A forex pair, also known as a currency pair, represents the quotation of two different currencies, with the value of one currency being quoted against the other. The first currency listed is the base currency, which is the currency bought or sold. The second currency listed is the quote currency, and it represents how much of the quote currency is needed to purchase one unit of the base currency. By comparing these two, traders can speculate on the strength and movements of one currency relative to the other, which forms the basis of the forex trading market.

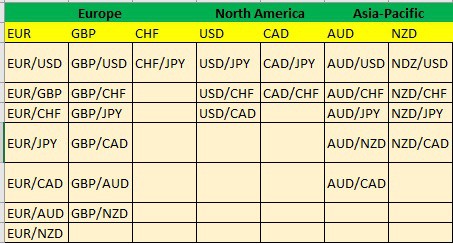

28 Major Forex Pairs List

The 28 major forex pairs are combinations of the seven key currencies: EUR, GBP, CHF, USD, CAD, AUD, and NZD. They are formed by pairing each currency with all the others, resulting in a comprehensive matrix representing the most traded pairs in the forex market.

- EUR/USD: The Euro paired with the U.S. Dollar represents the two large global economies that are widely traded.

- GBP/USD: The British Pound paired with the U.S. Dollar, known as “Cable,” is marked by its high liquidity.

- CHF/JPY: The Swiss Franc paired with the Japanese Yen, a cross-rate representing two safe-haven currencies.

- USD/JPY: The U.S. Dollar is paired with the Japanese Yen, a significant, heavily traded pair, especially in Asia.

- CAD/JPY: The Canadian Dollar pairs with the Japanese Yen, which is often influenced by commodity prices such as oil.

- AUD/USD: The Australian Dollar is paired with the U.S. Dollar, which frequently reflects changes in commodity markets.

- NDZ/USD: It seems to be a typo; it should be “NZD/USD,” which is the New Zealand dollar paired with the U.S. dollar, known for its relation to dairy commodity prices.

- EUR/GBP: The Euro paired with the British Pound, reflecting the economic interplay between the Eurozone and the U.K.

- GBP/CHF: The British Pound is paired with the Swiss Franc, which is often seen as a gauge for European stability.

- USD/CHF: The U.S. dollar is paired with the Swiss dollar, another pair where the Swiss dollar is considered a haven.

- CAD/CHF: The Canadian Dollar paired with the Swiss Franc, mixing a commodity-driven economy with a safe-haven one.

- AUD/CHF: The Australian Dollar paired with the Swiss Franc, combining commodity exposure with a safe-haven currency.

- NZD/CHF: The New Zealand Dollar pairs with the Swiss Franc, which is often affected by global risk sentiment and dairy prices.

- EUR/CHF: The Euro pairs with the Swiss Franc, which is closely watched for interventions by the Swiss National Bank.

- GBP/JPY: The British Pound pairs with the Japanese Yen, which is known for its volatility and nicknamed “the Dragon.”

- USD/CAD: The U.S. Dollar is paired with the Canadian Dollar, often called “Loonie,” and influenced by oil prices.

- AUD/JPY: The Australian Dollar is paired with the Japanese Yen, a famous currency in the carry trade.

- NZD/JPY: The New Zealand Dollar paired with the Japanese Yen, another carry trade pair with ties to commodity prices.

- AUD/NZD: The Australian Dollar, paired with the New Zealand Dollar, is often traded based on regional economic differences.

- NZD/CAD: The New Zealand Dollar paired with the Canadian Dollar, a minor cross pair influenced by commodity prices.

- AUD/CAD: The Australian Dollar is paired with the Canadian Dollar, a significant commodity currency pair.

- EUR/JPY: The Euro paired with the Japanese Yen, a widely traded cross that serves as a barometer for global risk.

- GBP/CAD: The British Pound paired with the Canadian Dollar, offering insights into U.K. and Canadian trade relations.

- EUR/CAD: The Euro paired with the Canadian Dollar, a cross-rate combining European and North American economic signals.

- EUR/AUD: The Euro paired with the Australian Dollar, reflecting the economic dynamics between Europe and Australia.

- GBP/AUD: The British Pound paired with the Australian Dollar, a pair sensitive to global trade and finance changes.

- GBP/NZD: The British Pound is paired with the New Zealand Dollar, which is known for its significant price movements.

- EUR/NZD: The Euro paired with the New Zealand Dollar, representing a mix of the Eurozone and the South Pacific economies.

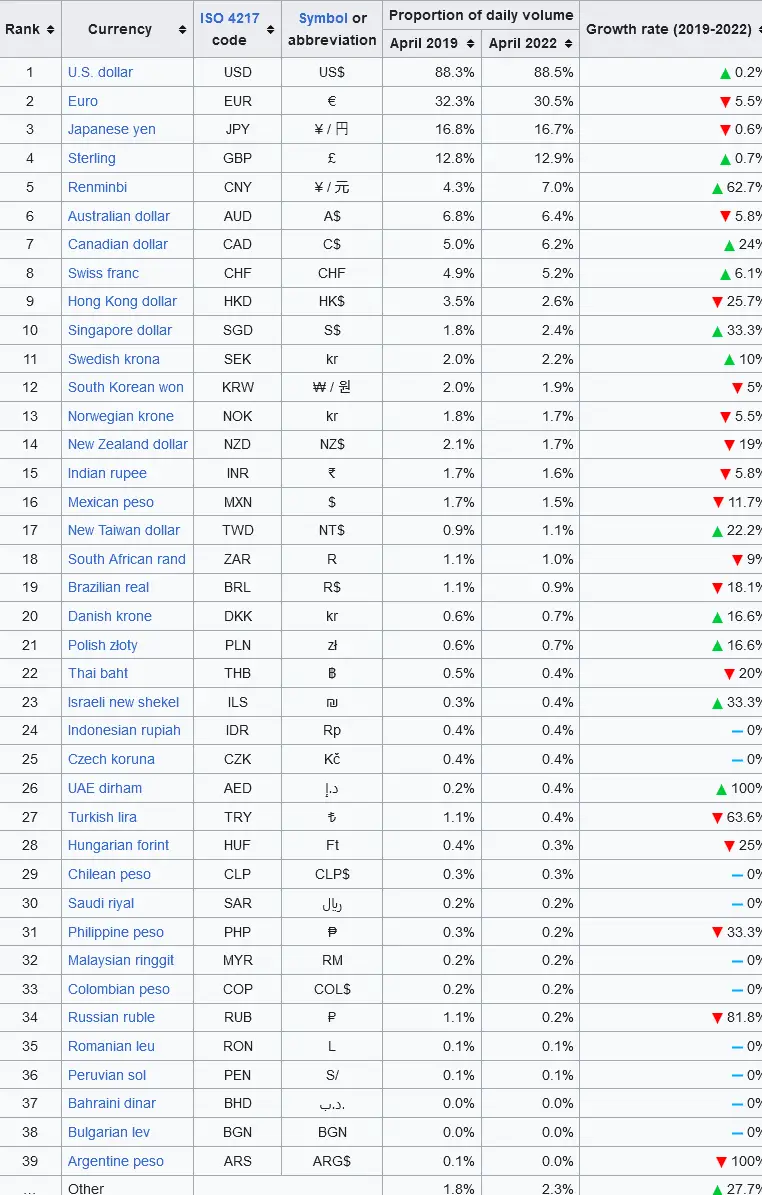

The economies of the EUR (Eurozone), GBP (United Kingdom), CHF (Switzerland), USD (United States), CAD (Canada), AUD (Australia), and NZD (New Zealand) are among the most stable and liquid globally. They have large-scale foreign exchange reserves and significant international trade flows. The Eurozone, the U.S., and the U.K. are major economic powers with extensive financial markets that contribute to a substantial volume of daily forex transactions.

The Swiss Franc is considered a safe-haven currency due to Switzerland’s stable political system and strong financial policies, which influence forex during times of global economic uncertainty. The Canadian, Australian, and New Zealand dollars are known as commodity currencies, as their values are closely tied to their countries’ abundant natural resources. This affects the forex market as commodity prices fluctuate.

These currencies are associated with countries with strong governance, low inflation, and consistent policies, making them attractive for forex traders. Therefore, due to their economic significance, financial stability, and governance, these seven currencies significantly impact the forex market, often setting trends and serving as benchmarks for global economic health.