Table of Contents

Over the past five years, the price of silver has exhibited a notable upward trajectory, reflecting a bullish trend in the commodities market. This increase can be attributed to a complex interplay of global economic shifts, monetary policy changes, and evolving industrial demands.

Silver has become a safe-haven asset among investors, especially during financial uncertainty and inflationary pressures. The rise in silver prices also mirrors trends in other precious metals, often moving in tandem with gold as an alternative investment choice. Additionally, the growing industrial applications of silver, particularly in areas like renewable energy and electronics, have further fueled its demand and contributed to its price ascent.

2024 Silver Price Forecast

The silver price forecast shows the possibility of going above $36 at the end of 2024. The 10-year silver price forecast offers the chance to go above $290 in the next ten years. Silver price projections are based on interest rates, technical analysis, and supply and demand projections.

Silver price prediction for the next 5 years: expect to see silver price above $100 based on the central Wall Street projections (see following chapters).

Like other commodities, silver prices are influenced by various factors, including supply and demand dynamics, global economic conditions, monetary policy, and investor sentiment.

- Supply and Demand: If the supply of silver has been constrained due to mining issues or geopolitical factors while demand has remained steady or increased (e.g., for industrial uses, jewelry, or investment), this would support higher prices.

- Economic Conditions: Economic growth can increase silver demand, especially in the electronics and solar energy industries. Conversely, economic downturns can boost silver prices if investors consider it a safe-haven asset.

- Monetary Policy: Loose monetary policies, like low interest rates and quantitative easing, often lead to bullish trends in precious metals. This is because they weaken the currency and drive investment towards assets like silver.

- Investor Sentiment: If investors anticipate inflation or seek to diversify their portfolios away from traditional assets like stocks and bonds, they may increase their holdings in silver, driving up its price.

Is the Price of Silver Going Up?

Yes, the silver price is going up because of the following factors:

- The recession is coming, and stocks are declining.

- Inflation is rising

- There is a substantial silver demand. Silver will be critical to the solar power generation market over the next ten years.

- Technical analysis shows a bullish pattern on daily, weekly, and monthly charts.

Wall Street Silver Price Prediction

The analysis and predictions of silver prices by Wall Street and central banks for 2024 and beyond vary widely, reflecting different perspectives on market dynamics, economic factors, and industrial demand. Here are some key predictions:

These predictions reflect a range of factors, including industrial demand, especially from the solar and automotive sectors, macroeconomic policies, particularly those of the Federal Reserve, and broader market dynamics, such as investor sentiment and the gold-silver ratio. It is important to note that these predictions are speculative and influenced by a rapidly changing economic environment.

Analysts’ and sources’ predictions for silver prices in 2024 vary significantly, reflecting a range of economic expectations and market conditions.

- InvestingHaven.com forecasts a bullish scenario with silver prices reaching between $34.70 and $48.00 by mid-2024 to mid-2025. This optimistic outlook is driven by anticipated increases in demand and favorable economic conditions? (GoldSilver).

- JP Morgan and Commerzbank predict silver prices to hit around $30 per ounce by the end of 2024. They cite factors such as the Federal Reserve’s potential rate cuts and a weaker US dollar as critical drivers for this price increase? (GoldSilver)?? (INN).

- Keith Neumeyer, CEO of First Majestic Silver, maintains a bullish long-term view, suggesting that silver could eventually reach $100 or more per ounce. However, this prediction is more speculative and based on historical market cycles and anticipated corrections? (INN).

- Heraeus Precious Metals offers a more conservative estimate, projecting silver prices to range between $22 and $29 per ounce in 2024. This forecast is based on supply constraints, rising industrial demand, particularly from the photovoltaic sector, and the impact of US monetary policy? (GoldSilver).

- Kitco News highlights that constrained supply, rising demand, and a weaker US dollar could push silver prices higher than expected. They suggest that economic conditions and geopolitical events will significantly determine the market trajectory? (Kitco).

Silver fundamental analysis – Interest rate and inflation

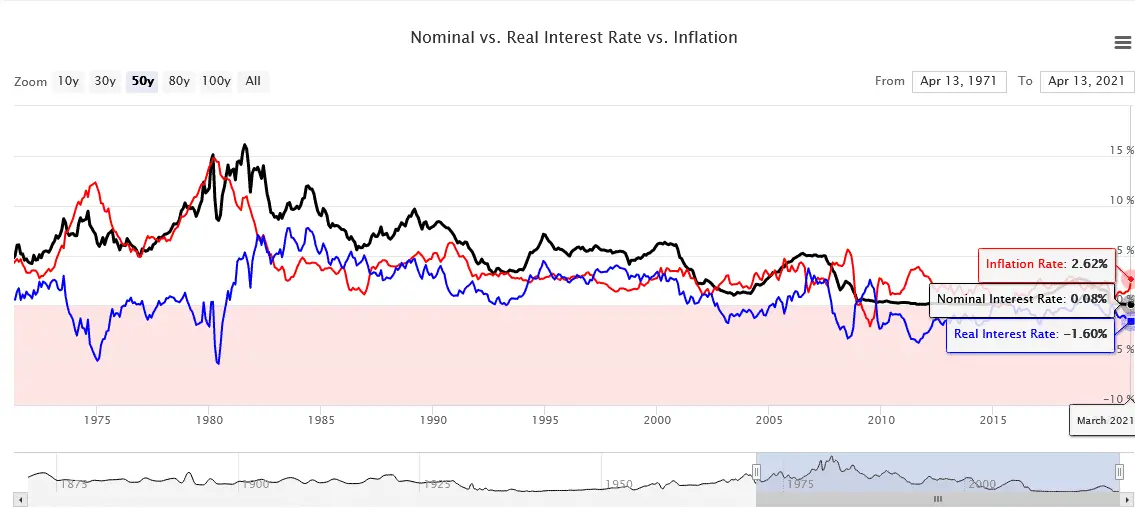

While inflation is rising and accurate, exciting rates are falling. Silver increases as more investors see precious metals as a better investment opportunity than bonds.

An interest rate is a percentage charged on the total amount you borrow or save. The nominal interest rate refers to the interest rate before considering inflation. Inflation is the rate at which the value of a currency is falling, and consequently, the general level of prices for goods and services is rising. The real interest rate is calculated as the difference between the nominal and inflation rates.

Silver and Green initiative

Silver represents raw material for photovoltaic (PV) cells, solar panels’ building blocks, and leading clean-energy technology. As a result, silver will be critical to the solar power generation market over the next ten years and essential in renewable energy production.

The Silver and Green initiative, focusing on the role of silver in renewable energy, particularly in solar power generation, can be detailed as follows:

- Key Component in Photovoltaic (PV) Cells:

- Silver is a vital component in manufacturing photovoltaic (PV) cells, the primary building blocks of solar panels.

- The metal’s excellent electrical conductivity makes it ideal for use in PV cells, which helps efficiently convert solar energy into electrical energy.

- Increasing Demand in the Solar Energy Sector:

- The demand for solar panels is rapidly increasing as the global focus shifts towards clean and renewable energy sources.

- This surge in solar energy adoption directly translates to a higher demand for silver, given its crucial role in solar panel production.

- Silver’s Role in Efficiency Improvement:

- Advances in solar technology often involve enhancing the efficiency of PV cells, where silver plays a significant role.

- Silver’s properties can significantly improve the efficiency of solar panels, making solar power a more viable and effective energy source.

- Impact on Silver Market and Prices:

- The growing solar industry is expected to impact the silver market significantly.

- As the demand for silver in solar panel production increases, this could lead to higher silver prices due to increased demand against limited supply pressures.

- Environmental and Economic Implications:

- Silver in solar energy contributes to environmental sustainability by promoting clean energy production.

- Economically, this creates a symbiotic relationship between the silver mining industry and the renewable energy sector, potentially leading to job creation and economic growth.

- Future Outlook:

- Over the next decade, silver’s role in the solar power generation market is anticipated to be substantial.

- As countries and companies invest more in renewable energy infrastructure, silver’s importance in this sector is expected to grow, marking it as a critical component in the transition to greener energy solutions.

Silver long-term technical analysis

In the last 50 years, silver has been on a moderate rising trend. Analyzing the chart from the previous 50 years shows the cup and handle pattern that projects a solid bullish trend. After a stable, rising trend during the 2008 crisis, the price is trying to break the historical maximum.

Silver Market Volatility

In general, ascertaining any asset’s price requires a lot of analysis; still, the answer is never absolutely accurate. Given the current crises, this has become an even more unpredictable task. In addition to the global pandemic, other factors can also influence the price of an asset. For example, the US presidential elections in 2020 made the financial market highly volatile, especially the value of the USD. Secondly, the COVID-19 cases are not flatlining globally, adding to economic anxiety and making economic recovery seem like a slow and distant dream. Many countries keep enforcing strict lockdowns as well.

Several critical historical events and factors can characterize silver market volatility:

- Hunt Brothers’ Attempt to Corner the Market (1980): The Hunt Brothers’ attempt to corner the silver market led to a massive spike in silver prices, reaching an all-time high of over $50 per ounce. A dramatic crash followed as regulatory measures were introduced, and the market corrected itself.

- Global Financial Crisis (2008): Silver prices significantly fluctuated during the 2008 financial crisis. Initially, they fell sharply alongside other commodities but later surged as investors sought safe-haven assets.

- Economic Uncertainty and Safe-Haven Demand: Silver, like gold, is often seen as a safe-haven asset. In times of economic uncertainty, geopolitical tensions, or inflation fears, demand for silver can spike, leading to price volatility.

- Industrial Demand Fluctuations: Silver’s extensive industrial uses, particularly in electronics and solar panels, mean that changes in industrial demand can significantly affect its price. Economic cycles and technological advancements can lead to variable demand.

- Changes in Mining Output: The quantity of silver mined can impact its price. For instance, if major silver-producing countries face mining disruptions, it can lead to reduced supply and higher prices.

- Speculative Trading: Silver is heavily traded on commodity markets, and speculative trading can lead to price volatility. Futures and options markets, where traders bet on future price movements, can exaggerate price swings.

- Monetary Policy and Currency Movements: Silver prices are also influenced by monetary policies, such as interest rate changes and quantitative easing, and fluctuations in currency values, particularly the US dollar.

These economic and political uncertainties hint that investors will continue to invest in precious metals like gold and silver, which are often seen as global currencies. This means that silver prices will continue to enjoy support from buyers.

Another aspect that needs to be highlighted is silver as both a precious and industrial metal. The economies have started to open up gradually, and while still slow, industrial activities are gaining momentum. Naturally, this will increase volatility in the silver market. However, this can also mean that while the prices may not see a sudden plunge this year, silver can be limited availability for industrial purposes as people are buying it for theiHavenen.

Conclusion

The silver market’s historical volatility is a testament to its sensitivity to various economic, industrial, and geopolitical factors. In recent years, rising industrial demand, especially from the renewable energy sector, and its status as a safe-haven asset have been key drivers of its price.

Looking ahead, projections for silver prices in 2023 and beyond show a wide range of estimates, reflecting uncertainty and differing views on economic trends and industrial demand. While some analysts foresee significant price increases due to declining mine supply and increasing industrial usage, others remain cautious, highlighting potential economic headwinds and market dynamics. This blend of bullish and bearish outlooks underscores silver market predictions’ complex and speculative nature.