Table of Contents

Among the myriad trading styles, one particular approach stands out due to its intensity and immediacy: day trading. Contrary to investors who might hold their positions for months, years, or even decades, day traders operate where minutes can matter just as much as months do for others. For these traders, a single day’s movement can mean profit or loss, success or failure.

Most traders in the contemporary trading landscape fall under the category of day traders. These individuals actively buy and sell financial instruments within the same trading day to capitalize on short-term price fluctuations. By the end of the trading day, a day trader typically closes out all their positions, avoiding the potential risks and uncertainties of holding them overnight.

The allure of day trading lies not only in the potential for quick profits but also in the thrill of the chase, the challenge of timing the market, and the continuous learning it necessitates. Equipped with charts, news feeds, and advanced trading platforms, day traders constantly analyze market conditions, news events, and other variables to determine the right moment to enter or exit a trade.

How Many Day Traders Are There?

Around 5.9 million active day traders worldwide, representing 41% of all traders. Based on the fact that there are 14.6 million active online traders, the most significant portion is on day traders. However, only 19% of day stock traders and 11% of forex day traders make positive returns.

Based on stats from research papers, 19% of all stock traders are day traders, while 40% of all forex traders are day traders. Read more in our article about How many forex traders are there.

A day trader is an individual who buys and sells financial instruments within the same trading day, aiming to profit from short-term price fluctuations. By the end of the trading day, they typically close all their positions to avoid overnight market risks.

The Appeal of Day Trading

Day trading appeals to many because of its immediacy. Traders are attracted to the potential for quick profits, the thrill of the chase, and the challenge of timing the market just right. The definition – buying and selling financial instruments within a single day – underscores the allure of quick turnarounds and the prospect of daily profits.

The Numbers: Stocks vs. Forex

The research statistics present an intriguing distinction between stock and forex traders. While only 19% of all stock traders engage in day trading, 40% of all forex traders choose this approach. This difference might be attributed to the unique characteristics of the forex market, such as its 24-hour trading cycle and higher liquidity. The volatility and dynamics of currency pairs can offer more frequent opportunities for short-term price movement, making it a playground for day traders.

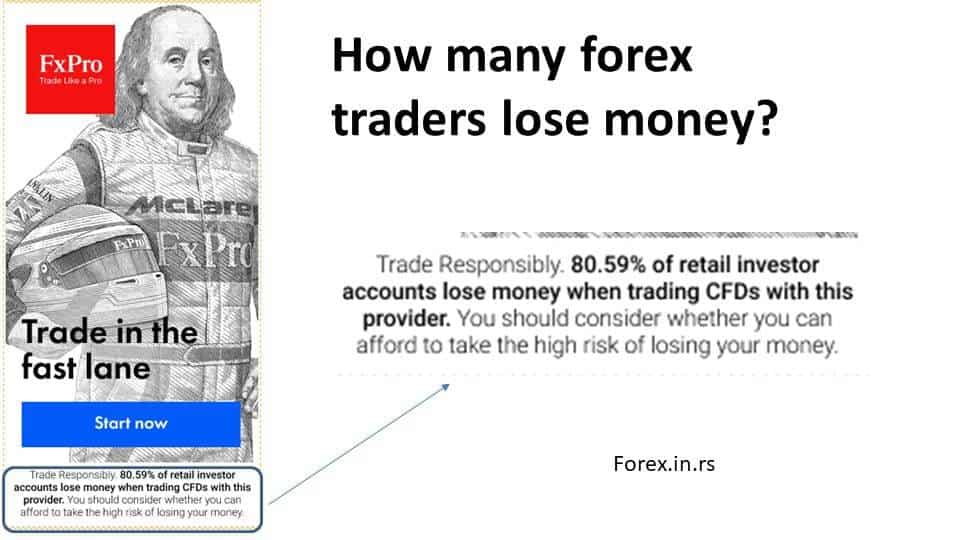

For example, we can see that in forex trading, around 19% do not lose money (see image below):

Success Rates: The Hard Truth

Despite the allure of day trading, the reality is sobering. Only 19% of day stock traders and a mere 11% of forex day traders consistently make positive returns. These numbers underscore the challenges and complexities of day trading. Achieving success in this field requires more than strategy; it demands discipline, emotional intelligence, rigorous risk management, and continuous learning. The fact that a large majority struggles to achieve consistent profitability highlights the risky nature of this trading style.

Why do we have these results?

The problem with forex traders is usually low capital and high risk. The majority of forex traders are day traders.

However, let’s compare stock day and forex day traders with more than $ 20,000. Forex day and stock day traders are equal in profitability because around 19% of them have profitable accounts annually.

Evidence from a day trading study

Understanding trader performance, especially among day traders, is essential for interpreting market dynamics and assessing market efficiency. A comprehensive analysis of day traders in Taiwan between 1992 and 2006 revealed intriguing patterns in these traders’ skill levels and outcomes.

The study found significant disparities in the returns earned by speculative traders. By examining the performance of traders in a given year (year y) and comparing it to their performance in the following year (year y+1), the researchers identified that the top 500 traders could achieve daily before-fee returns of 61.3 basis points (bps) and after-fee returns of 37.9 bps. In contrast, the lowest-performing traders garnered before-fee returns of -11.5 bps and after-fee returns of -28.9 bps.

Interestingly, despite these performance variations, less than 1% of the day trader population consistently earned positive returns after accounting for fees. Day trading, though speculative, was a significant activity on the Taiwan Stock Exchange during the study period, making up nearly 17% of the total trading volume. This practice was dominated by individual investors, who represented over 99% of day traders and 95% of the volume of day trades. In a typical year, around 450,000 individual traders engaged in day trading. Of this substantial number, 277,000 had trading volumes surpassing $NT 600,000 (approximately $US 20,000). However, only 20% of these traders could achieve profitability after accounting for all trading expenses.

The research also pointed out that while luck played a significant role in the success of many day traders in Taiwan, a small subset demonstrated genuine skill, producing consistently high returns. Notably, the most skilled day traders showed remarkable persistence in their performance. The top 500 traders from a given year could outdo their less successful counterparts by over 60 bps daily in the subsequent year. These elite traders could navigate commissions and a considerable transaction tax on sales set at 30 bps. Additionally, these top traders weren’t merely passive liquidity providers. Instead, they frequently placed aggressive orders, anticipating future price movements. They typically had a history of successful trades, demonstrated a willingness to sell short, and often focused on a limited selection of stocks.

This research fundamentally challenges the classic efficient markets hypothesis, suggesting that private information might not be as scarce as previously believed. While trading, on average, seemed to be detrimental to one’s financial well-being, not everyone bore this cost equally. Some traders consistently underperformed in their stock picks. In contrast, a few found trading to be a lucrative activity.

This paper illuminates the significant cross-sectional differences in trader ability, presenting a more nuanced picture of the day trading landscape and suggesting that the market might not always reflect all available information efficiently.

Read more about the richest trader in the world in our article.

Conclusion

Day trading remains attractive for many, given its potential for quick profits and the sheer volume of traders adopting this approach. Yet, the relatively low success rate among stock and forex day traders is a cautionary tale. While the forex market, in particular, sees a higher percentage of day traders, the challenges remain consistent across both domains. As with all forms of trading, education, continuous learning, and risk management are paramount for anyone considering entering the fast-paced world of day trading.