Table of Contents

In trading terms, points, pips, and ticks highlight the changes in the financial market.

Point value in trading is a crucial metric for traders and investors. It’s fundamental to comprehend because it determines the monetary value of each change in the price of a trading instrument. This article will delve into the meaning, importance, and usage of point value in trading.

What is Point Value in Trading?

Point value in futures trading represents the smallest whole-number price increment in an asset on the left side of the decimal point. For example, if an asset goes from 1234.5 to 1235.5, we can say that the asset rises by 1 point. If a stock price increases from $100 to $102, it has risen by two points.

Point value, as a measurement unit for price changes in the financial markets, represents the smallest change in the price of a security, such as a stock, bond, or derivative like a futures contract or an option. The point value is usually the smallest whole number price increment on the left side of the decimal point. For instance, if an asset price moves from $100.00 to $101.00, we say the asset has moved by one point.

Sometimes, in financial markets, points are subdivided further into fractions or decimals, known as ‘ticks.’ For instance, in the U.S. stock market, a tick is defined as a 0.01 change in price. So, in our previous example, if an asset moves from $100.00 to $100.01, that would represent a one-tick movement, but the point value remains unchanged at 100.

Why is Point Value Important in Trading?

The significance of point value is multi-faceted. On a fundamental level, the point value is essential because it sets the standard for price quotes and price changes in the market. It helps standardize prices, making trading more systematic and less susceptible to errors.

From a trading perspective, understanding point value becomes critical when considering a particular trade’s potential profit or loss. When multiplied by the number of units traded, the point value of an asset will give the monetary value of the price movement. So, traders can use point values to estimate potential gains or losses.

Consider a trader who buys 100 company shares at $50 each. If the price increases by 1 point to $51, the trader gains 100 points (1 point per share x 100 shares), representing a $100 gain in this trade.

Point value is more important in derivatives markets, like futures and options. This is because these are leveraged instruments, meaning traders often control large amounts of assets with relatively little capital. Thus, even small point-value changes can lead to significant profits or losses.

Pivot Points, Ticks, and Pips

Tick

- A tick is the smallest possible price movement of a trading instrument. The size of a tick can vary depending on the market and the specific instrument.

- In the stock market, a tick often represents a 0.01 change in price. However, futures contracts, for example, have tick sizes that can differ from this.

- Ticks are particularly important in day trading, where even the smallest price movements can impact profits due to the high volume of shares or contracts traded.

Pips

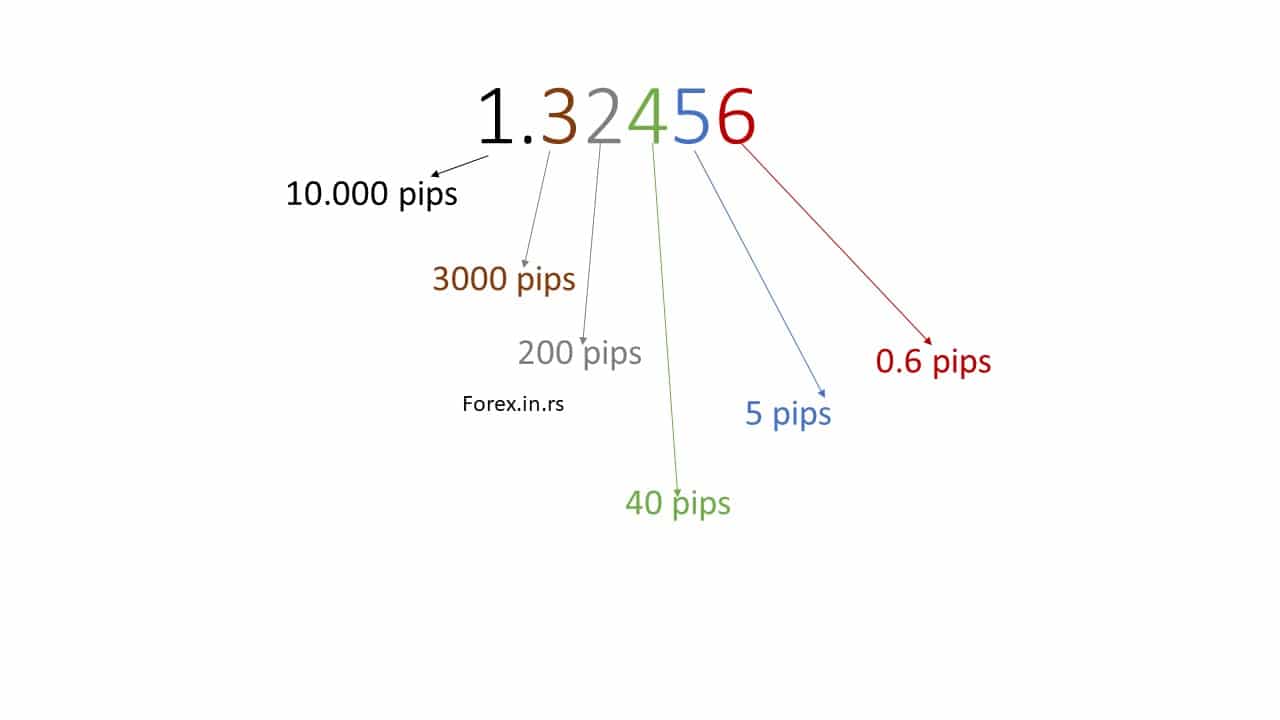

- Pips are a unit of measurement used in the foreign exchange (Forex) market to express the change in value between two currencies.

- A pip is usually the fourth decimal place in a currency pair. For example, if the EUR/USD pair moves from 1.1050 to 1.1051, that .0001 USD rise in value is one Pip.

- However, a pip is usually the second decimal place for pairs involving the Japanese yen. For instance, if the USD/JPY pair moves from 110.01 to 110.02, that .01 JPY rise in value is one Pip.

- Pipettes or fractional pips are smaller units of measurement, usually the fifth decimal place in most currency pairs and the third decimal place in JPY pairs.

Point Value

- The point value represents the smallest whole number price increment on the left side of the decimal point. For example, if a stock price increases from $100 to $101, it has risen by one point.

- Point values are essential in calculating a trade’s potential profits or losses. For example, if a trader owns 100 shares of a stock and the stock price rises by 1 point, the trader makes a profit equivalent to 100 points.

- Point value becomes crucial in derivatives markets, like futures and options, where small changes in point values can lead to substantial profits or losses due to leverage.

These three terms — tick, pips, and point value — are used to measure price changes in trading, with ticks being the smallest unit of price movement, pips being specific to the Forex market, and point value being the basic unit for price change in the stock and derivatives markets. Each of these terms plays a crucial role in defining potential profits and losses for traders.

Point Value and Leverage

In the futures market, the point value is often called the “tick value” or “minimum price fluctuation.” Futures contracts have standardized tick values that vary from contract to contract. For example, one tick in the E-mini S&P 500 futures contract is worth $12.50, representing a 0.25-point move in the index.

Leverage amplifies the effect of point value. In a futures contract, a trader might only have to put up a small fraction of the contract’s total value as a margin. Therefore, a small change in the underlying asset’s price can translate into a large profit or loss due to the leverage effect.

For example, suppose a trader buys a gold futures contract equivalent to 100 ounces of gold. If the point value of gold is $1, and the price increases by $10 (10 points), the trader would profit $1,000 (10 points x 100 ounces) from this trade.

Conclusion

Point value is an essential concept in trading and investing. It standardizes the measurement of price changes and facilitates the calculation of potential gains and losses in a trade. A solid understanding of point values and other trading principles, such as leverage and risk man,agement can significantly assist traders in making informed and successful trading decisions.