Table of Contents

EURCHF is a rarely traded currency pair because many traders experience slow price movements. However, mean reversion strategies can be applied to this currency pair, which can be interesting for trading in the euro session.

The EURCHF represents the currency pair symbol, the shortened term for the European euro against the Swiss franc pair or cross for the European euro (EUR) and the Swiss franc (CHF) currencies. The currency pair EURCHF indicates how many Swiss francs (the quote currency) are needed to purchase one European euro (the base currency).

EURCHF Live Chart

Below is the EURCHF live chart:

TRADINGVIEW PRO AD-FREE CHARTS

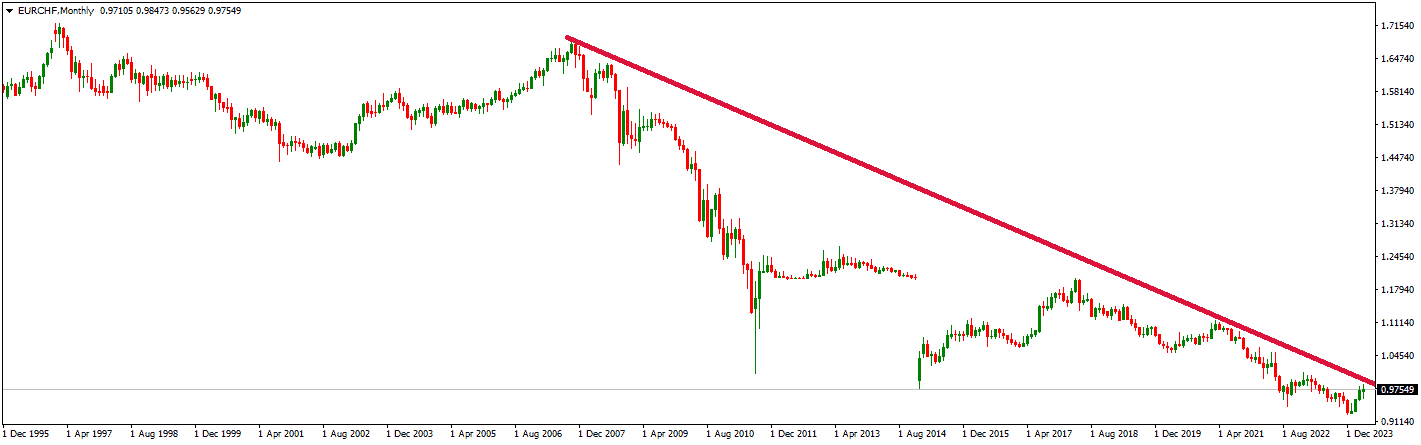

If we analyze the monthly chart, we can see a bearish trend in the last 17 years. EURCHF’s price range in the last 17 years is from 1.69 to 0.925 in bearish mode. In the next month the price can reach 0.9.

EURCHF Fundamental Analysis

Compared to the European Union (EU), the Swiss economy shows distinct characteristics that contribute to its perceived strength and stability. These differences help explain why the EUR/CHF exchange rate might trend downwards, favoring the Swiss franc over the euro.

Swiss Economy vs. EU Economy

1. Economic Structure and Stability:

- Switzerland: Switzerland boasts a highly developed service sector led by financial services and a manufacturing industry specializing in high-technology and knowledge-based production. Switzerland’s political and economic stability, transparent legal system, exceptional infrastructure, efficient capital markets, and low corporate tax rates contribute significantly to its competitiveness.

- European Union: The EU, a union of 27 member states, faces diverse economic conditions and challenges. The varying per capita income and differing national policies on inflation, debt, and foreign trade create a less uniform economic landscape. High unemployment in some member states, high public and private debt levels, and an aging population significantly drag growth.

2. Monetary Policy:

- Switzerland: The Swiss National Bank (SNB) has maintained a low to zero interest rate policy and has actively intervened in currency markets to prevent the Swiss franc from appreciating too intensely, which could harm export competitiveness.

- European Union: The European Central Bank (ECB) has also engaged in extensive monetary easing, including negative interest rates and bond-buying programs. However, these measures have been necessary to manage more significant economic disparities and crises within the eurozone, such as the sovereign debt crisis.

3. Fiscal Health:

- Switzerland: Compared to the EU, Switzerland has a lower public debt-to-GDP ratio (41.8% in 2017). It has also achieved a budget surplus, reflecting stronger fiscal discipline and economic management.

- European Union: The EU has struggled with higher debt levels in many member states and has faced challenges in maintaining fiscal unity across its diverse economies.

4. External Trade and Investment:

- Switzerland: Despite not being an EU member, Switzerland has closely aligned its regulations with the EU to access the single market effectively. Its economy is also less vulnerable to EU political uncertainties.

- European Union: The EU’s trade and investment are impacted by internal regulations and external relationships, which can be complex given its size and political structure. Brexit has also introduced significant uncertainty and potential economic fragmentation.

5. Currency Strength and Investment Flows:

- Switzerland: The Swiss franc is often viewed as a “haven” currency, attracting capital during global or regional uncertainty. This perception and Switzerland’s economic policies support the franc’s strength.

- European Union: The euro, while a primary global currency, is affected by the economic disparities and political dynamics within the EU, which can lead to fluctuations and sometimes weaken it relative to the Swiss franc.

Why EUR/CHF is in a Downward Movement

The downward trend of EUR/CHF can be attributed primarily to the relative strength and stability of the Swiss economy and its currency. Investors tend to prefer the Swiss franc during times of uncertainty in the eurozone or broader global economic stresses. Moreover, Switzerland’s consistent economic policies, lower debt levels, and the proactive measures of the SNB to manage the franc’s value make it an attractive investment compared to the euro, which is sometimes seen as exposed to various economic and political risks across the EU.

In conclusion, the Swiss economy’s robustness and prudent fiscal and monetary policies make it generally more stable and appealing to investors than the EU’s economy, which is more heterogeneous and exposed to various internal and external pressures. This stability and attractiveness contribute to the Swiss franc’s strength against the euro.