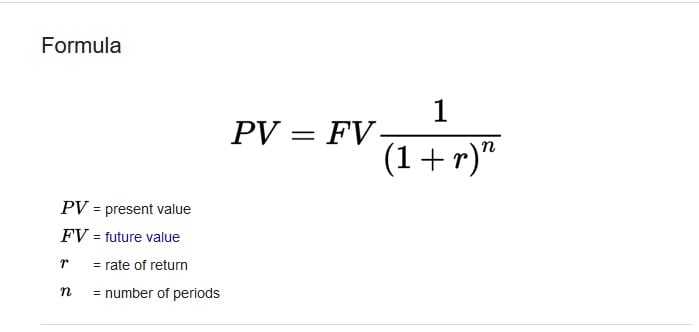

The present value formula is a financial calculation that helps investors determine the value of an investment in today’s dollars. This formula considers several factors, including the amount of money invested, the rate of return on that investment, and how long it will take to receive that return.

Using the present value formula would help if you first determined your expected return rate. This can be done by looking at historical market trends or consulting with an investment advisor. Once you have calculated your rate of return, you can plug this figure into the present value formula along with the total amount of money you are investing and the length of time you expect to receive that return.

Many different factors go into determining whether or not an investment is worth making using the present value formula. However, this calculation is essential for investors as they decide where to allocate their capital and how much risk they will take on when investing their money.

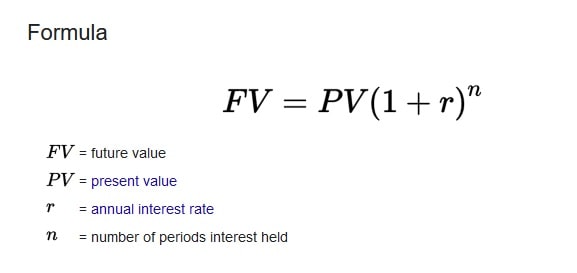

Future Value formula

The future value formula is a mathematical equation that is used to calculate the final value of an investment or asset given its current importance and rate of growth over time. This formula can help investors determine the best ways to invest their money to achieve maximum returns and give them a sense of how much they can expect to gain or lose over time.

There are several key components to the future value formula, including the initial investment amount, the rate of growth or interest, and the period over which this growth will occur. To calculate the future value using this formula, one must first determine these values, then use mathematical operations such as addition or subtraction to derive their final result.

While there may be other factors that can impact the future value of an investment, such as market conditions or inflation rates, understanding and applying the basic principles of the future value formula is essential for anyone looking to make informed financial decisions and investments.

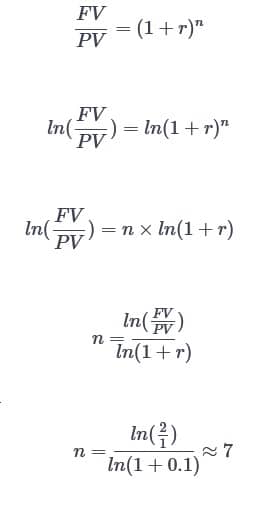

How to Find n in Present Value Formula?

To find n in the present value formula or to find n in the future value formula, we will apply the same algorithm where the main point is to use the natural logarithm.

Finding The Number of Time Periods

Solve for n in the present value formula and future value formula:

The formula below will solve the number of periods used to calculate the length of time required for a single cash flow (present value) to reach a certain amount (future value) based on the time value of money.

The actual time value of money is a primary thing in the financial concept. In this theory, the money you have at present is far more critical than the amount you will receive in the future. This is a practical and very accurate process. The money you have in your hands at present can be invested in something to earn a return. This investment may give you a lot of money in the future. So, the actual time value of money is very much significant. It is sometimes called the present net value of the capital.

Find n in the present value formula example:

Let’s check this simple example, which will show you the actual time value of the money. For example, someone is offering you or paying you for your work in two ways: they will pay you $1000 or $1100 one year from now. You will have to decide which option is suitable for you. It always depends on the type of investment return that you will earn from that money in the present situation. You will have to solve for the number of periods PV and FV. $1100 is 110% of $1000. So, you may earn more than a 10% return from investing next year. In this way, you may now decide to take the money of $1000. But if you think in another way, you may not earn more than 9% interest in the upcoming year by investing the money. So, you decide to take the amount of future payment of $1100.

Formulas for time value for money:

The time value is an important decision. It is not essential for the individual but also the business industrialists. Companies also calculate the time value for money to invest in a new product and acquire new business policies. You can use this simple formula to calculate the future value amount of the money.

FV = PV*[1+(i/n)] (n*t)

Here, PV’ is the present value, and FV’ is the future value amount. The interest rate and the other return based on the invested money are recognized as i’. The consecutive number of years you will consider is controlled by it. Last, n’ represents the consecutive number of periods of interest per year.

This particular formula also uses to figure out the present amount of value of the money you will receive in the future. You will have to divide the future value to get the calculation rather than multiplying the present value. This is very much helpful in getting the different values of both future and present amounts.

While calculating the future amount of value or FV, you calculate precisely how much a given amount of money will be worth in the future. But if you want to calculate the future value, you should know the other three essential variables: present value, number of periods, and interest rates. The calculation is very much straightforward. It is not at all complex. You can do it by yourself. You will have to know the basic details, and then you can go for it.