Table of Contents

If you are in forex trading or any other trading form, you must understand that money management is essential. Also, keeping a stronghold on your trading account is necessary, and controlling the loss is a significant component. Unfortunately, many traders take the risk of one or two percent to manage the loss.

What is Expectancy in Trading?

Expectancy in trading shows how much money, on average, we can expect to make or lose for every dollar we risk. Trading expectancy is a calculation that presents the profit for each trade placed – how many trades are won with the average loss on losing trades and the average gain on winning trades. The main question is, do traders have a positive outcome on average when dividing total profits by total trades?

Now let’s see how to calculate trade expectancy and expectancy ratio:

Expectancy formula in trading

To calculate expectancy, we need to calculate the average return for each trade, including wins and losses, using the following formula:

Expectancy = (Winning% x Average Win Size) – (Loss % x Average Loss Size)

Example:

Calculate expectancy if a trader wins 60% of the time, making $200 on average when they win but losing $500 on losing trades.

Winning percent: 60%

Loss percent: 40%

Average win size: $200

Average loss size: 5200

Expectancy = (0.6 x $200) – (0.4 x $500) = $120 – $200 = -$80

The trader has a negative expectancy.

Positive expectancy trading

Positive expectancy trading represents the positive number of dollars that implies how much money a trader can expect to win for every dollar he risks. Conversely, negative expectancy means the number of dollars that indicates how much a trader can expect to lose for every dollar he risks.

Having a money management algorithm helps increase your ability to set trading strategies. Two main parts of this money management include expectancy and risk. Expectancy in forex trading means the average expected amount you would gain or lose for a trade. Thus, it is a kind of risk-to-reward ratio.

After implementing this, you will have a better outlook on the market. We understand that this topic can be a little heavy and that taking time to comprehend the information is alright. Eventually, with practice, you would ace it with ease. Of course, to trade forex, you also need to have basic knowledge of probability concepts, but that’s all we promise!

As stated earlier, experience, in general terms, means how much you expect to earn for the risk you are willing to take in a trade. For example, if you take the risk of $1 and make $2, your expectancy is twice. Now, if you are expecting to earn $0.60, your experience would be 0.6 times that of your risk. Now, if you lose $0.50, your expectancy would be -0.5. Remember that any expectancy above 0 is profit, and below is a loss.

You can also calculate your expectancy rate by adding your average risk or reward for a trading series. However, it is better to understand the concept of R multiples before getting into such complexities.

Expectancy Ratio Formula Example

300 trades

100 winning trades: 33.33% winning trades

200 losing trades: 66.66% losing trades

Risk reward: $400 average winning trade/ $100 average losing trade = 4

Now, we can calculate the expectancy ratio:

(Reward to Risk ratio x win ratio) – Loss ratio = Expectancy Ratio

4 * 0.3333 – 0.6666 = 0.66

What is a Good Trading Expectancy?

Reasonable trading expectancy represents any positive expectancy ratio above 0.25. If you risk $100, you expect to earn $25 profit (0.25 * $100 = $25). Usually, traders consider that 0.25 R, where R is risk in dollars, is a reasonable trading expectancy in live trading.

Usually, traders consider that 0.25 R, where R is risk in dollars, is a good trading expectancy in live trading. If you risk $100, you can expect to earn at least $25 in profit on average.

While there is no guarantee that you will always earn this profit, having a positive expectancy is essential to being a successful trader. It shows that your method has the edge over the market and gives you a better chance of making money in the long run.

So, what factors can affect your trading expectancy? Here are just a few:

· The amount you risk per trade

· The size of your stop loss and take profit orders

· The volatility of the markets

· Your winning percentage

· The average size of your winning trades

· The average size of your losing trades

· The type of markets you trade

· Your emotional state

What are R Multiples?

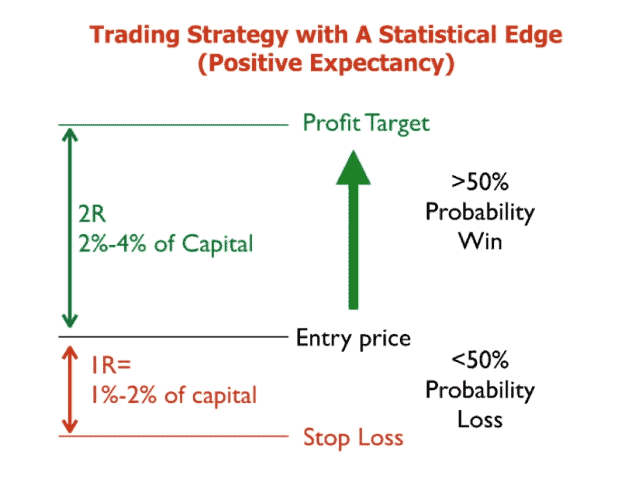

R multiples are the way that helps in deciding the initial level of risk for trade in terms of risk or reward. For example, if you have 40 pips, stop loss in the forex market, and have the risk of $5 pips, if the situations turn opposite you, you will lose $200. This $200 is the initial loss, also known as 1R risk. R stands for risk here.

We can define the risk using R, like 1R, 2R, etc., instead of pips or dollars. For example, if you are taking a trade worth $50 gain and $25 loss, you would double the risk you take, which would be 2R. But if you lose $25, you would lose 1R.

Traders implementing R multiples generally say, “I earned 3R yesterday and lost 1R today.” “This trade has the potential of 4R.”

Calculating the Expectancy Formula in Trading

You know R multiples, so let’s explore the expectancy formula. There are two main steps.

- Add the total R values of your total traded.

- Divide the total by the number of trades you have made.

Following is the expectancy formula:

Expectancy = Total R / Number of Trades

Let us take an example. If you have taken 20 traded in total and have made 40R in total, according to the equation,

40R / 20 = 2

You have an expectancy of 2 here.

Money Management and Entry/Exit Points

A trader can develop his money management tool to decide when to enter and exit the trade. You can also establish these rules without considering your entry or exit points. The following illustrates this.

- The entry and exit strategy can generate average R multiples with time.

- A money management or position sizing approach can be applied to the entry and exit strategy.

Your trading performance would depend on your total performance minus your trading mistakes. Let us simplify this with an example.

Van Tharp says 90 percent of the variance in any professional trader’s performance depends on position sizing. Of course, these are all variations, but the basics are the same.

- Each marble pulled out from the bag is denoted as a trade-in R multiple, like you may gain 5R or lose 1R.

- Each person has the same starting capital mount, and you must take a particular risk to pull a marble from the bag.

- Real money is involved in each game, is up to $1200 at a certain point.

- Each stimulation has at least around 30 pulls and up to 27 participants in each game. Everyone has the same trade. As a result, the system has more losing trades and a few large winning trades.

In this case, each marble pulled from the bag is called a trade. That is your entry and exit. The only control you have here is your position size.

After the end of each game, everyone has different equity, and the variations between that are also huge, ranging from being bankrupt to a million-dollar profit.

This marble bag game states the importance of position sizing and its application over the entry and exit points.

Money Management and Risk

If you want to trade and apply money management, you have to take a risk. Your return will be exactly what you assume the risk for. After understanding the expectancy rates and R multiples, the next big decision you should make is position sizing. That’s why some investors are happy with their ten or fifteen percent a year returns, while some traders prefer making millions from their twenty to thirty thousand.

Ultimately, you should trade according to your preferences and choose your trade position according to the risk you are willing to take.

Conclusion

The expectancy rate concept is a little complicated but is a crucial decision-making component that helps you manage your risk and return. Take your time and start with 1R risk; you can permanently alter it as you learn the efficiency.

This article has taught us various things, including the R multiples, calculating the expectancy rates, managing money over the entry and exit points, and the nature of risk. You can develop your money management approach and build a consistent trading career by taking baby steps. All the best!