Roth IRAs are a popular investment vehicle for individuals looking to save for retirement. Not only do they offer tax-free growth and withdrawals in retirement, but they also provide flexibility in contributions and distributions. However, as with any investment, there is always the risk of losses.

Are Roth IRA Losses Tax Deductible?

No, Roth IRA Losses are not tax deductible because contributions to a Roth IRA account are made with after-tax dollars. This means that the money contributed to a Roth IRA has already been taxed, so losses in the account do not result in a tax deduction.

Unlike traditional IRAs, which allow for tax-deductible contributions, Roth IRAs are funded with after-tax dollars. This means that the account holder does not receive a tax deduction for contributions made to the account. However, the benefit of a Roth IRA is that any qualified withdrawals, including gains, are tax-free.

When a Roth IRA account experiences losses, those losses cannot be deducted from the account holder’s income for tax purposes. This is because the money contributed to the account has already been taxed, so there is no additional tax benefit to deduct losses.

It’s important to note that losses in a Roth IRA account can still impact the holder’s overall investment strategy and long-term financial goals. Therefore, it’s essential to carefully monitor and manage the investments in a Roth IRA carefully minimize losses and maximize potential gains over time.

The Internal Revenue Service (IRS) does not allow investors to deduct losses from their Roth IRA accounts year-to-year. If your RotTherefore, ifIRA account incurs losses in a particular year; you cannot deduct those losses on that year’s tax return. This is because Roth IRA contributions are made with after-tax dollars, meaning any losses incurred are considered nondeductible personal losses.

However, this does not mean no options are available for Roth IRA investors who have suffered losses. If an investor decides to close their Roth IRA account, they can deduct the losses to the extent that they exceed the sum of their contributions to the account. For example, if an investor has contributed $50,000 to their Roth IRA over the years and their account has lost $70,000, they can deduct up to $20,000 in losses when they close the account.

However, it is essential to note that this deduction is subject to certain limitations. For one, the losses can only be deducted once the account is closed. Additionally, the deduction is limited to the investor’s tax basis in the account, which includes only the contributions made to the account and not the earnings on those contributions. Furthermore, the amount of losses that can be deducted is also subject to a cap of $3,000 per year for individuals and $1,500 for married couples filing separately.

So, while Roth IRA losses are not tax-deductible year-to-year, options are still available for investors who have suffered losses. Closing the account and deducting losses beyond the sum of contributions is one of those options, but it is essential to be aware of the limitations and restrictions involved. Roth IRA investors should also work closely with their financial advisors to develop an investment strategy considering their risk tolerance, financial goals, and tax implications.

Some strategies can help manage losses in a Roth IRA account, such as:

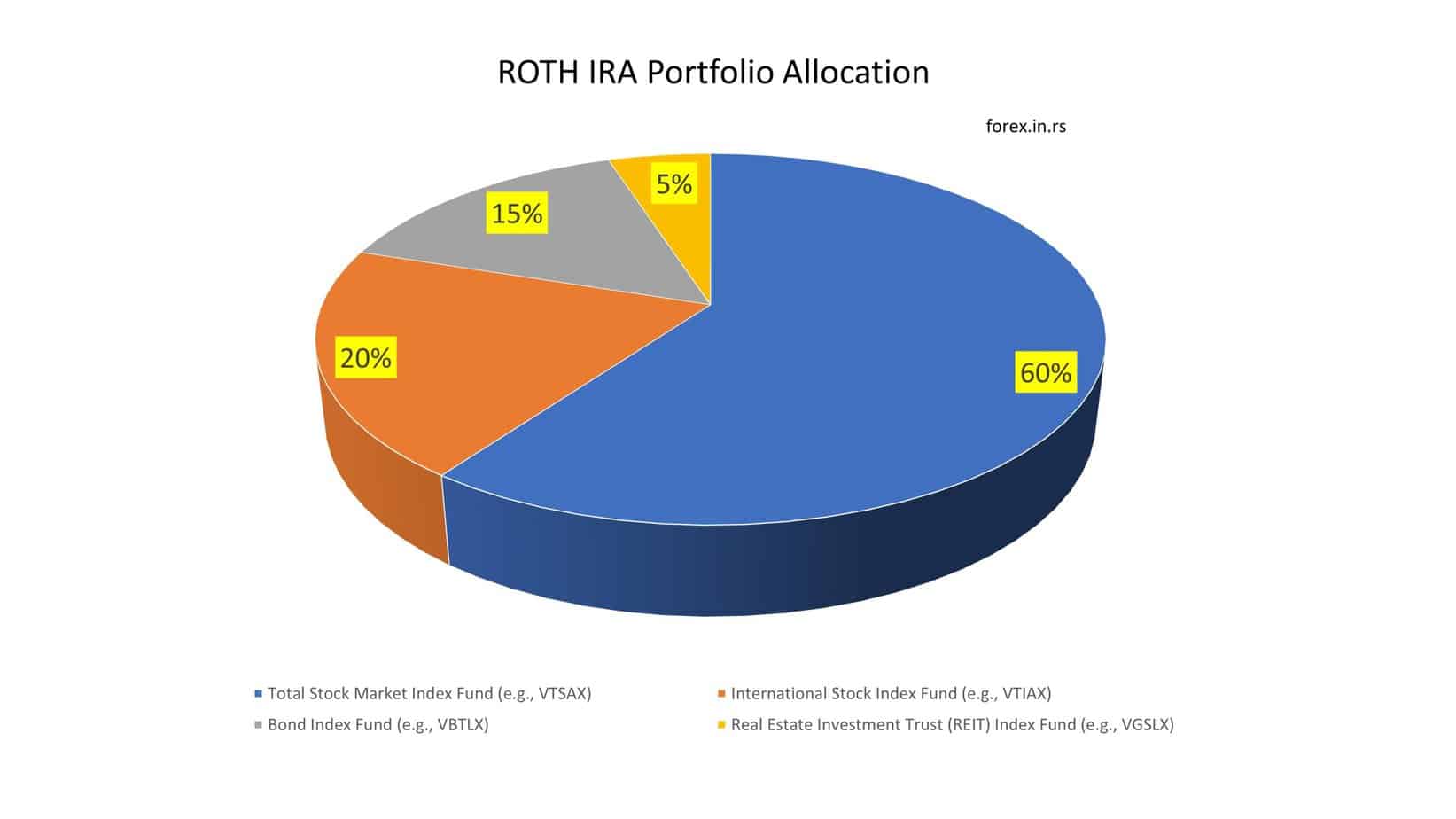

- Diversifying your investments: By spreading your investments across a mix of different asset classes, you can reduce the risk of losses in any one area. This can help mitigate the impact of losses in one investment on your overall portfolio.

- Regularly reviewing and rebalancing your portfolio: By periodically rebalancing your portfolio, you can ensure that it remains aligned with your investment goals and risk tolerance. This can help you avoid too much risk and potentially minimize losses.

- Considering tax-loss harvesting: While losses in a Roth IRA account are not tax-deductible, you may use a tax-loss harvesting strategy in a taxable account to offset gains or reduce your taxable income. This involves selling investments that have declined in value and using the losses to offset gains elsewhere in your portfolio.

It’s important to remember that investing always carries some risk, and losses are an inherent possibility. The key is to manage your investments carefully and take a long-term approach to your portfolio. If you’re uncertain about managing your Roth IRA account or minimizing losses, consider speaking with a financial advisor or tax professional for guidance.

In conclusion, while Roth IRA losses may not be deductible in the same way as losses in other investment accounts, there are still ways for investors to mitigate the impact of those losses. The key is to have a long-term investment strategy that considers both the potential for gains and losses and the tax implications of those gains and losses. Then, with careful planning and professional guidance, Roth IRA investors can navigate the complex world of investments and achieve their retirement savings goals.

You can protect your retirement fund if you invest in IRA precious metals. For example, investors with Gold IRAs can hold physical metals such as bullion or coins. Get a free pdf about Gold IRA.

GET GOLD IRA GUIDE