Interest Coverage Ratio for companies

Almost all businesses set their revenue and sales targets periodically and try to meet them. They will also try to reduce their expenses to maximize their earnings. One of the factors used for setting the target is the company’s debt and the interest that has to be repaid monthly. A business can survive in the long term only if it earns enough to repay the interest and other expenses quickly. Thus, the ratio of the company’s earnings and the interest payments are also closely monitored by the investors and lenders to determine the company’s financial health.

Interest Coverage Ratio Definition

The Interest Coverage Ratio, or ICR, is the ratio of a company’s earnings before interest and taxes (EBIT) and the total interest expenses. Most companies are borrowing money for capital investment and other reasons. The business will flourish only if the company has enough revenue to repay the interest on the loan and other expenses. If the ICR of a business is low, it implies that the business is facing a problem or there is a problem with the business model, and it may be necessary to review the business.

Interest Coverage Ratio Formula

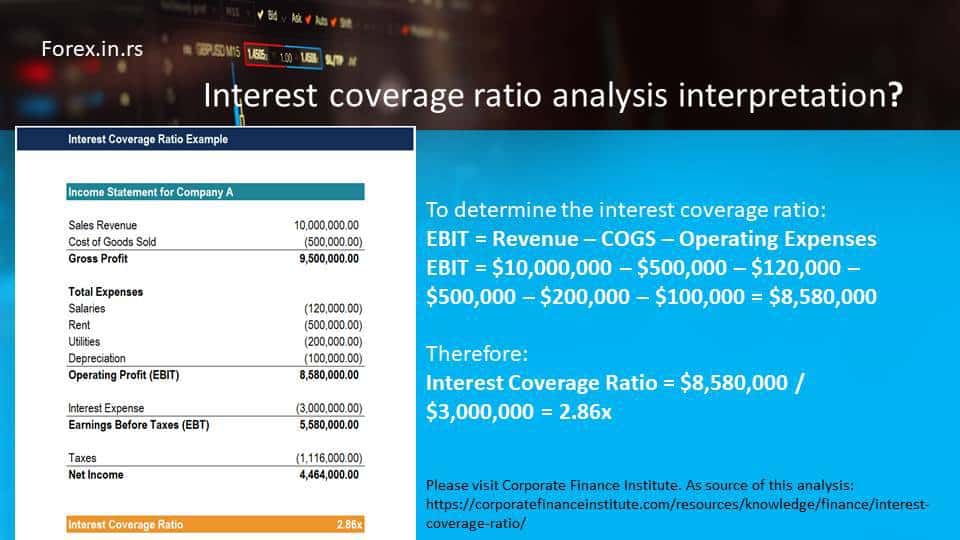

The basic formula for calculating ICR is as follows

ICR = EBIT /Interest expenses

In the comprehensive statement of income, the interest expenses may be replaced by finance costs. There are other ways of calculating the ICR. In some cases, the earnings before depreciation, amortization, interest, and taxes(EBITDA) may be considered instead of EBIT. When the EBITDA is used, the ICR calculated is usually higher in value than the EBIT ICR calculation. Another variation considers the Earnings before interest and after taxes (EBIAT) instead of EBIT for ICR calculation. In this case, the ICR is usually lower than the BIT ICR.

Interest coverage ratio calculator

Interest Coverage Ratio Explanation

The ICR is calculated for a specific period, which may be one month, quarterly, or or annually, depending on the business. The parameters are closely monitored by the company, especially the finance department, if the company has a lot of debt,, so can try to improve it, eitncreasing revenues or reducing expenses. It is also used by lenders to check the company’s financial condition. Like other investors, the lenders would like to be reasonably assured that the borrowers have enough income to repay the interest and principal on schedule., The ICR is one parameter used to check financial conditions.

Interest coverage ratio analysis interpretation:

High debt companies

The ICR of a company will vary depending on its financial condition, size, and industry sector. Usually, if the ICR is low at 1.5, the company is facing a financial crisis and cannot make enough money to repay the debt. If the ICR ratio is below 1.5, most lenders will refuse to lend money to the company since the risk of default is very high. A company with an ICR of less than one is not generating enough income to repay the interest expenses. In the short term, the business must use some of its cash reserves to repay interest. If the ICR does not improve long-term, the business will have to shut down.

Limitations of Interest Coverage Ratio

Like other ratios, the ICR has some limitations, and the investor or analyst should be aware of these variations. The acceptable ICR varies greatly depending on the industry sector. Utility companies have high earnings since there is less competition, yet they also have high debt, so the acceptable ICR is approximately two. On the other hand, for manufacturing companies, three is the typical ICR for most companies. Some companies may have high ICR. However, this could indicate that the company is very conservative and is missing out on opportunities available.

Variation

In addition to calculating the ICR at a specific time, investors and lenders should also consider the variation of the ICR over some time. If the ICR of the company is declining over some time, it could be facing a financial crisis. On the other hand, if the ICR is improving, it indicates an improvement in financial health. It should be noted that the ICR may reduce drastically due to an unexpected event like a strike or recession when sales or production decline significantly. Large, well-established companies often have low ICR.