S. earns $149,156. The same is true with the Gold Sachs bank, where a UK trader earns about 79,971 pounds, while in the US, a trader can make $129,578. (Remember that the figures are salaries and do not include bonuses or commissions.)

How Much Do Independent Forex Traders Earn?

Calculating an independent trader’s earnings and coming to a concluding figure may not be possible because every trader is different. Some started with very high capital and some with low. However, one constant factor is the higher the capital, the bigger the profits.

The biggest problem for independent retail traders is fund size because even $ 100,000 is insufficient capital to earn enough money for bills, life, etc. Assuming that the best traders can earn 20% annually if you have a $ 100,000 capital size, your monthly salary can be less than $1300 after tax deduction.

This is the difference between professional traders and amateur traders. Professional traders could have accounted for thousands of dollars; amateur traders could have accounted for hundreds. Both traders could earn 10% from the capital, but the amount would differ significantly. Consistent trading leads to more profits,e earnings, and significant accounts. However, note that traders with enormous gains are also the most significant risk-takers and could lose all profits quickly.

Why Is It Difficult To Have A Specific Figure?

The number of money experts in forex trading can not be conclusive because there is no exact amount of money traders make. Figures do vary because traders do not use the same amount of capital. Every trader has different trading approaches with other strategies, and what works for one trader might not work for another.

However, not everything goes as planned for traders; some months, the market can be so bad that traders barely make any profits, and sometimes trading could go well, and traders can make up to 50% of capital. Being a professional trader, one has to understand risk management, managing money, the risk-to-reward ratio, and all other things involved in trading. That is a significant path for growth in forex trading.

Conclusion

Coming to a conclusive figure a forex trader could make can be very difficult. Being a company trader affects income, such as location, seniority, and the company a trader works for.

Read more about the wealthiest trader in the world in our article.

Traders who work for themselves will earn based on capital and monthly profits. Furthermore, every trader is unique, and no trader makes the same percentage of profits.