Table of Contents

Leverage in trading refers to using borrowed funds to increase potential returns on an investment. It’s a double-edged sword that can amplify both gains and losses. Understanding the difference between 1:100 leverage and 1:500 leverage is crucial for traders to manage risk and capitalize on opportunities effectively.

Here’s a detailed explanation:

1:100 leverage vs. 1:500

In trading, 1:100 leverage is five times less buying power than 1:500 leverage. Therefore, 1:100 means that for every $1 in the trader’s account, a trader can place a trade worth up to $100. 1:500 means that for every $1 in the trader’s account, a trader can place a trade worth up to $500.

In this article, I will provide practical examples with actual numbers so you can see the difference between 1:100 and 1:500 leverage.

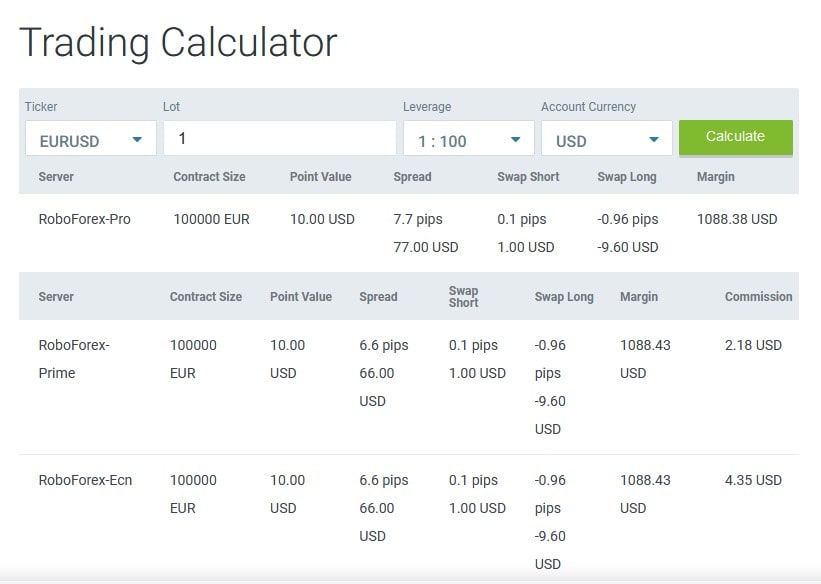

If you trade one lot EURUSD with a maximum of 1:100 leverage, you will need 1088 dollars minimum to execute the trade. However, if you have 1:500 leverage to generate one lot trade, you will need only $217.

When trading Forex, leverage allows traders to control a prominent position with relatively little capital. The leverage ratio essentially amplifies the buying power of a trader’s capital. This can increase potential profits and losses from the movements in currency prices. Let’s delve into how trading one lot of EUR/USD differs when using 1:100 leverage compared to 1:500 leverage, focusing on the minimum amount required to execute such trades.

Trading 1 Lot of EUR/USD with 1:100 Leverage

In Forex trading, one standard lot typically represents 100,000 units of the base currency. When trading EUR/USD, it means you are trading 100,000 Euros.

With 1:100 leverage, you can control $100 in the market for every $1 of your capital. Therefore, to control 100,000 Euros (or the equivalent amount in USD), you calculate the required margin as follows:

- Total Position Value: For simplicity, assume 1 Euro equals 1.088 USD. Thus, trading one lot of EUR/USD at this exchange rate means the total position value is 100,000 Euros * 1.088 USD/Euro = 108,800 USD.

- Margin Requirement: With 1:100 leverage, the margin requirement is 1% of the total position value. So, the margin needed to open one lot of EUR/USD is 108,800 USD * 1% = 1,088 USD.

You need at least 1,088 USD in your trading account as a margin to open a 1-lot trade of EUR/USD using 1:100 leverage.

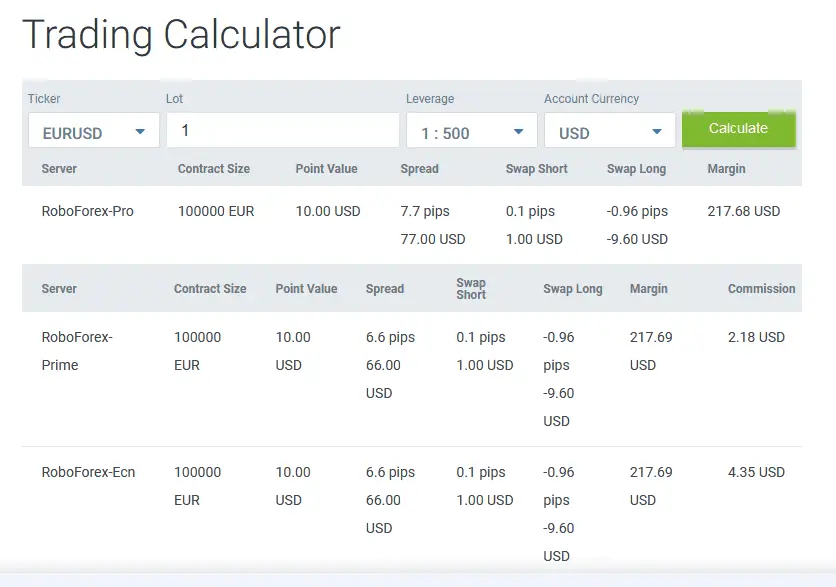

Trading 1 Lot of EUR/USD with 1:500 Leverage

When the leverage is increased to 1:500, you can control $500 in the market for every $1 of your capital. This significantly reduces the amount of your capital required to control the exact size position:

- Total Position Value: Remains the same, 108,800 USD.

- Margin Requirement: With 1:500 leverage, the margin requirement is 0.2% of the total position value (since 1/500 = 0.2%). Therefore, the margin needed to open one lot of EUR/USD is 108,800 USD * 0.2% = 217.6 USD.

Using 1:500 leverage, you only need approximately 217.6 USD in your trading account as a margin to control a one-lot position of EUR/USD, significantly less than with 1:100 leverage.

1:100 Leverage

With 1:100 leverage, a trader can control a position 100 times larger than their capital. For example, if a trader has $1,000 in their trading account, they can open a position worth $100,000. This high degree of leverage allows traders to make significant profits from relatively small price movements in the market.

Pros:

- Increased Profit Potential: Small movements in price can lead to significant profits, as the position size is much larger than the trader’s initial investment.

- Lower Required Capital: Traders can take prominent positions without investing much capital upfront.

- Flexibility: Offers the opportunity to diversify trading strategies and enter markets that might otherwise be inaccessible due to capital constraints.

Cons:

- Higher Risk: While the potential for profit increases, so does the risk of loss. Small movements in the wrong direction can lead to substantial losses.

- Margin Calls: If the market moves against the trader’s position, they may face a margin call, requiring them to deposit additional funds to keep the position open.

- Interest Costs: Depending on the broker and the duration of the position, borrowing to leverage might incur interest costs.

1:500 Leverage

At 1:500 leverage, the capacity to control a large position size with a relatively small amount of capital is even greater. Here, with the same $1,000, a trader could control a position worth $500,000. This extreme level of leverage can significantly magnify the effects of market movements on profits and losses.

Pros:

- Maximized Profit Potential: Offers the highest level of profit potential due to the size of the positions that can be controlled with a minimal investment.

- Market Entry: Enables entry into trades with high capital requirements with a relatively small amount of money.

- Diversification: Allows broader diversification as traders can spread their capital across more positions.

Cons:

- Amplified Risk: The risk of substantial losses is much higher as small price movements against the position can result in significant losses quickly.

- Margin Calls and Liquidation: The likelihood of facing margin calls increases, and the broker may liquidate positions if the account balance falls below the margin requirement.

- Interest and Fees: There is potential for higher interest costs and fees, depending on how long positions are held and the broker’s terms.

Comparison and Risk Management

While 1:500 leverage offers a more significant profit potential, it comes with significantly higher risks than 1:100 leverage. When choosing a leverage level, traders must consider their risk tolerance, trading strategy, and market conditions. Effective risk management strategies, including using stop-loss orders and monitoring positions closely, are essential to protect against significant losses, especially when using high leverage.