Table of Contents

Maintaining high-quality and consistent operations is a crucial concern in the complex and multifaceted world of business. As businesses grow, streamline their services, and adopt new technologies, it becomes essential to establish a structured approach to decision-making and task execution. Standard Operating Procedures (SOPs) are essential tools enabling businesses to achieve these objectives.

What is SOP?

SOP or Standard Operating Procedures represent written, detailed, easy-to-understand step-by-step instructions compiled by an organization to guide workers consistently and team members to perform tasks (complex routine operations). SOP describes the activities necessary to complete tasks showing action points, written instructions, and process flowcharts.

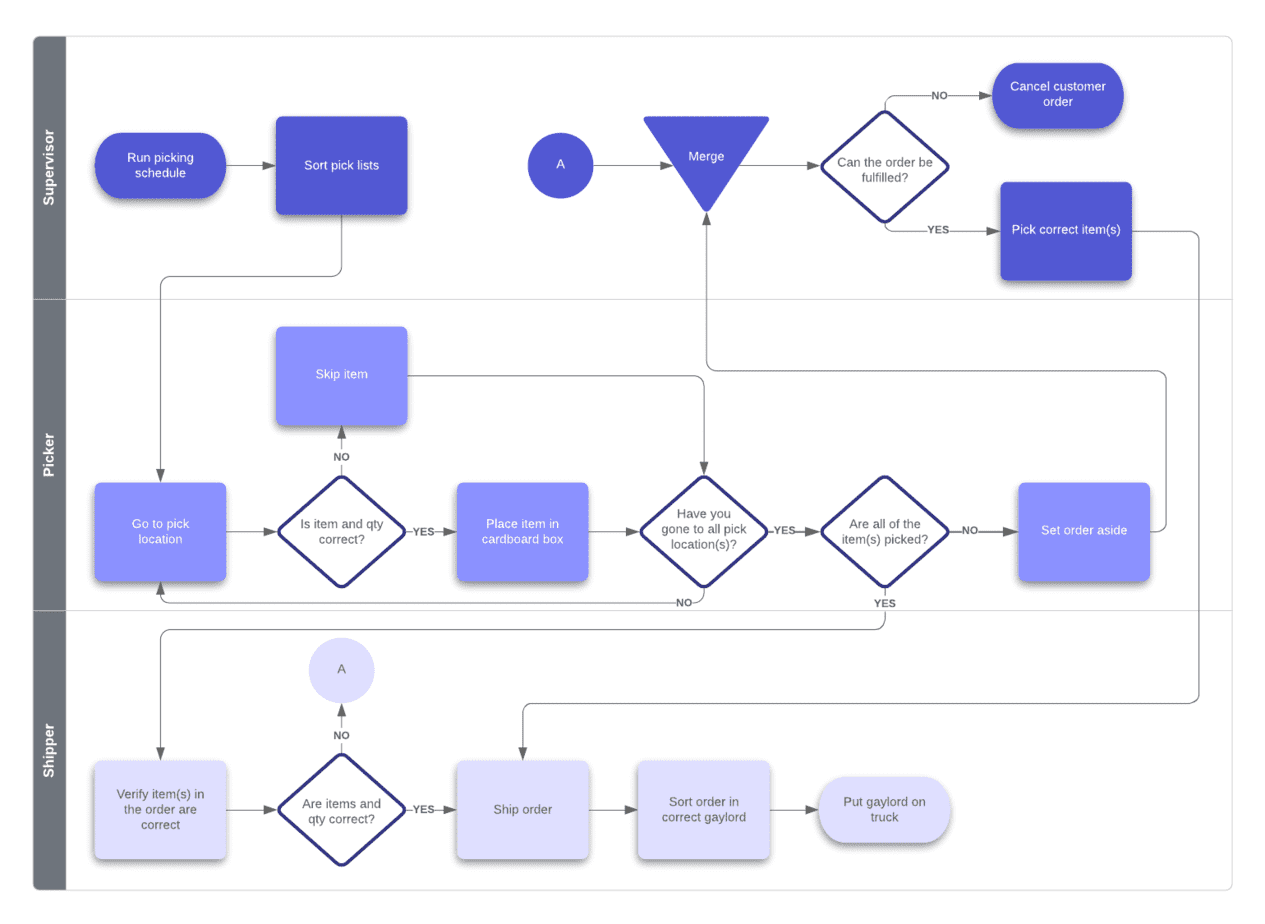

Standard operating procedure flowchart example:

As we can see, Standard Operating Procedures are detailed, written instructions that describe how to carry out a routine activity in a company. They are designed to achieve efficiency, quality output, and uniformity of performance while reducing miscommunication and ensuring compliance with industry regulations. SOPs can be viewed as a roadmap for businesses, guiding employees through the intricacies of their roles and clarifying expectations.

No matter the industry, SOPs can be applied to any recurring organizational task. They are commonly used in customer service, sales, production, operations, human resources, safety protocols, etc.

SOP Example in Trading Company

This SOP outlines a structured approach for making investment decisions using fundamental and technical analysis. The focus of the fundamental analysis will be Gross Domestic Product (GDP) and Industrial Production Dat. In contrast,e the technical analysis will involve the 200-day Simple Moving Average (SMA 200) and bullish resistance breakout on the daily chart.

Step 1: Preparation

1.1. Ensure you have reliable access to economic data, charting software, and a trading platform.

1.2. Establish your risk parameters before initiating trades (e.g., risk tolerance, position sizing, stop-loss, and take-profit levels).

Step 2: Fundamental Analysis

2.1. Gross Domestic Product (GDP)

2.1.1. Track GDP announcements from reliable sources like central banks, the Bureau of Economic Analysis (USA), or the Office for National Statistics (UK).

2.1.2. Compare the actual GDP figure with the expected figure. Higher than-expected GDP figures generally indicate a robust economy, which can be positive for the stock market.

2.2. Industrial Production Data

2.2.1. Monitor the release of industrial production data from relevant national sources.

2.2.2. An increase in industrial production can be a positive sign for the economy and the stock market. Conversely, a decrease may signal a potential economic slowdown.

Step 3: Technical Analysis

3.1. SMA 200 Analysis

3.1.1. Use your charting software to plot the 200-day simple moving average (SMA 200) on the daily chart of the asset of interest.

3.1.2. Observe the relationship between the price and the SMA 200. Prices above the SMA 200 line might indicate a bullish trend, while prices below may suggest a bearish trend.

3.2. Bullish Resistance Breakout

3.2.1. Identify resistance levels on the chart. The asset has had difficulty moving above these price levels in the past.

3.2.2. Watch for a bullish breakout when the price moves above a resistance level with increased volume.

Step 4: Trading Decision

4.1. If the GDP and Industrial Production data are positive and the technical analysis shows a bullish trend above SMA 200 and a resistance breakout, consider taking a long position on the asset.

4.2. Set your stop-loss and take-profit levels according to your pre-established risk parameters.

Step 5: Monitoring and Exiting the Trade

5.1. Regularly monitor your open positions and economic events that might impact your trade.

5.2. If the price hits your take-profit level, exit the trade to lock in profits.

5.3. If the price hits your stop-loss level or the GDP, Industrial Production Data or technical indicators turn bearish, consider closing the trade to limit losses.

Step 6: Review

6.1. After closing the trade, review the process. Identify what went right and what went wrong.

6.2. Make notes on possible improvements for future trades.

Step 7: Continuous Learning and Adjustment

7.1. Regularly review and update your trading strategy in response to changes in the market environment.

7.2. Continually educate yourself on both fundamental and technical analysis to enhance your trading skills.

This Standard Operating Procedure provides a systematic way to use a combination of fundamental and technical analysis in trading. It is crucial to remember that while this SOP can guide your trading decisions, it doesn’t guarantee profits. Markets can be unpredictable, and you should always trade within your risk tolerance levels. Lastly, continuous learning and adaptation are vital components of successful trading.

The Importance of SOPs in Business

1. Consistency and Quality Control

SOPs provide businesses with a standard approach to carrying out tasks. This uniformity means that the results should be consistently high quality irrespective of the employee performing the task. This stability can significantly boost a company’s reputation for reliability and professionalism.

2. Improved Communication and Training

SOPs function as a comprehensive guide to job functions and processes. They can improve communication within the organization by clearly outlining responsibilities and expectations. Moreover, SOPs make training new employees or cross-training existing staff more manageable as they provide reference points for job roles and tasks.

3. Risk Mitigation

By defining the accepted way to perform tasks, SOPs can minimize risks. These procedures are vital in safety-sensitive industries (like healthcare or aviation) or sectors heavily regulated by law (like finance or pharmaceuticals). SOPs provide clear directions to employees to prevent accidents, mistakes, or legal violations that could harm the company.

4. Business Growth and Continuity

SOPs can facilitate business growth by providing a scalable system for operations. As businesses expand, SOPs help maintain quality and consistency across multiple locations or larger teams. They also ensure business continuity in emergencies or staff turnovers, as the procedural knowledge is not limited to specific individuals but is documented in the SOPs.

Developing Effective SOPs

Developing effective SOPs is a process that requires careful planning, involvement from various levels of the organization, and regular updating. Here are some steps to consider:

1. Identify the Process

The first step in creating an SOP is to define the process that needs standardization. It should be a routine operation that significantly impacts the business’s efficiency, quality, or risk management.

2. Assemble the Team

Involve individuals who perform, manage, or are affected by the process. Their insights will ensure the SOP is practical and understandable, addressing the operation’s critical aspects.

3. Document the Procedure

Describe the process step-by-step, ensuring the language is clear, concise, and easy to understand. Using visuals, diagrams, or flowcharts for complex processes may be helpful.

4. Review and Test

Before finalizing the SOP, have it reviewed by the team and tested in real scenarios. This step will help identify potential gaps or areas of confusion that need clarification.

5. Implement and Train

Once the SOP is finalized, it must be properly implemented. This implementation will often require a training program to ensure that all relevant staff understand and can correctly follow the new procedures.

6. Regular Review and Update

Business processes and technologies evolve, and so should SOPs. Regularly review and update them to ensure they remain practical and relevant.

Conclusion

Standard Operating Procedures (SOPs) are a vital tool in a business environment, fostering consistency, promoting effective communication, mitigating risks, and facilitating growth. Businesses can improve operational efficiency and stay competitive in their respective industries by taking a systematic approach to creating, implementing, and maintaining SOPs. Ultimately, SOPs are more than just documents; they are strategic assets that can significantly enhance a company’s performance and sustainability.