Table of Contents

Discretionary trading is buying and selling securities based on the trader’s judgment and intuition rather than strictly adhering to a predefined strategy, algorithm, or system. Unlike systematic trading, which relies on established rules or automated trading systems, discretionary trading allows flexibility and adaptation to current market conditions. This article explores the depths of discretionary trading, its advantages and disadvantages, and compares it to non-discretionary or systematic trading.

The Essence of Discretionary Trading

Discretionary trading relies heavily on the trader’s ability to interpret and react to the financial markets’ ever-changing dynamics. Traders who adopt this approach use their experience, intuition, and real-time information to decide whether to enter, hold, or exit trades. This type of trading is inherently flexible and allows for adaptation to sudden market changes, making it suitable for those who prefer a hands-on approach to trading.

I do not like unquestioningly following Expert Advisors.

Key Characteristics of Discretionary Trading

- Flexibility: Discretionary traders can adapt their strategies based on current market conditions. This flexibility allows them to avoid trades in unfavorable conditions and seize opportunities that rigid systems might miss.

- Human Judgment: Decisions are made based on the trader’s market assessment. This could include interpreting news events, economic data, or technical analysis.

- Personal Experience: A discretionary trader’s success often hinges on their experience and ability to read the market accurately. Over time, they develop a keen sense of market trends and potential price movements.

- Risk Management: While discretionary traders might follow a general trading plan, they can adjust their risk management strategies based on the market’s behavior.

The Decision-Making Process in Discretionary Trading

When engaging in discretionary trading, traders continuously analyze market conditions to make informed decisions. They use various tools and techniques, such as:

- Technical Analysis: Evaluating price charts, trends, and patterns to predict future price movements.

- Fundamental Analysis: Assessing economic indicators, company performance, and market news.

- Sentiment Analysis: Gauging market sentiment through news, social media, and other sources.

- Macro Analysis: Considering broader economic and geopolitical factors that could impact the market.

Example Scenario of Discretionary Trading

Consider a discretionary trader reviewing the charts and noticing that all extended trade criteria are met. However, the trader also observes that the day’s volatility is unusually low, suggesting that the price may not reach the desired profit target. Based on this observation, the trader decides not to proceed with the trade, demonstrating the adaptive nature of discretionary trading.

Advantages of Discretionary Trading

- Adaptability: Traders can adjust their strategies based on real-time market conditions, allowing them to avoid trades in unfavorable environments and capitalize on favorable ones.

- Human Intuition: Experienced traders can leverage their intuition and market feel to make decisions that might not be evident through a rigid system.

- Dynamic Risk Management: Discretionary traders can modify their risk management strategies on the fly, potentially improving their overall performance.

Disadvantages of Discretionary Trading

- Emotional Influence: Emotions such as fear and greed can significantly impact decision-making, leading to poor trade choices.

- Inconsistency: The lack of a strict system can result in inconsistent trading performance, especially for less experienced traders.

- Second-Guessing: Traders may second-guess their decisions, leading to missed opportunities or losses.

Discretionary vs. Systematic Trading

Systematic Trading

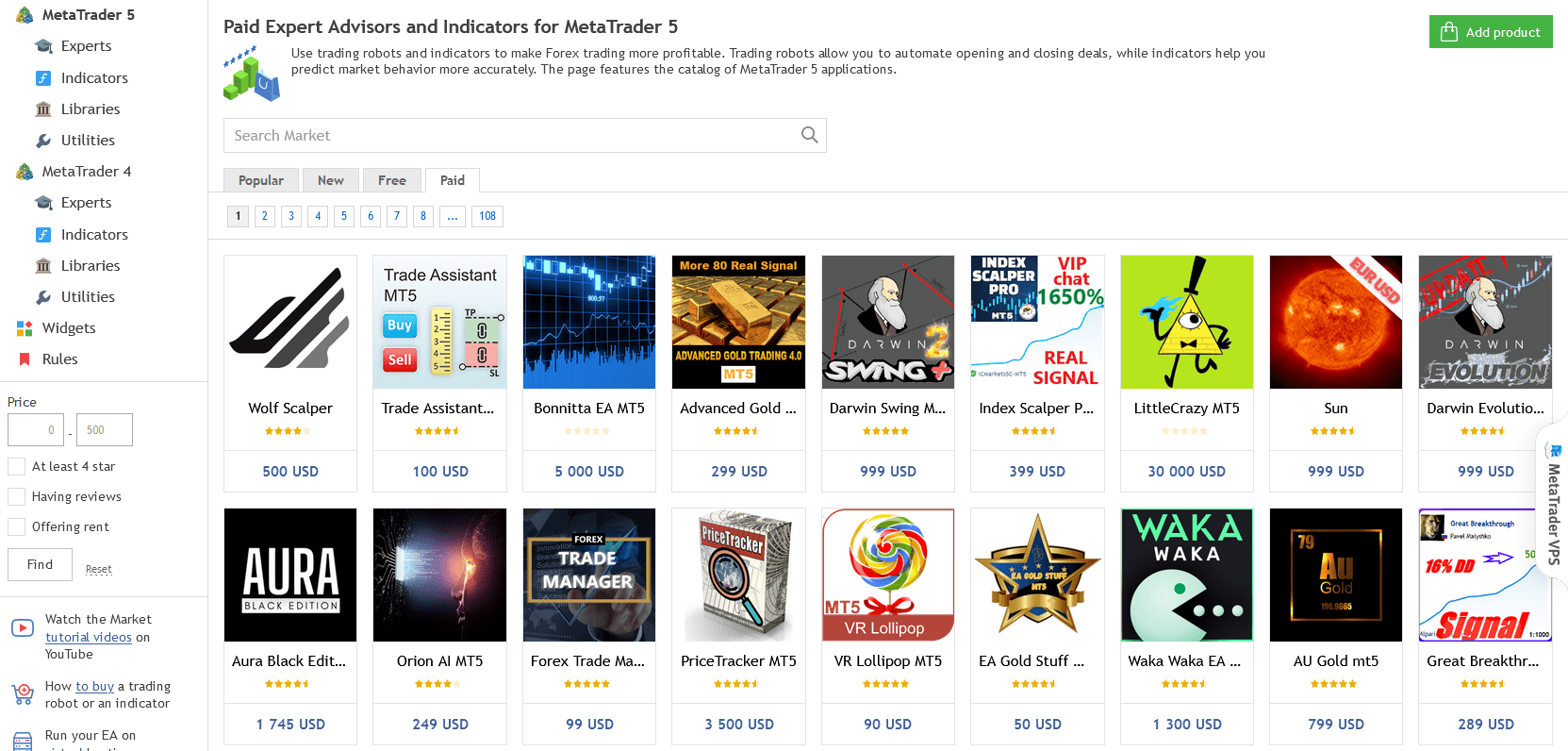

Systematic, non-discretionaryy, or rules-based trading involves executing trades based on a predefined set of rules or algorithms. This approach eliminates the need for human judgment, making the trading process possible to automate.

Critical Characteristics of Systematic Trading:

- Rule-Based: Trades are executed strictly according to predefined rules without considering the trader’s feelings or market intuition.

- Automation: Many systematic trading strategies can be automated, allowing for consistent execution without human intervention.

- Backtesting: Strategies can be backtested using historical data to evaluate their effectiveness before applying them in live markets.

Advantages of Systematic Trading:

- Consistency: Eliminates emotional decision-making, leading to more consistent trading performance.

- Efficiency: Automation allows for faster execution of trades and the ability to manage multiple trades simultaneously.

- Objectivity: Decisions are based on objective criteria, reducing the likelihood of human error.

Disadvantages of Systematic Trading:

- Rigidity: Lack of flexibility to adapt to changing market conditions can lead to poor performance in volatile or unexpected situations.

- Over-Optimization: Strategies may be over-optimized for historical data, leading to a subpar performance in live markets.

- Dependence on Technology: Requires reliable technology and infrastructure to effectively implement and monitor automated systems.

Choosing Between Discretionary and Systematic Trading

The choice between discretionary and systematic trading largely depends on the trader’s personality, experience, and preferences. Some traders may immediately know which style suits them best, while others might need to experiment with both approaches before deciding.

Discretionary Trading is often more suitable for traders who:

- I prefer a hands-on approach to trading.

- Have significant experience and intuition in the markets.

- Are comfortable making real-time decisions based on market conditions.

Systematic Trading may be more appropriate for traders who:

- I prefer a structured, rule-based approach.

- Are less experienced or prone to emotional decision-making.

- Want to leverage technology to automate their trading strategies?

Conclusion

Discretionary trading offers a flexible and intuitive approach, allowing traders to adapt their strategies based on current market conditions. While it provides the advantage of human judgment and experience, it also carries the risk of emotional influence and inconsistency. On the other hand, systematic trading offers consistency and efficiency through rule-based decision-making and automation but lacks the ability to adapt to changing market conditions.

Ultimately, the choice between discretionary and systematic trading depends on the individual trader’s personality, experience, and goals. Both approaches can be highly profitable when executed effectively, and some traders may even find success by combining elements of both strategies to suit their unique trading style.