Table of Contents

The EURNZD is one volatile forex currency pair. The EURNZD represents the currency pair symbol, the shortened term for the European euro against the New Zealand dollar pair or cross for the European euro (EUR) and the New Zealand dollar (NZD) currencies. The currency pair EURNZD indicates how many New Zealand dollars (the quote currency) are needed to purchase one European euro (the base currency).

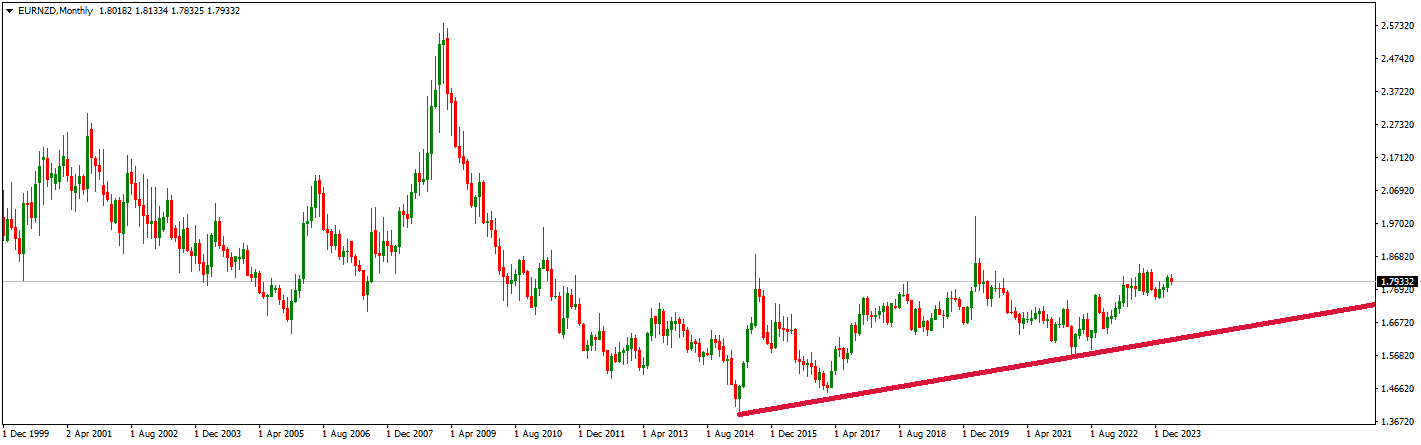

EURNZD Live Chart

Below is the EURNZD live chart:

TRADINGVIEW PRO AD-FREE CHARTS

EURNZD price has risen for the last 7 years from 1.39 to 1.97. See the screenshot below:

EURNZD Fundamental Analysis and Forecast

To deeply analyze the rising EUR/NZD exchange rate, we must dive into the specific economic data provided for both the Eurozone and New Zealand. These data points include GDP growth, interest rates, inflation rates, trade balances, and other economic indicators, which can provide insights into the factors driving the exchange rate movements.

Economic Data Comparison

GDP Growth

- Eurozone: Experienced modest GDP growth rates of 2.3% in 2017, 2% in 2016, and 2.3% in 2015.

- New Zealand: Reported slightly higher GDP growth rates of 2.22% in 2019, 3.22% in 2018, and 3.8% in 2017.

Analysis: New Zealand has shown more robust GDP growth in recent years than the Eurozone. Higher economic growth rates can increase investor confidence in a country’s currency, contributing to the NZD’s strength against the EUR.

Interest Rates and Monetary Policy

- Eurozone: The European Central Bank has implemented negative interest rates and bond-buying programs to stimulate the economy.

- New Zealand: Historically, higher interest rates in the OECD have attracted international capital inflows, although specific current rates aren’t provided in the data.

Analysis: Higher interest rates in New Zealand make NZD-denominated assets more attractive, supporting the NZD’s value against the EUR. In contrast, the ECB’s accommodative policy reduces the yield on Euro-denominated assets.

Inflation Rates

- Eurozone: Inflation rates were relatively low at 1.1% in 2019, 1.7% in 2018, and 1.5% in 2017.

- New Zealand: Inflation rates were slightly higher, at 1.6% in 2019, 1.5% in 2018, and 1.8% in 2017.

Analysis: New Zealand’s inflation is marginally higher, suggesting more vigorous domestic economic activity than the Eurozone, which has struggled to raise inflation to target levels. This can also support the strength of the NZD.

Trade Balances

- Eurozone: The region reported a large current account surplus of $404.9 billion in 2017 and $359.7 billion in 2016.

- New Zealand: It faced a current account deficit, with—$6.962 billion in 2019 and—$8.742 billion in 2018.

Analysis: Typically, a current account surplus strengthens a currency due to higher foreign capital inflows. However, the euro’s limited response might be overshadowed by other factors, such as overall economic performance and investor sentiment towards the broader EU stability.

Fiscal Health

- Eurozone: High public debt levels with 86.8% of GDP in 2014.

- New Zealand: Lower public debt at 31.7% of GDP in 2017.

Analysis: New Zealand’s relatively lower public debt levels contribute to its economic stability and currency attractiveness.

External Debt

- Eurozone: Extremely high external debt at around $29 trillion.

- New Zealand: Much lower external debt at approximately $190 billion.

Analysis: Lower external debt in New Zealand implies less vulnerability to external shocks, enhancing NZD’s appeal.